Frugal Christmas Ideas: How to Celebrate Big on a Small Budget

Frugal Christmas Ideas: How to Celebrate Big on a Small Budget

Christmas is often called “the most expensive time of the year”---but it doesn’t have to be. With a little creativity and intentionality, you can create a magical holiday season that brings joy to your family without emptying your wallet.

Whether you’re navigating a tight budget, paying off debt, or simply choosing to live more mindfully, a frugal Christmas isn’t about deprivation---it’s about focusing on what truly matters.

The Real Magic of Christmas Isn’t Bought

Before diving into practical tips, let’s address the elephant in the room: the pressure to spend.

Society tells us that love is measured in gifts, that memories require expensive experiences, and that a “proper” Christmas needs all the trimmings. But ask anyone about their favorite holiday memories, and they’ll likely talk about:

- Baking cookies with grandma

- Singing carols around a fireplace

- Watching movies in pajamas

- The anticipation, not the presents themselves

The best parts of Christmas are free. Keep that in mind as you plan your celebrations.

Frugal Gift-Giving Ideas

Gifts don’t need to cost a fortune to be meaningful. Here are thoughtful alternatives:

Homemade Gifts

- Baked goods: Cookies, fudge, or bread in festive packaging

- Photo gifts: Printed photos, a scrapbook, or a digital slideshow

- DIY spa kit: Homemade bath bombs, sugar scrubs, or candles

- Recipe collection: Family recipes handwritten in a notebook

Experience Gifts

- “Coupon book”: Offers for babysitting, home-cooked dinners, or car washes

- Quality time: A hiking date, movie marathon, or cooking session together

- Skill sharing: Teach something you know---language lessons, guitar, knitting

Smart Buying

- Shop secondhand: Vintage items, books, or gently used goods

- Buy throughout the year: Grab gifts on sale year-round instead of all in December

- Set price limits: Agree with family on spending caps before shopping

Budget-Friendly Decorating

You don’t need to spend hundreds on decorations. Try these ideas:

- Nature’s decor: Pine cones, branches, dried oranges, cinnamon sticks

- DIY ornaments: Paper snowflakes, salt dough decorations, popcorn garlands

- Repurpose and reuse: Refresh old decorations with ribbon or paint

- Minimalist approach: A single candle display can be more elegant than excess

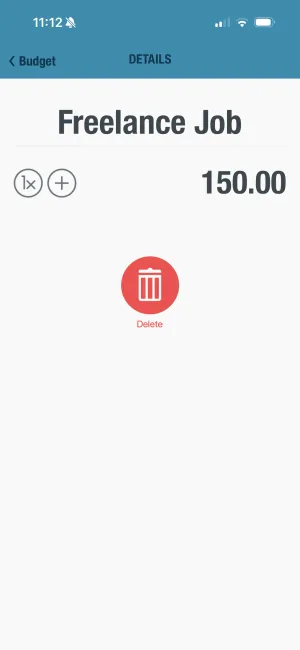

Save for Christmas starting now

Use BUDGT's Savings Mode to set aside money for the holidays. Start early and watch your Christmas fund grow without straining your monthly budget.

Affordable Holiday Meals

The Christmas feast doesn’t need to break the bank:

- Plan your menu: Choose recipes before shopping to avoid waste

- Potluck style: Have guests bring a dish---it’s less stress for everyone

- Shop sales and seasonal: Buy ingredients on sale, choose seasonal produce

- Simple is beautiful: A home-cooked roast chicken is just as special as an elaborate spread

Free and Low-Cost Holiday Activities

Fill your calendar with memorable moments that cost little or nothing:

- Drive around to look at Christmas lights

- Have a hot cocoa and cookie night

- Watch holiday movies with homemade popcorn

- Go caroling in your neighborhood

- Build a snowman or have a winter walk

- Make ornaments or decorations together

- Read Christmas stories aloud

- Play board games by the fireplace

- Write letters to Santa or create a gratitude jar

- Volunteer together at a local charity

Managing Family Expectations

One of the hardest parts of a frugal Christmas can be navigating family expectations. Here’s how:

- Be honest: Let family know you’re focusing on experiences over things this year

- Suggest alternatives: Propose Secret Santa, spending limits, or “presence not presents”

- Lead by example: Your enthusiasm for homemade gifts will be contagious

- Focus on children wisely: Kids often treasure one special gift more than many forgettable ones

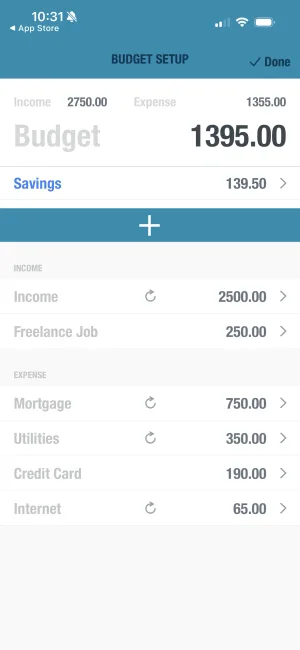

Set up your holiday budget in minutes

BUDGT makes it easy to plan your holiday spending. Enter your December income and expenses, then see exactly how much you can spend each day without going into debt.

Track Your Festive Spending with BUDGT

A frugal Christmas starts with knowing exactly where your money goes. BUDGT helps you:

- Set a total holiday budget and stick to it

- Create categories for gifts, food, decorations, and activities

- Track spending in real-time so you never go over

- See patterns that help you plan better next year

When you track your spending, you stay in control---and control feels like freedom.

Start a New Holiday Tradition

This year, consider starting a new tradition that doesn’t center on spending:

- An annual family game night

- Making ornaments together each year

- A holiday charity tradition

- A “gratitude dinner” where everyone shares what they’re thankful for

These traditions create lasting memories that no store-bought gift can match.

Celebrate What Matters

A frugal Christmas isn’t about sacrifice---it’s about clarity. When you spend intentionally, you can focus on connection, gratitude, and joy without the shadow of financial stress.

This holiday season, give yourself the gift of financial peace. Plan ahead, track your spending, and remember that the best things in life really are free.

🎄 Download BUDGT today and create a holiday season filled with joy---not debt.

Frequently Asked Questions

How can I celebrate Christmas on a tight budget?

Focus on homemade gifts, free activities (like looking at lights or baking together), and setting spending limits with family. The most meaningful parts of Christmas---time, connection, tradition---don\'t cost money.

What are some good homemade Christmas gift ideas?

Popular options include baked goods, photo books or framed pictures, DIY spa kits, handwritten recipe collections, and \"coupon books\" for services like babysitting or home-cooked meals.

How do I talk to family about spending less on gifts?

Be honest and positive. Frame it as wanting to focus on experiences and togetherness rather than things. Suggest alternatives like Secret Santa, spending limits, or \"presence not presents\" before the shopping season starts.

Can I still make Christmas special without spending much?

Absolutely. The most treasured holiday memories usually involve activities, not purchases: baking together, watching movies, playing games, looking at lights, and simply being present with loved ones.

How does BUDGT help with frugal holiday planning?

BUDGT lets you set a total holiday budget, create categories for different expenses, and track every purchase in real-time. You\'ll always know exactly where you stand, making it easier to stay on track and avoid overspending.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS