Bounce Back from Holiday Spending: 5 Quick Tips to Restore Your Budget

The holidays bring joy, connection, and memories—but they also leave many of us staring at credit card statements in January wondering what happened. If you overspent during the holiday season, you’re not alone. The average American adds $1,000-1,500 in holiday debt each year.

The good news? You can recover. With a clear plan and daily discipline, most people bounce back within 2-3 months. This guide gives you everything you need to restore your budget and start the new year financially strong.

The Reality of Holiday Overspending

Before diving into recovery strategies, let’s understand what we’re dealing with:

| Category | Average Holiday Overspending |

|---|---|

| Gifts | $400-600 |

| Food & entertaining | $200-350 |

| Decorations | $75-150 |

| Travel | $300-500 |

| Impulse purchases | $150-300 |

| Total | $1,125-1,900 |

Where Holiday Overspending Happens

The True Cost of Holiday Debt

If you put $1,500 on a credit card at 20% APR and pay only the minimum:

| Payment Strategy | Time to Pay Off | Total Interest Paid |

|---|---|---|

| Minimum payments only | 9+ years | $1,800+ |

| $100/month | 18 months | $250 |

| $200/month | 8 months | $110 |

| $300/month | 6 months | $70 |

The faster you pay it off, the more you save. That’s why starting now—not “later”—matters.

Your 5-Step Holiday Recovery Plan

Assess the Damage

Total up all holiday spending and current debt. You can't fix what you don't measure. Look at credit card statements, bank accounts, and receipts.

Set Your Daily Budget

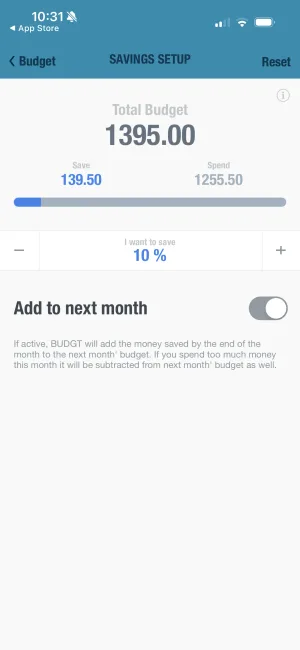

Calculate your recovery budget and track daily. BUDGT shows exactly what's safe to spend each day—and the color system warns you when to slow down.

Cut Subscriptions

Cancel unused subscriptions and redirect that money to debt payments. Even small recurring charges add up to significant annual savings.

Switch to Cash

Use cash for discretionary spending to prevent adding new debt. When it's gone, stop spending. This breaks the swipe-and-forget habit.

Pay Down Debt Strategically

Put every extra dollar toward highest-interest debt first. Once that's paid, roll payments to the next debt. Momentum builds.

Step 1: Assess the Damage

You can’t recover until you know exactly what you’re recovering from.

Create Your Holiday Spending Audit

Enter your numbers - totals and differences update automatically

Calculate Your Current Debt

Enter your numbers - totals update automatically

This isn’t about guilt—it’s about clarity. Once you see the numbers, you can make a plan.

See exactly where you stand

BUDGT's monthly overview shows your spending at a glance. When you're in the red, you know it. When you're recovering, you can see the progress.

Step 2: Set Your Daily Recovery Budget

The secret to budget recovery isn’t willpower—it’s a daily system that makes overspending harder than staying on track.

Calculate Your Recovery Budget

Calculate Your Recovery Budget

Enter your numbers above - results update automatically

Example Recovery Budget

| Category | Before Recovery | During Recovery |

|---|---|---|

| Dining out | $300/month | $75/month |

| Entertainment | $150/month | $50/month |

| Shopping | $200/month | $50/month |

| Subscriptions | $80/month | $30/month |

| Coffee/treats | $100/month | $40/month |

| Discretionary total | $830/month | $245/month |

| Extra for debt | $0 | $585/month |

At $585/month toward debt, you’d pay off $1,500 in under 3 months.

Know your daily limit

BUDGT calculates your safe daily spending automatically. Blue means you're good, yellow means slow down, orange means stop. Simple visual feedback keeps you on track.

Step 3: Cut Unnecessary Subscriptions

Subscriptions are silent budget killers. After the holidays, they’re the easiest money to redirect toward debt.

The Subscription Audit

| Subscription Type | Average Cost | Action |

|---|---|---|

| Streaming services | $10-20/month each | Keep 1-2, cancel the rest |

| Gym membership | $30-60/month | Cancel if unused 2+ weeks |

| Meal kit services | $50-100/month | Cancel (cook at home) |

| Premium apps | $5-15/month each | Cancel unless used weekly |

| Magazine/news subscriptions | $10-20/month | Cancel (use library instead) |

| Box subscriptions | $20-50/month | Cancel during recovery |

Hidden Subscriptions to Check

| Where to Look | Common Surprises |

|---|---|

| Credit card statements | Forgotten trial conversions |

| App store subscriptions | Auto-renewed apps |

| PayPal recurring | Old service sign-ups |

| Amazon Subscribe & Save | Items you no longer need |

A typical subscription audit saves $50-150/month—that’s $600-1,800/year toward debt payoff.

Monthly Subscription Savings Potential

Step 4: Switch to Cash for Daily Spending

Credit cards make spending too easy. During recovery, cash creates the friction you need.

Why Cash Works

| Factor | Credit Card | Cash |

|---|---|---|

| Spending awareness | Low (swipe and forget) | High (see money leave) |

| Overspending risk | High (no natural limit) | Low (when it’s gone, it’s gone) |

| Adding new debt | Likely | Impossible |

| Average overspend | 12-18% more | Baseline |

The Weekly Cash System

| Step | Action |

|---|---|

| 1 | Calculate weekly discretionary budget (daily limit × 7) |

| 2 | Withdraw that amount in cash on Sunday |

| 3 | Use only cash for: groceries, dining, entertainment, shopping |

| 4 | When cash is gone, stop discretionary spending |

| 5 | Use debit card only for gas and planned purchases |

What to Pay with Cash

| Use Cash | Use Debit/Auto-Pay |

|---|---|

| Groceries | Rent/mortgage |

| Dining out | Utilities |

| Coffee/treats | Insurance |

| Entertainment | Minimum debt payments |

| Shopping | Gas (for tracking ease) |

The psychological impact is real: watching $50 leave your wallet hurts more than swiping a card. That friction prevents impulse purchases.

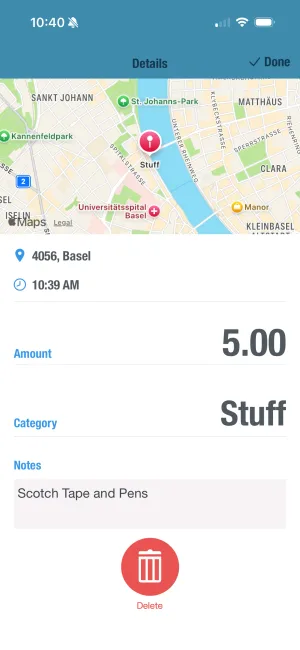

Track every purchase

Log each cash expense in BUDGT to stay aware. The daily total updates in real-time, showing exactly where you stand—even when using cash.

Step 5: Pay Down Debt Strategically

Not all debt payoff strategies are equal. Choose the one that keeps you motivated.

Avalanche Method (Mathematically Optimal)

Pay minimums on all debts. Put extra toward the highest interest rate first.

| Debt | Balance | Rate | Payment Order |

|---|---|---|---|

| Store card | $800 | 26% | Pay first |

| Credit card A | $1,200 | 21% | Pay second |

| Credit card B | $500 | 18% | Pay third |

Pros: Saves the most money on interest. Cons: Can feel slow if highest-rate debt is also the largest.

Snowball Method (Psychologically Optimal)

Pay minimums on all debts. Put extra toward the smallest balance first.

| Debt | Balance | Rate | Payment Order |

|---|---|---|---|

| Credit card B | $500 | 18% | Pay first |

| Store card | $800 | 26% | Pay second |

| Credit card A | $1,200 | 21% | Pay third |

Pros: Quick wins build momentum and motivation. Cons: Costs slightly more in interest.

Which Should You Choose?

| If you… | Choose |

|---|---|

| Need motivation from quick wins | Snowball |

| Want to minimize total cost | Avalanche |

| Have similar balances | Avalanche (interest matters more) |

| Have one small debt under $300 | Snowball (knock it out fast) |

Either method works if you stick with it. The worst strategy is switching methods or giving up.

Watch your projection improve

As you pay down debt and stick to your daily budget, BUDGT's month-end projection turns from red to green. Visual progress keeps you motivated.

Your 90-Day Recovery Timeline

Here’s what realistic recovery looks like:

| Timeframe | Focus | Milestones |

|---|---|---|

| Week 1 | Assess damage, set daily budget | Know exact debt total, start tracking |

| Week 2-3 | Cut subscriptions, switch to cash | $50-100 in monthly savings found |

| Month 1 | Build daily tracking habit | Stayed within budget 20+ days |

| Month 2 | Maintain system, increase debt payments | First debt paid off (if using snowball) |

| Month 3 | Refine budget, celebrate progress | 50-75% of holiday debt gone |

Signs You’re On Track

| Green Flag | What It Means |

|---|---|

| Daily budget feels normal | New habits forming |

| Less stress about money | Awareness creates control |

| Some money left at month end | System is working |

| Credit card balances dropping | Debt recovery happening |

Warning Signs

| Red Flag | What to Do |

|---|---|

| Frequently exceeding daily budget | Lower budget or cut more expenses |

| Adding new credit card charges | Switch fully to cash |

| Feeling deprived, tempted to splurge | Build small treats into budget |

| Skipping tracking | Set daily reminder in BUDGT |

Finding Free Fun During Recovery

Recovery doesn’t mean misery. Here’s how to enjoy life without spending:

| Free/Low-Cost Activity | Instead of |

|---|---|

| Game night at home | Going to a bar |

| Potluck with friends | Restaurant dinner |

| Nature walk/hike | Paid entertainment |

| Library books/movies | Streaming subscriptions |

| Community events | Paid events |

| Home workout videos | Gym membership |

| Free museum days | Paid attractions |

The goal is sustainable recovery. If you feel completely deprived, you’ll eventually binge spend and undo your progress.

After Recovery: Building Better Habits

Once you’ve paid off holiday debt, don’t return to old patterns. Here’s how to stay on track:

Year-Round Holiday Savings

| Month | Action |

|---|---|

| January | Calculate last year’s holiday spending |

| February | Set this year’s holiday budget |

| March-November | Save 1/10 of budget monthly |

| December | Spend only what you saved |

If you spent $1,200 on holidays, that’s $120/month to save year-round. In BUDGT, include this as part of your savings goal.

The Sinking Fund Strategy

| Fund | Monthly Contribution | Annual Total |

|---|---|---|

| Holiday gifts | $100 | $1,200 |

| Birthdays | $30 | $360 |

| Car maintenance | $50 | $600 |

| Home repairs | $50 | $600 |

| Vacation | $100 | $1,200 |

When these expenses come, you’ll have cash ready—no credit card needed.

From Debt to Control

Holiday overspending happens to almost everyone at some point. What matters isn’t the mistake—it’s the recovery.

With a clear daily budget, subscription cuts, cash spending, and strategic debt payoff, most people can recover within 90 days. The key is starting now, tracking every expense, and staying consistent.

This January doesn’t have to feel like punishment. It can be the month you took control of your finances for good.

One day, one purchase, one smart choice at a time.

Frequently Asked Questions

How long does it typically take to recover from holiday overspending?

Most people can recover within 2-3 months with disciplined daily budgeting. Light overspending ($500 or less) takes 4-6 weeks. Moderate overspending ($500-1500) takes 2-3 months. Heavy overspending ($1500+) may take 4-6 months. The key is starting immediately and staying consistent.

How can BUDGT help me recover from holiday debt faster?

BUDGT's daily budget shows exactly what's safe to spend each day. By living within your daily limit, you'll have money left at month's end for debt payments. The offline functionality lets you check your budget before any purchase, preventing impulse spending that derails recovery.

Should I focus on paying off debt or building savings first?

Pay off high-interest credit card debt first while maintaining a small emergency fund ($500-1000). Credit card interest (15-25% APR) costs more than savings earn. Once high-interest debt is gone, split extra money between debt payoff and building savings to 3-6 months of expenses.

What subscriptions should I cancel first after the holidays?

Cancel anything you haven't used in the past 30 days. Common targets: streaming services you rarely watch, gym memberships if not going weekly, meal kits, premium app subscriptions, and magazine subscriptions. Even $10/month saves $120/year for debt payoff.

How does using cash instead of credit cards help with recovery?

Cash creates a physical spending limit and psychological friction. When it's gone, spending stops. Studies show people spend 12-18% less with cash than cards. During recovery, this prevents adding new debt while you pay off old balances.

Can I still have fun while recovering from holiday spending?

Absolutely! Build small daily treats into your BUDGT budget. Focus on free activities: game nights, nature walks, library events, potlucks with friends. A sustainable recovery includes joy—deprivation leads to binge spending.

What's the fastest way to pay off holiday credit card debt?

Use the avalanche method: pay minimums on all cards, put extra toward the highest-interest card first. Or try the snowball method: pay off smallest balances first for quick wins. Either works—choose what keeps you motivated.

How much should I cut from my budget during recovery?

Aim to cut 15-25% from discretionary spending (dining out, entertainment, shopping). Don't cut essentials or you'll burn out. Track everything in BUDGT for 2 weeks first to see where money actually goes before deciding what to cut.

Should I use savings to pay off holiday debt?

Only if you have more than $1000 in savings AND your credit card interest exceeds 15%. Keep at least $500-1000 for emergencies—otherwise you'll add new debt when something breaks. Use extra savings above that threshold for debt payoff.

Does BUDGT require connecting to my bank account?

No. BUDGT works 100% offline with no bank linking. You manually enter expenses, which builds awareness. All data stays on your device—no cloud sync, no data sharing. Complete privacy during your financial recovery.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS