Budgeting for Your Child's Education in India: A Complete Guide

This post is crafted for our wonderful users in India—though the wisdom here applies no matter where you call home.

“Give your child the best education”—this isn’t just a phrase in India, it’s a mission. From the moment children are born, parents start thinking about schools, coaching, college, and beyond.

But here’s the challenge: education inflation in India runs at 10-12% annually—roughly double the general inflation rate. That ₹50,000/year school today will cost ₹1,30,000 in 10 years.

Planning for education isn’t optional—it’s essential.

The True Cost of Education Today

School Education (K-12)

- Government Schools: ₹500-5,000/year

- Private Schools (Non-Branded): ₹30,000-1,00,000/year

- Branded/Premium Schools: ₹1,00,000-5,00,000/year

- International Schools: ₹5,00,000-20,00,000/year

Coaching and Tuition

- Primary school tuition: ₹1,000-3,000/month

- Classes 6-10 coaching: ₹3,000-10,000/month

- JEE/NEET coaching: ₹2,00,000-5,00,000/year

Higher Education

- Government colleges: ₹20,000-1,00,000/year

- Private engineering: ₹1,00,000-3,00,000/year

- IITs/IIMs: ₹2,00,000-5,00,000/year

- Foreign education: ₹15,00,000-50,00,000/year

The Coaching Class Dilemma

When coaching makes sense:

- Your child is genuinely preparing for competitive exams (JEE, NEET, CLAT)

- The school curriculum leaves gaps in specific subjects

When coaching is marketing hype:

- “Everyone does it” peer pressure

- Starting coaching in Class 5 for exams in Class 12

- Child shows no genuine interest in the path being coached for

Ask your child what they want. Then decide if coaching supports that goal.

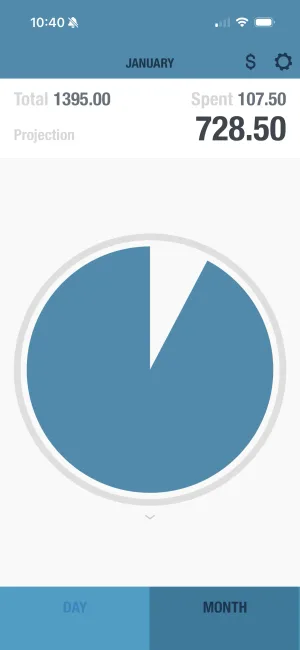

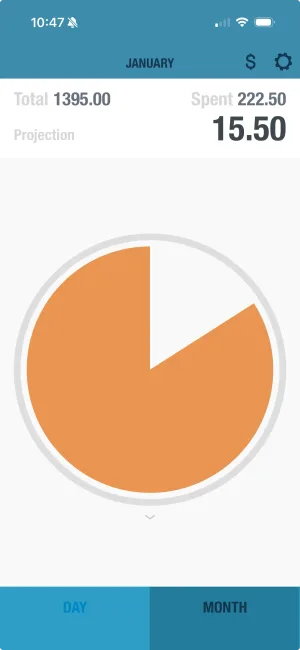

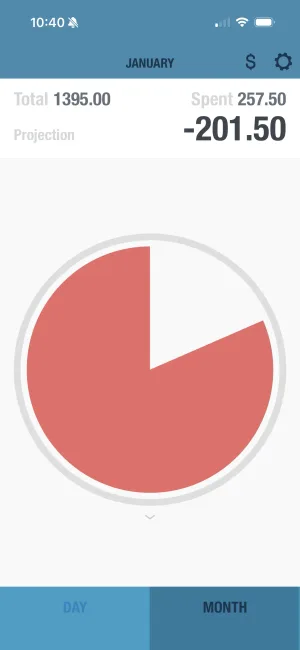

Track your education savings progress

See if you're on track for that ₹10 lakh education goal. BUDGT's projection feature shows where you'll be at month-end and beyond.

Education Savings Strategies

1. Sukanya Samriddhi Yojana (For Girls)

- Interest rate: 8.2% (tax-free)

- Limit: ₹1.5 lakhs/year

- Perfect for parents of daughters planning for higher education

2. Mutual Fund SIPs for Education

- Expected returns: 10-12% (equity)

- Example: ₹5,000/month SIP at 10% for 15 years = ₹20+ lakhs

3. Avoid Traditional Education Insurance

Education insurance plans often have lower returns than mutual funds with lock-in periods and high agent commissions.

Better approach: Buy a term insurance policy (for protection) and invest separately in mutual funds (for growth).

When Education Loans Make Sense

Good debt:

- Quality education with clear career ROI

- IIT/IIM/top abroad programs where starting salary covers EMIs

Bad debt:

- Degrees with unclear job prospects

- Overpriced private colleges with low placement rates

The Big Picture

Your child’s education is an investment in their future—but it shouldn’t bankrupt your present or retirement.

Balance is key:

- Don’t sacrifice retirement savings entirely for education

- Education loans exist for children; retirement loans don’t

- A moderately-priced education with good values beats expensive schooling with family financial stress

Your child’s success depends more on your involvement than your investment amount.

Frequently Asked Questions

How much should I save monthly for my child's education?

Aim to cover 50-70% of expected education costs through savings. For a target of ₹20 lakhs for college in 15 years, saving ₹5,000-7,000/month in equity mutual funds should get you there.

Is coaching class necessary for my child?

Not always. Coaching makes sense for competitive exams (JEE, NEET) where specialized preparation helps. But for general school subjects, good self-study and affordable tutoring can be equally effective.

Should I take an education loan or pay from savings?

Ideally, cover as much as possible from savings to avoid interest burden. However, for quality education with strong career ROI (IITs, IIMs, top international programs), loans make sense.

What's the best investment for child education in India?

For long-term (10+ years): Equity mutual fund SIPs offer best growth potential. Sukanya Samriddhi Yojana (8.2% tax-free) is excellent for daughters. Avoid traditional education insurance plans—they typically underperform.

How do I budget for multiple children's education?

Create separate savings timelines for each child. Take advantage of sibling discounts at schools. Encourage older children to pursue scholarships to free up funds for younger siblings.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS