Why February Is the Best Month to Save Money (The Short Month Advantage)

Here’s a budgeting secret that most people overlook: February is the best month to boost your savings, and it has nothing to do with Valentine’s Day or tax refunds.

It’s simpler than that. February has only 28 days (29 in leap years), but you still earn your full monthly paycheck. If you budget based on a 30-day month, those missing 1-2 days translate to bonus money you can redirect to your financial goals.

Let’s break down exactly how this works and how to take advantage of it.

The Short Month Math

Most budgeting advice assumes a 30-day month. When you calculate your daily spending limit, you typically divide your flexible budget by 30:

| Monthly Flexible Budget | ÷ 30 Days | = Daily Budget |

|---|---|---|

| $600 | 30 | $20/day |

| $900 | 30 | $30/day |

| $1,200 | 30 | $40/day |

| $1,500 | 30 | $50/day |

But February only has 28-29 days. If you continue spending at your usual $20/day pace, here’s what happens:

| Daily Budget | × 28 Days | February Spending | ”Bonus” Left Over |

|---|---|---|---|

| $20/day | 28 | $560 | $40 extra |

| $30/day | 28 | $840 | $60 extra |

| $40/day | 28 | $1,120 | $80 extra |

| $50/day | 28 | $1,400 | $100 extra |

That’s $40-100 in “found money” just because the calendar is shorter. In a leap year (29 days), you still get $20-50 extra.

Why This Matters More Than You Think

The Compound Effect

February’s bonus might seem small, but consider the long-term impact:

| Years | February Bonus ($50/yr avg) | With 7% Growth |

|---|---|---|

| 5 years | $250 | $287 |

| 10 years | $500 | $690 |

| 20 years | $1,000 | $2,049 |

| 30 years | $1,500 | $4,724 |

That’s nearly $5,000 from just paying attention to one short month each year.

Psychological Wins

Beyond the math, February savings create momentum:

| Benefit | Why It Matters |

|---|---|

| Quick win | Achieving a savings goal in 28 days feels faster |

| Builds confidence | ”I can save money” becomes a proven fact |

| Creates habit | Success in February carries into March |

| Low effort | No sacrifice required—just awareness |

Where to Put Your February Bonus

Not sure what to do with the extra $40-100? Here’s a priority framework:

High-Interest Debt First

If you have credit card debt at 15%+ interest, every dollar toward that balance saves you money. Your February bonus could save $15+ in annual interest charges.

Emergency Fund Second

No emergency fund? Use February to start one. Even $50 begins the habit. Aim for $500 initially, then build to 3-6 months of expenses over time.

Savings Goals Third

Already debt-free with an emergency fund? Put February's bonus toward a specific goal: vacation fund, new phone, holiday savings, or retirement.

Treat Yourself (Intentionally)

If your finances are solid, it's okay to use some of February's bonus for something enjoyable. The key is choosing intentionally, not spending unconsciously.

Quick Decision Guide

| Your Situation | February Bonus Goes To |

|---|---|

| Credit card debt | Extra payment on highest-interest card |

| No emergency fund | Start with $50-100 in savings account |

| Emergency fund < $1,000 | Add to emergency fund |

| Saving for something specific | Goal fund (vacation, car, etc.) |

| Finances are solid | Retirement account or intentional treat |

How to Actually Capture the Savings

Knowing about the short month advantage is one thing. Actually saving that money is another. Here’s how to make sure February’s bonus doesn’t disappear:

Method 1: Transfer on February 1st

The simplest approach: transfer your estimated bonus to savings on the first of the month.

| Your Daily Budget | Transfer to Savings |

|---|---|

| $20/day | $40-60 |

| $30/day | $60-90 |

| $40/day | $80-120 |

| $50/day | $100-150 |

This “pays yourself first” before you can spend it.

Method 2: End-of-Month Sweep

Prefer to play it safe? Wait until February 28/29 and transfer whatever remains in your checking account to savings. This guarantees you only save what’s actually left over.

Method 3: Split the Difference

Transfer half your expected bonus on February 1st, then sweep the rest at month’s end. Best of both worlds.

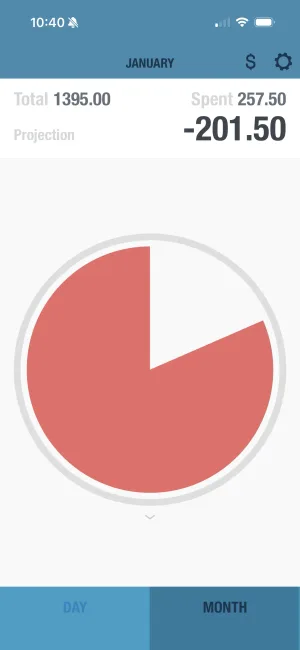

See your February advantage in action

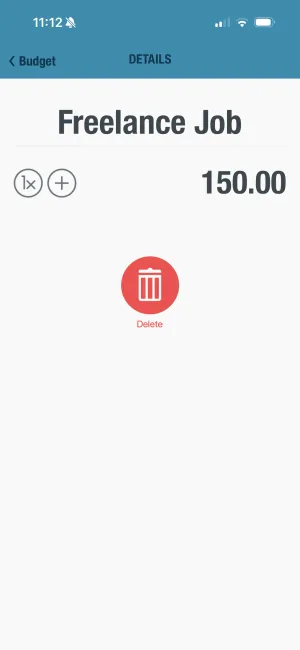

BUDGT automatically adjusts your daily budget based on how many days are in the current month. In February, you'll see your daily limit calculated for 28-29 days—making it easy to spot your savings opportunity.

See Your February Bonus

Enter your monthly flexible budget below to see how much you could save:

See Your February Bonus

Income minus fixed expenses (rent, bills, etc.)

Formula: Budget ÷ 31 × 3 = February bonus

Notice how February spending is lower than other months? That difference is your bonus—money you can redirect to savings, debt payoff, or your emergency fund.

In a leap year (29 days), February has one extra day, so the bonus is slightly smaller.

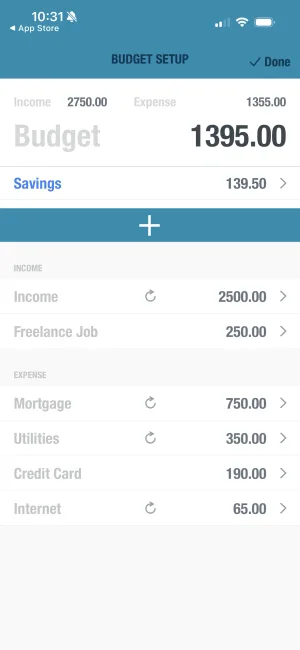

Making It Work With BUDGT

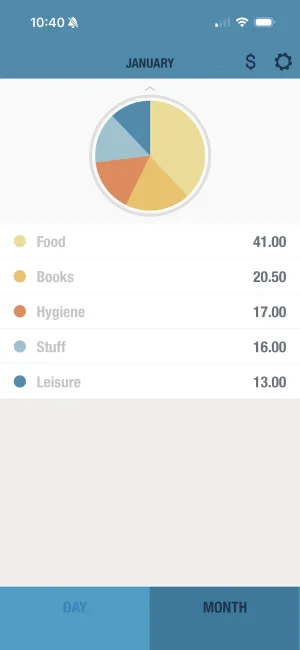

If you use BUDGT for daily budgeting, February’s advantage is built in automatically:

How BUDGT Handles Short Months

| Month | Days | How BUDGT Calculates |

|---|---|---|

| January | 31 | Budget ÷ 31 days |

| February | 28-29 | Budget ÷ 28-29 days |

| March | 31 | Budget ÷ 31 days |

| April | 30 | Budget ÷ 30 days |

In February, BUDGT gives you a slightly higher daily limit because it’s dividing by fewer days. You can either:

- Spend the higher amount (perfectly fine—your budget still balances)

- Spend your usual amount and watch the surplus build up

- Transfer the difference to savings on purpose

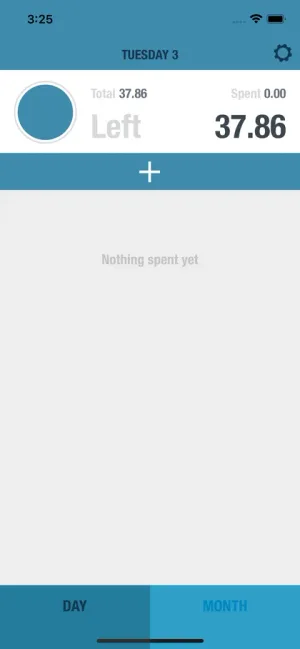

Daily budgets adjust automatically

BUDGT calculates your spending limit based on actual days remaining in the month. In February, you'll see this reflected in a slightly higher daily budget—your cue to save the difference.

The Psychology of “Found Money”

February’s bonus works partly because of how our brains process unexpected gains:

| Mental Accounting Principle | How It Helps |

|---|---|

| Windfall effect | ”Found” money feels different than earned money—easier to save |

| Small wins | Achieving a savings goal (even small) builds confidence |

| Fresh start | February feels like a second chance after January’s resolutions |

| Scarcity mindset reversal | Instead of “not enough,” you have “extra” |

Reframing Your Thinking

Instead of: “February is short, so I have less time to spend”

Think: “February is short, so I have bonus money to save”

This simple reframe turns a calendar quirk into a financial advantage.

February Savings Challenges

Want to maximize the short month? Try one of these challenges:

The “No Extra Spending” Challenge

| Week | Goal | Bonus Saved |

|---|---|---|

| Week 1 | Stick to daily budget | ~$10-15 |

| Week 2 | Stick to daily budget | ~$10-15 |

| Week 3 | Stick to daily budget | ~$10-15 |

| Week 4 | Stick to daily budget | ~$10-15 |

| Total | $40-60+ |

Simply maintain your usual spending pace and the short month does the work.

The “Round Down” Challenge

Every purchase, round down your remaining daily budget:

- If you have $23.47 left, act like you have $20

- Transfer the “rounded” amount ($3.47) to savings

- Combined with short month bonus = significant savings

The “Valentine’s Swap” Challenge

Instead of expensive Valentine’s Day plans:

| Traditional | Frugal Alternative | Savings |

|---|---|---|

| Dinner out ($100+) | Home-cooked meal | $70-80 |

| Dozen roses ($50+) | Single stem or houseplant | $40-45 |

| Jewelry ($200+) | Handwritten letter + small gift | $150+ |

| Weekend getaway | Day trip or staycation | $200+ |

Put the difference toward your February savings goal.

Planning Ahead: Your February Savings Checklist

Calculate Your Bonus Now

Take your current daily budget × 2 days = your February bonus potential. Write this number down.

Decide Where It Goes

Choose your destination: debt payoff, emergency fund, or savings goal. Be specific.

Set Up the Transfer

Schedule an automatic transfer for February 1st, or set a calendar reminder for month-end.

Track Your Progress

Use BUDGT or your preferred method to monitor daily spending. Stay at or under your usual pace.

Celebrate the Win

When March arrives and you've saved the bonus, acknowledge the achievement. Small wins build big habits.

Beyond February: Year-Round Awareness

While February is the standout short month, being aware of month length helps year-round:

| Month | Days | Budget Implication |

|---|---|---|

| Jan, Mar, May, Jul, Aug, Oct, Dec | 31 | Slightly lower daily budget |

| Apr, Jun, Sep, Nov | 30 | ”Standard” daily budget |

| February | 28-29 | Highest daily budget / savings opportunity |

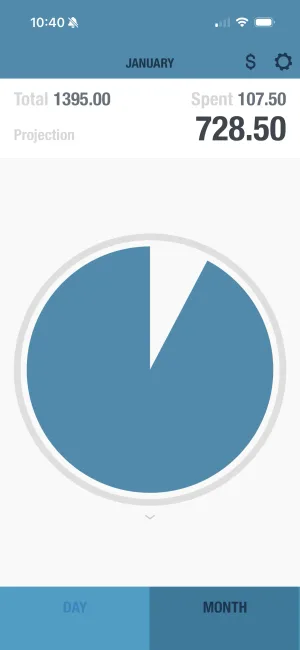

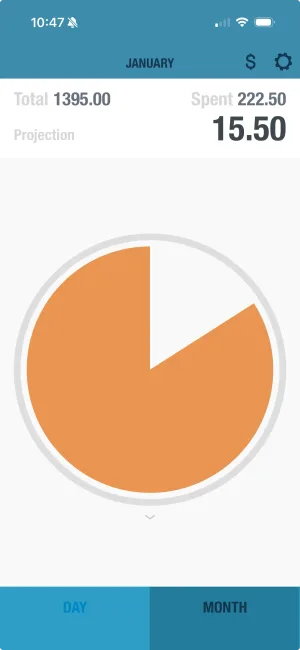

Month-end projection shows your trajectory

BUDGT's projection feature shows where you'll land at month's end based on current spending. In February, staying on track means automatic savings.

Common Questions About February Savings

“What if I get paid biweekly, not monthly?”

Biweekly pay actually works in your favor some months. Twice a year, you’ll get three paychecks in one month. Combined with February’s short month, that’s even more savings potential.

“I budget weekly, not monthly. Does this apply?”

Yes! If you budget weekly, February has exactly 4 weeks (28 days), which means no “leftover” days. But if you’ve been padding for partial weeks in other months, February is cleaner and potentially cheaper.

“What about bills that are the same regardless of month length?”

Fixed bills (rent, subscriptions, loan payments) don’t change with month length. The savings come from your flexible spending—groceries, gas, entertainment, dining out. That’s where the short month helps.

Start Planning Now

February 2026 is just weeks away. Here’s your action plan:

| This Week | Before February 1st | During February |

|---|---|---|

| Calculate your daily budget | Decide where bonus goes | Maintain normal spending |

| Identify bonus amount ($40-100) | Set up transfer or reminder | Track progress in BUDGT |

| Choose savings destination | Tell someone your goal | Resist lifestyle inflation |

The short month advantage is real, predictable, and requires zero sacrifice. All it takes is awareness and a plan.

Your February bonus is waiting. What will you do with it?

Start tracking your daily budget today

BUDGT makes daily budgeting effortless. Set up in 2 minutes, and you'll know exactly what you can spend each day—making it easy to capture February's savings advantage.

Frequently Asked Questions

Why is February good for saving money?

February has only 28-29 days but you still earn your full monthly income. If you budget based on a 30-day month, you get 1-2 "bonus" daily budgets worth of money that can go straight to savings, debt payoff, or your emergency fund. For someone with a $30/day budget, that's $30-60 in found money.

How much extra can I save in February?

The amount depends on your daily budget. Multiply your daily spending limit by 1-2 days (depending on leap year). If your daily budget is $25, you could save an extra $25-50. If it's $50/day, that's $50-100 extra. It adds up—over 5 years, that's $250-500 in bonus savings just from February.

Does this work with any budgeting method?

Yes, but it works best with daily budgeting methods. If you use the 50/30/20 rule or envelope system, you'll still benefit—just allocate the "extra" proportionally. BUDGT automatically adjusts your daily limit based on actual days in the month, making this effortless.

Should I save the extra money or pay off debt?

If you have high-interest debt (credit cards at 15%+), put the February bonus toward that first. If you don't have an emergency fund, start building one. If both are covered, add it to your savings goals. Any of these choices beats spending the extra money unconsciously.

Is February really that different from other months?

February is the only month that's always short. While some months have 30 days and others have 31, February consistently has 28-29. This predictability makes it perfect for planning a deliberate savings boost each year.

How does BUDGT handle February's shorter month?

BUDGT automatically calculates your daily budget based on the actual number of days in the current month. In February, it divides your flexible budget by 28 or 29 days (not 30), giving you a slightly higher daily limit. You can then consciously choose to spend at your usual pace and bank the difference.

What if I already spent the extra money?

Don't worry—awareness is the first step. Now that you know about the short month advantage, you can plan for it next February. Mark it in your calendar and set a savings goal for that month. Building good financial habits is more important than any single month.

Can I use this strategy in other short months?

February is unique because it's always 2-3 days shorter than a standard 30-day month. Months with 31 days technically give you one extra day of income, but it's less noticeable. February's consistent shortness makes it the best candidate for deliberate savings planning.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS