7 Holiday Spending Traps to Avoid This Christmas Season

The holidays are a time for joy, connection, and celebration—but they’re also prime time for budget disasters. Between glittering store displays, limited-time deals, and the pressure to make everything perfect, it’s easy to fall into spending traps that leave you financially drained come January.

The average American overspends by $400-600 during the holiday season, often starting the new year in debt. But it doesn’t have to be this way.

This guide exposes the seven most common holiday spending traps, explains the psychology behind each one, and gives you practical strategies to enjoy the festive season without the financial hangover.

The Holiday Spending Trap Overview

| Trap | Danger Level | Who’s Most Vulnerable | Recovery Difficulty |

|---|---|---|---|

| ”Just One More Gift” | High | Gift-givers, parents | Medium |

| Flash Sales Pressure | Very High | Online shoppers | Medium |

| Lifestyle Inflation | High | Social media users | Hard |

| Credit Card Amnesia | Very High | Previous debt holders | Very Hard |

| Gift-Giving Arms Race | Medium | People pleasers | Medium |

| Forgetting Extras | High | First-time budgeters | Medium |

| Post-Holiday Sales | Medium | Bargain hunters | Easy |

How to Avoid All 7 Traps

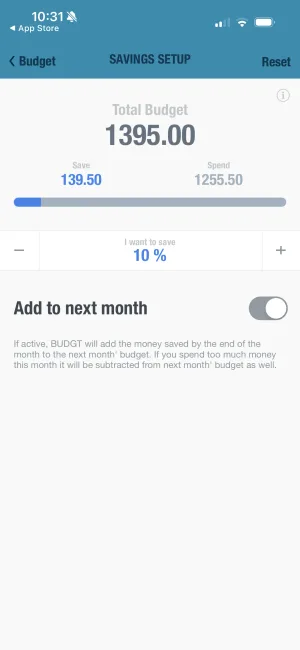

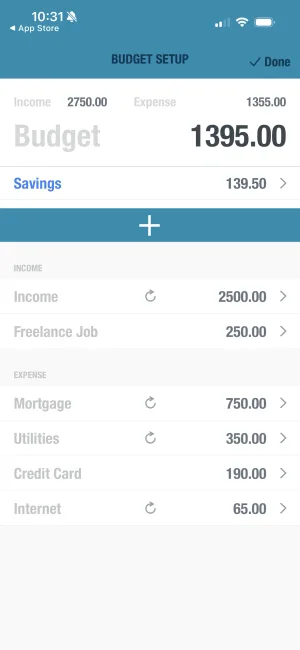

Set Your Total Budget

Before November, decide your complete holiday spending limit including gifts, food, decorations, travel, and entertainment.

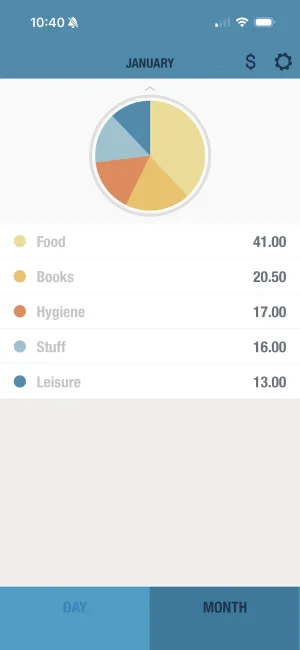

Create Spending Categories

Divide your total budget into specific categories. This prevents overspending in one area from hiding in your overall finances.

Make Your Gift List

Write down everyone you'll buy for with a specific amount allocated to each person. Stick to this list exactly.

Plan Your Shopping

Decide where and when you'll shop for each item. Planned shopping reduces impulse purchases dramatically.

Track Every Purchase

Log each expense in BUDGT immediately. Seeing your remaining budget in real-time keeps you accountable.

Build in Buffer

Add 15-20% buffer for unexpected expenses. This prevents small surprises from derailing your entire budget.

Trap #1: The “Just One More Gift” Syndrome

You’ve finished your shopping list, but then you spot the perfect item for someone. And another. And another. Before you know it, you’ve doubled your gift budget.

Why This Trap Works

| Psychological Trigger | How Retailers Use It |

|---|---|

| Completion desire | ”Complete the set” displays |

| Fear of inadequacy | ”Show them you care” messaging |

| Novelty seeking | New items prominently displayed |

| Gift anxiety | ”They’ll love this!” feelings |

The Real Cost

| Planned Gifts | ”One More” Additions | Total Spent |

|---|---|---|

| $300 | $50 here, $30 there | $500+ |

| $500 | $75, $45, $60 | $800+ |

| $800 | $100, $80, $75 | $1,200+ |

How to Avoid It

- Set a firm gift budget in BUDGT before you start shopping

- Once you’ve bought for everyone on your list, stop browsing entirely

- Leave stores/websites immediately after completing purchases

- Remember: thoughtfulness matters more than quantity

- Ask: “Is this person on my list? Is there budget for them?”

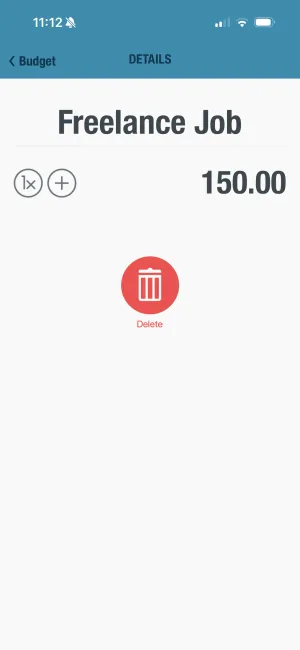

Know exactly what's left for gifts

BUDGT's daily budget shows exactly what you can spend today. When your gift budget is gone, you know it instantly—no guessing, no regrets.

Trap #2: Flash Sales and “Limited Time” Pressure

Retailers are experts at creating urgency. “Only 2 hours left!” “50% off today only!” These tactics trigger impulse buying—often for things you don’t need.

The Psychology of Urgency

| Tactic | What You Feel | Reality |

|---|---|---|

| Countdown timers | Panic, must act now | Sales often repeat |

| ”Only 3 left!” | Scarcity fear | Often restocked immediately |

| ”Limited edition” | Exclusivity desire | Usually just marketing |

| ”Members only” | Special status feeling | Anyone can sign up |

Sale Price Math That Fools You

| ”Deal” | What You Think | What Actually Happens |

|---|---|---|

| 50% off $100 item | ”I saved $50!” | You spent $50 you didn’t plan to |

| Buy 2, get 1 free | ”Free stuff!” | You bought 3 things you needed 0 of |

| $20 off $75 purchase | ”I need to spend $75 to save” | You spend $55 more than planned |

How to Avoid It

- Apply the 24-hour rule: wait a day before any unplanned purchase

- Ask yourself: “Would I buy this at full price?”

- Unsubscribe from promotional emails during November-December

- Use browser extensions that block sale notifications

- Remember: if you didn’t need it before the sale, you don’t need it now

Trap #3: Holiday Lifestyle Inflation

Suddenly, regular dinners become elaborate parties. Simple decorations become expensive displays. The pressure to match what you see on social media can inflate your spending dramatically.

How Social Media Amplifies Spending

| What You See | What You Feel | Reality |

|---|---|---|

| Perfect decorated homes | Inadequacy | Often sponsored content or debt-financed |

| Expensive gift hauls | Pressure to match | Many regret January credit bills |

| Elaborate parties | FOMO | Guests remember connection, not decor |

| ”Perfect” family moments | Must recreate | Staged photos, messy reality behind |

Lifestyle Inflation by Category

Average Holiday Lifestyle Inflation

Percentage increase over regular monthly spending

How to Avoid It

- Set a total holiday budget (not just gifts—include food, decorations, events)

- Remember that social media isn’t real life

- Focus on experiences over appearances

- Reuse decorations from previous years

- Host potluck-style gatherings instead of paying for everything

See all holiday spending in one place

BUDGT's monthly view shows your complete spending picture. See gifts, food, and decorations together so lifestyle inflation can't hide in separate mental accounts.

Trap #4: Credit Card Amnesia

“I’ll worry about it in January.” This mindset leads many people to rack up credit card debt during the holidays, only to face months of payments (plus interest) afterward.

The True Cost of Holiday Credit

| Amount Charged | Minimum Payments | Time to Payoff | Total Paid |

|---|---|---|---|

| $500 | $25/month | 24 months | $575 |

| $1,000 | $40/month | 32 months | $1,180 |

| $2,000 | $60/month | 47 months | $2,520 |

Assumes 20% APR with minimum payments only

Warning Signs of Credit Card Amnesia

| Sign | What It Means |

|---|---|

| Not tracking purchases | You don’t want to know |

| ”I deserve this” justification | Emotional spending override |

| ”It’s just once a year” | Annual pattern of debt |

| Planning to “figure it out later” | No actual plan exists |

| Using multiple cards | Hiding total from yourself |

How to Avoid It

- Pay with cash or debit whenever possible

- If using credit, track every purchase in BUDGT immediately

- Never spend more than you can pay off by your next statement

- Check your credit balance daily during shopping season

- Set a credit limit lower than your actual limit

Trap #5: The Gift-Giving Arms Race

Your colleague gave you an expensive bottle of wine, so now you feel obligated to match it. This reciprocity pressure can spiral your gift budget out of control.

How the Arms Race Escalates

| Year 1 | Year 2 | Year 3 | Year 4 |

|---|---|---|---|

| $20 gift | $30 gift | $45 gift | $60+ gift |

Common escalation pattern among friends/coworkers

Reciprocity Pressure Scenarios

| Situation | Pressure Response | Better Alternative |

|---|---|---|

| Unexpected gift from colleague | Buy expensive return gift | Send heartfelt thank-you card |

| Friend spent more than you | Feel guilty, buy more | Appreciate the thought, don’t match |

| Family member competing | Try to keep up | Opt out of competition entirely |

| Expensive gift from boss | Feel obligated | A sincere thank-you is appropriate |

How to Avoid It

- Set spending limits with friends and family in advance

- Suggest Secret Santa or gift exchanges with caps ($25-50)

- A heartfelt thank-you note is always appropriate—no expensive return gift required

- Remember: true generosity doesn’t keep score

- Practice saying: “That’s so thoughtful! I’m keeping things simple this year.”

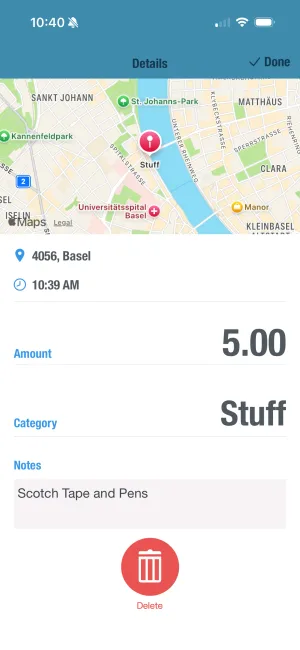

Track gift spending by person

Use BUDGT's notes feature to track who you've bought for and how much. Stay on budget without losing track of your gift list.

Trap #6: Forgetting the “Extras”

Gifts are just part of the equation. Travel costs, holiday meals, decorations, tips for service workers, shipping fees—these extras add up quickly and often catch people off guard.

Complete Holiday Expense Checklist

| Category | Common Expenses | Estimated Cost |

|---|---|---|

| Gifts | For family, friends, teachers, coworkers | $200-500 |

| Food | Holiday meals, baking supplies, entertaining | $150-400 |

| Decorations | Tree, ornaments, lights, outdoor decor | $50-200 |

| Travel | Gas, flights, hotels, parking | $100-1,000+ |

| Shipping | Online orders, gift mailing | $30-100 |

| Cards & Wrap | Cards, stamps, wrapping paper, bags | $25-75 |

| Tips | Mail carrier, garbage, doorman, salon | $50-200 |

| Events | Parties, shows, experiences | $50-200 |

| Clothing | Holiday outfits, accessories | $50-150 |

| Photos | Cards, family portraits | $25-200 |

How to Avoid It

- Create separate budget categories in BUDGT for different holiday expenses

- Add a 15-20% buffer for unexpected costs

- Track everything—even small purchases like tape and ribbon

- Review last year’s spending to create realistic estimates

- Book travel and events early when prices are lower

Trap #7: Post-Holiday Sales Binges

The spending doesn’t stop on December 25th. Post-Christmas sales can tempt you to “stock up” on things you don’t need, extending the financial damage into the new year.

Post-Holiday Sale Psychology

| Justification | The Reality |

|---|---|

| ”Stocking up for next year” | You’ll forget where you put it |

| ”It’s 75% off!” | Still 100% of something you don’t need |

| ”Treating myself after the holidays” | January budget needs recovery |

| ”The deals are too good to pass up” | Not buying is always the best deal |

When Post-Holiday Sales ARE Worth It

| Worth It | Not Worth It |

|---|---|

| Specific item you need anyway | ”Just browsing” the sales |

| Wrapping paper at 90% off | Decorations you’ll store and forget |

| Pre-planned replacement items | ”Deals” on things you don’t use |

| Quality basics (limited quantities) | Impulse clearance purchases |

How to Avoid It

- Only shop post-holiday sales with a specific list and budget

- Avoid “deals” on items you wouldn’t have bought otherwise

- Start focusing on your January financial reset instead

- Unsubscribe from all retail emails on December 26th

- Remember: January is recovery month, not bonus shopping month

Already overspent? See where you stand

BUDGT's monthly overflow view shows exactly how much you've exceeded your budget. The first step to recovery is knowing exactly where you are.

Your Holiday Budget Defense Plan

Before Shopping Season (November)

| Task | Why It Matters |

|---|---|

| Set total holiday budget | Creates your spending ceiling |

| Make complete gift list | Prevents “one more gift” syndrome |

| Divide into categories | Stops one area from stealing from others |

| Unsubscribe from promo emails | Reduces temptation triggers |

During Shopping Season (November-December)

| Task | Why It Matters |

|---|---|

| Check budget before each trip | Prevents overspending |

| Track every purchase immediately | No “I’ll log it later” surprises |

| Use cash for gifts | Makes spending feel real |

| Leave cards at home for browsing | Eliminates impulse buying |

After the Holidays (January)

| Task | Why It Matters |

|---|---|

| Calculate total spent | Face reality honestly |

| Create payoff plan if needed | Get back on track |

| Return unused items | Recover some spending |

| Set up holiday savings for next year | Break the cycle |

See your month-end projection

BUDGT's projection feature shows where you'll end up if current spending continues. Catch overspending early and adjust before it's too late.

Breaking the Holiday Debt Cycle

If you’ve overspent in past years, here’s how to break the pattern:

12-Month Holiday Savings Plan

| Month | Monthly Savings | Accumulated |

|---|---|---|

| January | $50 | $50 |

| February | $50 | $100 |

| March | $50 | $150 |

| April | $50 | $200 |

| May | $50 | $250 |

| June | $50 | $300 |

| July | $50 | $350 |

| August | $75 | $425 |

| September | $75 | $500 |

| October | $75 | $575 |

| November | $75 | $650 |

| December | Ready | $650 cash budget |

Final Thoughts

The holidays should bring joy, not financial stress. By recognizing these common traps and using BUDGT to track your spending, you can:

- Stay within your means

- Reduce post-holiday money anxiety

- Start the new year on solid financial ground

- Build better spending awareness

Remember: the best holiday memories aren’t made with money—they’re made with intention, presence, and the people you love.

The perfect gift is being present. The perfect decorations are the ones that make you smile. The perfect holiday is one you can afford.

Start tracking your holiday budget today

BUDGT makes holiday budgeting simple. Set your limits, track your spending, and enjoy the season knowing exactly where you stand financially.

Frequently Asked Questions

Why do people overspend during the holidays?

Holiday overspending is driven by emotional factors (wanting to show love through gifts), social pressure (keeping up with others), marketing tactics (urgency, limited-time offers), and the "treat yourself" mentality. Research shows the average person spends 30% more than planned during the holidays. Awareness of these triggers is the first step to staying in control.

How can I avoid impulse buying during Christmas sales?

Use the 24-hour rule—wait a day before any unplanned purchase. Shop with a pre-made list, set your budget in BUDGT before browsing, unsubscribe from promotional emails, and avoid browsing "for fun." If you must shop online, don't save payment information so checkout requires more effort.

What's the best way to track holiday spending?

Create specific categories in BUDGT for gifts, food, decorations, travel, and entertainment. Track every purchase immediately—not at the end of the day. Set your total holiday budget before November, divide it by category, and check your remaining balance before each shopping trip. The daily budget approach keeps you from the "I'll figure it out later" trap.

How do I handle gift-giving pressure from friends or family?

Be proactive—suggest spending limits, Secret Santa exchanges, or experience-based gifts before shopping season starts. Use phrases like "I'm focusing on meaningful over expensive this year." Most people feel relieved when someone else brings up budget boundaries. For unexpected gifts, a heartfelt thank-you is always appropriate without requiring an expensive return gift.

Is it okay to use credit cards for holiday shopping?

Only if you can pay off the balance in full by your next statement. If you're carrying debt into January, you'll pay 15-25% interest that makes every purchase more expensive. A $500 gift budget becomes $600+ when financed over several months. When in doubt, use cash or debit to feel the spending immediately.

How much should I budget for holiday spending?

Financial experts recommend keeping total holiday spending under 1.5% of your annual income. For someone earning $60,000, that's $900 total including gifts, food, decorations, travel, and entertainment. Start by listing last year's actual spending, then decide what's realistic and meaningful for your situation.

What are the hidden costs of the holidays most people forget?

Common forgotten expenses include shipping fees, gift wrap and cards, tips for service workers, travel costs, holiday meals and entertaining, decorations, new outfits for parties, and photographer fees. Add these to your budget upfront with a 15-20% buffer for surprises.

How can I enjoy the holidays without spending much money?

Focus on experiences over purchases—baking cookies together, driving to see holiday lights, game nights, volunteer activities, homemade gifts, or handwritten letters. Research shows experiences create more lasting happiness than material gifts. The best holiday memories rarely come with price tags.

What should I do if I've already overspent this holiday season?

First, stop the bleeding—no more purchases until you assess the damage. Calculate exactly how much you've overspent, then create a payoff plan. Consider returning unused items, canceling unnecessary subscriptions, and using January to recover. BUDGT's monthly overflow view helps you see where you stand and plan recovery.

How do I start planning for next year's holiday budget?

Open a dedicated holiday savings account in January and set up automatic transfers. Even $50/month creates a $600 holiday fund by December. Use BUDGT's savings mode to set aside money throughout the year. Review this year's spending to set realistic targets for next year.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS