How to Budget for Christmas Gifts Without the Financial Hangover

The holiday season is magical—but for many, it comes with a side of financial stress. Between gifts for family, friends, colleagues, and that surprise Secret Santa, December spending can spiral out of control fast.

The average person spends between $500-$1000 on holiday gifts alone. Add decorations, food, travel, and events, and that number climbs even higher. Without a plan, many start the new year with credit card debt and financial regret.

But here’s the good news: with a little planning and the right tools, you can give generously without wrecking your budget. This guide walks you through creating a complete gift budget—so you can enjoy the season without the January hangover.

Why Gift Budgeting Changes Everything

Without a budget, it’s easy to:

| Problem | How It Happens | January Impact |

|---|---|---|

| Impulse overspending | ”It’s perfect for them!” | Credit card surprise |

| Guilt buying | ”I should get them more” | Debt stress |

| Last-minute panic | Premium prices, rushed choices | Regret and overpaying |

| Keeping up appearances | Matching others’ spending | Living beyond means |

A gift budget isn’t about being cheap—it’s about being intentional. When you know exactly how much you can spend, you focus on finding meaningful gifts instead of stressing over money.

The 5-Step Gift Budget System

Calculate Your Total Budget

Before shopping, determine the maximum amount you can spend on all gifts combined without going into debt or sacrificing January's needs.

Create Your Gift List

Write down everyone you plan to buy for—family, friends, colleagues, teachers, service providers. Don't forget Secret Santas and gift exchanges.

Allocate by Relationship

Assign a specific dollar amount to each person based on relationship closeness. Spouse and children get more; acquaintances get less.

Add Buffer for Extras

Include 10-15% for wrapping, shipping, cards, and unexpected recipients. These hidden costs add up fast.

Track As You Shop

Log every purchase in BUDGT immediately. Watching your remaining budget shrink in real-time prevents overspending.

Step 1: Calculate Your Total Gift Budget

Before you start shopping, determine the total amount you can comfortably spend on gifts this season.

Christmas Gift Budget Calculator

Enter your numbers above - results update automatically

Budget Guidelines by Income

| Annual Income | Suggested Gift Budget | Per Person Average |

|---|---|---|

| $30,000 | $300-450 | $20-30 |

| $50,000 | $500-750 | $30-50 |

| $75,000 | $750-1,000 | $50-75 |

| $100,000+ | $1,000-1,500 | $75-100 |

These are suggestions—your actual budget depends on your savings, debt, and priorities.

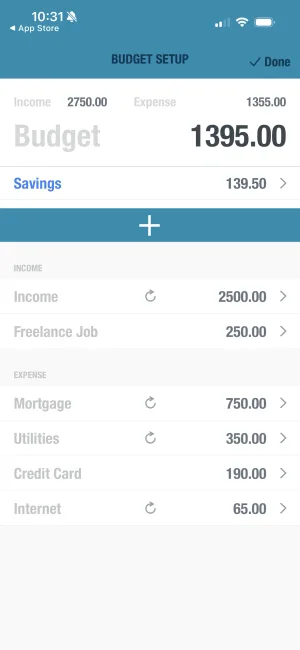

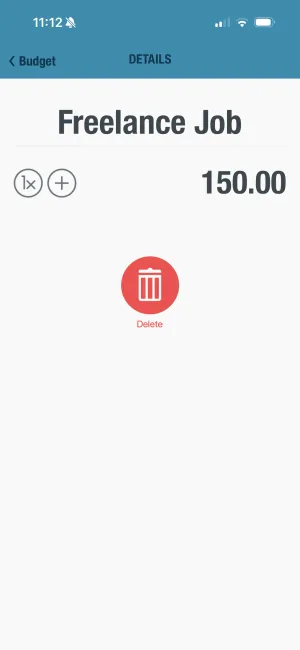

See exactly what you can spend

BUDGT's daily budget shows your safe spending limit at a glance. No guessing, no math—just clarity on what's available for gifts today.

Step 2: Create Your Complete Gift List

Write down everyone you plan to buy for. Most people forget several recipients until the last minute:

The Complete Gift Recipient Checklist

| Category | Common Recipients |

|---|---|

| Immediate Family | Spouse/partner, children, parents, siblings |

| Extended Family | Grandparents, aunts/uncles, cousins, in-laws |

| Friends | Close friends, friend groups, neighbors |

| Work | Boss, colleagues, direct reports, clients |

| Service Providers | Mail carrier, garbage collectors, hair stylist |

| Children’s World | Teachers, coaches, babysitters, tutors |

| Gift Exchanges | Secret Santa, White Elephant, family draws |

| Surprise Recipients | People who might give you unexpected gifts |

The Hidden Recipients

Don’t forget these often-forgotten people:

| Forgotten Recipient | Why They Matter | Budget Range |

|---|---|---|

| Pet sitter/dog walker | Cares for your family member | $20-50 |

| House cleaner | In your home regularly | $50-100 |

| Apartment doorman | Daily service | $25-100 |

| Newspaper carrier | Reliable daily service | $15-25 |

| School bus driver | Your child’s safety | $15-25 |

Step 3: Allocate Budget by Relationship

Not everyone needs an expensive gift. Allocate based on relationship closeness:

Recommended Gift Spending by Relationship

| Relationship | Budget Range | Notes |

|---|---|---|

| Spouse/Partner | $75-200 | Can be one big gift or several smaller |

| Children | $50-150 each | Consider “something to wear, read, want, need” |

| Parents | $25-75 each | Often prefer time together over things |

| Siblings | $20-50 each | Or suggest adult sibling gift exchanges |

| Extended Family | $15-30 each | Quality over quantity |

| Close Friends | $20-40 each | Thoughtfulness matters most |

| Casual Friends | $10-20 | Small gesture is enough |

| Colleagues | $10-25 | Keep it professional |

| Service Providers | $10-25 | Cash or gift card preferred |

| Teachers | $15-25 | Gift cards are always appreciated |

Sample Gift Budget Allocation

| Recipient | Amount | Running Total |

|---|---|---|

| Spouse | $100 | $100 |

| 2 Children ($75 each) | $150 | $250 |

| 2 Parents ($40 each) | $80 | $330 |

| 2 Siblings ($25 each) | $50 | $380 |

| 4 Extended family ($20 each) | $80 | $460 |

| 3 Close friends ($25 each) | $75 | $535 |

| 3 Service providers ($15 each) | $45 | $580 |

| Teacher gifts | $25 | $605 |

| Secret Santa exchange | $25 | $630 |

| Buffer (15%) | $95 | $725 |

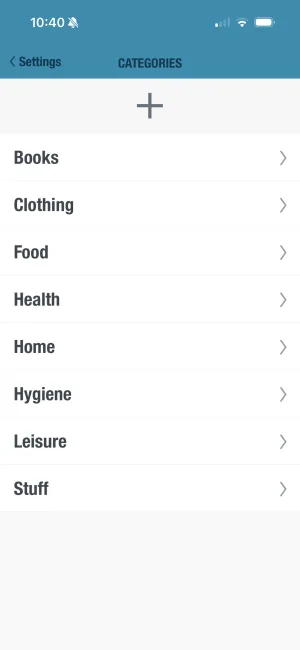

Track gift spending by category

BUDGT's Categories feature lets you create a dedicated 'Christmas Gifts' category. See exactly how much you've spent and how much is left for each recipient.

Step 4: Shop Smart and Stay on Budget

Once your budget is set, shop strategically:

Smart Shopping Timeline

| When | What to Do | Why |

|---|---|---|

| January | Open holiday savings account | Start building fund |

| October | Finalize gift list | Plan before deals hit |

| November 1-20 | Research prices, make wishlist | Know what to look for |

| Black Friday/Cyber Monday | Buy planned items only | Best deals of the year |

| December 1-15 | Complete remaining shopping | Avoid last-minute rush |

| December 16-24 | Emergency backup only | Prices highest, stress worst |

Shopping Strategies That Save Money

| Strategy | How It Works | Typical Savings |

|---|---|---|

| Start early | Avoid desperation pricing | 20-30% |

| Compare prices | Check multiple stores | 10-25% |

| Use cashback apps | Earn while spending | 2-10% |

| Wait for sales | Black Friday, Cyber Monday | 25-50% |

| Buy quality used | Thrift stores, eBay | 50-80% |

| DIY gifts | Homemade is priceless | 70-100% |

| Group gifts | Split expensive items | Per-person reduction |

What to Avoid

| Trap | Why It’s Dangerous |

|---|---|

| ”Browsing” without a list | Leads to impulse buys |

| Shopping when emotional | Stress spending is real |

| Saving payment info online | One-click enables impulse |

| Last-minute shopping | Premium prices, poor choices |

| Keeping up with others | Their budget isn’t yours |

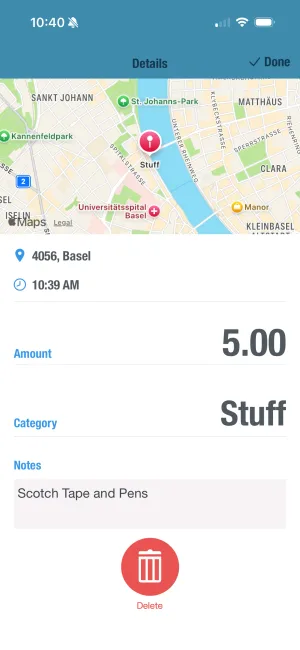

Add notes to remember gift details

BUDGT's notes feature lets you add details to each purchase—who it's for, where you bought it, and gift ideas for next year. Stay organized through the holiday rush.

Step 5: Account for Hidden Costs

Gifts aren’t the only expense. Budget for these often-forgotten costs:

The Complete Hidden Costs List

| Hidden Cost | Typical Range | Notes |

|---|---|---|

| Wrapping paper & supplies | $15-40 | Ribbon, tape, gift tags |

| Gift bags & tissue | $10-25 | Easier than wrapping |

| Shipping costs | $20-75 | For distant recipients |

| Holiday cards | $15-40 | Cards, stamps, photo printing |

| Stocking stuffers | $25-75 | Adds up fast with multiple kids |

| Host/hostess gifts | $15-30 per party | When attending gatherings |

| Gift receipts/returns | $0-20 | Reshipment costs |

| Last-minute emergency | $25-50 | Unexpected recipients |

Add Your Buffer

Total Gift Budget with Buffer

For unexpected recipients

Enter your numbers above - results update automatically

Thoughtful Gifts at Every Price Point

The best gifts don’t always cost the most. Here are meaningful options for every budget:

Under $10

| Gift Idea | Who It’s Good For |

|---|---|

| Homemade cookies/treats | Anyone who appreciates food |

| Photo in a simple frame | Family members |

| Quality chocolate bar | Colleagues, neighbors |

| Handwritten letter | Close friends, parents |

| Single nice candle | Anyone |

| Plant cutting from your garden | Plant lovers |

Under $25

| Gift Idea | Who It’s Good For |

|---|---|

| Book you loved | Readers |

| Quality coffee/tea | Office workers |

| Streaming gift card | Young adults |

| Cozy socks or slippers | Anyone |

| Homemade gift basket | Family, close friends |

| Local experience voucher | Adventure seekers |

Under $50

| Gift Idea | Who It’s Good For |

|---|---|

| Nice wine/spirits | Adults who drink |

| Quality kitchen tool | Home cooks |

| Weighted blanket | Stress relief seekers |

| Board game | Families, couples |

| Subscription box (one month) | Anyone with interests |

| Donation in their name | Those who have everything |

Experience Gifts (Any Budget)

| Experience | Cost | Why It Works |

|---|---|---|

| Cook dinner for them | $20-40 | Time > money |

| Movie night kit | $15-25 | Create memories |

| Babysitting voucher | Free | Priceless to parents |

| Day trip together | Variable | Quality time |

| Teach them a skill | Free | Share your talents |

| Photo album of memories | $15-30 | Personalized and meaningful |

See your spending over time

BUDGT's month-end projection shows where you'll end up if current spending continues. Catch overspending early and adjust before it's too late.

Managing Gift Expectations

Sometimes the hardest part is managing what others expect:

Having the Budget Conversation

| Approach | Script |

|---|---|

| Spending limits | ”Let’s agree to keep gifts under $30 this year” |

| Secret Santa | ”What if we draw names instead of buying for everyone?” |

| Experience gifts | ”I’m focusing on experiences over things this year” |

| Homemade only | ”Let’s make it a homemade gifts year!” |

| No gifts | ”Your presence is the gift—let’s skip presents” |

Handling Gift Anxiety

| Fear | Reality Check |

|---|---|

| ”They’ll think I’m cheap” | Thoughtfulness matters more than price |

| ”Their gift will be bigger” | Gift-giving isn’t a competition |

| ”They’ll be disappointed” | True loved ones care about intention |

| ”I need to match their spending” | You don’t—and they probably don’t expect it |

Your Gift Budget Action Plan

This Week

| Task | Time Needed |

|---|---|

| Calculate total available budget | 15 min |

| Create complete recipient list | 20 min |

| Allocate budget by person | 15 min |

| Set up BUDGT gift category | 5 min |

Before Shopping

| Task | Time Needed |

|---|---|

| Research gift ideas for each person | 30 min |

| Check for sales and deals | 15 min |

| Make shopping list with budget | 15 min |

| Plan shopping trips/online orders | 10 min |

While Shopping

| Task | Why It Matters |

|---|---|

| Track every purchase immediately | Prevents overspending |

| Stick to your list | Avoids impulse buys |

| Note who each gift is for | Stays organized |

| Stop when budget is gone | No exceptions |

Start your gift budget today

BUDGT makes gift budgeting simple. Set your limits, create your category, and track as you shop. Know exactly where you stand all season long.

After the Season: Learn for Next Year

When January arrives:

| Review Task | What You’ll Learn |

|---|---|

| Total actual spending | Was budget realistic? |

| Biggest surprises | What to plan for next time |

| What worked | Repeat these strategies |

| What didn’t | Change for next year |

| Start saving for next year | Break the cycle |

Final Thoughts

Gift-giving should bring joy—both to the giver and the receiver. A good gift budget ensures you can be generous without sacrificing your financial health.

Remember:

- The best gift is one you can actually afford

- Thoughtfulness always beats price tag

- No one worth keeping would want you in debt

- January you will thank December you

Start your gift budget today. Open BUDGT, create your category, make your list, and shop with confidence. This can be your most organized—and stress-free—holiday season yet.

Frequently Asked Questions

How much should I spend on Christmas gifts?

A good rule is to spend only what you can afford without going into debt. Financial experts suggest keeping total gift spending between 1-1.5% of your annual income. For someone earning $60,000, that's $600-900 for all gifts combined. Start by setting a total budget based on your savings and expenses, then divide it among recipients based on relationship closeness.

How do I stick to my gift budget when shopping?

Track every purchase in real-time using BUDGT. Seeing your remaining budget shrink prevents impulse buys. Shop with a specific list, avoid browsing "just in case," use cash instead of credit, and apply the 24-hour rule for any unplanned purchases. Having someone to hold you accountable also helps significantly.

What if I can't afford gifts for everyone?

Be honest with yourself and others. Suggest Secret Santa exchanges (everyone buys one gift instead of many), set spending limits with family ($25 max), give homemade gifts, or offer experiences instead of things. Most people appreciate thoughtfulness over expense and are often relieved when someone suggests budget boundaries.

When should I start budgeting for Christmas?

Ideally, start saving in January and planning your list in October. This gives you 10 months to save, time to catch sales throughout the year, and reduces December stress. But even starting in November or December is better than not budgeting at all—it's never too late to create a plan.

How can BUDGT help with holiday gift planning?

BUDGT lets you create a dedicated gift category, set spending limits, and track purchases as you shop. The daily budget feature tells you exactly how much you can spend today. Use the notes feature to track who each gift is for, and export your data to review next year's planning.

How much should I spend on different relationships?

There's no fixed rule, but common ranges are - Spouse/partner ($75-200), Children ($50-150 each), Parents ($25-75 each), Siblings ($20-50 each), Extended family ($15-30 each), Close friends ($20-40 each), Acquaintances ($10-20), Teachers/service providers ($10-25). Adjust based on your total budget and relationship closeness.

Should I buy gifts on credit cards?

Only if you can pay off the balance in full by your next statement. Carrying gift debt into January means paying interest that increases the actual cost of every gift. A $50 gift becomes $60+ when financed over months. If you can't afford it without debt, scale back your gift list or give homemade alternatives.

What are the best budget-friendly gift ideas?

Homemade gifts (baked goods, crafts, photo albums) cost little but show effort. Experience gifts (movie night voucher, cooking a meal, babysitting) cost nothing but time. Group gifts let you split expensive items. Subscription samples (one month of streaming) are affordable. Books, quality chocolate, and plants are always appreciated at low price points.

How do I handle gift expectations from others?

Proactive communication is key. Before shopping season, suggest spending limits, Secret Santa exchanges, or "experience gifts only" to your family or friend group. Most people feel relieved when someone else brings up budget boundaries. For unexpected gifts, a heartfelt thank-you is appropriate—you don't need to match their spending.

How do I budget for gifts when my income is inconsistent?

Use your lowest typical month as your baseline for planning. Start a dedicated holiday savings account early in the year and set up automatic transfers. If you have a good month, transfer extra. By December, you'll have a cash fund specifically for gifts that doesn't depend on that month's income.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS