Summer Spending Reset: How to Enjoy the Season Without Wrecking Your Budget

Summer Spending Reset: How to Enjoy the Season Without Wrecking Your Budget

Summer is a season full of contradictions.

On one hand, it’s the time to unwind, explore, and enjoy life outdoors. On the other, it can be a real test of financial discipline. From impromptu trips and social events to higher energy bills and extra childcare costs, summer has a way of quietly draining your savings before you even notice.

If you’ve been watching your budget slip---or if you’ve never really had one---don’t panic. A summer spending reset is the perfect way to get back on track, enjoy the rest of the season guilt-free, and set yourself up for long-term financial stability.

In this guide, we’ll walk you through how to:

- Assess your current financial standing

- Spot common summer money traps

- Build a flexible, seasonal budget using BUDGT

- Enjoy affordable summer fun

- Plan ahead to avoid end-of-year financial stress

1. Mid-Year Money Check: Where Do You Stand?

July marks the halfway point in the year---making it the ideal time to conduct a personal financial check-up.

Why a Mid-Year Budget Review Matters

Many people set financial goals in January---like saving more, spending less, or sticking to a budget---but never revisit them. As a result, they don’t realize they’re drifting until it’s too late.

A mid-year check gives you a chance to:

- Celebrate progress: Maybe you’ve saved more than expected or paid down debt faster.

- Course-correct: Notice overspending or unexpected expenses and make adjustments.

- Realign your priorities: Life changes---your budget should adapt accordingly.

Quick Steps for a Summer Financial Audit

- Look at your actual vs. planned spending for the past 6 months.

- Check in on your savings goals (emergency fund, vacation fund, debt repayment).

- Note lifestyle or income changes: New job? Side hustle? Higher grocery bills?

- Log it all in BUDGT to visualize your financial health.

Watch your summer spending progress

BUDGT's color system shows your status throughout the day. Blue to yellow to orange—instant feedback keeps you aware of summer spending without constant worry.

🧠 SEO Tip Note: This section includes phrases like “how to assess your spending,” “budget tracking app,” and “financial check-up,” which are commonly searched by budget-conscious users in July.

2. The Hidden Costs of Summer (And How to Handle Them)

Summer might feel more relaxed---but it’s one of the most expensive times of the year for many people.

Let’s break down some typical budget-busters and how to keep them under control:

🧳 Travel & Vacation Spending

Even a simple road trip can get pricey when you add up fuel, lodging, food, entrance fees, and incidentals. And with prices often inflated during peak season, budgeting is crucial.

Tips:

- Set a travel spending cap in BUDGT before booking anything.

- Use “vacation” as a separate category to isolate those costs.

- Look for budget travel hacks: off-season destinations, house swaps, public transport, travel points.

☀️ Utility Bills Spike

Running air conditioning or fans 24/7 can double or triple your electricity costs.

Tips:

- Adjust thermostats when away or at night.

- Use blackout curtains, fans, and dehumidifiers efficiently.

- Track your utility bills as a recurring monthly category to spot trends.

🍹 Eating Out & Entertainment

Summer means socializing---barbecues, rooftop drinks, festivals, and brunches. It adds up fast.

Tips:

- Set a weekly entertainment cap in BUDGT and track spending daily.

- Alternate expensive outings with free or low-cost ones (see section 4).

- Do a “fun for less” challenge: how many free events can you attend this month?

🧒 Kids & Extra Activities

School’s out, which means extra childcare, camp fees, day trips, and activities to keep the kids entertained.

Tips:

- Budget childcare or summer activities separately from regular kid expenses.

- Look for free city-run programs, library events, or swap playdates with other parents.

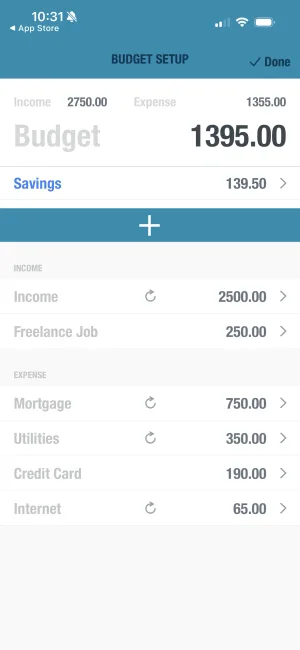

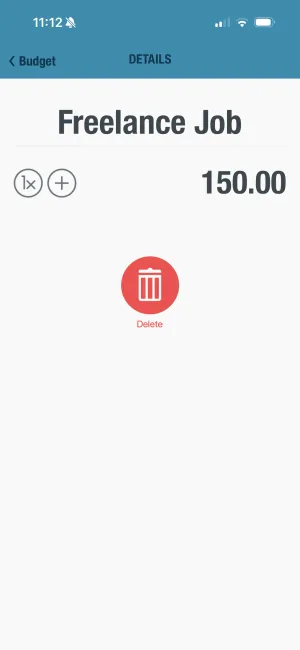

Set up your summer budget reset

BUDGT makes seasonal budget resets simple. Enter your summer income and expenses, adjust for vacations and activities, and see exactly what you can spend each day.

3. Building a Flexible Summer Budget with BUDGT

Rigid budgets often fail in the summer because life gets unpredictable. That’s why you need a flexible, seasonal budget---something that moves with you, not against you.

What Makes BUDGT Perfect for Summer Budgeting

- Minimal setup: No spreadsheets or complex rules---just define categories and start tracking.

- Dynamic budgeting: Move money between categories as priorities shift (ex: reduce “transport” and increase “fun”).

- Daily check-ins: Small interactions keep you mindful and on target.

- Works offline: Perfect for travel---BUDGT keeps working even when you’re off-grid.

How to Structure a Summer Budget

Here’s a sample summer budget breakdown for a single adult:

| Category | Monthly Budget |

|---|---|

| Rent/Mortgage | $1,200 |

| Utilities | $200 |

| Groceries | $400 |

| Eating Out | $150 |

| Travel & Fun | $300 |

| Kids’ Activities | $100 |

| Savings Goals | $250 |

| Emergency Fund | $100 |

| Total | $2,700 |

4. 25 Budget-Friendly Summer Activities That Don’t Feel Like Sacrifices

You don’t have to overspend to enjoy summer. In fact, some of the best experiences are completely free---or nearly.

Free or Low-Cost Outdoor Fun

- Local hikes or nature walks

- City-sponsored movie nights or concerts

- Free days at museums or zoos

- Stargazing or meteor shower watching

- Biking along local trails

- Beach day with packed lunch

- Outdoor yoga in the park

- Free outdoor fitness bootcamps

- Visit a botanical garden or community garden

- Volunteer at a summer event or festival

Low-Key At-Home Fun

- Host a potluck dinner party

- Backyard camping with kids

- DIY spa night

- Cook international dishes at home

- Start a summer book club

- Garden or grow balcony herbs

- Build a DIY fire pit for marshmallow roasting

- Create an outdoor movie night with a sheet and projector

Frugal Family Activities

- Library events and story hours

- Free workshops at hardware or craft stores

- Farmer’s market scavenger hunt

- DIY tie-dye or arts & crafts day

- Visit splash pads or water playgrounds

- Nature photo challenge

- Home science experiments for kids

🎯 Track these ideas in a “Fun for Free” or “Summer Goals” category in BUDGT---it helps keep entertainment spending intentional.

5. Plan Ahead to Avoid the End-of-Year Budget Crash

Many people overspend in summer only to scramble in fall and winter---when back-to-school costs, holiday shopping, and heating bills pile up. But with smart summer planning, you can avoid that.

Start a “Fall Buffer” Fund Now

If your income allows, start saving $50—$100/month now toward Q4 costs. BUDGT lets you easily tag and track savings goals so you stay motivated.

Review Annual Subscriptions

Summer is a good time to cancel unused services---streaming platforms, fitness apps, magazines, and delivery memberships. Reallocate that money to savings or debt reduction.but

6. The Emotional Side of Budgeting in Summer

Budgeting isn’t just about numbers---it’s about mindset. Summer often triggers “FOMO spending” (fear of missing out) because everyone’s traveling, posting, and living their “best lives.”

But budgeting is ultimately an act of self-respect, not self-denial.

How to Stay Motivated:

- Remind yourself of your “why”---what are you saving for?

- Celebrate small wins---like a debt-free vacation or hitting a savings goal.

- Use BUDGT’s simple interface to check in daily. It’s visual, calming, and helps reduce anxiety around money.

Remember: It’s not about saying no to everything---it’s about saying yes to what matters most.

Conclusion: Your Summer Budget Reset Starts Today

Summer doesn’t have to derail your financial progress. With a bit of planning, some honest reflection, and a tool like BUDGT in your pocket, you can enjoy the season while still staying on track.

So take a moment, reset your budget, and set yourself up for a fun, frugal, and financially empowered second half of the year.

👉 Download BUDGT today and take control of your summer finances---one smart decision at a time.

Frequently Asked Questions

**1. What is a summer spending reset?**

A summer spending reset is a mid-year review and adjustment of your budget to align with seasonal expenses like travel, events, and increased utility bills. It helps you stay in control of your finances while still enjoying summer activities.

**2. How do I stop overspending in summer?**

Track your daily expenses using a budgeting app like BUDGT, set limits on discretionary categories (like eating out or travel), and plan low-cost activities. Awareness and planning are key to avoiding impulse spending.

**3. Is BUDGT good for seasonal budgeting?**

Yes, BUDGT is ideal for flexible, seasonal budgeting. You can easily adjust spending categories, track one-time expenses like vacations, and get a daily overview of your financial health---all in a simple, mobile-friendly app.

**4. What are the most common summer expenses to budget for?**

Common summer expenses include vacations, social events, childcare, kids' activities, higher utility bills, and impulse purchases. Identifying and budgeting for these in advance can prevent financial stress.

**5. How can I have fun in summer on a tight budget?**

Enjoy free or low-cost activities like local hikes, free concerts, beach days, potlucks, and library events. Create a "Fun for Free" category in BUDGT to track these and stay motivated without overspending.

**6. When should I start saving for fall and holiday expenses?**

Start now. July and August are perfect months to begin setting aside money for back-to-school costs, fall bills, and holiday shopping. Use BUDGT to set a saving target to make sure something is there when that vacation starts.

**7. How often should I check my budget in summer?**

Daily check-ins are best during summer when spending can fluctuate. BUDGT makes this easy with a quick daily tracker, helping you stay mindful and in control---even on the go.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS