Money Fights in Relationships: How to Avoid Financial Conflicts

Money is the number one cause of stress in relationships. Studies show that finances cause more divorces than infidelity, and couples fight about money more than any other topic—more than chores, more than parenting, more than in-laws.

But here’s the good news: money fights are preventable. They’re not about the money itself—they’re about communication, values, and expectations. Master those, and money becomes a tool that brings you closer instead of driving you apart.

This guide covers everything you need to prevent financial conflicts and build a financially healthy relationship.

Why Couples Fight About Money

Before solving the problem, understand what’s really happening:

| Surface Issue | Underlying Cause |

|---|---|

| ”You spend too much” | Different values about what’s worth buying |

| ”You never told me about that purchase” | Lack of communication and transparency |

| ”We can’t afford that” | Different risk tolerance and priorities |

| ”You’re too controlling with money” | Power imbalance or autonomy concerns |

| ”We never have enough” | Anxiety, past trauma, or unrealistic expectations |

Money fights are rarely about the specific purchase. They’re about trust, control, values, and fear.

The Real Cost of Financial Conflict

| Impact | How It Shows Up |

|---|---|

| Relationship health | Resentment builds, intimacy suffers |

| Financial decisions | Avoidance leads to worse outcomes |

| Individual stress | Anxiety, sleep problems, health issues |

| Future planning | Can’t work toward goals together |

| Children | Kids absorb financial stress and conflict patterns |

Understanding Your Money Personalities

Every person has a money personality shaped by upbringing, experiences, and values. Conflicts often arise when personalities clash:

| Money Type | Characteristics | Strengths | Challenges |

|---|---|---|---|

| Saver | Prioritizes security, avoids debt, feels anxious spending | Financial stability, emergency preparedness | Can seem restrictive, misses experiences |

| Spender | Enjoys using money, generous, lives in the moment | Appreciates life, generous with others | May neglect future, create debt |

| Avoider | Ignores finances, overwhelmed by money discussions | Reduces daily stress | Problems compound, surprises happen |

| Planner | Researches, budgets, tracks everything | Organized, prepared | Can seem controlling, inflexible |

| Risk-Taker | Comfortable with debt, invests aggressively | Potential for gains, entrepreneurial | Financial volatility, partner anxiety |

Common Personality Clashes

| Pairing | Typical Conflict | Resolution Approach |

|---|---|---|

| Saver + Spender | One feels deprived, one feels controlled | Define “fun money” for guilt-free spending |

| Planner + Avoider | One over-manages, one disengages | Simplify systems, assign clear roles |

| Risk-Taker + Saver | Disagreement on investments, big purchases | Agree on “safe” base before any risks |

Understanding your types helps depersonalize conflict. You’re not “wrong”—you’re different.

How to Have Money Conversations That Work

The way you talk about money matters more than what you say:

Schedule a Money Date

Pick a time when you're both calm and fed—not during or after a conflict. Treat it as a regular appointment, monthly for most couples.

Start with Shared Goals

Begin by discussing what you both want: security, experiences, home ownership, retirement. Find common ground before discussing specifics.

Review Together, Not Against

Look at spending data as partners solving a puzzle, not opponents. Ask 'What can WE do?' not 'Why did YOU do that?'

Use 'I' Statements

Say 'I feel anxious when I don't know our balance' not 'You never tell me anything.' Take ownership of feelings without accusations.

Agree on Next Steps

End every money conversation with clear action items. Who does what by when? Write it down.

Celebrate Progress

Acknowledge wins—even small ones. 'We stayed under budget this month' reinforces positive patterns.

Money Conversation Ground Rules

| Do | Don’t |

|---|---|

| Pick a calm, private moment | Discuss money during or after arguments |

| Focus on shared goals first | Start with complaints or accusations |

| Use “we” and “our” language | Use “you always” or “you never” |

| Take breaks if emotions rise | Push through when someone is upset |

| End with clear next steps | Leave conversations vague or unresolved |

| Assume good intentions | Assume your partner is being malicious |

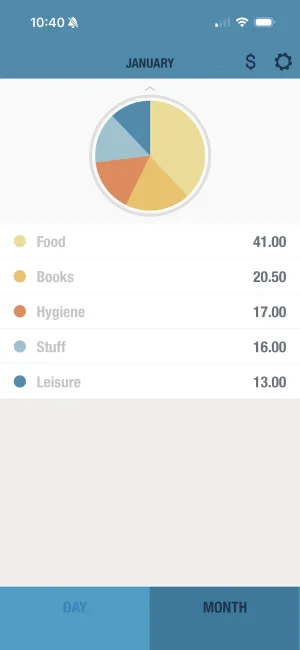

Review your finances together

BUDGT's monthly view gives couples a clear picture of where money went. Review together without confusion or finger-pointing—just facts that help you plan.

Building a Couples Budget That Works

A shared budget is essential, but the structure matters:

Step 1: Choose Your Account System

| System | How It Works | Best For |

|---|---|---|

| Full Combination | All money goes to one joint account | High trust, similar spending styles |

| Partial Combination | Joint account for shared expenses, separate accounts for personal spending | Different spending styles, need for autonomy |

| Separate + Contribution | Separate accounts, each contributes agreed amount to shared expenses | Early relationships, income disparity, rebuilding trust |

There’s no “right” answer—only what works for you both.

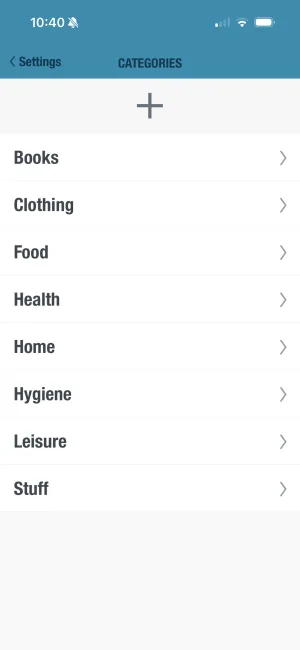

Step 2: Define Your Categories

| Category | Examples | Decision |

|---|---|---|

| Fixed shared expenses | Rent/mortgage, utilities, insurance | Joint responsibility |

| Variable shared expenses | Groceries, household items, kids | Agree on limits |

| Individual expenses | Personal shopping, hobbies, gifts | Individual discretion |

| Savings goals | Emergency fund, vacation, retirement | Joint priority |

| Fun money | Personal spending, no questions asked | Individual amounts |

Step 3: Set a Spending Threshold

Agree on an amount that requires discussion before purchasing:

| Income Level | Suggested Threshold |

|---|---|

| Under $50K combined | $50 |

| $50K - $100K combined | $75-100 |

| $100K - $150K combined | $100-150 |

| Over $150K combined | $200+ |

This isn’t about permission—it’s about partnership and communication.

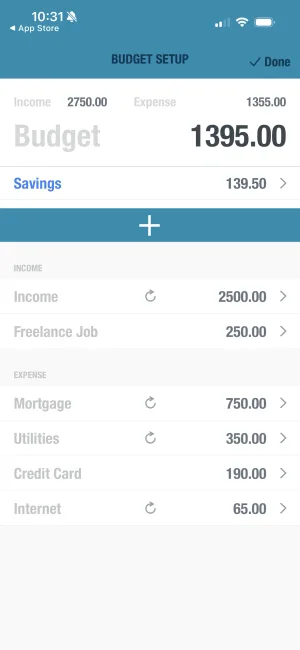

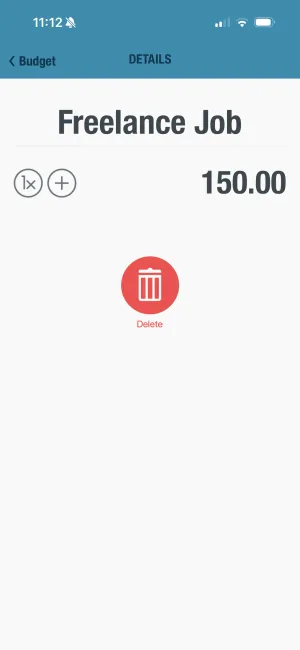

Set up your shared budget

BUDGT makes it simple to create a household budget. Enter your combined income and expenses, then see exactly how much your household can spend each day.

Handling Income Differences Fairly

When one partner earns significantly more, fairness requires thought:

Option 1: Proportional Contributions

Each partner contributes the same percentage of their income to shared expenses.

Example:

| Partner | Income | Contribution % | Monthly Amount |

|---|---|---|---|

| Partner A | $6,000 | 60% | $1,800 |

| Partner B | $4,000 | 40% | $1,200 |

| Total | $10,000 | 100% | $3,000 |

Option 2: Higher Earner Covers More Fixed Costs

The higher earner handles most fixed expenses while the lower earner covers discretionary categories.

Option 3: Full Income Pooling

All income goes into one pot, and both have equal access regardless of who earned what.

Key principle: The method matters less than both partners feeling the arrangement is fair.

Common Financial Conflicts and Solutions

Conflict: Secret Spending

| Warning Signs | What’s Really Happening | Solution |

|---|---|---|

| Hidden purchases, cash withdrawals | Shame, control issues, or different values | Establish transparency + “no questions asked” personal spending |

| Separate credit cards you didn’t know about | Financial infidelity | Serious conversation, possibly counseling |

| Small lies about prices | Avoiding conflict | Address underlying judgment patterns |

Conflict: Different Priorities

| They Want | You Want | Bridge |

|---|---|---|

| Save everything | Enjoy today | Agree on savings %, use remainder freely |

| Expensive vacations | Pay off debt | Alternate priorities by year or quarter |

| Invest aggressively | Keep it safe | Split investments (safe + growth) |

| Help family members | Focus on your household | Set family support budget with cap |

Conflict: One Person Handles Everything

| Problem | Impact | Solution |

|---|---|---|

| One partner manages all finances | Other feels out of control or uninformed | Monthly review together, even if one person does daily tracking |

| One partner refuses to engage | Other feels unsupported, resentful | Start with simple monthly overview, not details |

| Control used as power | Financial abuse potential | Ensure both have visibility and access |

Track daily spending together

BUDGT's daily view shows how much your household can spend today. Both partners can see the same number—no surprises, no secrets.

Recovering from Financial Mistakes

Everyone makes money mistakes. Here’s how to handle them without destroying your relationship:

When Your Partner Makes a Mistake

| Don’t | Do Instead |

|---|---|

| ”I can’t believe you did that" | "Let’s figure out how to fix this" |

| "You always overspend" | "I noticed the budget is off—what happened?” |

| Bring up past mistakes | Focus on this situation |

| Punish or withhold | Problem-solve together |

When You Make a Mistake

| Don’t | Do Instead |

|---|---|

| Hide it hoping they won’t notice | Disclose promptly and honestly |

| Make excuses | Take responsibility |

| Promise it will never happen again | Explain what you’ll do differently |

| Get defensive when they’re upset | Allow them to feel frustrated |

The Recovery Conversation

Acknowledge What Happened

State the facts without minimizing or dramatizing. 'I spent $300 on clothes that wasn't in the budget.'

Take Responsibility

Own it without excuses. 'I knew we were tight this month and I bought it anyway.'

Understand the Impact

Recognize how it affects you both. 'Now we need to figure out how to cover the electricity bill.'

Propose a Solution

Come with ideas, not just problems. 'I can return some items and pick up extra shifts this week.'

Prevent Future Recurrence

Identify what will change. 'I'll text you before any purchase over $50 so we can decide together.'

Building Financial Trust

Trust is built through consistent actions, not promises:

Daily Trust-Building

| Action | Why It Matters |

|---|---|

| Log shared expenses promptly | No surprises at month end |

| Mention significant purchases | Keeps partner informed |

| Stick to agreed spending limits | Demonstrates reliability |

| Share financial wins and concerns | Maintains connection |

Monthly Trust-Building

| Action | Why It Matters |

|---|---|

| Review budget together | Both stay informed |

| Celebrate hitting goals | Reinforces teamwork |

| Discuss upcoming expenses | Plan together |

| Adjust budget as needed | Flexibility shows partnership |

Long-Term Trust-Building

| Action | Why It Matters |

|---|---|

| Work toward shared goals | Creates joint investment |

| Maintain transparency | Nothing to hide |

| Support each other’s priorities | Shows respect |

| Navigate setbacks together | Strengthens bond |

See where money goes together

BUDGT's category breakdown makes it easy to review spending patterns. No blame games—just clear data to inform decisions together.

Financial Red Flags in Relationships

Some financial behaviors signal deeper problems:

| Red Flag | What It Might Mean | What to Do |

|---|---|---|

| Hiding significant debt | Shame, fear, or deception pattern | Require full financial disclosure |

| Controlling all money decisions | Power imbalance, financial abuse potential | Ensure equal access and visibility |

| Refusing any financial discussion | Avoidance, fear, or control | Start with professional mediation |

| Gambling or addictive spending | Addiction requiring treatment | Seek professional help |

| Using money as punishment | Emotional abuse | Consider relationship counseling |

If you recognize serious red flags, consider working with a financial therapist or couples counselor who specializes in money issues.

Special Situations

Living Together, Not Married

| Consideration | Recommendation |

|---|---|

| Joint accounts | Consider “partial combination” system |

| Shared assets | Document contributions clearly |

| Shared debts | Keep debt in one name when possible |

| Exit plan | Uncomfortable but necessary—know how you’d separate financially |

Remarriage/Blended Families

| Consideration | Recommendation |

|---|---|

| Child support/alimony | Factor into household budget transparently |

| Children’s expenses | Clear agreement on who pays what |

| Previous financial baggage | Disclose debts before combining finances |

| Inheritance/estate | Protect children from prior relationships if needed |

One Partner Stays Home

| Consideration | Recommendation |

|---|---|

| Equal access to money | Both partners get personal spending regardless of who earns |

| Career gap impact | Acknowledge and plan for long-term earning impact |

| Contribution recognition | Home management has economic value |

| Financial independence | Ensure stay-home partner has some financial autonomy |

Making Peace with Money Together

Start your financial partnership

BUDGT helps couples see the same financial picture. One simple number tells you both what you can spend today—no arguments about who spent what.

Your Action Plan for Financial Harmony

| This Week | This Month | This Quarter |

|---|---|---|

| Schedule your first money date | Choose your account system | Review and adjust budget |

| Identify your money personalities | Set up shared budget | Celebrate first goal achieved |

| Agree on communication ground rules | Establish spending threshold | Plan for next quarter’s goals |

| Download BUDGT together | Complete first month of tracking | Evaluate what’s working |

The Bottom Line

Money doesn’t have to cause fights. When couples:

- Understand their different money personalities

- Communicate openly and regularly about finances

- Create a budget system that works for both

- Build trust through transparency and consistency

- Recover gracefully from inevitable mistakes

…money becomes a tool that strengthens the relationship instead of straining it.

The goal isn’t to agree on everything financial. The goal is to work together even when you disagree.

Download BUDGT today and start your journey toward financial partnership. When you both see the same simple daily limit, there’s nothing to argue about—just decisions to make together.

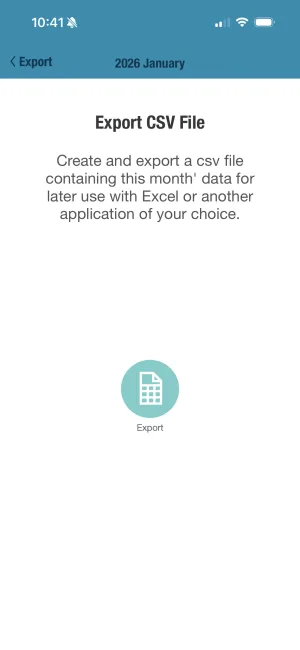

Export your shared data

BUDGT lets you export your financial data anytime. Perfect for annual reviews, tax preparation, or deeper analysis of your household spending together.

Frequently Asked Questions

How often should couples talk about money?

Monthly "money dates" work well for most couples - a scheduled 30-minute conversation reviewing the budget, upcoming expenses, and progress toward goals. Couples just starting to budget or going through major transitions (job change, new baby, buying a house) benefit from weekly 15-minute check-ins until things stabilize.

What if my partner and I have very different spending habits?

Different spending styles are normal and manageable. First, identify your styles (saver vs. spender, planner vs. spontaneous). Then create a shared budget that includes individual "fun money" accounts - money each person can spend however they want with no questions asked. This preserves autonomy while maintaining shared financial goals.

Should couples combine finances or keep them separate?

There's no single right answer. Options include full combination (one pot), partial combination (joint account for shared expenses, separate for personal), or separate with contribution agreement. The best system is the one you both commit to and feel comfortable with. Many couples start separate and gradually combine as trust builds.

How do I bring up money problems without starting a fight?

Use "I" statements instead of accusations. Say "I feel anxious when I don't know where we stand financially" rather than "You never tell me what you're spending." Choose a calm moment, not during or after a conflict. Focus on the problem together, not on blaming each other. Approach it as partners solving a puzzle, not opponents in a debate.

What if my partner refuses to budget or track spending?

Start by understanding their resistance - is it fear, control issues, or different priorities? Focus on shared goals they care about (vacation, house, retirement) rather than the budget itself. Offer to handle the tracking while they participate in monthly reviews. Sometimes showing results (savings growth) over 2-3 months converts skeptics.

Should couples always split expenses 50/50?

Equal (50/50) isn't always equitable. If incomes differ significantly, proportional splitting feels fairer - if one person earns 60% of household income, they contribute 60% to shared expenses. What matters is that both partners feel the arrangement is fair and sustainable. Discuss and agree rather than assuming.

How do I handle a partner who hides spending?

Financial infidelity is serious and needs to be addressed. Approach without accusations initially - there may be shame or fear involved. Establish transparency systems (both see all accounts) and spending limits that require discussion. If hiding continues after agreements, consider couples counseling to address underlying trust issues.

What's the spending threshold where couples should discuss purchases?

Most financial advisors suggest a threshold between $50-100 for everyday decisions, meaning any purchase above that amount gets discussed first. The specific number depends on your income and budget. The goal isn't permission-seeking but partnership - keeping each other informed about significant spending.

How do we budget when one partner earns much more?

Three common approaches work for income imbalances. First, proportional contributions (each contributes same percentage of income). Second, higher earner covers more fixed costs while lower earner handles discretionary. Third, full combination with equal access regardless of who earned it. The key is agreement, not which method.

Can budgeting really improve a relationship?

Yes. Financial stress is the top predictor of divorce, and working together on money creates shared goals and regular communication. Couples who budget together report less conflict, more trust, and greater relationship satisfaction. The process of budgeting - making decisions together - often strengthens other areas of the relationship too.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS