Post-Holiday Money Recovery: 7 Steps to Reset Your Budget

Post-Holiday Money Recovery: 7 Steps to Reset Your Budget

The holidays are over. The decorations are coming down. And if you’re like millions of people, you’re facing a credit card statement that makes you want to crawl back under the covers.

First, take a breath. Holiday overspending happens to nearly everyone—yes, even people who “should know better.” The guilt and shame you might be feeling right now? Completely normal, but also completely unhelpful. What matters now isn’t what you spent in December; it’s what you do in January.

This guide will walk you through a practical, judgment-free recovery plan. No lectures about what you should have done differently. Just seven concrete steps to get your finances back on track.

Step 1: Face the Numbers (Without Judgment)

The first step in any recovery is knowing exactly where you stand. This is often the hardest part—not because the math is complicated, but because looking at the damage can trigger shame spirals.

Here’s how to do it without falling apart:

The 10-Minute Financial Reality Check

Set a timer for 10 minutes. During this time, you’re going to gather three numbers:

-

Total holiday spending: Add up everything you spent from mid-November through New Year’s. Credit cards, cash, Venmo, all of it.

-

Current debt balance: If you put holiday purchases on credit cards, what’s the total balance you’re carrying?

-

Monthly minimum payments: What are you required to pay each month on any debt you accumulated?

Write these numbers down. Then close your statements and step away.

Why This Matters

You can’t create a recovery plan without knowing the starting point. But you also don’t need to dwell on it. Ten minutes of facing reality, then move forward.

Important mindset shift: These numbers are data, not a judgment of your worth as a person. They’re simply the starting point for your recovery plan.

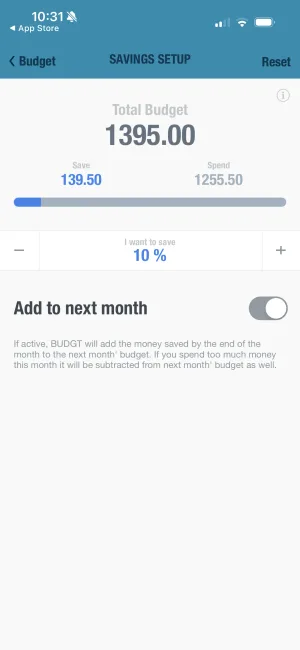

See where you stand after the holidays

BUDGT's month overflow feature shows the reality of overspending clearly. Facing the numbers is the first step to recovery—and BUDGT makes it manageable.

Step 2: Stop the Bleeding

Before you can recover, you need to stop accumulating more damage. January is prime time for “treating yourself” after the holiday stress, or continuing to spend because “what’s a little more at this point?”

The 2-Week Spending Pause

For the next two weeks, commit to spending money only on true necessities:

- Rent/mortgage

- Utilities

- Groceries (basics, not treats)

- Gas/transportation to work

- Medications

Everything else waits. Not forever—just two weeks.

How to Survive the Pause

Unsubscribe from retail emails — Remove the temptation entirely. You can always re-subscribe later.

Delete shopping apps from your phone — Make impulse buying inconvenient.

Find free entertainment — Library books, walks, cooking at home, calling friends. January is actually a great month for cozy, low-cost activities.

Track every urge — When you want to buy something, write it down instead. After two weeks, review the list. Most “urgent” wants will feel less compelling.

Step 3: Create Your Recovery Budget

Now that you’ve stopped the bleeding, it’s time to build a budget designed specifically for recovery. This isn’t your forever budget—it’s your “get back on track” budget.

The Recovery Budget Formula

Income - Essential expenses - Minimum debt payments = Recovery funds

Recovery funds get split between:

- Extra debt payments (if you have holiday debt)

- Rebuilding savings (if you dipped into emergency funds)

- A small “sanity” allowance (because total deprivation backfires)

Sample Recovery Budget

Let’s say your monthly take-home is $4,000:

| Category | Amount | Notes |

|---|---|---|

| Housing | $1,200 | Rent + utilities |

| Transportation | $300 | Gas, parking, transit |

| Groceries | $400 | Basics only |

| Insurance | $150 | Health, car |

| Minimum debt payments | $200 | Credit cards |

| Phone/Internet | $100 | Essentials |

| Extra debt payment | $400 | Accelerated payoff |

| Emergency fund rebuild | $150 | If you dipped in |

| Sanity allowance | $100 | Prevents deprivation spiral |

This leaves a buffer for unexpected expenses. If nothing comes up, roll it into debt payment or savings.

The “Sanity Allowance” Isn’t Optional

I know it seems counterintuitive to budget for fun when you’re trying to recover. But here’s the truth: budgets that allow zero enjoyment don’t last. That $100 (or whatever you can afford) prevents the deprivation → binge spending cycle that derails so many recovery attempts.

Spend it on whatever brings you genuine joy. Coffee with a friend. A single nice meal out. A book. Just keep it within the limit.

Watch your recovery progress daily

BUDGT's color system shows your status as you recover. Start in orange, work back to blue. Daily visual feedback keeps you motivated on your journey back to financial health.

Step 4: Attack Holiday Debt Strategically

If you’re carrying credit card debt from holiday spending, you have options for paying it down faster.

Option A: The Avalanche Method

Pay minimums on all cards, then throw extra money at the highest interest rate card first. This saves the most money mathematically.

Best for: People motivated by efficiency and math.

Option B: The Snowball Method

Pay minimums on all cards, then throw extra money at the smallest balance first. Once it’s paid off, roll that payment to the next smallest.

Best for: People who need quick wins to stay motivated.

Option C: Balance Transfer

Transfer high-interest debt to a 0% APR card and pay it off during the promotional period.

Best for: People with good credit who can realistically pay off the balance before the promo rate ends. Be aware of transfer fees (typically 3-5%).

See Your Payoff Timeline

Use this calculator to see exactly how long it will take to pay off your holiday debt—and how much you’ll save by paying a little extra each month:

Holiday Debt Payoff Calculator

See how faster payments save you money and time

Key insight: Every extra dollar you pay goes directly to principal, speeding up your recovery. Even an extra $50/month can cut months off your payoff timeline.

How Long Will Recovery Take?

Be realistic. If you overspent by $2,000 and can put $400/month toward extra payments, you’re looking at 5-6 months to full recovery. That’s okay. Sustainable progress beats aggressive plans you abandon in February.

Step 5: Rebuild Emergency Savings

Did you dip into savings during the holidays? You’re not alone—many people use emergency funds for holiday expenses, even though that’s not what they’re for.

The “Refill First” Approach

Some financial experts say to focus entirely on debt before rebuilding savings. I disagree. Here’s why:

If you have zero savings and a car repair hits, you’ll put it on credit and end up worse off than before. A small emergency buffer protects your debt payoff progress.

Minimum target: $500-1,000 while paying down debt Full target: 3-6 months of expenses (after debt is clear)

How to Rebuild

- Set up automatic transfers on payday, even if it’s just $25/week

- Sell items you no longer need (holiday gifts that missed the mark?)

- Put tax refunds toward savings before anything else

- Round up purchases and save the difference

Step 6: Set Up Systems to Prevent Next Year’s Overspending

While the pain is fresh, put systems in place for next holiday season. Future you will be grateful.

The Holiday Sinking Fund

Starting now, set aside a small amount each month for next year’s holidays. Even $50/month gives you $600 by November—that’s $600 you won’t put on credit cards.

Where to keep it: A separate savings account labeled “Holiday Fund.” Out of sight, out of mind until November.

The Gift List Approach

In January, while you remember what you spent, create a master list:

- Who you bought gifts for

- What you spent on each person

- Whether that amount felt right

Use this list next November to set realistic per-person limits before the shopping frenzy begins.

The “Enough” Conversation

Many families have discovered that scaling back holiday spending actually increases enjoyment. Less stuff, more presence. If you suspect your loved ones would be open to spending less on gifts, January is a great time to have that conversation—before another expensive season rolls around.

Step 7: Practice Self-Compassion (Seriously)

This might sound soft, but it’s actually crucial for financial recovery. Research shows that self-criticism after financial setbacks leads to more overspending, not less. It’s counterintuitive but true: being kind to yourself helps you make better financial decisions.

What Self-Compassion Looks Like

Instead of: “I’m so stupid. I can’t believe I did this again. I’ll never get my finances together.”

Try: “I overspent during a season designed to make people overspend. I’m human. Now I’m taking steps to recover, and that’s what matters.”

The Relapse Plan

Recovery isn’t linear. You might slip up—buy something you shouldn’t, skip a debt payment, fall back into old patterns.

When (not if) this happens:

- Notice without judgment

- Ask what triggered the slip

- Adjust your plan if needed

- Keep going

One slip doesn’t erase your progress. What matters is the overall trend.

Your January Recovery Action Plan

Here’s the week-by-week breakdown to get you started:

Week 1: Assessment

Complete the 10-minute financial reality check. Start your 2-week spending pause. Unsubscribe from retail emails and delete shopping apps from your phone.

Week 2: Planning

Create your recovery budget using the formula above. Decide on your debt payoff strategy (avalanche or snowball). Set up automatic savings transfers on payday.

Week 3: Systems

Start your holiday sinking fund for next year—even $50/month helps. Begin daily expense tracking with BUDGT. Create your gift list while memories are fresh.

Week 4: Review

Check progress against your recovery budget. Adjust categories as needed based on what you've learned. Acknowledge how far you've come in just one month.

The Bigger Picture

Holiday overspending is a symptom, not the disease. The real issue is usually some combination of:

- Social pressure to show love through spending

- Emotional spending to cope with holiday stress

- Lack of planning and systems

- Marketing designed to override rational thinking

Your recovery isn’t just about paying off this year’s debt. It’s about understanding your patterns and building systems that protect you going forward.

You’ve got this. January is for fresh starts, and you’ve already taken the first step by reading this guide. Now pick one action from this list and do it today.

Need help tracking your daily spending during recovery? BUDGT shows you exactly what you can spend today, with color-coded feedback (blue for on track, red for over budget). No judgment, no bank linking—just clarity when you need it most.

Frequently Asked Questions

How long does it take to recover from holiday overspending?

Recovery time depends on how much you overspent and your monthly budget. If you overspent by $2,000 and can put $400/month toward extra payments, expect 5-6 months to full recovery. Create a realistic timeline and focus on sustainable progress rather than aggressive plans you can't maintain.

Should I pay off debt or rebuild savings first after the holidays?

Do both, but prioritize differently. Build a small emergency buffer of $500-$1,000 while paying down debt, then focus entirely on debt payoff. Without any savings, an unexpected expense will put you right back on credit cards and derail your recovery.

What is the snowball vs avalanche method for paying off holiday debt?

The avalanche method pays highest-interest debt first (saves the most money). The snowball method pays the smallest balance first (provides quick wins for motivation). Choose avalanche if you're motivated by math and efficiency; choose snowball if you need psychological momentum.

How much should I budget for fun during debt recovery?

Include a small "sanity allowance" of $50-$100/month depending on your budget. Budgets with zero enjoyment don't last—total deprivation leads to binge spending that derails recovery. Spend it on whatever brings genuine joy, just stay within the limit.

What is a spending pause and how long should it last?

A spending pause means buying only true necessities (rent, utilities, basic groceries, medication) for a set period. Two weeks is effective for breaking the holiday spending momentum without being unsustainably long. Use this time to unsubscribe from retail emails and delete shopping apps.

How do I prevent holiday overspending next year?

Start a "holiday sinking fund" in January—even $50/month gives you $600 by November. Create a master gift list now while you remember what you spent, set per-person limits before shopping season, and consider having a family conversation about scaling back gift spending.

Why do I feel so much guilt about holiday overspending?

Holiday overspending triggers shame because we feel we "should know better." But the holidays are designed to encourage spending through marketing, social pressure, and emotional triggers. Self-compassion actually helps—research shows self-criticism leads to more overspending, not less.

What is a recovery budget and how is it different from a regular budget?

A recovery budget is specifically designed to get you back on track, not maintain forever. It's stricter on non-essentials but includes a small fun allowance. The formula is Income minus essential expenses minus minimum debt payments equals recovery funds for extra debt payments, savings, and sanity allowance.

How does BUDGT help with post-holiday financial recovery?

BUDGT shows your daily spending limit with color-coded feedback—blue means on track, red means over budget. This real-time awareness helps during recovery by making you conscious of every purchase. Track expenses, stay within your recovery budget, and see progress daily without judgment.

Should I do a balance transfer for holiday credit card debt?

A balance transfer to a 0% APR card can work if you have good credit and can realistically pay off the balance before the promotional period ends. Be aware of transfer fees (typically 3-5%) and don't use this as permission to accumulate more debt on the old card.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS