Single Mom Budget Guide: How to Make Every Dollar Count in 2026

Single Mom Budget Guide: How to Make Every Dollar Count in 2026

You already know you need to budget. What you need is a system that works within the reality of single parenting—limited time, unpredictable schedules, and the mental load of managing everything alone.

This isn’t about extreme frugality or unrealistic suggestions like “just skip the coffee.” It’s about practical strategies that make a real difference without adding to your already-full plate.

The Single Mom Financial Reality

Before diving into strategies, let’s acknowledge what makes single mom finances unique:

| Challenge | Impact |

|---|---|

| One income | Less margin for error, every dollar matters |

| Time scarcity | Can’t spend hours on financial optimization |

| Childcare costs | Often 20-30% of income |

| Decision fatigue | Budget decisions compete with a thousand others |

| Variable income | Child support, overtime, gig work aren’t guaranteed |

| Emotional pressure | Guilt about what you can’t provide |

But single moms also have advantages:

| Advantage | Benefit |

|---|---|

| Full financial control | No spending disagreements |

| Simple decision-making | You choose priorities |

| Modeling resilience | Teaching kids valuable lessons |

| Tax benefits | Head of household, child credits |

Understanding your situation clearly is the first step to improving it.

How to Create a Single Mom Budget That Works

The best budget for single moms is simple enough to maintain when you’re exhausted. Here’s how to build one:

Calculate True Monthly Income

Include salary, child support, benefits, and any side income. Use the lower number if income varies—you can always adjust up.

List Fixed Expenses

Rent, utilities, insurance, childcare, car payment, debt minimums. These rarely change month to month.

Estimate Variable Expenses

Groceries, gas, kids' activities, household items. Track for one month if you're unsure.

Build in Savings

Even $25-50/month counts. Take this off the top before calculating what's left to spend.

Calculate Your Daily Limit

Income minus all expenses, divided by days in month = your daily spending limit. This one number guides all decisions.

Sample Single Mom Budget ($3,500/month income)

| Category | Amount | % of Income |

|---|---|---|

| Housing (rent + utilities) | $1,200 | 34% |

| Childcare | $600 | 17% |

| Transportation | $350 | 10% |

| Groceries | $400 | 11% |

| Insurance (health, car, life) | $200 | 6% |

| Debt payments | $150 | 4% |

| Phone/internet | $100 | 3% |

| Kids’ activities/needs | $150 | 4% |

| Personal/household | $150 | 4% |

| Savings | $100 | 3% |

| Emergency buffer | $100 | 3% |

| Total | $3,500 | 100% |

Adjust percentages based on your local cost of living and priorities.

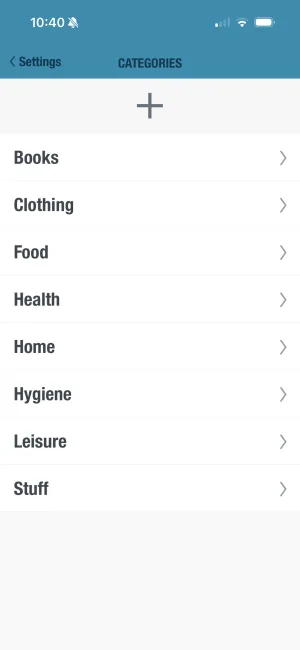

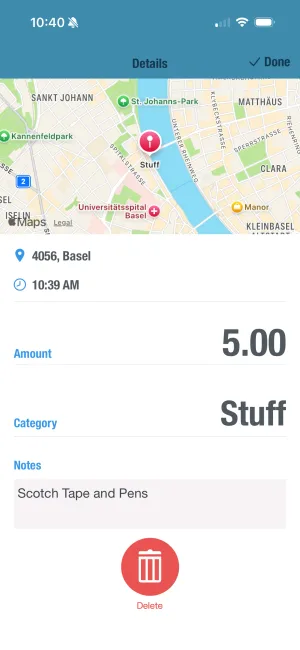

See your daily budget at a glance

BUDGT calculates your daily spending limit automatically. One number tells you if you can afford a purchase—no spreadsheets, no complicated categories.

Budget Ideas That Save Real Money

Groceries and Meal Planning

Food is often the most flexible category in a single mom budget:

| Strategy | Monthly Savings | Effort |

|---|---|---|

| Meal planning | $150-300 | Medium |

| Shopping with list | $75-100 | Low |

| Store brands | $50-75 | Low |

| Strategic timing (markdowns) | $30-50 | Low |

| Batch cooking | $50-100 | Medium |

Make it work with limited time:

- Sunday power hour: Prep ingredients for the week in one session

- Theme nights: Taco Tuesday, Pasta Wednesday reduces decisions

- Freezer strategy: Double recipes, freeze half for “free” future meals

- Kids help = life skills: Age-appropriate cooking tasks teach and free your hands

Kids’ Expenses

Kids are expensive, but strategic spending helps:

| Area | Strategy | Savings |

|---|---|---|

| Clothing | Thrift stores, consignment, Buy Nothing groups | $300-600/year |

| Activities | Free library programs, community sports, scholarship programs | $100-500/year |

| School supplies | Back-to-school sales, dollar store, school assistance | $50-100/year |

| Entertainment | Parks, library, home movie nights, play dates | $50-200/month |

Reality check: Kids remember experiences and time together more than expensive activities. A park picnic beats an expensive outing every time.

Track kids' expenses separately

BUDGT's categories show exactly what you're spending on kids' needs. Understand patterns and make informed decisions about activities and purchases.

Subscriptions and Recurring Expenses

Set a quarterly calendar reminder to audit every recurring charge:

| Common Subscription | Monthly Cost | Question to Ask |

|---|---|---|

| Streaming services | $10-50 | Which do we actually watch? |

| Gym membership | $20-50 | Am I going consistently? |

| App subscriptions | $5-30 | Is this worth it? |

| Kids’ activity memberships | $30-100 | Is there a free alternative? |

Quick wins:

- Cancel unused services (most people find $30-100/month)

- Share family plans legally with trusted family/friends

- Use library for books, movies, audiobooks (your taxes paid for it)

- Negotiate bills annually (internet, insurance, phone)

Budgeting When You’re Exhausted

Automate Everything Possible

| Automation | Benefit |

|---|---|

| Automatic savings transfer on payday | Can’t spend what you don’t see |

| Auto-pay essential bills | No late fees, no mental load |

| Automatic debt payments | Progress without decisions |

Reduce Decision Fatigue

| Strategy | How It Works |

|---|---|

| Default cheap meals | Go-to dinners that are fast and affordable |

| 24-hour waiting rule | Purchases over $25 wait a day |

| Unsubscribe from temptation | Retail emails deleted, shopping apps removed |

”Good Enough” Spending

Perfect frugality is exhausting. Aim for good enough:

- Sometimes convenience is worth it—pre-made dinner on your worst days beats expensive takeout every night

- Protect a small “no guilt” allowance—you need something that’s just for you

- Not every choice needs optimization—save your energy for the big wins

Track spending in seconds

BUDGT's quick entry takes 10 seconds per purchase. No complicated categories, no receipt photos—just amount and done. Your daily limit updates instantly.

Building an Emergency Fund on a Single Income

An emergency fund prevents small problems from becoming financial disasters:

Emergency Fund Goals

| Stage | Target | Purpose |

|---|---|---|

| Starter fund | $500 | Covers minor emergencies without credit cards |

| Mini fund | $1,000 | Handles most common emergencies |

| Basic fund | 1 month expenses | Provides buffer for job loss |

| Full fund | 3-6 months | Real financial security |

How to Build It When Money Is Tight

| Method | Weekly Savings | Annual Total |

|---|---|---|

| Cancel 1 streaming service | $4 | $208 |

| Pack lunch 2x per week | $10 | $520 |

| Skip coffee shop 1x/week | $5 | $260 |

| Sell one unused item monthly | $6 | $300 |

| Total | $25 | $1,288 |

That’s a solid emergency fund in one year—from small changes.

Build savings automatically

BUDGT's Savings Mode reserves money for your goals before calculating your daily budget. Your emergency fund grows while you stay on budget.

Tap Into Community Resources

Many programs exist specifically to help single moms—using them frees up money for savings:

Financial Assistance Programs

| Program | What It Provides | How to Access |

|---|---|---|

| SNAP | Food assistance | Local DSS office |

| WIC | Nutrition for moms and young kids | Health department |

| LIHEAP | Utility bill assistance | Local utility or 211 |

| Medicaid/CHIP | Healthcare for kids | Healthcare.gov or state |

| School lunch program | Free/reduced meals | School registration |

| Head Start | Free preschool | HeadStart.gov |

Tax Credits to Claim

| Credit | Potential Benefit |

|---|---|

| Earned Income Tax Credit | Up to $7,430 (2024) |

| Child Tax Credit | Up to $2,000 per child |

| Child and Dependent Care Credit | Up to $3,000-$6,000 |

| Head of Household status | Lower tax brackets |

Using these programs isn’t failure—it’s smart resource management that frees up money for your family’s future.

The Mental Side of Single Mom Budgeting

Dealing With Mom Guilt

The urge to buy things for kids—to make up for time, attention, or the missing parent—is real.

| Guilty Thought | Reality Check |

|---|---|

| ”I should buy them more” | Presence matters more than presents |

| ”Other families have more” | Many “rich-looking” families are in debt |

| ”I’m depriving my kids” | You’re teaching them valuable lessons |

Redirect the urge: When you want to buy, try doing something together instead. Cost: $0. Impact: Huge.

Managing Comparison

Social media shows other families’ highlight reels—not their credit card statements.

- Define your enough: What actually makes your family happy? Pursue that.

- Limit exposure: Unfollow accounts that make you feel inadequate

- Remember: Financial stability is worth more than appearances

Ways to Increase Income

Sometimes the best budget strategy is bringing in more money:

Maximize What You’re Owed

| Source | Action |

|---|---|

| Child support | Contact state enforcement if payments inconsistent |

| Benefits | Research SNAP, CHIP, utility assistance, childcare subsidies |

| Tax credits | Claim everything you qualify for |

| Employer benefits | Review for missed opportunities |

Flexible Side Income Ideas

| Option | Earning Potential | Flexibility |

|---|---|---|

| Freelance work | $15-50/hour | High |

| Tutoring | $20-50/hour | Medium |

| Selling items online | Variable | High |

| Childcare for others | $15-25/hour | Medium |

Caution: Only pursue side income if the numbers work after childcare costs. If childcare eats most of the extra income, it may not be worth the sacrifice.

Teaching Kids About Money

Kids who understand budgeting become financially responsible adults:

Age-Appropriate Conversations

| Age | Concepts | Activities |

|---|---|---|

| 3-5 | Coins have value, waiting | Piggy bank, “saving for” talks |

| 6-8 | Earning, spending choices | Small allowance, saving jars |

| 9-12 | Budgeting, comparison shopping | Own budget for activities |

| 13+ | Banking, compound interest | Savings account, part-time work |

Frame limitations positively: “We’re choosing to save for [goal]” works better than “we can’t afford that.”

Your Single Mom Budget Action Plan

This Week

- Track every expense (no judgment, just data)

- List all subscriptions and recurring charges

- Check one community resource (211.org is a good start)

- Download a simple budgeting app

This Month

- Create a complete monthly budget

- Set up automatic savings (even $25)

- Cancel at least one unused subscription

- Calculate your daily spending limit

This Year

- Build a $1,000 emergency fund

- Review and claim all tax credits

- Reduce one major expense category by 10%

- Teach kids one money concept per quarter

You’re Already Doing the Hard Part

Single parenting is one of the hardest jobs there is. The fact that you’re here, working on your finances, shows incredible strength.

You don’t need to implement everything at once. Pick two or three strategies from this guide. Try them for a month. Add more when those feel manageable.

Progress over perfection. Small wins compound. Every dollar you save is a dollar working for your family’s future.

You’ve got this.

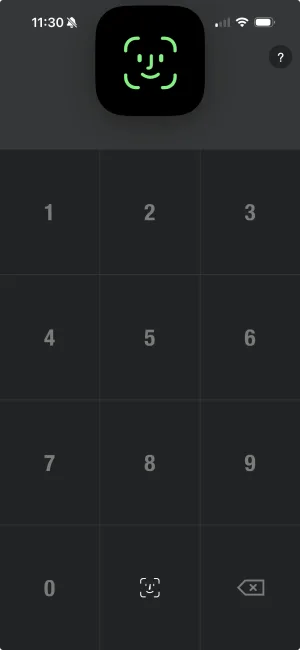

Your data stays completely private

BUDGT works 100% offline with no cloud sync or bank linking. Your family's financial data stays on your device—complete privacy while you build financial security.

Need a simple way to manage your single mom budget? BUDGT shows you what you can spend today—one glance, no complicated setup. Perfect for moms with zero extra time.

Frequently Asked Questions

What is the best budget method for single moms?

The daily budget method works best for most single moms. Calculate your monthly income, subtract fixed expenses and savings, then divide by days in the month. This gives you one number—your daily spending limit. Apps like BUDGT show this number at a glance, making budget decisions instant without complicated spreadsheets or categories.

How much should a single mom save each month?

Start with whatever you can afford—even $25 per week builds a $1,300 emergency fund in a year. Financial experts recommend 10-20% of income, but that's not realistic for everyone. The priority order is typically a small emergency fund ($500-1,000) first, then increase savings while paying down high-interest debt.

What percentage of income should go to rent for single moms?

Aim for 30% or less of your gross income on housing, but many single moms in high-cost areas spend 35-40%. If you're above 40%, look for ways to reduce (roommate, moving, housing assistance programs). The less you spend on housing, the more flexibility you have for other expenses and savings.

How can a single mom budget with irregular income?

Budget based on your lowest expected monthly income so you're never caught short. When extra money comes in, immediately assign it—don't let it sit in checking where it gets absorbed. Build a one-month buffer in your account to smooth out income variations. Track income patterns over 3-6 months to understand your real baseline.

What are the best budget ideas for single moms on a tight income?

Focus on the big wins first—housing, transportation, and food account for most spending. Meal planning saves $150-300/month. Buy kids' clothes secondhand. Use library resources extensively. Apply for any assistance you qualify for (SNAP, utility programs, free lunch). Track every expense to find "money leaks" in subscriptions and small purchases.

Should single moms use cash envelopes or apps for budgeting?

Apps are generally more practical for single moms because time is limited. Cash envelopes require bank trips and physical management. Budgeting apps like BUDGT take seconds to update and show your daily spending limit instantly. The best method is whichever you'll actually use consistently.

How do I budget for unexpected expenses as a single mom?

Build a small "irregular expenses" category into your monthly budget for things like car repairs, medical copays, and school fees. Even $50-100/month accumulates for emergencies. Also, work toward a $500-1,000 emergency fund specifically for true emergencies. BUDGT's Savings Mode helps by reserving money before calculating your daily budget.

What bills should a single mom pay first?

Prioritize in this order—housing (rent/mortgage), utilities, food, transportation, insurance, then everything else. These keep your family housed, fed, and able to get to work. After essential bills, minimum debt payments, then savings. Anything left goes to debt payoff or wants. Never let housing or utilities fall behind.

How can I teach my kids about budgeting as a single mom?

Use age-appropriate honesty. Frame choices positively—"We're saving for X, so we're choosing free activities this weekend." Involve older kids in budget discussions. Give them small allowances to practice money decisions. Point out your budgeting in action without creating anxiety. Kids who understand money become financially responsible adults.

Is it possible to save money as a single mom?

Yes, but start smaller than conventional advice suggests. Even $25/week builds $1,300 in a year. The key is automating savings so money moves before you can spend it. Many single moms find $100-300/month in "invisible" spending when they start tracking—subscriptions, small purchases, convenience foods. Redirecting this builds savings without feeling deprived.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS