Budgeting with Irregular Income

Create stability when your paycheck isn't predictable.

Whether you're a server, salesperson, contractor, or seasonal worker, irregular income requires a different budgeting approach. This guide helps you smooth out the ups and downs.

Budget Priorities for Irregular Income

Buffer Fund

2-3 months of baseline expenses in checking

Baseline Expenses

Know your absolute minimum monthly needs

Variable Spending Cap

Limit lifestyle spending to prevent overspending

Emergency Fund

Separate from buffer, for true emergencies only

Calculate Your Daily Budget

Enter your income and expenses to find your daily spending limit. We recommend saving at least 20% for your situation.

Income

$0Fixed Expenses

-$0Savings Goal

$0/monthHow much of your remaining income do you want to save?

10% of remaining income

Monthly Budget

Your Daily Budget

That's $0 ÷ 31 days = $0.00/day

Money Tips for Irregular Income

Base your budget on your lowest expected monthly income

Calculate your "baseline" — minimum needed to survive each month

In good months, fund your buffer account before lifestyle spending

Maintain a 2-3 month buffer in checking for expense smoothing

Prioritize bills by due date and consequence of late payment

Automate savings transfers on payday (before you spend)

Track income by source to identify your most reliable streams

Review and adjust your baseline budget quarterly

Common Challenges

- Never knowing exactly what next month's income will be

- Temptation to spend more in high-income months

- Difficulty planning for large expenses or goals

- Stress and anxiety around money unpredictability

- Maintaining discipline during both high and low periods

Frequently Asked Questions

How do I create a budget as a irregular income?

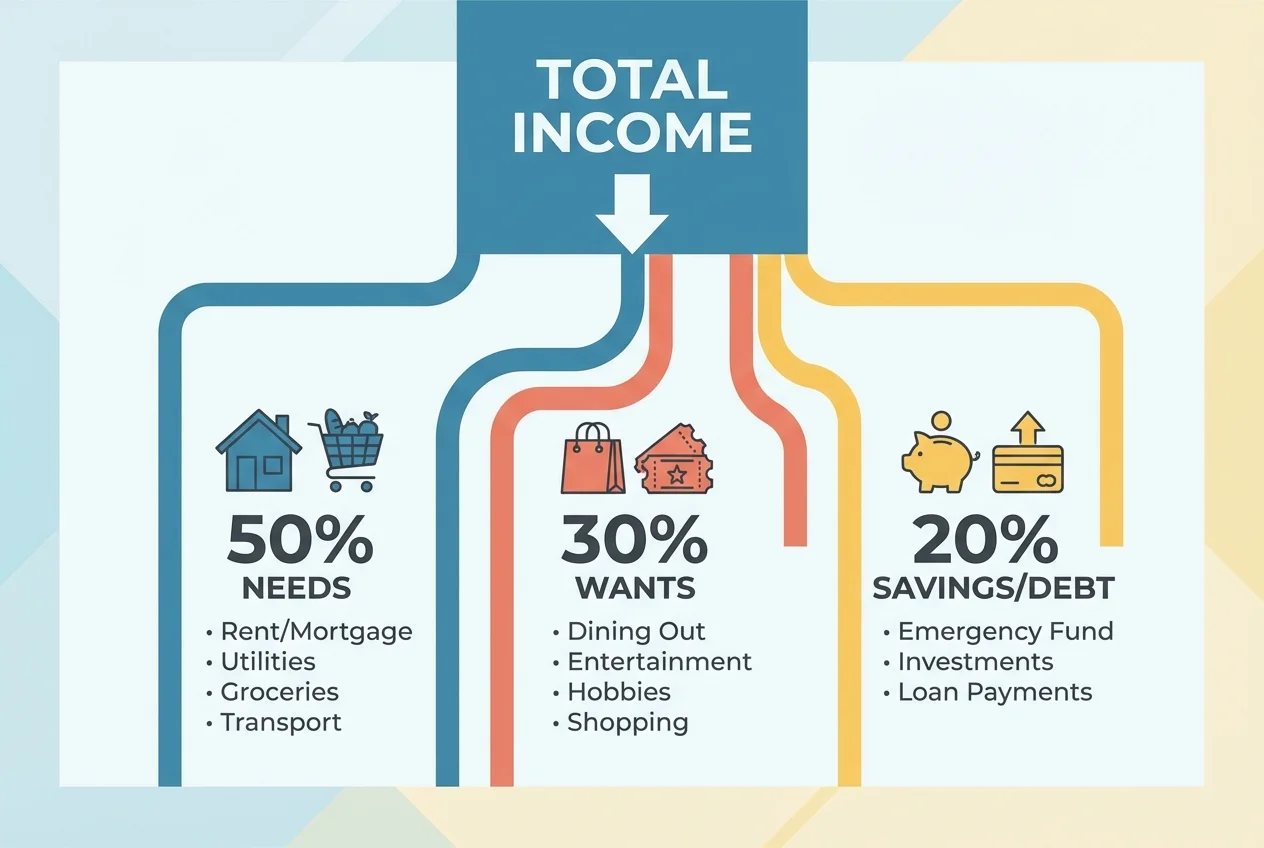

Start by listing all income sources, then categorize expenses into needs and wants. For irregular income, prioritize essentials buffer, debt payments, savings. Use the calculator above to find your daily spending limit after essential expenses.

What percentage should I save?

For irregular income, a savings rate of 20% is recommended. Adjust based on your specific circumstances — even small amounts help build financial security over time.

Does this calculator need to connect to my bank?

No. This calculator is 100% private — no bank connection, no account creation, no data collection. Everything stays in your browser and is never sent anywhere.

Helpful Budgeting Articles

Simple Budget Tracking Without Spreadsheets or Stress

Discover budget tracking methods that don't require spreadsheets, complex apps, or hours of your time

Single Mom Budget Guide: How to Make Every Dollar Count in 2026

The complete single mom budget guide for 2026. Realistic budgeting strategies, money-saving tips, and financial advice that works with your actual life—not some idealized version.

The 50/30/20 Rule: The Simplest Budget That Works

The 50/30/20 budget rule divides your after-tax income into three simple categories: needs, wants, and savings. Learn how this flexible framework can work for any income level.

Track Your Budget Anywhere

Download BUDGT to manage your daily spending on the go — even offline.

Download for iOS