Managing EMIs Without Losing Sleep: A Simple Approach to Loan Tracking

This post is crafted for our wonderful users in India—though the wisdom here applies no matter where you call home.

“Sir, no-cost EMI available!”

These five words have become the siren song of modern Indian shopping. That smartphone? Easy EMI. The new washing machine? Just ₹1,999/month. Before you know it, you’re juggling 3, 4, or even 5 different monthly payments—and the stress starts creeping in.

If you’ve ever wondered where your salary disappears each month, if you’ve felt that knot in your stomach when EMI dates approach, or if you’re simply tired of living paycheck to paycheck—this guide is for you.

The EMI Culture in India

EMIs have become a way of life in India. And honestly, they’re not inherently bad. EMIs make expensive but necessary purchases accessible—a home, a vehicle, education.

The problem starts when:

- You lose track of how many EMIs you’re paying

- “Affordable” EMIs across multiple purchases exceed your income capacity

- You’re taking new loans to pay off old ones

- EMI dates create monthly anxiety

The average young Indian professional in metros has 2-4 active EMIs at any given time.

Know Your Total EMI Burden

Step one to managing EMIs: know exactly what you owe. List every EMI with:

- Monthly amount

- Remaining tenure

- Interest rate

Now add them up. If the total shocks you—good. That’s the wake-up call many of us need.

The 40% Rule for EMIs

Here’s a simple guideline: Your total EMI payments should not exceed 40% of your take-home salary.

If you earn ₹50,000/month after taxes, your total EMIs should stay under ₹20,000.

When EMIs cross 50-60% of income, you enter dangerous territory where any unexpected expense becomes a crisis.

Set up automatic EMI tracking

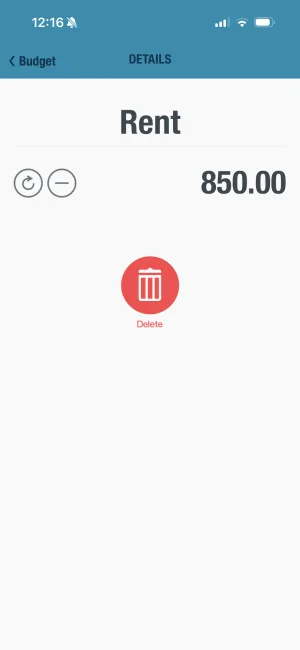

Enter your EMIs as recurring expenses in BUDGT. Your daily spending limit is calculated from what's left—money you can actually use.

Prioritize Your Payments

Not all debt is equal. Here’s how to prioritize:

Pay off highest interest rate loans first:

- Credit card dues (18-42% interest) - TOP PRIORITY

- Personal loans (12-18% interest)

- Consumer durable loans (12-15% interest)

- Car loans (8-12% interest)

- Home loans (7-9% interest)

Every rupee you put toward high-interest debt saves you more than paying low-interest debt.

Build EMIs Into Your Daily Budget

Most people treat EMI dates like surprise attacks—they hit your account and you scramble. Instead:

Enter EMIs as recurring expenses in BUDGT. When you set up your monthly budget, deduct all EMIs upfront. Your daily spending limit is calculated from what’s left—money you can actually use.

This mental shift is powerful: you stop thinking of your salary as “₹50,000” and start thinking of it as “₹27,500 after EMIs.” That’s your real money.

The No-New-EMI Challenge

Ready for a radical experiment? Commit to taking no new loans or EMIs for 6 months.

This means:

- No upgrading your phone on EMI

- No “no-cost EMI” purchases

- No personal loans for lifestyle

- No credit card spending beyond what you can pay in full

Six months of this does two things:

- Your existing EMIs reduce (some may finish)

- You break the mental habit of financing everything

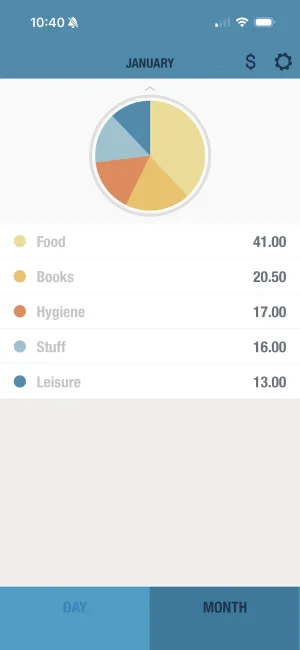

Track your progress toward EMI freedom

See your monthly overview and watch as your debt burden shrinks. BUDGT shows exactly how much you have after all obligations.

Sweet Dreams Await

Imagine a month where no EMI dates stress you out. Where your salary feels like yours again. Where an unexpected expense doesn’t trigger panic.

That’s not a fantasy—it’s a mathematical inevitability if you follow a plan. Every EMI you pay off is one less weight on your shoulders.

Start today. Your future self—and your sleep—will thank you.

Frequently Asked Questions

How many EMIs are too many?

There's no magic number, but the 40% rule is your guide: total EMIs shouldn't exceed 40% of your take-home salary. If you earn ₹50,000/month, keep total EMIs under ₹20,000.

Should I prepay my loan or invest?

It depends on the interest rate. If your loan charges 15% interest and your investments earn 10-12%, prepaying the loan gives you guaranteed 'returns' of 15%. Rule of thumb: prepay loans above 12% interest; invest instead of prepaying loans below 9%.

How do I stop taking new EMIs?

Start with a 6-month 'no new EMI' challenge. Before any purchase, wait 48 hours and ask: 'Can I buy this with cash I have?' If not, you can't afford it right now.

What happens if I miss an EMI payment?

Missing an EMI triggers late fees (typically ₹500-1,000), increased interest charges, and most importantly—a negative mark on your CIBIL score. One missed payment can drop your score by 50-100 points.

How can I reduce my EMI burden quickly?

Use any bonus or extra income to prepay high-interest loans (credit cards first). Consider balance transfer to lower-interest options. Focus on finishing the one with the shortest tenure first for quick psychological wins.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS