Am I a Shopaholic? 10 Signs of Shopping Addiction + How to Stop

Have you ever asked yourself: “Am I a shopaholic?”

If you find yourself constantly adding items to your cart, buying things you don’t need, or struggling to stick to a budget, you might be dealing with more than the occasional splurge. The fact that you’re asking the question is actually a good sign—it means you’re developing awareness, which is the first step toward change.

A shopaholic is someone who struggles with compulsive shopping—buying as a way to cope with emotions, fill a void, or chase a temporary high. It leads to overspending, financial stress, and guilt. But here’s the good news: shopping addiction is not permanent. With awareness and the right strategies, you can take back control.

Shopaholic vs. Occasional Splurge: What’s the Difference?

Not every shopping spree makes you a shopaholic. Treating yourself to a new outfit or gadget every once in a while is normal—especially if it’s planned and budgeted.

The difference is in the control and consequences:

| Healthy Shopping | Compulsive Shopping |

|---|---|

| Planned and budgeted | Impulsive and unplanned |

| Brings lasting satisfaction | Followed by guilt or regret |

| You can take it or leave it | Feels like you can’t stop |

| Transparent (no hiding) | Hidden from others |

| Within your financial means | Causes financial stress |

| Occasional treats | Frequent, regular pattern |

If you’re unsure which category you fall into, the self-assessment below will help clarify.

Self-Assessment: Are You a Shopaholic?

Answer honestly. For each statement, score yourself:

- 0 = Never/Rarely

- 1 = Sometimes

- 2 = Often

- 3 = Almost Always

| Question | Score (0-3) |

|---|---|

| 1. I buy things I don’t need or won’t use | __ |

| 2. I shop to feel better when stressed, sad, or bored | __ |

| 3. I hide purchases or lie about how much I spent | __ |

| 4. I feel a “high” or rush when buying something new | __ |

| 5. I feel guilt or regret after shopping | __ |

| 6. I have items with tags still on that I’ve never used | __ |

| 7. I think about shopping when I should be doing other things | __ |

| 8. I’ve argued with family/friends about my spending | __ |

| 9. I’ve missed bills or savings goals due to shopping | __ |

| 10. I feel anxious or irritable when I can’t shop | __ |

Scoring Your Results

| Total Score | What It Suggests |

|---|---|

| 0-7 | Healthy shopping habits. Stay mindful! |

| 8-14 | Yellow flag. Some compulsive tendencies worth watching. |

| 15-21 | Orange flag. Shopping is affecting your life. Take action. |

| 22-30 | Red flag. Compulsive shopping is a serious problem. Consider professional help. |

This isn’t a clinical diagnosis, but it can help you understand your relationship with shopping.

The 10 Warning Signs of a Shopaholic

If several of these sound familiar, it may be time to re-evaluate your habits.

1. Constant Impulse Buying

You rarely stick to your shopping list. You went for milk and came home with $150 worth of stuff. Online, you buy from ads without thinking.

| Red Flag | What It Looks Like |

|---|---|

| Cart abandonment… then return | Items sit in cart, but you keep going back |

| ”I deserve this” purchases | Frequent self-justification |

| Surprise deliveries | Forgot you even ordered something |

2. Emotional Spending

You shop to cope with feelings—stress, boredom, sadness, even celebration. Shopping becomes your go-to emotional regulation tool.

| Emotion | Shopping Response |

|---|---|

| Stressed | ”Retail therapy” after hard day |

| Bored | Browsing apps to pass time |

| Sad | Buying something to cheer up |

| Anxious | Shopping to feel in control |

| Celebrating | Must buy something to mark occasion |

3. Hiding Purchases

You feel the need to conceal shopping bags, intercept packages, or minimize what you spent. If asked “How much was that?”, you instinctively low-ball.

4. Credit Card Dependency

You rely on credit to fund your shopping. Minimum payments are your friend. You might have multiple cards to spread the damage.

| Warning Sign | Reality |

|---|---|

| ”I’ll pay it off next month” | You said that last month too |

| Opening new cards for rewards | Actually just enabling more spending |

| Only paying minimums | Debt is growing, not shrinking |

5. Closet Full of Unused Items

You own clothes, gadgets, or décor that still have tags—never worn or used. Yet you still feel like you “have nothing.”

| What You Have | What You Feel |

|---|---|

| Full closet | ”Nothing to wear” |

| Dozens of unused items | Still browsing for more |

| Tags still attached | Plans to “wear it someday” |

See your spending patterns at a glance

BUDGT's color system shows you exactly where you stand. Blue means you're safe, yellow means be careful, orange means slow down. This visual feedback builds awareness and helps break compulsive habits.

6. Chasing the Shopping High

You crave the rush of buying something new—the anticipation, the purchase, the unboxing. The item itself matters less than the feeling.

| Stage | The High |

|---|---|

| Browsing | Excitement building |

| Adding to cart | Anticipation |

| Buying | Dopamine spike |

| Receiving | Brief satisfaction |

| 1 hour later | High fades, need more |

7. Regret and Guilt After Shopping

You feel bad about overspending—but still can’t stop the cycle. The guilt feeds more negative emotions, which leads to more shopping.

| The Cycle | What Happens |

|---|---|

| 1. Negative emotion | Stress, boredom, guilt |

| 2. Shopping | Temporary relief, dopamine hit |

| 3. Regret | ”Why did I buy that?“ |

| 4. More negative emotion | Guilt adds to stress |

| 5. More shopping | To escape the bad feelings |

8. Ignoring Essential Bills

You prioritize shopping over rent, savings, or utility payments. “I can pay that late” becomes a regular thought.

9. Defensiveness About Spending

You get upset when someone questions your shopping habits. You rationalize, justify, or attack back.

| What They Say | What You Think |

|---|---|

| ”That’s expensive" | "It’s my money!" |

| "Do you need that?" | "You don’t understand" |

| "How much did you spend?" | "None of your business” |

10. Loss of Control

You feel powerless to stop, even when you know you’re overspending. You promise yourself “no more shopping” and break the promise within days.

The Psychology Behind Shopping Addiction

Understanding why you shop compulsively is key to stopping. It’s not about willpower—it’s about brain chemistry and coping mechanisms.

The Dopamine Connection

Shopping triggers dopamine—the brain’s “reward” chemical. This creates:

| Phase | Brain Response |

|---|---|

| Anticipation | Dopamine rises (excitement) |

| Purchase | Dopamine spikes (reward) |

| Post-purchase | Dopamine drops (crash) |

| Craving | Brain wants another hit |

Why Willpower Doesn’t Work

You can’t just “decide” to stop. The dopamine system is powerful. That’s why strategies focus on changing environments and building awareness—not relying on willpower alone.

Common Root Causes

| Cause | How It Leads to Shopping |

|---|---|

| Low self-esteem | Buying things to feel worthy |

| Anxiety | Shopping provides sense of control |

| Depression | Temporary mood boost |

| Childhood experiences | Learning that buying = love/reward |

| Social media | Constant exposure to what others have |

| Easy credit | Removes natural spending friction |

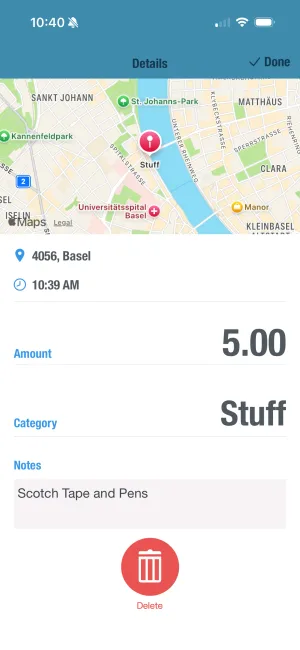

Track emotional spending patterns

BUDGT lets you add notes to every expense. Use this to track how you felt before buying. Over time, you'll see which emotions trigger spending—and can address them directly.

How to Stop Being a Shopaholic: The Recovery Process

Recovery isn’t about never shopping again—it’s about shopping mindfully. Here’s a proven process:

Admit the Problem

Acknowledge that shopping has become compulsive. This isn't about shame—it's about honesty. You can't fix what you won't face.

Identify Your Triggers

Track when you shop and how you feel. Stress? Boredom? Social media? Knowing your triggers lets you prepare for them.

Remove Easy Access

Delete shopping apps, unsubscribe from marketing emails, remove saved credit cards. Add friction between impulse and purchase.

Find Replacement Activities

When the urge hits, have alternatives ready. Walk, call a friend, exercise, or journal. Healthy dopamine sources replace unhealthy ones.

Track Every Purchase

Log all spending in BUDGT. The act of tracking creates pause and awareness. You'll think twice before buying.

Build New Habits

Replace shopping time with other activities. The goal is 30+ days of consistent new behavior to rewire habits.

Practical Strategies That Work

The 30-Day Rule

For any non-essential purchase over $50, wait 30 days. Write it down, date it, and revisit.

| What Happens | Result |

|---|---|

| Strong desire fades | Most items forgotten |

| Still want it after 30 days | Likely a real want (buy it) |

| Realize you don’t need it | Money saved |

| Impulse broken | Pattern interrupted |

The Cash Diet

For problem categories (clothes, electronics, etc.), switch to cash only.

| Why It Works | The Effect |

|---|---|

| Physical money feels more real | Harder to overspend |

| When it’s gone, it’s gone | Natural limit |

| No credit card buffer | Forces decisions |

The Unfollow/Unsubscribe Cleanse

| Action | Impact |

|---|---|

| Unfollow brands on social media | Remove visual triggers |

| Unsubscribe from marketing emails | Stop “sale” temptations |

| Delete shopping apps | Add friction |

| Block shopping sites | Prevent mindless browsing |

The Accountability Partner

Tell someone you trust about your goal. Share your BUDGT data weekly. External accountability dramatically increases success rates.

Build better habits with daily reminders

Set gentle reminders to log your expenses. Consistent tracking builds awareness and helps you catch impulse purchases before they become patterns.

Building a Healthy Relationship with Shopping

Recovery doesn’t mean never buying anything. It means shopping intentionally.

The Mindful Shopping Checklist

Before any purchase, ask:

| Question | If No… |

|---|---|

| Do I need this? | Don’t buy |

| Can I afford this without credit? | Don’t buy |

| Will I use/wear this regularly? | Don’t buy |

| Is this in my budget? | Don’t buy |

| Would I buy this if I had to pay cash? | Don’t buy |

| Will I still want this in 30 days? | Wait and see |

Planned Treats vs. Impulse Buys

| Planned Treat | Impulse Buy |

|---|---|

| Budgeted in advance | No budget consideration |

| Specific item in mind | ”Just browsing” |

| Brings lasting satisfaction | Guilt follows |

| You remember buying it | Often forgotten |

| Feels like a choice | Feels compulsive |

Build treats into your budget. When you plan for them, they become choices rather than compulsions.

When to Seek Professional Help

Self-help strategies work for many people, but sometimes professional support is needed.

| Seek Help If… | Why |

|---|---|

| Shopping has caused serious debt | Financial counseling needed |

| Relationships are suffering | Pattern may be deeper |

| You feel depressed or anxious | Underlying issues to address |

| You’ve tried self-help without success | Professional strategies may help |

| Shopping is your only coping mechanism | Need to build healthy alternatives |

Options include:

- Financial counselors

- Cognitive behavioral therapists (CBT)

- Debtors Anonymous or spending support groups

- Online therapy platforms

Your First Week Recovery Plan

| Day | Action | Time |

|---|---|---|

| Day 1 | Complete self-assessment above | 10 min |

| Day 2 | Download BUDGT, set up budget | 15 min |

| Day 3 | Unsubscribe from 5 marketing emails | 10 min |

| Day 4 | Delete 1 shopping app | 2 min |

| Day 5 | Track all purchases today | Ongoing |

| Day 6 | Identify 2 alternative activities | 10 min |

| Day 7 | Review your week, plan the next | 20 min |

See exactly where you stand

BUDGT's daily budget shows what's safe to spend. This simple number helps recovering shopaholics make intentional choices rather than impulsive purchases.

What Recovery Looks Like

Recovery isn’t perfection—it’s progress. Here’s what to expect:

| Timeline | What Happens |

|---|---|

| Week 1-2 | Awareness increases, urges still strong |

| Week 3-4 | Triggers become clearer, some wins |

| Month 2 | New habits forming, fewer impulses |

| Month 3 | Shopping feels different, more intentional |

| Month 6+ | Mindful shopping becomes natural |

Signs You’re Making Progress

| Progress Sign | What It Means |

|---|---|

| You notice urges before acting | Awareness is growing |

| You successfully delay purchases | Control is building |

| Guilt decreases | Healthy relationship developing |

| Budget is working | Financial stress reducing |

| You enjoy what you buy | Quality over quantity |

From Shopaholic to Smart Spender

If you’re asking yourself “Am I a shopaholic?”, you’re already taking the first step toward change. Awareness is the foundation of recovery.

The next steps are building accountability and replacing old patterns with new habits. That’s where tracking every purchase becomes powerful. When you see where your money goes, when you have to log each expense, the compulsive spell breaks. You start making choices instead of reacting to urges.

You don’t need to give up shopping—you need to take back control. And control starts with awareness.

One day, one purchase, one mindful choice at a time.

Frequently Asked Questions

What does it mean to be a shopaholic?

A shopaholic is someone who struggles with compulsive shopping—buying things they don't need, can't afford, or won't use, often as a way to cope with emotions. It's not about enjoying shopping occasionally; it's about feeling unable to stop despite negative consequences.

How do I know if I'm a shopaholic or just someone who likes shopping?

The key difference is control and consequences. Normal shopping is planned, budgeted, and brings lasting satisfaction. Shopaholic behavior involves impulse buying, hiding purchases, feeling guilt afterward, and continuing despite financial problems. If shopping causes more stress than joy, that's a warning sign.

Is shopping addiction a real thing?

Yes. While not officially classified as a distinct disorder, compulsive buying disorder is recognized by mental health professionals. It shares characteristics with other behavioral addictions, including the dopamine rush, tolerance (needing more to feel satisfied), and withdrawal symptoms (anxiety when not shopping).

What triggers shopaholic behavior?

Common triggers include emotional stress (shopping to feel better), boredom, social pressure (keeping up with others), marketing and sales, low self-esteem (buying to feel worthy), and the dopamine rush from acquiring new things. Identifying your personal triggers is the first step to managing them.

Can shopaholics recover without professional help?

Many people successfully manage compulsive shopping through self-awareness, tracking spending, building new habits, and support from friends or online communities. However, if shopping has led to serious debt, relationship problems, or depression, professional help from a therapist or financial counselor is recommended.

How can tracking expenses help with shopping addiction?

Tracking creates visibility and accountability. When you log every purchase in an app like BUDGT, you see exactly where money goes. This awareness often naturally reduces impulse buying because you think twice before spending. The data also reveals patterns—like spending more when stressed—that you can then address.

What's the difference between retail therapy and shopping addiction?

Retail therapy is occasional, controlled, and provides genuine stress relief without negative consequences. Shopping addiction is frequent, feels out of control, and leads to financial problems, guilt, and hidden behavior. One is a choice; the other feels compulsive.

How long does it take to stop being a shopaholic?

Recovery varies by person and severity. Many people see significant improvement within 3-6 months of consistent effort—tracking spending, avoiding triggers, and building new habits. The goal isn't perfection; it's progress. Most recovering shopaholics learn to shop mindfully rather than quitting shopping entirely.

Is it bad to treat myself if I'm recovering from shopping addiction?

No—treats are healthy when planned and budgeted. The key is intentionality. A recovering shopaholic who plans a $50 treat and enjoys it guilt-free is making progress. The problem is impulsive, unplanned spending that leads to regret. Build treats into your budget so they're choices, not compulsions.

Can BUDGT really help with shopping addiction?

Yes—BUDGT is designed for daily awareness, which is exactly what shopaholics need. The daily budget shows what's safe to spend, the color system provides instant feedback, and tracking every purchase builds mindfulness. Many users report that simply having to log purchases makes them pause before buying.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS