How to Budget for Christmas: 5 Easy Steps to Save Money

Are you worried about holiday expenses breaking your bank? You’re not alone. The average American spends over $1,000 during Christmas, and many go into debt to do it.

But here’s the truth: you don’t have to choose between a joyful holiday and financial stress. With a clear plan and the right strategies, you can celebrate Christmas generously while keeping your finances intact.

This guide gives you everything you need to enjoy the holidays without the January regret.

The Real Cost of Christmas

Before creating your budget, understand what the holiday season actually costs:

Average Holiday Spending by Category

Where Holiday Money Goes

The Hidden Costs of the Holidays

| Hidden Cost | Average Amount | Often Forgotten? |

|---|---|---|

| Shipping costs | $50-150 | Yes |

| Gift wrapping | $20-50 | Yes |

| Holiday tips | $50-200 | Sometimes |

| Batteries for toys | $15-30 | Yes |

| Last-minute gifts | $50-100 | Always |

| New Year’s celebration | $50-200 | Often |

| Extra utility bills | $30-50 | Yes |

Why Budgeting Matters

| Without Budget | With Budget |

|---|---|

| Average credit card debt: $1,000+ | Spend within means |

| 5 months to pay off at 20% APR | No debt to carry |

| January financial stress | Peace of mind |

| Guilt and regret | Joy and pride |

The 5-Step Christmas Budget Plan

Set Your Total Holiday Budget

Calculate what you can actually afford based on your income and existing obligations. Be realistic—no wishful thinking allowed.

Create Gift and Category Budgets

Divide your total budget into categories: gifts, food, decorations, travel. Then break gifts down by person.

Plan Budget-Friendly Gift Giving

Use strategies like the 4-gift rule, DIY gifts, and experience gifts to stretch your budget further.

Shop Smart and Track Everything

Hunt for deals, compare prices, and track every purchase in real-time to avoid overspending.

Create Your Christmas Emergency Fund

Build a buffer for unexpected expenses and start saving for next year immediately.

Step 1: Set Your Total Holiday Budget

The most important step is deciding what you can actually afford—not what you want to spend.

Holiday Budget Guidelines

| Annual Income | Recommended Gift Budget | Total Holiday Budget |

|---|---|---|

| $30,000 | $300-450 | $400-600 |

| $50,000 | $500-750 | $650-1,000 |

| $75,000 | $750-1,125 | $1,000-1,500 |

| $100,000 | $1,000-1,500 | $1,300-2,000 |

The 1-1.5% Rule: Spend no more than 1-1.5% of your annual income on holiday gifts.

Calculate Your Christmas Budget

Your Christmas Budget Calculator

What's left after essentials

What you'll spend on non-holiday items

Regular spending (non-holiday)

Enter your numbers above - results update automatically

This is your realistic holiday budget. If the number seems low, that’s okay—we’ll make it work.

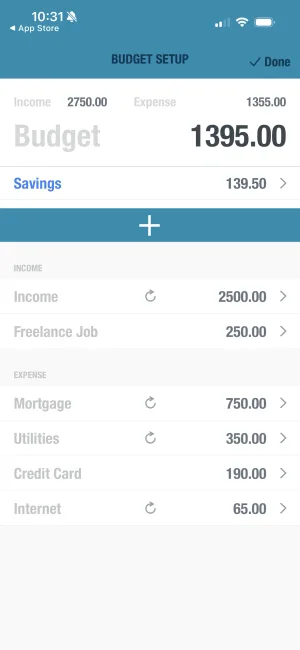

Set up your Christmas budget in minutes

BUDGT makes holiday budgeting simple. Enter your December income and expenses, then see exactly how much you can spend each day on gifts and celebrations.

Step 2: Create Gift and Category Budgets

Once you know your total, divide it strategically.

The 50-30-20 Holiday Split

| Category | Percentage | Example ($800 budget) |

|---|---|---|

| Gifts | 50% | $400 |

| Food & Entertaining | 30% | $240 |

| Everything else | 20% | $160 |

Gift Budget Planning

| Recipient Type | Priority | Budget Range |

|---|---|---|

| Children | High | $30-75 each |

| Partner | High | $50-150 |

| Parents | Medium-High | $25-75 each |

| Siblings | Medium | $20-50 each |

| Extended family | Lower | $15-30 each |

| Friends | Lower | $15-25 each |

| Teachers/caregivers | Consider | $10-25 each |

| Coworkers | Optional | $10-20 each |

Sample Gift Budget Worksheet

| Person | Relationship | Budget | Spent | Remaining |

|---|---|---|---|---|

| $ | $ | $ | ||

| $ | $ | $ | ||

| $ | $ | $ | ||

| $ | $ | $ | ||

| $ | $ | $ | ||

| Total | $ | $ | $ |

Typical Family Gift Budget Distribution

Step 3: Plan Budget-Friendly Gift Giving

The key to staying on budget is smart gift strategies, not cheap gifts.

The 4-Gift Rule

Each person receives only 4 gifts:

| Gift Type | Purpose | Budget-Friendly Ideas |

|---|---|---|

| Something they want | Fulfill a wish | Ask directly, check wishlists |

| Something they need | Practical item | Quality basics, everyday items |

| Something to wear | Clothing/accessories | Cozy socks, scarves, jewelry |

| Something to read | Books/learning | Books, magazine subscriptions |

This rule reduces quantity while maintaining thoughtfulness.

DIY Gift Ideas Under $15

| Gift | Materials Cost | Time | Best For |

|---|---|---|---|

| Cookie/soup mix in jar | $5-8 | 20 min | Anyone who cooks |

| Photo calendar | $10-15 | 30 min | Grandparents |

| Homemade candles | $10-15 | 1 hour | Adults |

| Infused oils/vinegars | $8-12 | 15 min + time | Food lovers |

| Customized mug | $5-10 | 30 min | Coworkers |

| Spa kit in basket | $10-15 | 20 min | Women |

| Baked goods box | $10-15 | 2 hours | Everyone |

| Plant cuttings in pot | $5-10 | 15 min | Plant lovers |

Experience Gift Ideas

| Experience | Cost Range | Best For |

|---|---|---|

| Movie night basket | $15-25 | Families |

| Date night IOU | Free-$50 | Partner |

| Babysitting coupons | Free | New parents |

| Cooking lesson together | $20-40 | Foodies |

| Hiking/picnic adventure | $10-20 | Active people |

| Game night pack | $15-30 | Families |

| Museum membership | $50-100 | Culture lovers |

| Class/lesson | $30-100 | Learners |

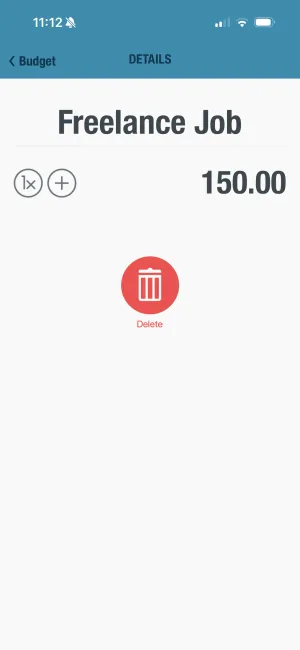

Track every gift purchase

BUDGT's Notes feature lets you track which gifts you've bought for whom. Stay organized and within budget without losing track of your holiday shopping.

Step 4: Shop Smart and Track Everything

When you shop matters as much as what you buy.

Holiday Shopping Timeline

| When | What to Buy | Why |

|---|---|---|

| January-October | Slowly accumulate when on sale | Best prices, no pressure |

| October | Make complete gift list | Plan before sales begin |

| Early November | Research prices, set alerts | Know what’s actually a deal |

| Black Friday/Cyber Monday | Big-ticket items from your list | Only planned purchases |

| December 1-15 | Fill in remaining gifts | Good selection, time to ship |

| December 15-20 | Local gifts, experience gifts | Avoid shipping anxiety |

| December 21+ | Gift cards only | Emergency last-minute only |

Black Friday/Cyber Monday Strategy

| Do | Don’t |

|---|---|

| Make list before sales start | Browse without a plan |

| Research regular prices | Assume everything is a deal |

| Set spending limit | Get swept up in “limited time” |

| Use price tracking tools | Buy just because it’s cheap |

| Track purchases in real-time | Forget what you’ve spent |

Price Comparison Strategies

| Strategy | How It Helps | Tools |

|---|---|---|

| Price alerts | Know when items drop | Camelcamelcamel, Honey |

| Multiple stores | Compare before buying | Google Shopping |

| Coupon stacking | Extra savings | Rakuten, browser extensions |

| Gift card deals | Pay less than face value | Raise, CardCash |

| Cashback apps | Money back on purchases | Ibotta, Fetch |

Potential Savings from Smart Shopping

Percentage savings compared to full-price, store-bought gifts

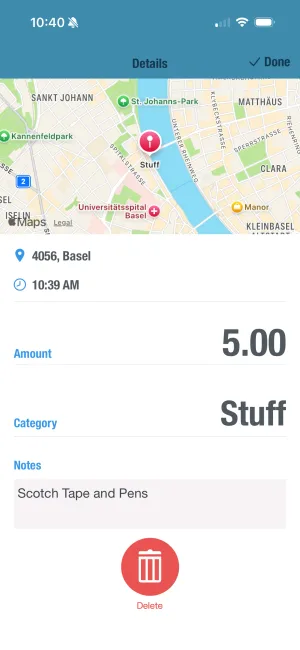

Track spending in real-time

BUDGT works 100% offline, so you can log purchases immediately while shopping—no internet required. See exactly how holiday spending affects your daily budget before you overspend.

Step 5: Create Your Christmas Emergency Fund

Smart planning includes buffers and future preparation.

Holiday Emergency Buffer

Set aside 10-15% of your holiday budget for:

| Unexpected Expense | Typical Cost |

|---|---|

| Last-minute gifts | $30-100 |

| Shipping rush fees | $20-50 |

| Forgotten recipients | $25-50 |

| Party contributions | $20-40 |

| Travel emergencies | $50-200 |

Start Next Year’s Christmas Fund Now

| Monthly Savings | Annual Total | Notes |

|---|---|---|

| $20/week | $1,040 | Covers most family needs |

| $30/week | $1,560 | Comfortable holiday budget |

| $50/week | $2,600 | Generous without stress |

Calculate Your Weekly Savings Need

What you want to have saved

Enter your numbers above - results update automatically

Save for next Christmas starting now

Use BUDGT's Savings Mode to set aside money for next year's holidays. Start in January and you'll have a stress-free Christmas fund by December.

Cutting Holiday Costs Without Losing Joy

Food & Entertaining Savings

| Strategy | Savings | How |

|---|---|---|

| Potluck dinners | $50-150 | Guests bring dishes |

| Batch cooking | $30-50 | Make ahead, reduce waste |

| Generic brands | $20-40 | Store brands taste the same |

| Meal plan | $40-60 | No last-minute expensive runs |

| BYOB | $30-100 | Guests bring drinks |

Decoration Savings

| Strategy | Savings | Alternative |

|---|---|---|

| Dollar store | 70-80% | Ornaments, wrap, bags |

| Natural decor | 90%+ | Pinecones, branches, berries |

| DIY decorations | 50-75% | Paper snowflakes, popcorn garland |

| After-Christmas sales | 50-75% | Buy for next year |

| Reuse existing | 100% | Curate what you have |

Free and Low-Cost Holiday Activities

| Activity | Cost | Joy Level |

|---|---|---|

| Drive to see lights | $5-10 gas | High |

| Hot cocoa and movie | $5-10 | High |

| Caroling | Free | High |

| Baking together | $10-20 | High |

| Free community events | Free | High |

| Board game marathon | Free | High |

| Star/snowflake making | $5 | Medium-High |

| Gingerbread houses | $10-20 | High |

Your Christmas Budget Action Plan

30 Days Before Christmas

| Task | Time | Priority |

|---|---|---|

| Set total budget | 30 min | Critical |

| List all recipients | 20 min | Critical |

| Assign per-person budgets | 20 min | Critical |

| Research gift ideas | 1 hour | High |

| Check sales calendars | 15 min | Medium |

14 Days Before Christmas

| Task | Time | Priority |

|---|---|---|

| Complete main shopping | 2-4 hours | Critical |

| Order online items | 1 hour | Critical |

| Buy wrapping supplies | 30 min | Medium |

| Plan holiday meals | 30 min | High |

7 Days Before Christmas

| Task | Time | Priority |

|---|---|---|

| Finish remaining shopping | 1-2 hours | High |

| Wrap gifts | 2-3 hours | Medium |

| Grocery shopping | 1-2 hours | High |

| Prep make-ahead food | 2-3 hours | Medium |

Christmas Week Checklist

| Item | Status |

|---|---|

| All gifts purchased and wrapped | □ |

| Food shopping complete | □ |

| Travel plans confirmed | □ |

| Budget tracked and on target | □ |

| Emergency buffer intact | □ |

| Next year’s savings started | □ |

Managing Gift Expectations

Having “The Talk” About Budget Limits

| Conversation | Script |

|---|---|

| With partner | ”Let’s set a gift limit for each other this year—how about $X? I’d rather us both enjoy the season without financial stress.” |

| With parents | ”This year we’re simplifying gifts. We’d love to focus on time together rather than expensive presents.” |

| With siblings | ”Want to do Secret Santa this year? One meaningful gift instead of trying to buy for everyone?” |

| With extended family | ”We’re keeping gifts to kids only this year. Let’s focus on enjoying each other’s company.” |

Alternative Gift Arrangements

| Arrangement | How It Works | Best For |

|---|---|---|

| Secret Santa | Each person buys for one person | Large families |

| White Elephant | One gift per person, everyone swaps | Parties, friend groups |

| Kids only | Adults skip gifts, focus on children | Extended families |

| Experience swap | Trade experiences instead of things | Close friends |

| Charity donations | Donate in someone’s name | Those who have everything |

After Christmas: Review and Plan

January Budget Recovery

| If You… | Action |

|---|---|

| Stayed within budget | Celebrate! Start saving for next year |

| Went slightly over | Adjust January budget to compensate |

| Went significantly over | Create debt payoff plan, no new charges |

Post-Holiday Review Questions

- What category did I overspend in?

- What purchases do I regret?

- What brought the most joy for the cost?

- What would I do differently next year?

- What should I start saving for now?

Review your holiday spending patterns

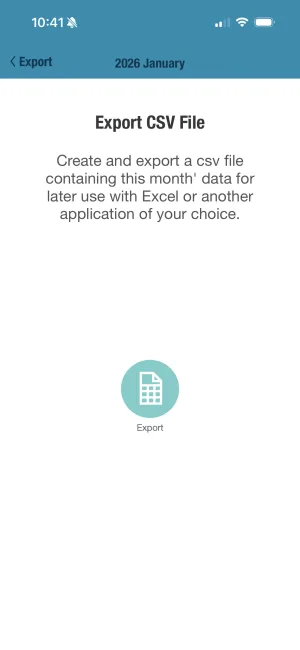

BUDGT's CSV export lets you review all your holiday spending after the season. See exactly where money went and use those insights to plan better for next year.

A Meaningful Christmas Without the Debt

The best gifts aren’t always the most expensive ones. The best memories often come from shared experiences, thoughtful gestures, and quality time together.

This year, give yourself the gift of financial peace:

- Set a realistic budget and stick to it

- Plan ahead to avoid panic purchases

- Focus on meaning over money

- Track every expense as you go

- Start saving for next year immediately

A meaningful Christmas doesn’t require expensive gifts or elaborate celebrations. What it requires is intentionality—with both your time and your money.

You’ve got this. Happy holidays!

Frequently Asked Questions

How far in advance should I start budgeting for Christmas?

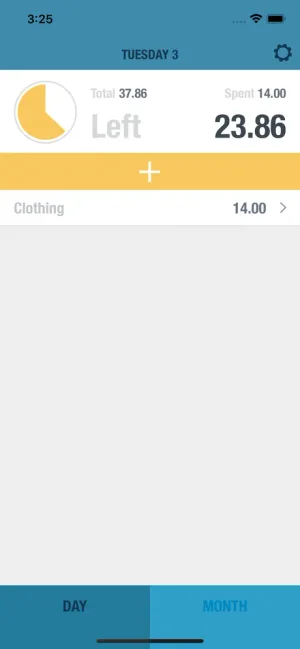

Ideally, start budgeting for Christmas in January by setting aside small amounts weekly. If you save $20-50 per week throughout the year, you'll have $1,000-2,500 by December. BUDGT's daily budget approach helps you find this extra money by showing exactly what's safe to spend each day.

Can BUDGT help me track holiday spending in real-time?

Yes, BUDGT tracks all your expenses in real-time with categories to separate gifts, decorations, food, and entertainment. Since it works 100% offline, you can log purchases immediately while shopping without needing internet. The daily budget updates show how holiday spending affects your overall budget.

Does BUDGT require a subscription or can I try it for free during the holidays?

BUDGT offers a free trial with full functionality, so you can use all features during the busy holiday season before deciding on a subscription. After the trial, choose from flexible options including weekly, monthly, 3-month, 6-month, or yearly subscriptions.

How can I use BUDGT to avoid overspending on Christmas gifts?

Set up a specific category for holiday gifts in BUDGT and allocate your total gift budget. Add notes to each expense to track who gifts are for, ensuring you stay within your per-person limits. The daily budget feature shows how much you can spend each day while staying on track.

Can I export my Christmas spending data to review after the holidays?

Yes, BUDGT includes CSV export functionality. You can export all your holiday spending data to review patterns, see what categories consumed the most money, and use that information to plan better for next year's holiday season.

Is my financial data safe when using BUDGT for holiday budgeting?

Absolutely. BUDGT is 100% offline with no cloud sync or bank linking. All your financial data stays private on your iOS device. There's no risk of data breaches or sharing your holiday spending information with third parties.

How does BUDGT's daily budget feature help during the expensive holiday season?

BUDGT calculates a safe daily spending limit based on your income, bills, and savings goals. During the holidays, you can see immediately how gift purchases affect your daily budget, helping you make informed decisions and avoid January debt by sticking to what you can actually afford.

What percentage of my budget should go to Christmas gifts?

Most financial experts recommend spending no more than 1-1.5% of your annual income on holiday gifts. For a $50,000 income, that's $500-750 for all gifts. If that feels low, adjust your expectations or supplement with DIY gifts and experiences rather than going into debt.

How do I handle gift expectations from family when I'm on a tight budget?

Be honest about your budget with close family. Suggest alternatives like Secret Santa (one gift per person), experience gifts, or a no-gift policy for adults. Most people respect honesty about finances, and many secretly feel relieved to spend less themselves.

What's the best strategy for Black Friday and Cyber Monday shopping?

Make your gift list and set price limits BEFORE the sales start. Research regular prices so you know what's actually a deal. Stick to your list—sales are only savings if you planned to buy the item anyway. Use BUDGT to track your spending in real-time to avoid getting swept up in "deal" excitement.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS