Why Am I a Shopaholic? Understanding Your Spending Triggers

Why Am I a Shopaholic? Understanding Your Spending Triggers

You promise yourself you won’t. Then you do. Again.

Whether it’s late-night scrolling that ends with a full cart, retail therapy after a bad day, or the rush of finding a “deal” you didn’t need—you know the pattern. And you’re tired of it.

The question “Why am I like this?” isn’t just rhetorical. Understanding why you overspend is the first step toward changing the pattern. This isn’t about judgment or shame. It’s about curiosity—treating your spending habits as a puzzle to solve rather than a character flaw to punish.

The Psychology of Compulsive Shopping

Compulsive shopping isn’t about willpower failure. It’s about brain chemistry, emotional needs, and behavioral patterns—most of which developed long before you understood what was happening.

The Dopamine Connection

Shopping triggers dopamine release—the same neurotransmitter involved in all pleasurable activities. Here’s the catch: the biggest dopamine hit comes from anticipation, not the purchase itself.

The cycle:

- Browse/hunt for items → dopamine rises

- Add to cart / find the “perfect” thing → dopamine peaks

- Purchase → brief satisfaction

- Item arrives → often disappointment (“buyer’s remorse”)

- Repeat to chase the feeling

This is why window shopping can feel almost as good as buying—and why the actual possession rarely lives up to the hunt.

Emotional Regulation

Shopping often serves as emotional management:

- Boredom: Shopping provides stimulation and novelty

- Stress: Retail therapy offers escape and control

- Sadness: New things promise temporary happiness

- Anxiety: Buying creates illusion of preparedness

- Loneliness: Online shopping fills time, creates connection to something

- Celebration: Purchases mark achievements or milestones

The problem isn’t using shopping to manage emotions occasionally—it’s when shopping becomes your primary coping mechanism.

Create a natural pause before purchases

When you see your daily spending limit in BUDGT, it creates that moment of awareness between impulse and action.

Identity and Self-Worth

Some overspending connects to deeper identity questions:

- “This dress is who I want to be”

- “This gadget shows I’m successful”

- “This gift proves I’m a good friend/parent/partner”

- “These home items create the life I deserve”

When self-worth gets tangled with possessions, shopping becomes about proving something—to yourself or others.

Common Spending Triggers

Understanding your specific triggers helps you anticipate and address them. See which resonate:

Emotional Triggers

Stress shopping: Using purchases to feel in control when life feels chaotic. Often happens after difficult work days, family conflicts, or unexpected problems.

Reward shopping: “I deserve this” after accomplishing something (or just surviving something hard). The purchase becomes the treat.

Sadness shopping: Trying to buy your way to a better mood. Particularly common during seasonal depression, breakups, or grief.

Anxiety shopping: Buying things to prepare for imagined scenarios. “What if I need this?” justifies purchases that rarely get used.

Environmental Triggers

Sales and “deals”: The fear of missing out overrides the question of whether you actually need the item. Limited-time offers create artificial urgency.

Social media: Influencer culture, targeted ads, and the constant stream of other people’s purchases normalize overconsumption.

Physical stores: The sensory experience—lighting, music, smells—is designed to trigger buying. You didn’t come for candles, but here you are.

Boredom browsing: Shopping as entertainment. Scrolling Amazon or wandering Target with no specific purpose.

Social Triggers

Keeping up: Buying to match peers’ lifestyles. The house, the car, the vacations, the kids’ activities.

People-pleasing: Overspending on gifts or picking up checks to be liked or avoid conflict.

Social events: Needing new outfits for every occasion. Wedding season can be financially devastating.

Life Transition Triggers

New identity: New job, new relationship, new home—each brings the urge to “upgrade” everything to match.

Breakups/divorce: Retail therapy peaks during relationship transitions. Buying becomes reclaiming independence.

New parenthood: The baby industry is designed to make parents feel like they’re failing if they don’t buy everything.

The Spending Trigger Assessment

Answer honestly:

-

When did you last make an unplanned purchase over $50? What were you feeling beforehand?

-

Where do most impulse purchases happen? (Specific store, online retailer, or situation?)

-

What time of day do you tend to overspend? (Evening? Weekend? Lunch breaks?)

-

What emotions most often precede shopping? (Stress, boredom, sadness, excitement?)

-

Who or what influences your purchases? (Social media, friends, family, marketing?)

Your answers reveal patterns. Same emotion, same retailer, same time of day—these patterns are targetable.

Why Knowing Your Triggers Matters

Awareness alone changes behavior. Studies show that simply naming an emotion reduces its intensity. When you can say “I’m stress shopping because of that meeting,” you’ve created a pause between trigger and behavior.

Without awareness: Stress → Autopilot shopping → Regret → More stress → More shopping

With awareness: Stress → “I notice I want to shop” → Conscious choice → Different coping strategy OR intentional purchase

The goal isn’t to eliminate shopping. It’s to make purchases conscious choices rather than automatic reactions.

Addressing Different Trigger Types

For Emotional Triggers

Build an alternatives menu. When the shopping urge hits, what else could address the underlying need?

| Emotion | Shopping provides | Alternative |

|---|---|---|

| Stress | Control, escape | Walk, bath, call friend |

| Boredom | Stimulation | Book, hobby, organizing |

| Sadness | Momentary lift | Movement, music, journaling |

| Anxiety | Preparedness feeling | List-making, actual preparation |

| Loneliness | Connection to something | Text someone, join community |

Post this list somewhere visible. The key is having alternatives ready before the urge hits.

For Environmental Triggers

Reduce exposure. You can’t be tempted by what you don’t see:

- Unsubscribe from retail emails

- Unfollow shopping-focused accounts

- Delete shopping apps

- Avoid stores unless you have a specific purpose

- Use website blockers during high-temptation times

Create friction. Make impulse buying harder:

- Remove saved payment information

- Implement a 24-48 hour waiting period

- Require writing down every purchase before making it

For Social Triggers

Examine the pressure. Ask: Whose expectations am I trying to meet? Are these expectations real or assumed?

Find your enough. What would actually satisfy your needs versus what you’re told you should want?

Build community around different values. Surround yourself with people who value experiences, relationships, and contentment over consumption.

The Deeper Work

For some people, overspending connects to deeper patterns that require more than tips and tricks:

Childhood Money Messages

What did you learn about money growing up?

- “Money is for spending—you can’t take it with you”

- “We don’t have money for that” (scarcity creates later compensation)

- “Nice things show we’ve made it”

- “Buying things shows love”

These early messages shape adult behavior in ways you might not recognize.

Trauma Responses

Compulsive shopping can be a trauma response—a way to self-soothe, feel in control, or create comfort. If your spending feels truly out of control, consider working with a therapist who specializes in behavioral issues or financial therapy.

When to Seek Help

Consider professional support if:

- You hide purchases from family/partners

- Shopping has created serious debt or financial problems

- You feel unable to stop despite consequences

- Shopping is affecting relationships or work

- You feel deep shame about your spending

Compulsive buying disorder is a real condition that responds to treatment. There’s no shame in getting help.

Building New Patterns

Understanding triggers is step one. Building new responses is the ongoing work.

The Pause Practice

When you feel the urge to shop, pause and ask:

- What am I feeling right now?

- What am I actually looking for?

- Will this purchase address that need?

- How will I feel about this tomorrow?

This takes 30 seconds. It interrupts the automatic pattern.

The “Future Self” Check

Before purchasing, imagine your future self:

- In 24 hours: Will you still want this?

- In a week: Will you remember buying it?

- In a month: Will it improve your life?

- In a year: Will it matter?

Most impulse purchases fail these tests.

Track the Urges, Not Just Purchases

Keep a simple log:

- Date/time

- Trigger (emotion, situation)

- What you wanted to buy

- What you did instead (or if you bought it)

- How you felt afterward

Over time, patterns become obvious. You’ll see exactly when and why you overspend.

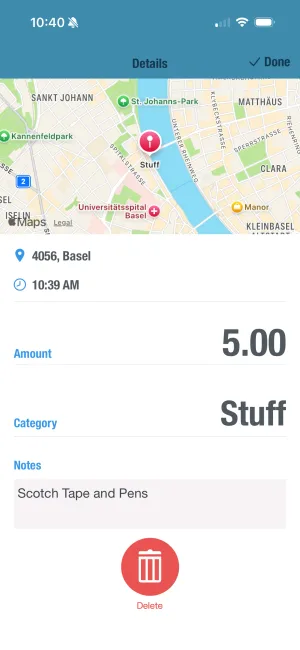

Add notes to every expense

Track your emotional state alongside purchases. BUDGT lets you add notes to each expense, making it easy to spot patterns.

Progress, Not Perfection

Changing spending patterns takes time. You will slip up. That’s not failure—it’s data.

When you overspend:

- Notice without judgment

- Get curious: What triggered this?

- Add to your understanding

- Adjust your strategy

- Keep going

The goal isn’t to never shop again. It’s to shop consciously, in alignment with your values and financial goals.

Your Next Step

Pick one trigger from this article that resonates most strongly. Just one. For the next week, pay attention when it shows up. Notice without trying to change anything yet.

Awareness is the foundation. Everything else builds from there.

See your progress at a glance

BUDGT's color-coded daily view shows when you're on track (blue), getting close (yellow), or need to slow down (orange)—visual feedback that supports awareness.

Frequently Asked Questions

Is being a shopaholic a real condition?

Yes. Compulsive buying disorder (CBD) is recognized by mental health professionals as a behavioral addiction. It shares characteristics with other impulse control disorders: preoccupation with shopping, loss of control over purchasing, continuing despite negative consequences, and using shopping to manage emotions. While not everyone who overspends has CBD, the condition is real and treatable.

What's the difference between retail therapy and shopping addiction?

Occasional retail therapy—buying something to lift your mood—is normal and generally harmless. Shopping addiction involves frequent, compulsive purchases that create financial problems, emotional distress, or relationship issues. Key differences include frequency (occasional vs. regular), control (can stop vs. cannot), and consequences (manageable vs. significant problems).

Why do I keep shopping even when I know I shouldn't?

Shopping activates the brain's reward system, releasing dopamine before and during purchases. This neurological response is powerful and can override logical thinking. Additionally, shopping often meets emotional needs (stress relief, boredom cure, mood boost) that feel urgent in the moment. Breaking the pattern requires addressing both the brain chemistry and the underlying needs.

Can shopping addiction be cured?

Yes, though "managed" may be more accurate than "cured." Like other behavioral patterns, compulsive shopping can be changed through awareness, new coping strategies, environmental modifications, and sometimes professional help. Most people see significant improvement within 3-6 months of focused effort. The urge may still appear occasionally, but you can develop the tools to handle it.

Why do sales and deals make me buy things I don't need?

Sales trigger fear of missing out (FOMO) and create artificial urgency. The brain processes "saving money" as a gain, even when you're spending money on something unnecessary. Retailers design promotions to bypass rational thinking. Recognizing this manipulation is the first step—that "limited time offer" is a psychological trick, not a genuine opportunity.

How do I tell if I'm an emotional shopper?

Signs of emotional shopping include: buying most after stressful or emotional events, shopping to change your mood, feeling temporary relief followed by guilt, difficulty identifying why you bought certain items, and patterns of buying during specific emotional states (sad, bored, anxious, celebrating). Tracking purchases alongside your emotional state reveals patterns.

Is overspending genetic or learned behavior?

Both factors contribute. Studies show some genetic predisposition to impulse control and reward-seeking behaviors. However, learned patterns from childhood—how your family handled money and emotions—play an equal or larger role. The good news: learned behaviors can be unlearned regardless of genetic factors.

How long does it take to break a shopping habit?

Significant improvement typically takes 2-3 months of consistent effort. Breaking automatic patterns requires repetition—about 66 days on average to form new habits. The first two weeks are hardest as you resist established patterns. After that, new coping strategies begin to feel more natural. Complete change may take 6-12 months.

What should I do right after an unplanned purchase?

Return it if possible—this reinforces the message that impulse purchases aren't final. If you can't return it, journal about the trigger and feelings involved without judgment. Ask what need you were trying to meet and how you might meet it differently next time. Don't spiral into guilt; treat it as data for understanding your patterns.

Should I tell someone about my shopping problem?

Sharing with a trusted person often helps. Accountability reduces the secrecy that can enable compulsive behavior. Choose someone non-judgmental who can check in supportively. You don't need to share financial details—just having someone who knows you're working on spending patterns provides external motivation and support.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS