Daily Budget Tips: Master Your Money One Day at a Time

How daily budgeting transforms your relationship with money—small daily choices that create big results

Practical budgeting tips, saving strategies, and financial guides to help you take control of your money.

No articles found matching your filters.

How daily budgeting transforms your relationship with money—small daily choices that create big results

Complete 2026 guide to first-time buyer mortgages in the UK. Learn about stamp duty relief, deposit requirements, Help to Buy, and use our free mortgage calculator to see your monthly payments.

Learn the one savings strategy that works regardless of income—pay yourself first and watch your wealth grow automatically

Gold is both tradition and investment in India—learn smart strategies for Dhanteras, Akshaya Tritiya, and everyday gold purchases.

Practical strategies for breaking compulsive spending patterns—with compassion, not shame

The envelope budgeting method gives each spending category its own physical (or digital) envelope. When the envelope is empty, you stop spending. Learn how this simple system creates real spending limits.

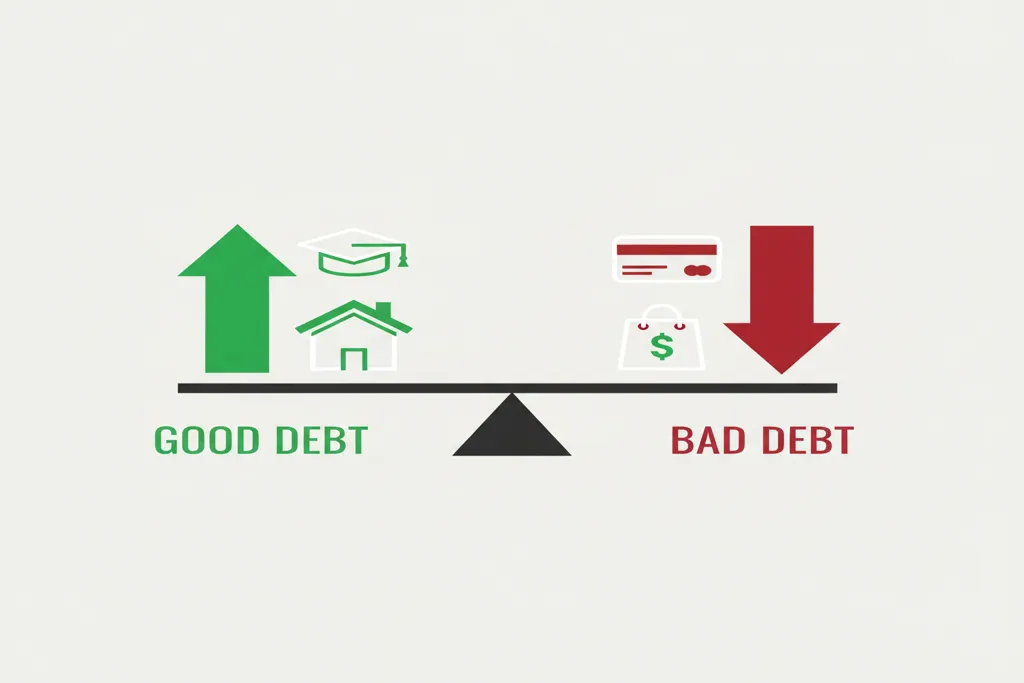

Not all debt is created equal. Learn the difference between debt that builds wealth and debt that destroys it—so you can borrow strategically instead of recklessly.

India celebrates year-round—here's how to budget for every festival from Holi colors to Onam sadhya without financial stress.

Practical frugal living ideas that don't feel like deprivation—smart adjustments that add up to thousands saved

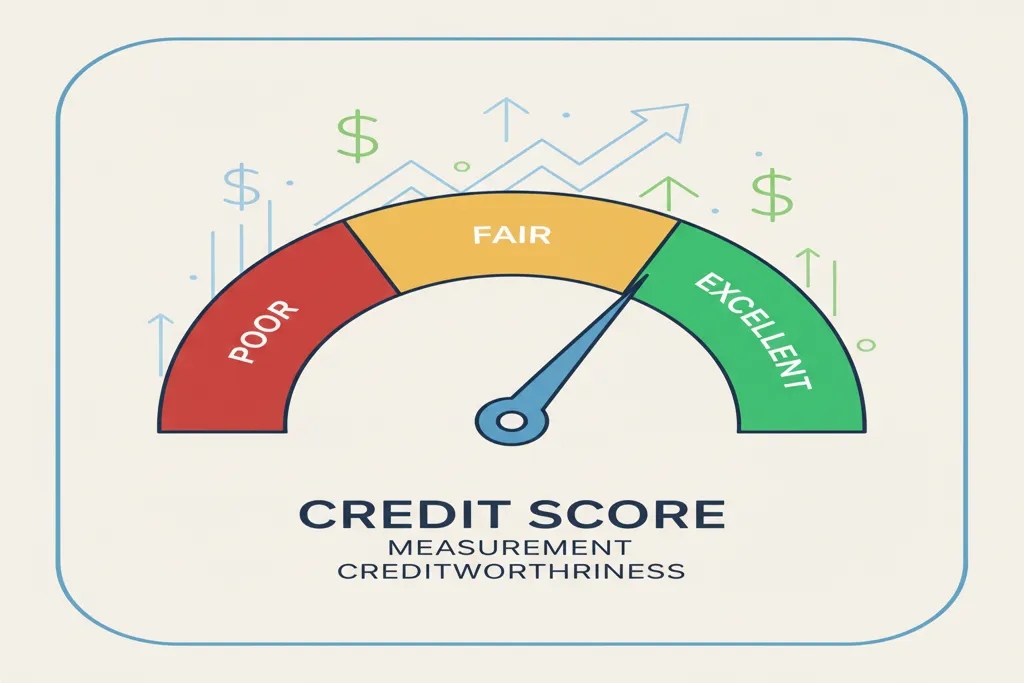

Your credit score affects everything from loan rates to apartment approvals. Learn what it is, how it's calculated, and exactly how to improve it—without falling for myths and scams.

Discover budget tracking methods that don't require spreadsheets, complex apps, or hours of your time

An emergency fund is the foundation of financial security. Learn how much you actually need, where to keep it, and how to build one—even when money feels impossibly tight.

Juggling phone EMIs, car loans, and credit card dues? Here's a simple system to track and manage multiple EMIs without the anxiety.

Discover the psychology behind compulsive shopping and learn to identify your personal spending triggers

Inflation quietly erodes your money's purchasing power every year. Learn what causes it, how it affects your daily life, and what you can do to protect your savings.

February's 28-29 days means your monthly budget stretches further. Learn how to turn the short month into bonus savings for your emergency fund, debt payoff, or financial goals.

15 budget ideas for single moms that actually work + free $3,500/month budget template. Realistic money-saving tips, emergency fund strategies, and budgeting methods designed for exhausted single parents. No judgment.

Master frugal living in 2026 with 7 proven financial habits that actually stick. Learn how to track spending effectively, build a realistic budget, curb impulse purchases, and automate your savings—without feeling deprived.

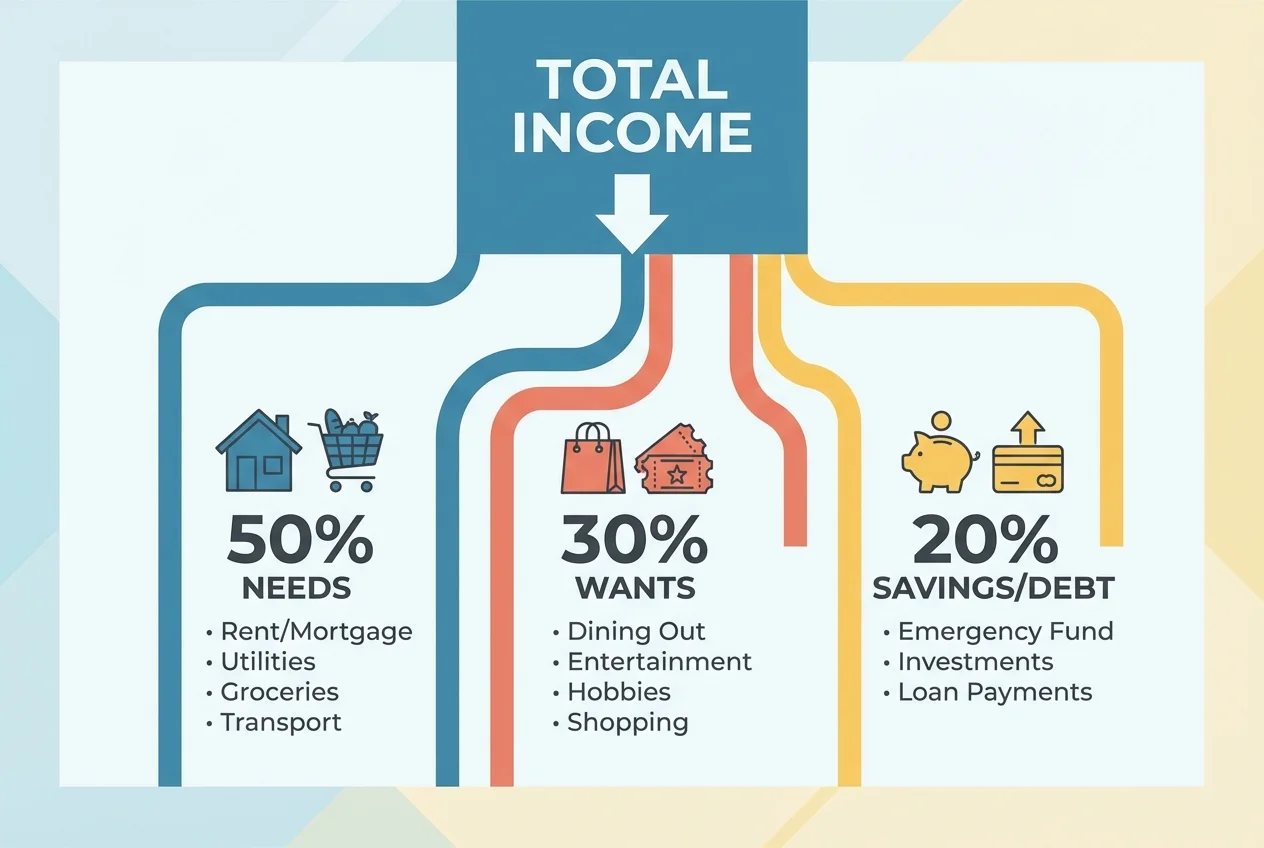

The 50/30/20 budget rule divides your after-tax income into three simple categories: needs, wants, and savings. Learn how this flexible framework can work for any income level.

Navigate shaadi season without emptying your bank account—from outfits to gifts to travel, here's how to budget for being a wedding guest.

Discover the expense tracking method that actually fits your life—from quick daily check-ins to detailed category breakdowns

Complete guide to financial planning for 2026. Includes goal-setting frameworks, savings calculators, investment basics, and monthly action plans to build lasting wealth this year.

Zero-based budgeting means giving every dollar a purpose before the month begins. Learn how this simple but powerful method can transform your finances—even on an irregular income.

Overspent during the holidays? Here's your judgment-free guide to getting your finances back on track in January

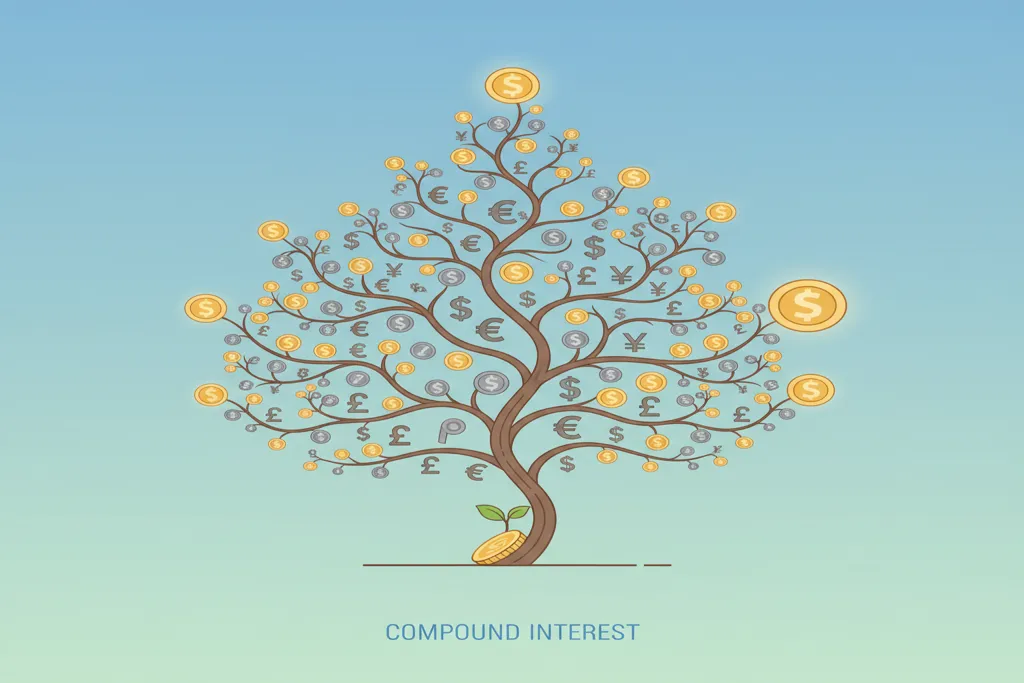

Compound interest is when you earn interest on your interest—turning small savings into big wealth. See the math: $1,000 becomes $17,449 in 30 years. Includes interactive calculator and the Rule of 72.

Celebrate the Festival of Lights without dimming your savings—practical tips for Diwali shopping that keep your budget bright.

Practical saving strategies for the current economy—no extreme frugality required, just smart adjustments that add up

Learn 5 proven methods to track your spending in 2026—from 2-minute daily check-ins to the 50/30/20 rule. Includes comparison table, habit-building tips, and common mistakes to avoid. No spreadsheets required.

Complete guide to resetting your finances in January. Includes step-by-step budget setup, holiday debt recovery plan, goal-setting frameworks, and daily tracking strategies to make this your best financial year yet.

Create magical holiday memories without breaking the bank.

Complete guide to avoiding holiday overspending. Learn to recognize the 7 most common Christmas budget traps, understand the psychology behind holiday spending, and use proven strategies to enjoy the season without financial regret.

Complete guide to Christmas gift budgeting. Create your gift list, calculate your total budget with our interactive worksheet, discover meaningful gifts at every price point, and learn to give generously without January debt.

The complete beginner's guide to personal budgeting. Learn step-by-step how to create your first budget, track expenses effectively, and build lasting financial habits that lead to real savings.

Stop money fights before they start. Learn proven communication strategies, budgeting systems, and conflict resolution techniques to build financial harmony in your relationship.

Think you might have a shopping problem? Take our self-assessment quiz, learn the 10 warning signs of shopping addiction, and discover practical strategies to take back control of your spending.

Complete comparison of BUDGT vs other budgeting apps. See how BUDGT's daily budget approach, 100% offline privacy, and simple design compare to Mint, YNAB, and EveryDollar. Includes feature comparison tables, user type guides, and pricing breakdown.

Complete guide to the one-account budget method. Learn how to simplify your finances, ditch complex systems, and save more money using a single checking account paired with daily tracking in BUDGT.

Reset your summer budget and enjoy the season without overspending.

Discover why BUDGT's minimalist design makes budgeting easier. See how intentional simplicity, offline privacy, and daily awareness help frugal people save more while spending less time on their finances.

Complete guide to understanding and overcoming financial anxiety. Includes a stress assessment quiz, coping strategies, daily habits for mental wellness, and practical budgeting techniques that reduce money-related anxiety.

Complete stress-free budgeting guide for busy women. Learn the 10-step system that takes just 15 minutes a week, compare budgeting methods, use the interactive budget calculator, and discover time-saving hacks that work with your hectic schedule.

Complete guide to escaping the paycheck-to-paycheck cycle. Includes a self-assessment quiz, 5-step action plan, emergency fund calculator, expense cutting strategies, and debt payoff methods to build real financial security.

Plan your next party without breaking the bank. This complete party budget checklist covers cost breakdowns, potluck strategies, DIY decorations, and free entertainment ideas for birthdays, celebrations, and gatherings.

A judgment-free guide to paying off debt using proven strategies like the snowball and avalanche methods. Learn how to create a debt payoff plan that actually works.

Complete family budgeting guide with 6 actionable steps. Includes budget worksheets, expense tracking strategies, savings challenges, and age-appropriate ways to involve kids in money management.

Complete guide to recovering from holiday overspending. Includes a 90-day recovery timeline, debt payoff strategies, subscription audit checklist, and daily budgeting tips to get your finances back on track.

Master your financial planning for 2025 with actionable goals, proven strategies, and step-by-step guidance. Learn how to assess your finances, set SMART goals, build emergency savings, and track progress throughout the year.

Master frugal living in 2025 with these 7 proven financial habits. From tracking spending to automating savings, learn practical strategies that actually work for busy women.

Complete Christmas budgeting guide with 5 actionable steps. Includes gift budget calculator, shopping timelines, DIY gift ideas, and strategies to avoid January debt while still enjoying the holidays.

Complete guide to student budgeting and money management. Includes realistic budget templates, expense-cutting strategies, income ideas, and practical tips for building financial habits that last beyond graduation.

Complete guide to affordable self-care with 50+ ideas organized by cost and time. Includes DIY spa recipes, free wellness resources, budget allocation strategies, and weekly self-care planning templates.

Complete guide to free and budget-friendly family activities. Includes 8 detailed activity ideas, cost comparison tables, seasonal planning guides, and tips for making quality time memorable without spending money.

Practical money-saving strategies for single parents. Learn how to stretch your budget, build savings on one income, and create financial security for your family without feeling deprived.

Complete home organization guide with 10 budget-friendly strategies. Includes room-by-room guides, DIY storage solutions, dollar store finds, decluttering methods, and family maintenance routines—all for under $50.

Are you looking for ways to stretch your budget, save more and more?

Complete guide to making emergency money fast as a single mom. Includes 12 proven money-making strategies with realistic earnings, time requirements, and step-by-step instructions for getting started quickly.

Complete guide to affordable self-care for single mothers. Includes free and low-cost self-care ideas, budget-friendly wellness strategies, tips for finding time, and ways to prioritize yourself without guilt or financial stress.

Complete guide to back-to-school shopping on a tight budget. Includes shopping timeline, cost-saving strategies, supply checklists by grade, and tips for single mothers to stretch every dollar.