Breaking the Overspending Cycle: A Recovering Shopaholic's Guide

Breaking the Overspending Cycle: A Recovering Shopaholic’s Guide

You’ve been here before. The promise to yourself that this time will be different. The resolution to stop. The inevitable slip. The shame. The cycle continues.

Breaking the overspending cycle isn’t about willpower—it’s about understanding patterns, building systems, and treating yourself with compassion while making concrete changes.

This guide is for people who’ve tried “just stopping” and failed, who know the drill of regret and repeat, and who need a different approach.

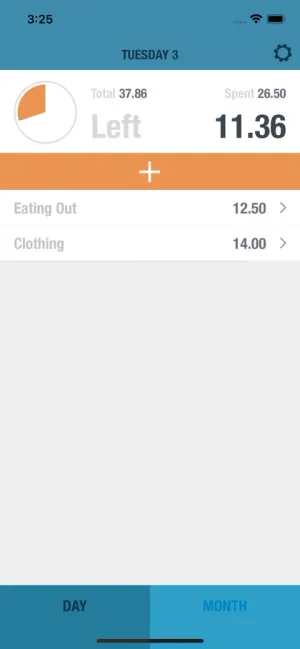

See where you stand instantly

Color-coded daily feedback helps you pause before purchasing.

Understanding Your Cycle

Every overspending pattern has a shape. Understanding yours is the first step to interrupting it.

The Typical Overspending Cycle

| Stage | What Happens |

|---|---|

| 1. Trigger | Something happens (stress, boredom, celebration, seeing an ad) |

| 2. Urge | The pull toward shopping/buying |

| 3. Permission | Internal justification (“I deserve this,” “It’s on sale”) |

| 4. Action | The purchase |

| 5. Brief relief | Momentary satisfaction or excitement |

| 6. Regret | Guilt, shame, self-criticism |

| 7. Numbness | Avoiding the reality |

| 8. New trigger | Cycle restarts |

Sound familiar? Most people can identify their personal version of this pattern.

Mapping Your Personal Cycle

Answer honestly:

- What typically triggers your spending urges?

- What do you tell yourself to justify purchases?

- How long does the “good feeling” last after buying?

- What emotions follow the purchase?

- How do you cope with regret?

Your answers reveal intervention points—places in the cycle where change is possible.

Breaking the Cycle: The Four-Point Intervention

You can interrupt the overspending cycle at multiple points. The more interventions you build, the more likely you’ll break the pattern.

Intervention Point 1: The Trigger

If you never hit the trigger, the cycle can’t start.

Reduce exposure:

- Unsubscribe from all retail marketing emails

- Unfollow shopping influencers and deal accounts

- Delete shopping apps from your phone

- Avoid stores without a specific purpose

- Use website blockers during high-risk times

Address root causes:

- If boredom triggers spending, find engaging alternatives

- If stress triggers spending, develop other coping methods

- If social situations trigger spending, set limits beforehand

Intervention Point 2: The Urge

When the urge hits, you have a window before action.

The HALT check: Before spending, ask if you’re:

- Hungry

- Angry

- Lonely

- Tired

If any apply, address that need instead of shopping.

Urge surfing: Rather than fighting the urge, observe it. “I notice I want to buy something right now.” Urges typically peak and fade within 15-20 minutes if you don’t act on them.

The 48-hour rule: For any non-essential purchase, wait 48 hours. Most urges lose power with time.

Intervention Point 3: The Permission

This is where you talk yourself into purchases. Notice your justifications.

Common permission stories and counter-scripts:

| What You Tell Yourself | The Truth |

|---|---|

| ”I deserve this” | You deserve financial peace more |

| ”It’s on sale” | A discount on something unnecessary isn’t saving |

| ”I’ll return it” | You probably won’t |

| ”It’s just one thing” | One thing, hundreds of times, is a pattern |

| ”I’ve been good” | Rewards that harm you aren’t rewards |

Write rebuttals to your favorite justifications. Read them when tempted.

Intervention Point 4: The Action

Add friction between urge and purchase.

Practical barriers:

- Remove saved payment information from websites

- Carry only cash for discretionary spending

- Require sleeping on all purchases over $25

- Make shopping inconvenient (delete apps, unsubscribe)

- Use accountability (tell someone before buying)

The purchase pause: Before completing any non-essential purchase:

- Leave the store or close the website

- Wait 24-48 hours

- If you still want it, return and buy

Building New Patterns

Track your progress

Watch your daily spending improve as new patterns form.

Breaking a cycle requires replacing it, not just stopping it.

Alternative Activities List

When the urge hits, what else could you do?

Create a menu of alternatives:

- Call/text a friend

- Go for a walk

- Read something engaging

- Exercise

- Create something

- Organize a space

- Journal

- Watch something comforting

The alternative should address the underlying need the shopping was meeting.

The “Future Self” Practice

Before purchases, vividly imagine your future self:

- Tomorrow morning, looking at your bank account

- Next week, when the item is no longer new

- At month’s end, reviewing your spending

Would that person be grateful or regretful?

Building Identity

“I’m someone who struggles with shopping” is different from “I’m someone building healthier money habits.”

Identity statements that help:

- “I spend intentionally”

- “I find joy in things other than buying”

- “I’m building financial freedom”

- “I make choices my future self will appreciate”

Repeat these, act on them, and gradually they become true.

Handling Slips Without Spiraling

You will slip. Everyone does. What matters is the response.

The Slip Response Protocol

- Notice without judgment: “I overspent. That happened.”

- Get curious: What triggered it? What was I really seeking?

- Return if possible: Reverse the damage if you can

- Learn: What intervention failed? What could work better?

- Recommit: One slip doesn’t erase progress

- Continue: The cycle breaks through persistence, not perfection

What Not to Do After a Slip

- Don’t spiral into shame (“I’m hopeless, why try”)

- Don’t restrict severely (“I won’t spend ANYTHING for a month”)

- Don’t ignore it (“Pretend it didn’t happen”)

- Don’t give up (“I knew this wouldn’t work”)

These responses either restart the cycle or set you up for future failure.

The “Data Not Drama” Approach

Treat slips as information, not identity:

- “That tells me I’m more vulnerable when I’m tired”

- “Interesting—sales emails still trigger me”

- “I need better alternatives when I’m bored”

Curiosity works better than criticism.

The Support System

Breaking entrenched patterns rarely works alone.

Finding Accountability

- Spending buddy: Someone you tell before non-essential purchases

- Check-in partner: Weekly conversation about money progress

- Support group: Online communities like Debtors Anonymous or r/shoppingaddiction

- Therapist/counselor: For patterns rooted in deeper issues

When to Seek Professional Help

Consider professional support if:

- Spending has created serious debt

- You hide purchases from loved ones

- Spending affects relationships or work

- You feel unable to stop despite consequences

- Underlying anxiety, depression, or trauma may be factors

Financial therapists specifically address the emotional and behavioral aspects of money issues.

The Long Game

Real pattern change takes time—typically 3-6 months of consistent effort for significant improvement. Here’s what to expect:

| Phase | Focus | What to Expect |

|---|---|---|

| Month 1 | Awareness | Identifying triggers and patterns. Building initial interventions. High difficulty, frequent urges. |

| Month 2 | Experimentation | Finding what works. Adjusting strategies. Some success, some slips. |

| Month 3 | Habit Formation | New behaviors becoming more automatic. Reduced frequency of strong urges. Growing confidence. |

| Months 4-6 | Consolidation | Handling triggers more easily. Identity beginning to shift. Occasional challenges but stronger recovery. |

| Beyond | Maintenance | Continued vigilance. Some situations may always require attention. New default patterns established. |

Measuring Progress

Track improvements beyond just “did I overspend”:

| Metric | What to Track |

|---|---|

| Urge-to-action ratio | How often do urges lead to purchases vs. being surfed through? |

| Recovery speed | When you slip, how quickly do you get back on track? |

| Trigger reduction | Are you encountering fewer triggers due to environmental changes? |

| Emotional regulation | Are you developing other coping methods? |

| Financial metrics | Is overall spending trending down? Savings trending up? |

Progress isn’t linear, but the overall trend should improve.

A Note on Compassion

The shame-and-willpower approach doesn’t work for behavioral change. Research consistently shows that self-compassion leads to better outcomes than self-criticism.

This isn’t letting yourself off the hook. It’s recognizing that:

- You developed this pattern for reasons

- The pattern served a purpose (even if unhealthy)

- Change is possible but takes time

- You deserve to break this cycle

Be the kind, firm friend to yourself that you would be to someone you love struggling with the same issue.

Your Starting Point

Choose one intervention from each category:

| Category | Pick One |

|---|---|

| Trigger reduction | Unsubscribe from marketing emails |

| Delete one shopping app | |

| Avoid one store for two weeks | |

| Urge management | Practice the HALT check |

| Try urge surfing once | |

| Implement 48-hour rule | |

| Permission interruption | Write counter-scripts to your top 3 justifications |

| Post a note where you’ll see it before purchasing | |

| Action barriers | Remove saved payment info from one site |

| Set up spending accountability with someone |

Start with these four interventions for two weeks. Then evaluate and adjust.

The cycle can be broken. Not through perfect willpower, but through understanding, systems, and self-compassion applied consistently over time.

When you’re ready to track daily spending, BUDGT provides gentle accountability. See what you can spend today, in real-time, with color feedback that helps you make conscious choices.

Frequently Asked Questions

How long does it take to break an overspending habit?

Significant improvement typically takes 3-6 months of consistent effort. The first month is hardest as you build awareness and initial interventions. By month three, new patterns begin feeling more natural. Complete change may take longer, and some situations may always require extra attention. Progress isn't linear, but the overall trend should improve.

Why do I keep overspending even when I know better?

Overspending often serves emotional needs (stress relief, boredom cure, mood boost) that feel urgent in the moment. The brain's reward system releases dopamine during shopping, creating powerful urges that override logical thinking. Additionally, deeply ingrained habits can run on autopilot before conscious thought intervenes. Understanding this isn't an excuse—it's information for building better interventions.

What should I do immediately after overspending?

First, don't spiral into shame—self-criticism often leads to more overspending. Return items if possible. Get curious about what triggered the purchase without judgment. Journal about what you were feeling and seeking. Learn what intervention failed. Recommit to your goals and continue forward. One slip doesn't erase progress.

Is overspending a sign of a deeper problem?

It can be. Compulsive spending sometimes masks underlying issues like anxiety, depression, trauma responses, or unmet emotional needs. If you've tried multiple strategies without success, or if spending patterns feel truly out of control, consider working with a therapist who specializes in behavioral issues or financial therapy.

How do I stop making excuses to buy things?

Notice and name your permission stories ("I deserve this," "It's on sale"). Write counter-scripts and read them when tempted. Example: "I deserve this" becomes "I deserve financial peace and freedom from this cycle more than I deserve this item." Post your counter-scripts where you'll see them before shopping. Awareness of the permission phase helps interrupt it.

Should I cut myself off from shopping completely?

Extreme restriction often backfires, leading to binge spending. Instead, create structural limits (removing temptation, adding friction) while allowing some intentional spending within boundaries. The goal is conscious, aligned spending—not deprivation. Some people benefit from a brief "spending fast" to reset, but this should be time-limited.

How do I handle online shopping temptation?

Delete shopping apps from your phone. Unsubscribe from all retail marketing emails. Remove saved payment information from websites. Use website blockers during high-temptation times. Make wishlists instead of carts—you can always buy later if you still want items after waiting. The goal is adding friction between urge and purchase.

Can I recover from overspending without telling anyone?

While recovery is possible alone, accountability significantly improves outcomes. You don't need to share everything—even having one person who knows you're working on spending patterns provides external motivation. Consider a spending buddy, therapist, or online support community. Secrecy often enables compulsive behavior.

What's the difference between normal shopping and compulsive shopping?

Normal shopping meets actual needs, is generally planned, and doesn't create significant guilt or financial problems. Compulsive shopping often serves emotional purposes, feels out of control, continues despite negative consequences, and involves preoccupation with buying. The distinction is about frequency, control, and consequences—not about being perfect.

How do I resist sales and deal pressure?

Remember that a sale on something you don't need costs money, not saves it. Unsubscribe from deal alerts. When tempted by sales, apply the 48-hour rule—if you still want it after waiting, consider it. Ask yourself if you would buy it at full price; if not, you don't really want it. Create a "deal" counter-script: "A discount doesn't make something free."

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS