How to Be More Frugal in 2026: 7 Financial Habits Every Woman Should Adopt

As we step into 2026, many of us are setting intentions to live more intentionally with our money. Whether you’re a single mom stretching every dollar, a career woman building wealth, or someone simply passionate about mindful spending, frugal habits can transform your financial future.

Frugality isn’t about deprivation—it’s about intention. It’s spending on what truly matters while cutting waste on what doesn’t. Research shows that people who track spending save an average of $600 more per year than those who don’t, simply from increased awareness.

This guide covers 7 proven financial habits that build real savings without making you feel deprived.

Why Frugal Living Matters More in 2026

The economic landscape continues to shift. Understanding why frugality matters helps you stay motivated:

| Economic Reality | Frugal Response |

|---|---|

| Persistent inflation | Stretch each dollar further with intentional spending |

| High interest rates | Avoid debt, build cash reserves |

| Housing costs | Reduce variable expenses where you have control |

| Uncertain job market | Build emergency fund for security |

| Rising healthcare costs | Save more for unexpected expenses |

The math is simple: Every dollar you don’t waste is a dollar saved. Over a year, small frugal choices compound into significant savings.

The Frugal vs. Cheap Distinction

| Frugal Living | Being Cheap |

|---|---|

| Values quality that lasts | Buys cheapest option always |

| Spends intentionally on what matters | Avoids all spending |

| Prioritizes experiences over stuff | Misses experiences to save pennies |

| Generous with loved ones | Stingy with everyone |

| Sustainable long-term | Burns out quickly |

Frugality is a lifestyle choice. Being cheap is a limitation. The goal is mindful abundance, not deprivation.

Habit 1: Track Your Spending

Understanding where your money goes is the foundation of frugal living. Without tracking, you’re guessing—and research shows people underestimate their spending by 20-40%.

Why Tracking Works

| Without Tracking | With Tracking |

|---|---|

| ”I don’t know where my money went" | "I spent $340 on dining out” |

| Surprised at month end | Know exactly where you stand |

| Can’t identify leaks | Spot waste immediately |

| Reactive to problems | Proactive with solutions |

How to Start Tracking

Choose Your Tool

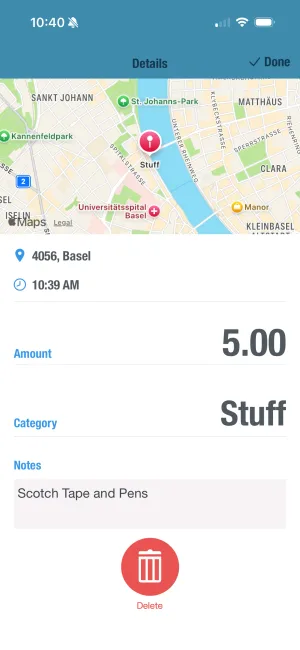

Use BUDGT for effortless daily tracking. It works 100% offline and shows you exactly what you can spend each day.

Track Everything for 2 Weeks

Log every purchase—coffee, parking, groceries, everything. Don't try to change behavior yet. Just observe.

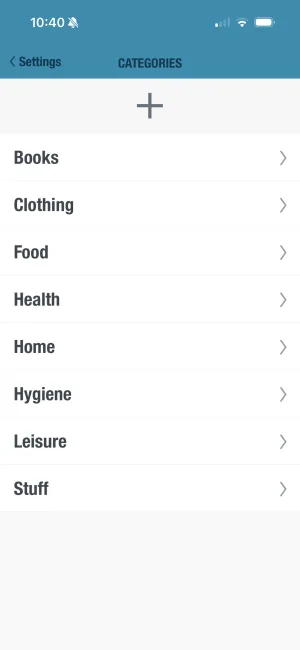

Categorize Your Spending

Group expenses into meaningful categories: food, transportation, entertainment, subscriptions, etc.

Identify Your Patterns

After 2 weeks, review categories. Where does most money go? What surprises you?

Find Your Easy Wins

Identify 2-3 categories where you can cut back without major lifestyle changes.

What to Track (And Why It Matters)

| Category | What to Include | Why Track It |

|---|---|---|

| Food | Groceries, dining out, coffee, snacks | Often 15-20% of budget; easy to reduce |

| Transportation | Gas, parking, ride shares, transit | Second biggest variable expense |

| Subscriptions | Streaming, memberships, apps | Often forgotten; easy to cancel |

| Shopping | Clothes, household, online orders | Impulse spending often hides here |

| Entertainment | Events, hobbies, leisure | Should align with what you value |

Track spending in seconds

BUDGT makes logging effortless—tap, enter amount, done. Your daily limit updates instantly so you always know where you stand.

Habit 2: Create a Realistic Budget

A budget isn’t a restriction—it’s permission to spend within limits you’ve set. The key is making it realistic enough to actually follow.

The 50/30/20 Framework

| Category | % of Income | Includes |

|---|---|---|

| Needs | 50% | Housing, utilities, groceries, transportation, insurance, minimum debt payments |

| Wants | 30% | Dining out, entertainment, hobbies, subscriptions, shopping |

| Savings | 20% | Emergency fund, retirement, debt payoff above minimums, goals |

Calculate Your Daily Spending Limit

Find Your Frugal Daily Budget

All income sources

Your biggest fixed cost

All travel costs

Health, life, other insurance

Required payments only

All recurring charges

Pay yourself first

Enter your numbers above - results update automatically

Note: This uses 30 days as an average month. Actual months vary from 28-31 days—BUDGT adjusts automatically based on the current month.

If 50/30/20 Doesn’t Work for You

| Your Situation | Adjusted Framework |

|---|---|

| High housing costs | 60/20/20 (reduce wants) |

| Aggressive debt payoff | 50/20/30 (more to savings/debt) |

| Low income | 70/20/10 (save what you can) |

| High income | 40/30/30 (boost savings) |

The percentages are guidelines, not rules. What matters is having a plan that works for your life.

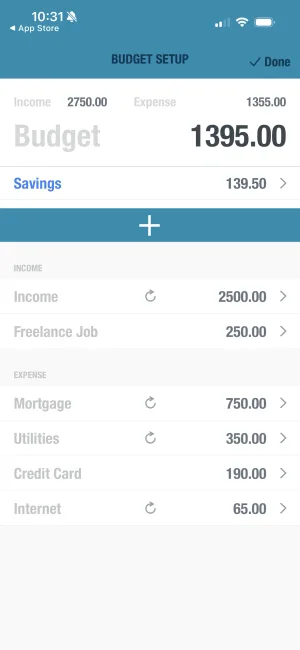

Set up your budget once

BUDGT takes your income and fixed expenses, then calculates exactly what you can spend each day. No spreadsheets, no complicated categories—just one clear number.

Habit 3: Plan Your Purchases

Impulse buying is the enemy of frugal living. Research shows the average American makes $450/month in impulse purchases. Planning ahead eliminates most of this waste.

The Impulse Spending Problem

| Trigger | Average Waste | Better Response |

|---|---|---|

| Online shopping boredom | $100-200/month | Remove saved cards, add friction |

| Store displays | $50-100/month | Stick to shopping list |

| Sales and “deals” | $75-150/month | Ask: would I buy at full price? |

| Emotional spending | $100+/month | Wait 24-48 hours |

| Social pressure | $50-100/month | Suggest free alternatives |

How to Plan Purchases

Make a Running List

Keep a note of things you need. Only buy from the list, never on impulse.

Research Before You Shop

Compare prices, read reviews, identify the best value—not just the lowest price.

Set a Monthly Cap

Decide how much you can spend on discretionary purchases. When it's gone, it's gone.

Wait Before Buying

For anything over $50, wait 24-48 hours. For over $200, wait a week.

Ask the Frugal Questions

Do I need this? Can I borrow it? Is there a cheaper alternative? Will I use it in 6 months?

Pre-Purchase Checklist

| Question | If Yes | If No |

|---|---|---|

| Is it on my list? | Consider it | Skip it |

| Can I afford it today? | Proceed | Wait |

| Will I use it regularly? | Worth considering | Probably skip |

| Have I comparison-shopped? | Ready to buy | Research first |

| Would I pay full price? | True need | Sale-driven impulse |

Know if you can afford it

BUDGT's daily limit gives you instant clarity. If buying something would push you into yellow or orange, you know it's not the right time.

Habit 4: Embrace the 30-Day Rule

The 30-day rule is the ultimate impulse purchase killer. For any non-essential item over $50, wait 30 days before buying. If you still want it after 30 days, it might be worth purchasing.

Why 30 Days Works

| Psychological Effect | Impact on Spending |

|---|---|

| Initial desire fades | 70% of items no longer wanted |

| Emotional distance | See item objectively |

| Time to research | Find better alternatives |

| Budget stabilizes | Can actually afford it |

| True priorities emerge | Buy what matters |

Implementing the 30-Day Rule

| Step | Action |

|---|---|

| 1 | See something you want but don’t need |

| 2 | Write it down with today’s date |

| 3 | Note the price and where you saw it |

| 4 | Set a calendar reminder for 30 days |

| 5 | After 30 days, reassess: still want it? |

| 6 | If yes, check your budget and buy guilt-free |

| 7 | If no, celebrate the money saved |

Adapting the Rule to Your Life

| Item Cost | Waiting Period |

|---|---|

| Under $25 | 24 hours |

| $25-100 | 7 days |

| $100-500 | 30 days |

| Over $500 | 60-90 days |

Habit 5: Use Cash Strategically

While card payments are convenient, cash creates a psychological barrier that reduces spending. Studies show people spend 12-18% less when using cash compared to cards.

Why Cash Works

| Cash Advantage | How It Helps |

|---|---|

| Physical awareness | You see money leaving your hands |

| Hard limit | When cash is gone, spending stops |

| No interest | Can’t overspend into debt |

| Mindful spending | Each purchase feels more intentional |

The Cash Envelope System

| Category | Monthly Cash Allocation | How to Use |

|---|---|---|

| Groceries | $_____ | One envelope per week |

| Dining out | $_____ | When it’s empty, cook at home |

| Entertainment | $_____ | Covers movies, events, hobbies |

| Personal spending | $_____ | Guilt-free fun money |

If Cash Isn’t Practical

| Alternative | How It Works |

|---|---|

| Prepaid debit card | Load specific amount, can’t overspend |

| Separate “spending” account | Transfer weekly allowance only |

| BUDGT daily limit | Visual reminder of what you can spend |

Visual spending awareness

BUDGT's color system creates cash-like awareness digitally. Blue means safe, yellow means careful, orange means stop—instant feedback without carrying cash.

Habit 6: Automate Your Savings

The most effective way to save is to make it automatic. When savings happen before you see the money, you can’t spend it—and you adapt to living on what’s left.

Pay Yourself First

| Traditional Approach | Automated Approach |

|---|---|

| Spend first, save what’s left | Save first, spend what’s left |

| Savings often $0 | Savings happen every month |

| Relies on willpower | Requires no willpower |

| Inconsistent results | Predictable growth |

How to Automate

Calculate Your Savings Rate

Start with 10% if new to saving, work up to 20%. Even $25/paycheck builds habit.

Set Up Direct Deposit Split

Have employer deposit savings portion directly to savings account.

Schedule Automatic Transfers

If no direct deposit split, set up auto-transfer on payday.

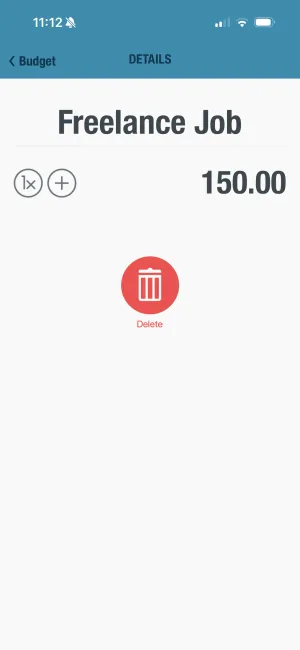

Use BUDGT Savings Mode

Set your savings percentage in BUDGT so your daily limit already accounts for savings.

Don't Touch It

Treat automated savings as untouchable. Only emergency fund is for emergencies.

Where to Put Automated Savings

| Goal | Best Account Type | Target |

|---|---|---|

| Emergency fund | High-yield savings (4-5% APY) | 3-6 months expenses |

| Short-term goals | High-yield savings | Varies |

| Retirement | 401k or IRA | 15% of income |

| Long-term goals | Investment account | Varies |

Savings built into your budget

BUDGT's Savings Mode reserves your savings goal before calculating your daily limit. You can't accidentally spend your savings—it's already set aside.

Habit 7: Evaluate Subscriptions and Recurring Expenses

Subscriptions are the silent budget killer. The average American spends $237/month on subscriptions—often for services they rarely use.

Common Subscription Categories

| Category | Examples | Average Cost |

|---|---|---|

| Streaming | Netflix, Hulu, Disney+, Spotify | $50-100/month |

| Fitness | Gym, apps, classes | $30-100/month |

| News/Media | Newspapers, magazines, Patreon | $20-50/month |

| Apps/Software | Cloud storage, productivity, gaming | $20-50/month |

| Beauty/Boxes | Subscription boxes | $20-50/month |

| Delivery | Amazon Prime, meal kits | $15-200/month |

Subscription Audit Checklist

| Question | Action |

|---|---|

| Have I used this in the past 30 days? | If no, consider canceling |

| Would I buy this month-to-month? | If no, it’s not worth annual |

| Can I get this free elsewhere? | Library, free tiers, sharing |

| Does it bring joy or solve a problem? | Keep if yes to both |

| What could I do with this money instead? | Compare to savings goals |

Subscription Reduction Strategies

| Strategy | Potential Savings |

|---|---|

| Cancel unused memberships | $50-200/month |

| Switch to free tiers | $30-50/month |

| Share family plans | $20-40/month |

| Rotate subscriptions (1 at a time) | $20-50/month |

| Negotiate rates | 10-30% reduction |

Track all recurring expenses

Create a 'Subscriptions' category in BUDGT to see exactly how much goes to recurring charges. Monthly review makes canceling forgotten subscriptions easy.

Building Your Frugal Habit Stack

The key to sustainable frugality is habit stacking—linking new habits to existing routines:

| Existing Habit | Stack This Frugal Habit |

|---|---|

| Morning coffee | Check BUDGT daily limit |

| Leaving a store | Log purchase immediately |

| Sunday meal planning | Review weekly spending |

| Payday | Confirm savings transfer |

| End of month | Audit subscriptions |

Month-by-Month Habit Implementation

| Month | New Habit | Goal |

|---|---|---|

| January | Track all spending | Complete awareness |

| February | Create realistic budget | Daily limit set |

| March | Plan purchases (lists) | Reduce impulse buys 50% |

| April | 30-day rule for wants | Zero impulse purchases over $50 |

| May | Automate savings | 15% saving automatically |

| June | Subscription audit | Cancel 3+ unused services |

| July-December | Refine and maintain | Continuous improvement |

Frugal Living Quick Wins

If you’re ready to start today, try these immediate changes:

| Quick Win | Annual Savings |

|---|---|

| Make coffee at home | $500-1,000 |

| Pack lunch 3x/week | $1,000-2,000 |

| Cancel 2 streaming services | $200-400 |

| Switch to generic brands | $300-600 |

| Use library for books/media | $200-500 |

| Negotiate one bill | $100-300 |

| Unsubscribe from retail emails | $500+ (avoided temptation) |

Make 2026 Your Frugal Breakthrough Year

Frugal living isn’t about sacrifice—it’s about intentional choices that align with your values. When you spend less on what doesn’t matter, you have more for what does.

The seven habits work together:

- Track spending → Know where money goes

- Budget realistically → Plan where it should go

- Plan purchases → Eliminate impulse waste

- 30-day rule → Ensure intentional spending

- Use cash strategically → Create spending awareness

- Automate savings → Guarantee monthly progress

- Audit subscriptions → Stop silent budget leaks

Start with one habit this week. Track every expense for 7 days. You’ll be amazed at what you discover—and motivated to continue.

Download BUDGT today and make 2026 the year you master frugal living, one intentional choice at a time.

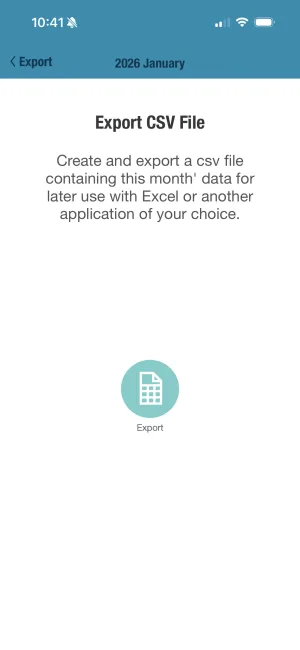

Export your frugal journey

BUDGT lets you export all spending data to CSV. Review your progress quarterly, celebrate wins, and keep improving your frugal habits all year.

Frequently Asked Questions

What's the easiest way to start tracking spending as a beginner in 2026?

Start by using a budgeting app like BUDGT that works completely offline on your iOS device. Simply log each expense with a category and optional note. After a week or two, you'll see clear patterns showing where your money goes, making it easier to identify areas for improvement.

Does BUDGT require linking to my bank account or sharing financial data?

No, BUDGT is 100% offline with no cloud sync or bank linking required. All your financial information stays completely private on your device. You manually log expenses, which actually makes you more aware of your spending habits compared to automatic tracking.

How can BUDGT help me stick to the 30-day rule for purchases?

Use BUDGT's notes feature to create a wishlist of items you're considering. When you add a potential purchase to your notes, date it and wait 30 days. The daily budget feature shows whether you can actually afford the item without compromising your financial goals.

What subscription options does BUDGT offer for long-term budgeting?

BUDGT offers a free trial with full functionality, plus flexible subscription options including weekly, monthly, 3-month, 6-month, and yearly plans. Choose the plan that best fits your budgeting timeline and financial situation. All plans include complete access to categories, Savings Mode, Travel Mode, and other features.

Can I use BUDGT while traveling to maintain my frugal habits?

Yes, BUDGT includes a Travel Mode feature specifically for managing budgets while traveling. Since it works 100% offline, you can track expenses anywhere in the world without internet or worrying about roaming charges. Geotagging shows where you spent money during your trip.

How does the daily budget philosophy help build long-term savings?

BUDGT calculates a safe daily spending limit based on your income, fixed expenses, and savings goals. If you stick to this limit each day, you're guaranteed to have money left at the end of the month. This simple approach removes guesswork and builds consistent savings habits over time.

Can I export my spending data to analyze my frugal progress over time?

Yes, BUDGT includes CSV export functionality. You can export your spending data monthly or yearly to analyze trends, celebrate improvements in your frugal habits, and identify categories where you've successfully reduced spending throughout 2026.

What is the 50/30/20 rule and how can BUDGT help me follow it?

The 50/30/20 rule allocates 50% of income to needs (rent, groceries), 30% to wants (entertainment, dining), and 20% to savings and debt repayment. Use BUDGT's categories to organize spending according to this framework and track whether you're staying within each allocation.

How do I evaluate and cut unnecessary subscriptions?

Review your bank statements to identify all recurring charges. In BUDGT, create a "Subscriptions" category to track these monthly expenses. Cancel services you rarely use, share accounts with family, or switch to free alternatives to free up money for savings.

Is using cash really better than cards for staying on budget?

Using cash creates a tangible connection to spending—you physically see money leaving your hands. It sets clear boundaries since once your cash is gone, spending stops. For digital tracking, log cash withdrawals in BUDGT and note what the cash was used for.

How can I automate my savings while still tracking in BUDGT?

Set up automatic transfers to your savings account on payday. In BUDGT, use the Savings Mode feature to set a savings percentage, which automatically adjusts your daily spending limit. This way, you're saving first and spending what's left.

What's the difference between frugal living and being cheap?

Frugal living is about being mindful and strategic with your money—spending intentionally on what matters and avoiding waste. Being cheap often means sacrificing quality or experiences to save money. Frugality focuses on value, not just the lowest price.

How often should I review my budget to stay on track with frugal habits?

Daily check-ins with BUDGT take just seconds and keep you aware of your spending limit. Weekly reviews help identify patterns. Monthly assessments allow you to adjust categories and goals. Consistency is more important than perfection.

Can BUDGT help me plan for irregular expenses throughout 2026?

Yes, use the Month Overflow feature to manage money across months for irregular expenses like car maintenance, holidays, or annual subscriptions. You can also create specific categories for planned big purchases and track your progress toward those goals.

What are the best frugal habits to start with if I'm overwhelmed?

Start with just one habit: tracking your spending. Use BUDGT for two weeks without trying to change anything—just observe. Once you see where your money goes, you'll naturally identify easy wins. Then add one new habit each month for sustainable change.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS