How to Make Emergency Money Fast: 12 Ideas for Single Moms

When an unexpected expense hits—a car repair, medical bill, or broken appliance—single moms often face an impossible choice: pay the emergency or cover regular bills. Without savings to fall back on, these moments create real financial crises.

The good news? You can build emergency cash quickly using skills, time, and resources you already have. This guide provides 12 realistic strategies for making emergency money fast, with honest earnings estimates and practical steps to get started today.

Why Emergency Funds Matter for Single Moms

Single-income households face unique vulnerability to financial emergencies:

| Emergency Type | Average Cost | Without Savings | With Emergency Fund |

|---|---|---|---|

| Car repair | $500-1,500 | Credit card debt, payday loan | Covered, no stress |

| Medical bill | $200-1,000 | Collections, payment plan | Paid immediately |

| Appliance replacement | $300-800 | Go without, borrow money | Handled quickly |

| Job loss buffer | 1-3 months expenses | Immediate crisis | Time to find new work |

| School expenses | $100-500 | Kid goes without | Covered comfortably |

The cost of not having emergency savings:

Cost of Emergency Without Savings

A $500 emergency without savings can easily cost $300-400 extra in fees and interest. Building even a small emergency fund prevents this expensive cycle.

Emergency Fund Goals: Start Small

Don’t let big numbers discourage you. Build your emergency fund in stages:

| Stage | Target | Purpose | Timeline |

|---|---|---|---|

| Starter | $500 | Minor emergencies | 1-3 months |

| Basic | $1,000 | Most common emergencies | 3-6 months |

| Standard | 1 month expenses | Job loss buffer | 6-12 months |

| Secure | 3 months expenses | Extended protection | 1-2 years |

| Full | 6 months expenses | Complete security | 2-3 years |

Start with $500. Once you hit that, work toward $1,000. Each milestone builds confidence and security.

Your Emergency Money Action Plan

Calculate Your Emergency Need

Identify how much you need and by when. Knowing your specific target helps you choose the right strategies and stay motivated.

Inventory Your Assets

List items you could sell, skills you could offer, and time you have available. Most people have more resources than they realize.

Choose 2-3 Strategies

Pick methods that match your skills, schedule, and situation. Don't overwhelm yourself—a few focused approaches work better than many half-hearted attempts.

Take Action Today

List one item for sale, sign up for one app, or reach out to one potential client. Starting immediately builds momentum.

Track Your Progress

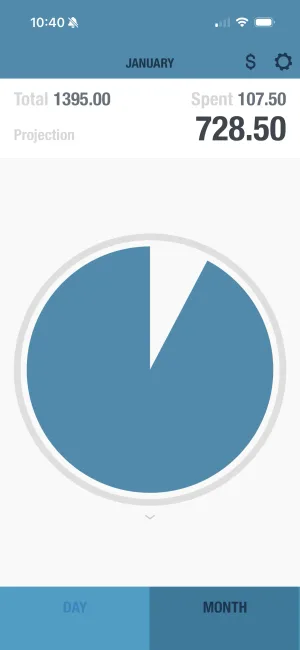

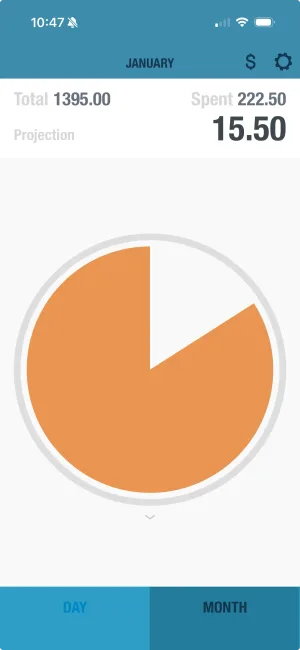

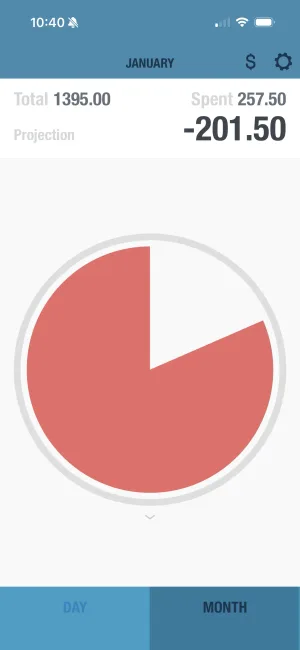

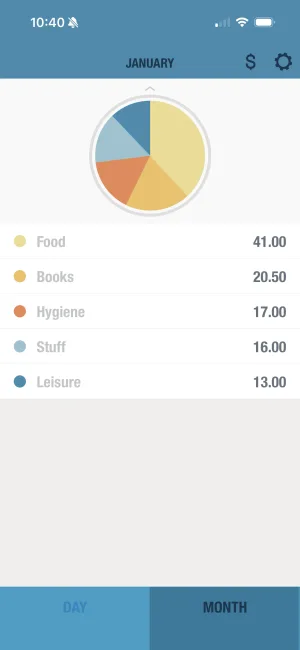

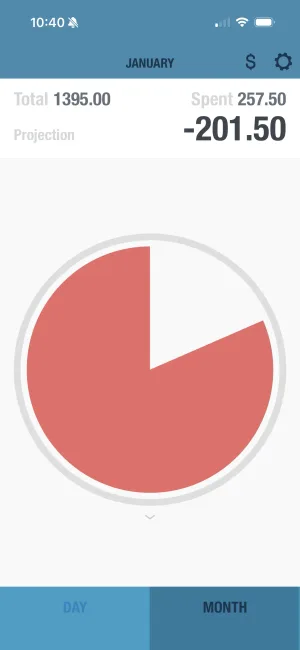

Use BUDGT to monitor earnings and watch your emergency fund grow. Seeing progress keeps you motivated during the push.

Build Prevention Habits

Once the immediate need is met, keep saving small amounts regularly. Preventing the next emergency is easier than solving it.

12 Ways to Make Emergency Money Fast

1. Sell Unused Items

The fastest way to generate cash is selling things you already own. Most homes have hundreds of dollars worth of unused items.

What sells quickly:

| Item Category | Where to Sell | Typical Earnings | Time to Sell |

|---|---|---|---|

| Electronics | Facebook Marketplace, eBay | $50-500 | 1-7 days |

| Kids’ clothes/toys | Facebook groups, consignment | $20-200 | 1-14 days |

| Furniture | Facebook Marketplace, Craigslist | $50-500 | 3-14 days |

| Designer items | Poshmark, ThredUp | $25-300 | 7-30 days |

| Books | Amazon, Half Price Books | $10-100 | 1-14 days |

| Tools/equipment | Facebook Marketplace | $25-200 | 1-7 days |

Tips for fast sales:

- Price 20-30% below retail for quick turnover

- Take clear, well-lit photos from multiple angles

- Write detailed, honest descriptions

- Respond to inquiries within hours

- Offer local pickup for immediate cash

High-value items to look for:

- Old smartphones (even broken ones sell)

- Gaming consoles and games

- Exercise equipment

- Small appliances

- Baby gear (strollers, car seats, cribs)

- Brand-name clothing in good condition

Track your selling income

Use BUDGT to track money earned from selling items. Watch your emergency fund grow as you convert clutter into cash and financial security.

2. Offer Babysitting or Childcare

As a mom, you have childcare experience that’s valuable to other families. This is often the highest-paying flexible option.

Potential earnings:

| Service Type | Rate | Hours/Week | Monthly Potential |

|---|---|---|---|

| Weekend babysitting | $15-25/hr | 8-16 | $480-1,600 |

| After-school care | $12-20/hr | 10-15 | $480-1,200 |

| Date night sitting | $18-30/hr | 4-8 | $288-960 |

| Full day care | $100-150/day | 4-8 days/mo | $400-1,200 |

How to find clients:

| Method | Time to First Client |

|---|---|

| Care.com, Sittercity | 1-2 weeks |

| Neighborhood app (Nextdoor) | 1-7 days |

| Word of mouth | Varies |

| School parent networks | 1-2 weeks |

| Church community | 1-7 days |

Bonus: Your kids can play with the children you’re watching, making it a playdate for them too.

3. Pet Sitting and Dog Walking

Pet owners pay well for reliable care, and this work fits around your schedule.

Earnings potential:

| Service | Rate | Time Required | Notes |

|---|---|---|---|

| Dog walking (30 min) | $15-25 | 30-45 min total | Can bring kids |

| Drop-in pet visits | $15-25 | 30 min | Quick and flexible |

| Overnight pet sitting | $50-100 | At their home | Higher commitment |

| In-home boarding | $30-75/night | At your home | Pets stay with you |

Platforms to join:

- Rover (most popular, highest fees)

- Wag (dog walking focused)

- Nextdoor (local connections, no fees)

- Care.com (includes pet care)

Making it work with kids:

- Dog walking is great with kids in strollers or on bikes

- Drop-in visits can be done during nap time or school

- In-home boarding lets your kids enjoy pets without long-term commitment

4. Utilize Cashback and Reward Apps

Turn everyday spending into extra cash without changing your routine.

Best cashback apps:

| App | Best For | Typical Returns | Payout Minimum |

|---|---|---|---|

| Rakuten | Online shopping | 1-10% cashback | $5 |

| Ibotta | Groceries | $0.25-$5/item | $20 |

| Fetch | All receipts | Points for gift cards | $3 |

| Dosh | Credit card linking | 1-5% automatic | $25 |

| Honey | Price comparison + cashback | Varies | $10 |

Maximizing cashback earnings:

| Strategy | Potential Monthly Savings |

|---|---|

| Use Ibotta for all grocery trips | $15-40 |

| Shop through Rakuten for online purchases | $5-30 |

| Scan all receipts with Fetch | $5-15 |

| Stack coupons with cashback | $10-25 |

| Total monthly potential | $35-110 |

Annual Cashback Potential

5. Run Errands for Others

Busy people pay for convenience. Offer errand services to neighbors and community members.

Services you can offer:

| Errand Type | Typical Rate | Time Required |

|---|---|---|

| Grocery shopping | $20-40 + tip | 1-2 hours |

| Prescription pickup | $10-20 | 30 min |

| Returns/exchanges | $15-25 | 30-60 min |

| Post office runs | $10-15 | 20-30 min |

| Waiting for service people | $15-25/hr | Varies |

| Airport pickup/dropoff | $30-75 | 1-2 hours |

Finding clients:

- Post on Nextdoor offering services

- Join Instacart, Shipt, or DoorDash for shopping/delivery

- Ask at local senior centers

- Post in church bulletins

- Create simple flyers for your neighborhood

Kid-friendly errands:

Many errands work with kids in tow—grocery shopping, pharmacy runs, and post office trips are all doable with children.

Build your emergency fund with Savings Mode

Set a savings goal in BUDGT and watch your emergency fund grow. Every errand you run gets you closer to financial security.

6. Declutter and Have a Yard Sale

When you have many items to sell, a yard sale can generate substantial quick cash.

Yard sale success tips:

| Factor | Impact on Sales |

|---|---|

| Location (high traffic) | +50-100% |

| Good signage | +30-50% |

| Friday + Saturday | +40% vs. single day |

| Pricing (low, ready to deal) | +25-40% |

| Organization | +20-30% |

| Weather | Can make or break it |

Realistic earnings:

| Yard Sale Size | Typical Earnings |

|---|---|

| Small (1 family, few items) | $75-200 |

| Medium (1 family, lots of items) | $200-500 |

| Large (multi-family) | $500-1,500 |

| Estate sale level | $1,000+ |

What doesn’t sell at yard sales:

- Sell online instead: electronics, brand-name items, collectibles

- Donate: worn clothing, outdated items, broken things

7. Participate in Paid Research

Companies pay for opinions through surveys, focus groups, and product testing.

Paid research options:

| Type | Payment | Time Required | Where to Find |

|---|---|---|---|

| Online surveys | $0.50-$5 each | 5-30 min | Swagbucks, Survey Junkie |

| Focus groups | $50-200 | 1-2 hours | Respondent.io, local facilities |

| Product testing | Free products + $10-50 | Varies | Influenster, BzzAgent |

| App testing | $10-50 | 15-60 min | UserTesting, Userbrain |

| Mock juries | $50-150 | 2-4 hours | eJury, OnlineVerdict |

Realistic survey earnings:

| Effort Level | Hours/Week | Monthly Earnings |

|---|---|---|

| Casual | 2-3 | $20-50 |

| Active | 5-8 | $50-100 |

| Dedicated | 10-15 | $100-200 |

Tips for maximizing survey income:

- Sign up for multiple platforms

- Complete profile surveys for better matches

- Focus on higher-paying opportunities (focus groups, testing)

- Do surveys during downtime (waiting rooms, kids’ activities)

8. Offer Cleaning Services

Cleaning is in high demand and requires no special training—just reliability and attention to detail.

Pricing guide:

| Service | Rate | Time | Frequency |

|---|---|---|---|

| Basic house cleaning | $25-45/hr | 2-4 hrs | Weekly/biweekly |

| Deep cleaning | $150-300 | 4-8 hrs | One-time/quarterly |

| Move-out cleaning | $200-400 | 4-8 hrs | One-time |

| Office cleaning | $75-200 | 2-4 hrs | Weekly |

| Post-construction | $300-600+ | 6-12 hrs | One-time |

Building a cleaning client base:

| Method | Cost | Time to First Client |

|---|---|---|

| Nextdoor posts | Free | 1-7 days |

| Word of mouth | Free | Varies |

| Care.com housekeeping | $20-40/month | 1-2 weeks |

| Thumbtack | Pay per lead | 1-7 days |

| Flyers in neighborhoods | $10-20 | 1-2 weeks |

Making it work:

- Start with 1-2 clients and build reputation

- Schedule around school hours or when you have childcare

- Some clients are flexible about kids coming along for quick jobs

- One regular weekly client = $200-400/month consistent income

9. Rent Out What You Own

Your possessions can generate passive income when you’re not using them.

Rental opportunities:

| Item | Platform | Typical Earnings |

|---|---|---|

| Parking space | SpotHero, neighbor | $50-300/month |

| Storage space | Neighbor | $50-200/month |

| Car | Turo, Getaround | $300-800/month |

| Tools/equipment | Fat Llama | $20-100/rental |

| Camera gear | Fat Llama, ShareGrid | $50-200/rental |

| Spare room | Airbnb, Furnished Finder | $500-1,500/month |

Considerations:

| Rental Type | Pros | Cons |

|---|---|---|

| Parking/storage | Truly passive | Need space to rent |

| Car | High earnings | Insurance complexity |

| Equipment | Easy to manage | Damage risk |

| Room | Highest earnings | Sharing your space |

10. Freelance Your Skills

Everyone has marketable skills—the key is identifying yours and finding buyers.

Skills in demand:

| Skill | Platform | Rate | Getting Started |

|---|---|---|---|

| Writing | Upwork, Fiverr | $0.05-$1/word | Portfolio + samples |

| Virtual assistance | Belay, Upwork | $15-35/hr | Basic office skills |

| Tutoring | Wyzant, Varsity Tutors | $20-80/hr | Subject expertise |

| Graphic design | 99designs, Fiverr | $25-100/hr | Portfolio |

| Bookkeeping | Upwork, local businesses | $20-50/hr | QuickBooks knowledge |

| Social media management | Local businesses | $300-1,000/month | Social media savvy |

Unexpected freelance opportunities:

- Resume writing: $50-150 per resume

- Proofreading: $15-35/hour

- Data entry: $12-20/hour

- Transcription: $15-25/hour

- Customer service: $12-20/hour

Track freelance income and expenses

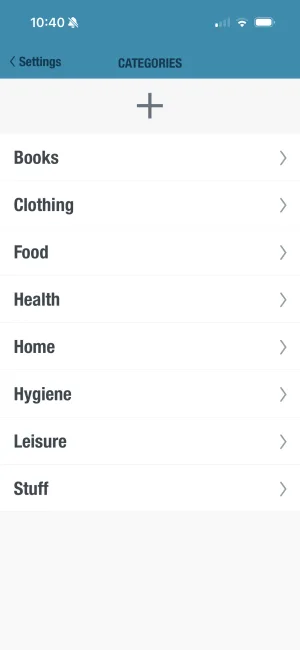

BUDGT's Categories feature helps you track freelance earnings separately. See how side income contributes to your emergency fund and overall financial picture.

11. Start a Small Home Business

A simple home-based business can provide ongoing income while building toward bigger goals.

Low-startup business ideas:

| Business | Startup Cost | Monthly Potential | Time to First Sale |

|---|---|---|---|

| Baked goods | $20-50 | $200-1,000+ | 1-2 weeks |

| Crafts/jewelry | $50-100 | $100-500+ | 2-4 weeks |

| Photography | Existing phone | $200-2,000 | 2-4 weeks |

| Tutoring | $0 | $200-800+ | 1-2 weeks |

| Personal shopping | $0 | $100-500+ | 1-2 weeks |

| Lawn care | $50-200 | $200-800+ | 1-2 weeks |

Keys to home business success:

- Start with what you already know and have

- Keep startup costs minimal

- Build word of mouth through quality

- Reinvest early earnings for growth

- Track all income and expenses in BUDGT

12. Leverage Community Resources

When money is tight, don’t overlook free resources that reduce your needs.

Money-saving community resources:

| Resource | What It Provides | Annual Value |

|---|---|---|

| Food banks | Groceries | $1,200-2,400 |

| Clothing closets | Clothes for family | $300-600 |

| Library | Books, movies, programs | $500+ |

| Community centers | Free activities | $200-500 |

| SNAP benefits | Food assistance | Varies |

| LIHEAP | Utility assistance | $200-800 |

| School meal programs | Breakfast/lunch | $1,000+ |

Finding resources:

- Dial 211 for local assistance referrals

- Visit your local library (they know all community resources)

- Check with schools for family support programs

- Ask at churches regardless of membership

- Search benefits.gov for federal/state programs

Quick-Start Emergency Money Plan

Need money within the next 1-2 weeks? Here’s your action plan:

| Day | Action | Potential Earnings |

|---|---|---|

| Day 1 | List 5-10 items for sale on Facebook Marketplace | — |

| Day 1 | Sign up for 3 cashback apps | — |

| Day 2 | Post services on Nextdoor (babysitting, errands, cleaning) | — |

| Day 3 | Complete profile surveys on 2-3 survey sites | $5-10 |

| Day 4-7 | Sell items, fulfill service requests | $100-500+ |

| Day 7-14 | Continue selling, add more services | $200-1,000+ |

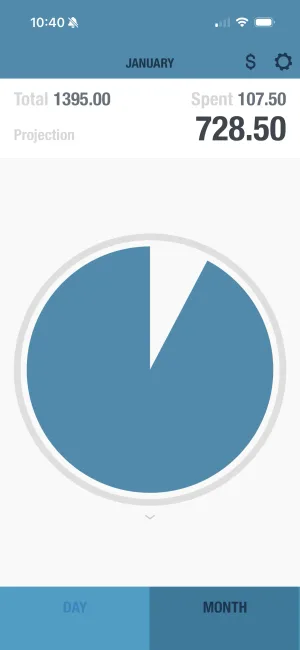

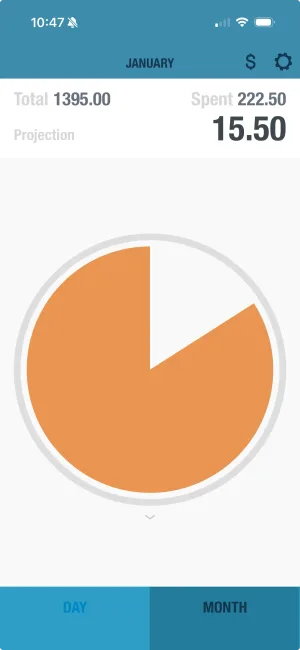

Watch your emergency fund grow

Use BUDGT's month-end projection to see how your emergency money efforts add up. Every dollar earned brings you closer to financial security.

Building Long-Term Financial Security

Once the immediate emergency is handled, shift focus to prevention:

| Habit | How It Helps | Monthly Amount |

|---|---|---|

| Automatic savings | Builds fund painlessly | $25-100 |

| Regular side income | Ongoing buffer | Varies |

| Lower expenses | More room for saving | Varies |

| BUDGT daily tracking | Prevents overspending | N/A |

The emergency fund progression:

- Week 1-2: Handle immediate need with quick strategies

- Month 1-3: Build to $500 starter fund

- Month 3-6: Reach $1,000 basic fund

- Month 6-12: Build toward one month’s expenses

- Year 2+: Continue to 3-6 months expenses

From Emergency to Empowerment

Financial emergencies are stressful, but they’re also opportunities to discover your resourcefulness. The strategies in this guide can help you handle today’s crisis—and build the foundation to prevent the next one.

Start with what you have: items to sell, skills to offer, time to invest. Take one action today. Track your progress. Watch your emergency fund grow.

You’ve handled hard things before. You can handle this too.

Every dollar you earn brings you closer to the security your family deserves.

Frequently Asked Questions

How much should I aim to save in an emergency fund?

Financial experts typically recommend 3-6 months of living expenses, but start with a smaller, achievable goal like $500-$1000. Even $25-50 per month adds up over time. The key is starting small and building consistently rather than feeling overwhelmed by a large target. Once you hit $1,000, keep building toward one month of expenses, then three months.

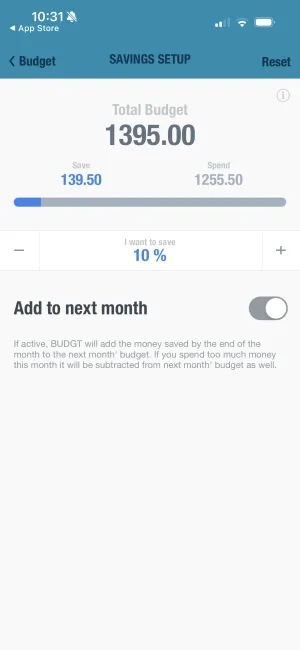

How can BUDGT help me build an emergency fund on a tight budget?

BUDGT's daily budget philosophy shows you exactly what's left after essential expenses each day. By sticking to your daily limit, any money left at month's end can go directly into your emergency fund. Use the Savings Mode feature to set aside money for emergencies, and track it separately from your daily spending budget.

What are the quickest ways to earn emergency money as a single mom?

The fastest options include selling unused items on Facebook Marketplace or eBay (can earn same day), taking on flexible odd jobs like babysitting or pet sitting through apps like Care.com, offering services based on your skills (tutoring, cleaning, errands), and participating in paid focus groups. Selling items you already own provides the quickest cash.

Are cashback apps really worth using?

Yes! Cashback apps like Rakuten, Ibotta, and Fetch give you money back on purchases you'd make anyway. While individual returns might be small ($0.50-$5 per transaction), they add up significantly—active users earn $100-300 annually. Combined with coupons and strategic shopping, cashback apps contribute meaningfully to your emergency fund.

How do I find time for side gigs as a busy single mother?

Look for flexible opportunities that fit your schedule: online surveys during kids' bedtime, weekend babysitting when you have childcare, freelance work during nap times, or selling items online whenever convenient. Home-based tasks like virtual assistance or data entry offer the most flexibility since you control when and how much you work.

What BUDGT features help with tracking multiple income sources?

BUDGT's Categories feature lets you organize different income streams and expenses separately. You can see how side hustle earnings contribute to your overall daily budget. The CSV Export feature allows you to analyze your income and spending patterns over time to optimize your money-earning strategies and see which side hustles are most worth your time.

Is it realistic to make $500-1000 quickly in an emergency?

Yes, especially by combining strategies. Selling unused items can generate $200-500 quickly. Adding one weekend of babysitting ($100-200), a few hours of cleaning ($50-100), and cashback from regular shopping ($20-50) can reach $500+ within 1-2 weeks. The key is acting quickly and working multiple approaches simultaneously.

What should I avoid when trying to make quick money?

Avoid anything requiring upfront payment, multilevel marketing schemes, payday loans, high-interest personal loans, selling things you actually need, or taking on debt to cover emergencies. Also avoid opportunities that seem too good to be true—legitimate side gigs have realistic earnings, not promises of getting rich quick.

How can I make extra money without leaving my kids?

Many options work from home: selling items online, virtual assistance, online tutoring, data entry, transcription, customer service, paid surveys, and freelance writing. You can also bring kids along for activities like grocery shopping for others, neighborhood errands, or yard sales. Some parents offer babysitting services where kids can play together.

Is BUDGT available on Android devices?

No, BUDGT is currently iOS-only and designed specifically for iPhone users. The app is optimized for iOS features and works 100% offline, with no cloud sync required. All your financial data stays private and secure on your iPhone, which is especially important when tracking emergency fund progress.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS