Financial Planning for 2026: 5 Essential Goals to Boost Your Savings with BUDGT

A new year brings fresh motivation to improve your finances. Whether you’re recovering from holiday overspending, finally ready to build savings, or aiming to break the paycheck-to-paycheck cycle, 2026 can be the year you take control.

The key isn’t dramatic changes or perfect budgeting. It’s setting clear goals, building daily habits, and tracking progress consistently. This guide gives you a complete framework to make 2026 your best financial year yet.

Why Most Financial Resolutions Fail (And How to Beat the Odds)

Studies show that 80% of New Year’s resolutions fail by February. Financial resolutions fail for predictable reasons:

| Why Resolutions Fail | How to Succeed Instead |

|---|---|

| Too vague (“save more money”) | Specific targets (“save $200/month”) |

| No tracking system | Daily budget tracking in BUDGT |

| All-or-nothing thinking | Progress over perfection |

| No accountability | Weekly reviews and milestones |

| Unrealistic expectations | Start small, build momentum |

The people who succeed at financial goals share one trait: they track their progress daily, not just monthly.

Goal 1: Assess Your Current Financial Situation

You can’t improve what you don’t measure. Before setting 2026 goals, understand where you stand today.

Calculate Your Net Worth

Add up all assets (savings, investments, property equity) and subtract all debts (credit cards, loans, mortgage). This single number shows your starting point.

Review Last Year's Spending

Look at bank and credit card statements. Categorize spending into needs, wants, and savings. Most people are surprised where money actually went.

Identify Your Biggest Money Leaks

Find the 2-3 categories where you overspent most. These are your biggest opportunities for improvement in 2026.

Calculate Your Savings Rate

Divide last year's total savings by total income. If it's under 10%, you have significant room to improve.

List All Debts with Interest Rates

Write down every debt, its balance, interest rate, and minimum payment. This helps prioritize what to pay off first.

Your Financial Snapshot Worksheet

| Category | Your Number |

|---|---|

| Assets | |

| Checking accounts | $_____ |

| Savings accounts | $_____ |

| Retirement accounts (401k, IRA) | $_____ |

| Other investments | $_____ |

| Property equity | $_____ |

| Total Assets | $_____ |

| Debts | |

| Credit card balances | $_____ |

| Student loans | $_____ |

| Car loans | $_____ |

| Mortgage | $_____ |

| Other debts | $_____ |

| Total Debts | $_____ |

| Net Worth (Assets - Debts) | $_____ |

Key Questions to Answer

| Question | Why It Matters |

|---|---|

| What’s my monthly take-home income? | Sets the ceiling for your budget |

| What are my fixed monthly expenses? | Determines what’s left for flexible spending |

| What’s my current savings rate? | Shows if you’re building wealth or not |

| What’s my highest-interest debt? | Should be your payoff priority |

| Where did I overspend last year? | Identifies opportunities for change |

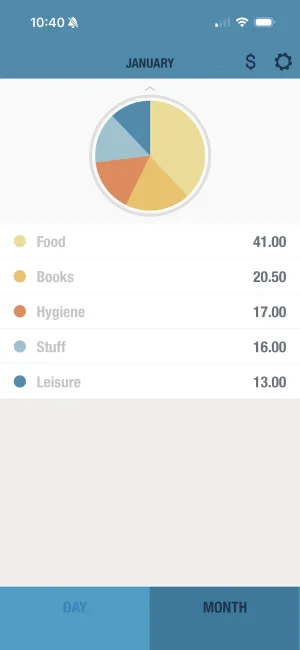

See your complete monthly picture

BUDGT's monthly overview shows income, expenses, and remaining budget at a glance. Know exactly where you stand before setting 2026 goals.

Goal 2: Set SMART Financial Targets for 2026

Vague goals lead to vague results. Use the SMART framework to create goals you’ll actually achieve:

The SMART Framework

| Element | Description | Example |

|---|---|---|

| Specific | Exactly what you want | ”Build emergency fund” |

| Measurable | A number to track | ”$5,000” |

| Achievable | Realistic for your situation | Based on your income |

| Relevant | Matters to your life | Provides security |

| Time-bound | Has a deadline | ”by December 31, 2026” |

SMART Goal Example: “Save $5,000 in an emergency fund by December 31, 2026, by saving $417/month.”

Recommended 2026 Goals by Situation

| Your Situation | Primary Goal | Secondary Goal |

|---|---|---|

| No emergency fund | Build $1,000-3,000 mini emergency fund | Reduce one expense category by 20% |

| High-interest debt | Pay off credit cards completely | Build $500 emergency buffer |

| Living paycheck to paycheck | Save 1 month’s expenses | Track spending for 90 days |

| Already saving | Increase savings rate by 5% | Max out retirement match |

| Debt-free with savings | Build 6-month emergency fund | Start investing consistently |

Goal-Setting Worksheet

| Goal | Target Amount | Monthly Amount | Deadline |

|---|---|---|---|

| Emergency fund | $_____ | $_____ | ________ |

| Debt payoff | $_____ | $_____ | ________ |

| Vacation fund | $_____ | $_____ | ________ |

| Retirement | $_____ | $_____ | ________ |

| Other: _______ | $_____ | $_____ | ________ |

Set and track your savings goals

BUDGT's Savings Mode automatically reserves money toward your goals before calculating your daily budget. Watch your savings grow while staying on track with daily spending.

Goal 3: Create Your 2026 Budget

A budget isn’t a restriction—it’s a plan that gives you permission to spend without guilt.

The 50/30/20 Rule (Adjusted for Reality)

| Category | Traditional | Adjusted for 2026 |

|---|---|---|

| Needs | 50% | 50-60% (housing costs have risen) |

| Wants | 30% | 20-30% (more flexibility here) |

| Savings/Debt | 20% | 15-25% (adjust based on debt level) |

Sample 2026 Budget ($4,500/month income)

| Category | Percentage | Amount |

|---|---|---|

| Needs (55%) | $2,475 | |

| Housing (rent/mortgage) | 30% | $1,350 |

| Utilities | 5% | $225 |

| Groceries | 10% | $450 |

| Transportation | 8% | $360 |

| Insurance | 2% | $90 |

| Wants (25%) | $1,125 | |

| Dining out | 5% | $225 |

| Entertainment | 5% | $225 |

| Shopping | 5% | $225 |

| Personal care | 3% | $135 |

| Subscriptions | 3% | $135 |

| Miscellaneous | 4% | $180 |

| Savings/Debt (20%) | $900 | |

| Emergency fund | 10% | $450 |

| Retirement | 5% | $225 |

| Debt payoff | 5% | $225 |

Calculating Your Daily Budget

This is where BUDGT excels. Here’s the formula:

| Step | Calculation |

|---|---|

| 1. Monthly income | $4,500 |

| 2. Minus fixed expenses (housing, utilities, insurance) | -$1,665 |

| 3. Minus savings goal | -$900 |

| 4. = Flexible spending | $1,935 |

| 5. Divided by 30 days | $64.50/day |

That $64.50 is your daily budget for groceries, gas, dining, entertainment, and everything else that isn’t fixed.

Know your daily spending limit

BUDGT calculates your safe daily spending automatically. Blue means you're on track, yellow means slow down, orange means stop. One number tells you everything.

Goal 4: Build Your Financial Safety Net

An emergency fund is the foundation of financial security. Without one, every unexpected expense becomes a crisis.

Emergency Fund Targets

| Stage | Amount | Purpose |

|---|---|---|

| Starter | $500-1,000 | Covers minor emergencies without credit cards |

| Basic | 1 month expenses | Handles short-term job loss |

| Solid | 3 months expenses | Provides real security |

| Full | 6 months expenses | Weatherproof against most setbacks |

Building Your Emergency Fund in 2026

| Monthly Contribution | Reach $1,000 | Reach $3,000 | Reach $6,000 |

|---|---|---|---|

| $100 | 10 months | 2.5 years | 5 years |

| $200 | 5 months | 15 months | 2.5 years |

| $300 | 3.5 months | 10 months | 20 months |

| $500 | 2 months | 6 months | 12 months |

Where to Keep Emergency Funds

| Option | Pros | Cons |

|---|---|---|

| High-yield savings account | Earns 4-5% interest, FDIC insured | May take 1-2 days to access |

| Money market account | Higher rates, check-writing | May have minimums |

| Regular savings | Instant access | Low interest (0.01-0.5%) |

Choose accessibility over maximum return. Emergency funds need to be available when emergencies happen.

Track your progress visually

BUDGT's projection shows where you'll be at month's end. Watch your emergency fund grow as you stick to your daily budget consistently.

Goal 5: Pay Down Debt Strategically

Not all debt payoff strategies are equal. Choose based on what keeps you motivated.

Debt Payoff Methods Compared

| Method | How It Works | Best For |

|---|---|---|

| Avalanche | Pay highest interest rate first | Minimizing total interest paid |

| Snowball | Pay smallest balance first | Quick wins and motivation |

| Hybrid | Pay off one small debt, then switch to avalanche | Best of both worlds |

Example Debt Payoff Plan

| Debt | Balance | Rate | Minimum | Avalanche Order | Snowball Order |

|---|---|---|---|---|---|

| Store card | $800 | 26% | $25 | 1st | 2nd |

| Credit card A | $2,500 | 22% | $50 | 2nd | 3rd |

| Credit card B | $400 | 18% | $15 | 3rd | 1st |

| Car loan | $8,000 | 6% | $200 | 4th | 4th |

The Debt Payoff Accelerator

Every extra dollar toward debt saves interest:

| Extra Monthly Payment | Time Saved on $5,000 debt at 20% | Interest Saved |

|---|---|---|

| $50 | 8 months | $450 |

| $100 | 14 months | $750 |

| $200 | 21 months | $1,100 |

| $300 | 26 months | $1,350 |

See where your money goes

BUDGT's category breakdown shows spending patterns clearly. Identify where you can cut back and redirect that money toward debt payoff.

Your 2026 Monthly Action Plan

Break the year into manageable monthly focuses:

| Month | Focus | Action |

|---|---|---|

| January | Assess and plan | Complete financial snapshot, set SMART goals |

| February | Build tracking habit | Log every expense in BUDGT daily |

| March | Cut subscriptions | Audit and cancel unused services |

| April | Tax refund strategy | Put 50%+ toward savings/debt |

| May | Review Q1 progress | Adjust budget based on actuals |

| June | Mid-year check | Are you on track for annual goals? |

| July | Summer spending audit | Watch for vacation overspending |

| August | Back-to-school prep | Budget ahead for seasonal expenses |

| September | Q3 review | Course-correct if needed |

| October | Holiday prep begins | Start setting aside gift money |

| November | Final push | Maximize year-end savings |

| December | Celebrate and plan | Review 2026, set 2027 goals |

Quarterly Review Checklist

Every 3 months, assess your progress:

| Review Item | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

| Net worth change | __ | __ | __ | __ |

| Savings rate achieved | __% | __% | __% | __% |

| Debt paid down | $__ | $__ | $__ | $__ |

| Emergency fund balance | $__ | $__ | $__ | $__ |

| Goals on track? | Y/N | Y/N | Y/N | Y/N |

| Adjustments needed | __ | __ | __ | __ |

Investment Basics for 2026

Once you have an emergency fund and high-interest debt paid off, consider investing:

Beginner Investment Options

| Option | Risk Level | Good For |

|---|---|---|

| High-yield savings | Very low | Emergency fund, short-term goals |

| Index funds (S&P 500) | Medium | Long-term growth (5+ years) |

| Target-date funds | Medium | Retirement (auto-adjusts over time) |

| Bond funds | Low-medium | Stability, income |

| Individual stocks | High | Only with money you can lose |

Retirement Account Priorities

| Priority | Account | Why |

|---|---|---|

| 1st | 401(k) up to employer match | Free money (50-100% return) |

| 2nd | High-interest debt | Guaranteed return (15-25%) |

| 3rd | Roth IRA | Tax-free growth |

| 4th | 401(k) above match | Tax-deferred growth |

| 5th | Taxable brokerage | Flexibility |

Your 2026 Success Toolkit

| Tool | Purpose | How BUDGT Helps |

|---|---|---|

| Daily budget check | Stay on track | Shows safe daily spending |

| Weekly review | Spot patterns | Category breakdown |

| Monthly assessment | Track progress | Month-end projection |

| Quarterly review | Big picture | Export data for analysis |

Make 2026 Your Best Financial Year

Financial success isn’t about perfection. It’s about:

- Starting with clear goals

- Tracking your progress daily

- Adjusting when life happens

- Celebrating wins along the way

The difference between people who achieve financial goals and those who don’t isn’t willpower—it’s systems. A daily budget check takes 30 seconds but changes everything.

Download BUDGT today and make 2026 the year you finally take control of your money. One day, one dollar, one smart decision at a time.

Your data stays completely private

BUDGT works 100% offline with no cloud sync or bank linking. Your 2026 financial journey stays on your device—complete privacy guaranteed.

Frequently Asked Questions

How can BUDGT help me achieve my 2026 financial goals?

BUDGT uses a daily budget philosophy that shows you exactly how much you can spend each day while meeting your savings goals. By sticking to this daily limit, you're guaranteed to have money left at month's end. Features like Savings Mode, categories, and Month Overflow help you track progress toward specific financial goals throughout 2026.

Is BUDGT available on Android or does it work offline?

BUDGT is currently available for iOS only and works 100% offline. You don't need internet connectivity, cloud sync, or bank linking. This makes it perfect for privacy-focused financial planning, as all your 2026 goal data stays secure on your device.

Can I try BUDGT before committing to a year-long subscription?

Yes, BUDGT offers a free trial with full functionality so you can test all features before subscribing. After the trial, choose from flexible subscription options including weekly, monthly, 3-month, 6-month, or yearly plans. The yearly option is great for long-term financial planning throughout 2026.

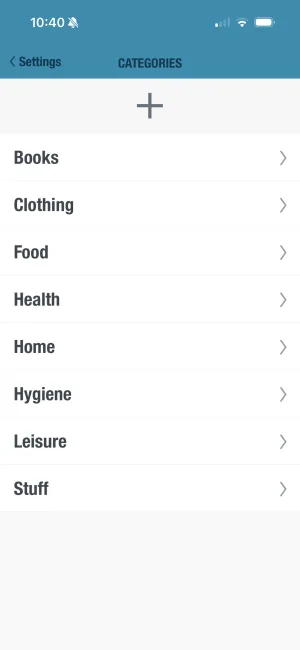

How does BUDGT help track multiple savings goals simultaneously?

Use BUDGT's categories feature to separate different savings goals like emergency fund, vacation fund, or retirement. The Savings Mode helps you set aside money for specific purposes, while notes let you track progress details. CSV export allows you to analyze how well you're meeting each goal over time.

What is the SMART goal framework and how do I apply it to my 2026 finances?

SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example: 'Save $5,000 for an emergency fund by December 31, 2026' is SMART. Use BUDGT to track your daily progress toward these concrete targets.

How do I assess my current financial situation before setting 2026 goals?

Review your bank statements and spending from the previous year. Identify how much went to essentials versus non-essentials. Use BUDGT to categorize and track your spending patterns for at least one month to establish a baseline before setting new goals.

What's the best way to create a realistic savings plan for 2026?

Start with the 50/30/20 rule: 50% for needs, 30% for wants, 20% for savings. Calculate your monthly income, subtract fixed expenses, and use BUDGT to set a daily spending limit that ensures you hit your savings target. Adjust monthly based on actual results.

Should I focus on paying off debt or building savings first in 2026?

Generally, build a small emergency fund ($500-$1,000) first, then aggressively pay down high-interest debt while maintaining minimum payments on other debts. Once high-interest debt is cleared, balance saving and lower-interest debt repayment. Track both in BUDGT categories.

How often should I review and adjust my financial plan?

Check your daily budget in BUDGT every day (takes seconds). Do a weekly review to spot spending patterns. Monthly, assess whether you're on track for your goals and adjust categories or limits. Quarterly, evaluate bigger picture progress and make strategic changes.

What are the best investment options for beginners in 2026?

For beginners, consider high-yield savings accounts for emergency funds, then index funds or ETFs for long-term investing due to built-in diversification and lower fees. Contribute to retirement accounts (401k, IRA) for tax benefits. Start small and increase as you learn.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS