New Year Budget Reset: Your Complete Financial Fresh Start Guide

January is the perfect time for a fresh start—especially when it comes to your finances. Whether you overspent during the holidays, want to finally get control of your money, or simply want to build better habits, a New Year financial reset can set you up for 12 months of success.

This guide walks you through exactly how to reset your finances, create a budget that works, and build habits that stick.

Why January Is the Best Time for a Financial Reset

There’s something powerful about the start of a new year. It’s a natural pause point—a moment to reflect on what worked, what didn’t, and what you want to change.

| Why January Works | The Benefit |

|---|---|

| Natural transition point | Motivation is naturally high |

| Holiday spending is fresh | Easy to see where money went |

| Full year ahead | Time to build momentum |

| Tax season approaching | Financial documents gathered |

| Clean calendar | New habits start fresh |

A financial reset in January allows you to review the past year’s spending patterns, clear any holiday debt before it grows, set meaningful goals for the year ahead, and build momentum early when motivation is high.

Don’t let January slip by without taking advantage of this fresh-start energy.

The 7-Step Financial Reset Process

Here’s the complete roadmap for your New Year budget reset:

Review Holiday Spending

Calculate total holiday costs, identify any new debt, and note where you overspent.

Assess Current Finances

Document your savings, debts, income, and fixed expenses for a clear starting point.

Set Clear Goals

Define short-term, medium-term, and long-term financial goals using the SMART framework.

Create Your Budget

Build a realistic monthly budget with categories for needs, wants, savings, and debt.

Build Tracking Habits

Commit to daily expense tracking and weekly budget reviews.

Tackle Holiday Debt

Create a debt payoff plan using snowball or avalanche method.

Plan for Next December

Start a Christmas Fund now to avoid next year's holiday debt.

Step 1: Review Your Holiday Spending

Before you can move forward, look back. How did December treat your wallet? Use this interactive audit to compare what you planned to spend versus what you actually spent:

Your Holiday Spending Audit

Enter your numbers - totals and differences update automatically

Key questions to answer:

- Did you take on any new debt (credit cards, buy-now-pay-later)?

- Which categories had the biggest overspend?

- What would you do differently next year?

This isn’t about guilt—it’s about awareness. You can’t improve what you don’t measure.

Pro tip: If you tracked your holiday spending in BUDGT, this review takes just minutes. If you didn’t, now you know why tracking matters!

Step 2: Assess Your Current Financial Situation

Get a clear picture of where you stand right now. Use these three calculators to build your financial snapshot:

Your Assets

Total Assets

Enter your numbers above - results update automatically

Your Debts

Total Debt

Enter your numbers above - results update automatically

Monthly Cash Flow

Available for Budget

Enter your numbers above - results update automatically

This snapshot becomes your starting point for the year—and the benchmark you’ll measure progress against.

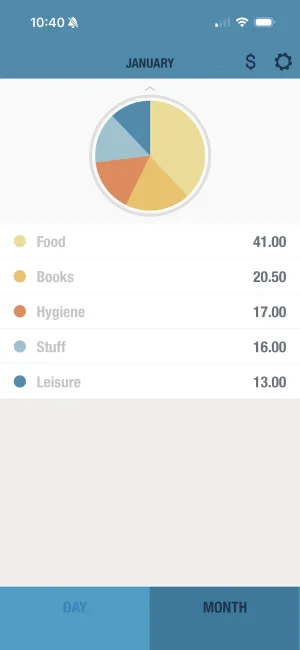

See your complete financial picture

BUDGT's monthly view shows your income, expenses, and what's left at a glance. No complicated spreadsheets—just clear numbers that make sense.

Step 3: Set Clear Financial Goals

Goals give your budget purpose. Without them, you’re just tracking numbers. With them, you’re building toward something meaningful.

Short-term Goals (1-3 months)

| Goal | Target | Timeline |

|---|---|---|

| Pay off holiday credit card | $_______ | By March |

| Build emergency buffer | $500 | 90 days |

| Stick to budget | 30 days | January |

Medium-term Goals (3-12 months)

| Goal | Target | Timeline |

|---|---|---|

| Build emergency fund | 3 months expenses | By December |

| Pay off specific debt | $_______ | By _______ |

| Save for vacation | $_______ | By summer |

Long-term Goals (1+ years)

| Goal | Target | Timeline |

|---|---|---|

| Become debt-free | All consumer debt | _______ |

| House down payment | $_______ | _______ |

| Retirement savings | $_______ annually | Ongoing |

Make your goals SMART:

| Letter | Meaning | Example |

|---|---|---|

| S | Specific | ”Pay off $2,000 credit card balance” |

| M | Measurable | Track balance weekly |

| A | Achievable | $500/month payment fits budget |

| R | Relevant | Reduces stress, saves interest |

| T | Time-bound | Paid off by April 30 |

Step 4: Create Your New Year Budget

Now for the main event: your 2026 budget.

Sample Monthly Budget Framework

| Category | % of Income | Example ($4,000) |

|---|---|---|

| Needs (50%) | ||

| Housing | 25-30% | $1,000-1,200 |

| Utilities | 5% | $200 |

| Groceries | 10% | $400 |

| Transportation | 5-10% | $200-400 |

| Insurance | 5% | $200 |

| Wants (30%) | ||

| Dining out | 5% | $200 |

| Entertainment | 5% | $200 |

| Shopping | 5% | $200 |

| Subscriptions | 2-3% | $80-120 |

| Personal care | 2% | $80 |

| Savings & Debt (20%) | ||

| Emergency fund | 5-10% | $200-400 |

| Retirement | 5-10% | $200-400 |

| Debt payoff | 5% | $200 |

Building Your Budget Step by Step

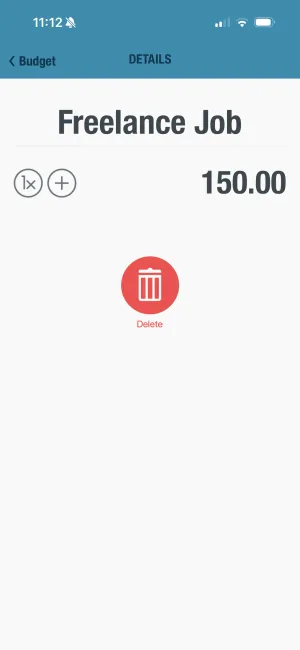

1. Start with income: List all sources of monthly income after taxes.

2. List fixed expenses: These don’t change much month to month—rent, utilities, insurance, subscriptions.

3. Estimate variable expenses: Groceries, transportation, entertainment, personal care. Use last year’s averages as a guide.

4. Allocate savings: Pay yourself first. Decide what percentage goes to savings before you budget the rest.

5. Calculate daily budget: Divide your remaining discretionary spending by days in the month.

6. Leave room for flexibility: Life happens. A small buffer for unexpected expenses keeps your budget realistic.

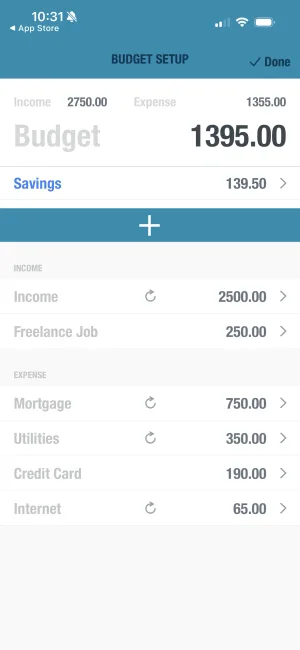

Set up your budget in minutes

BUDGT automatically calculates your daily spending limit based on your income and fixed expenses. Know exactly what's safe to spend every single day.

Step 5: Build Sustainable Money Habits

A budget only works if you use it. Here’s how to make budgeting a habit that sticks:

| Habit | Frequency | Time Required |

|---|---|---|

| Log expenses | Daily | 30 seconds |

| Check daily budget | Daily | 5 seconds |

| Review categories | Weekly | 10 minutes |

| Adjust budget | Monthly | 30 minutes |

| Full financial review | Quarterly | 1 hour |

The Daily Tracking Advantage:

| Tracking Method | Success Rate | Why |

|---|---|---|

| End of month review | 23% | Too late to adjust |

| Weekly tracking | 47% | Some awareness |

| Daily tracking | 78% | Real-time feedback |

Consistency beats perfection. A few minutes daily is more powerful than hours once a month.

Know where you stand every day

BUDGT's color system shows your status at a glance—blue means safe to spend, yellow means on track, orange means slow down. No math required.

Step 6: Tackle Any Holiday Debt

If December left you with debt, make a plan to clear it:

Debt Payoff Comparison

| Method | How It Works | Best For |

|---|---|---|

| Snowball | Pay smallest debt first | Motivation through quick wins |

| Avalanche | Pay highest interest first | Saving the most money |

| Consolidation | Combine into one payment | Simplifying multiple debts |

Sample Debt Payoff Plan

| Debt | Balance | Interest | Min Payment | Payoff Order |

|---|---|---|---|---|

| Store card | $400 | 25% | $25 | 1st (Snowball) |

| Credit card | $1,500 | 22% | $45 | 2nd |

| Personal loan | $3,000 | 12% | $100 | 3rd |

Debt payoff tips:

- List all debts with amounts, interest rates, and minimum payments

- Choose snowball (smallest first) or avalanche (highest interest first)

- Temporarily cut non-essential spending until debt is cleared

- Avoid taking on new debt—pause credit card use if needed

- Celebrate milestones to stay motivated

The sooner you address holiday debt, the less interest you’ll pay.

Step 7: Plan for Next December Now

Here’s a game-changer: start a “Christmas Fund” in January.

| Monthly Savings | December Fund |

|---|---|

| $25/month | $300 |

| $50/month | $600 |

| $75/month | $900 |

| $100/month | $1,200 |

If you want to spend $600 on the holidays, that’s just $50 per month. By December, you’ll have cash ready—no debt, no stress.

Why this works:

| Approach | December Stress | January Debt |

|---|---|---|

| No planning | High | High |

| Last-minute savings | Medium | Medium |

| Year-long fund | None | None |

Set up a savings goal in BUDGT and watch it grow throughout the year.

Your January Action Plan

| Week | Action | Time |

|---|---|---|

| Week 1 | Review holiday spending, assess finances | 1 hour |

| Week 2 | Set goals, create budget | 1 hour |

| Week 3 | Start daily tracking, set up systems | 30 min |

| Week 4 | Review first month, adjust as needed | 30 min |

Your Fresh Start Begins Today

A new year is a chance to take control—to stop worrying about money and start making it work for you.

Whether you’re recovering from holiday spending, building your first real budget, or recommitting to financial goals, the steps in this guide will set you up for success.

The best part? You don’t have to do it alone. BUDGT is designed to make budgeting simple, intuitive, and sustainable.

Download BUDGT today and make this your best financial year yet.

Frequently Asked Questions

How do I start budgeting in the new year?

Begin by reviewing your current financial situation: income, expenses, savings, and debt. Then set clear goals and create a budget that allocates your income to needs, wants, savings, and debt repayment. Use BUDGT to track everything in one place.

How do I recover from holiday overspending?

First, calculate how much you overspent and any new debt. Then create a repayment plan, temporarily reduce non-essential spending, and avoid taking on new debt until you're back on track.

What's the best way to set financial goals?

Use the SMART framework: make goals Specific, Measurable, Achievable, Relevant, and Time-bound. Break big goals into smaller milestones and track progress regularly.

How can I make budgeting a habit that sticks?

Track expenses daily (it takes seconds with BUDGT), review your budget weekly, and adjust monthly. Consistency is more important than perfection—small daily actions build lasting habits.

Should I start saving for next Christmas in January?

Absolutely! Starting a Christmas Fund in January means spreading the cost over 12 months. Even $50/month gives you $600 by December—no debt, no stress.

How does BUDGT help with a New Year financial reset?

BUDGT helps you set budgets, create spending categories, track expenses in real-time, and visualize your progress. It turns your financial goals into daily, actionable steps.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS