Frugal Living Ideas for 2026: Small Changes, Big Savings

Frugal Living Ideas for 2026: Small Changes, Big Savings

Frugal living has an image problem. It conjures visions of extreme couponing, never eating out, and living in uncomfortable deprivation. No wonder most people want nothing to do with it.

But real frugal living isn’t about suffering—it’s about spending intentionally. It’s keeping money you’d otherwise waste and redirecting it toward what actually matters to you.

This guide offers practical frugal ideas for 2026 that work in the real world, where you have limited time, actual preferences, and no desire to live on rice and beans forever.

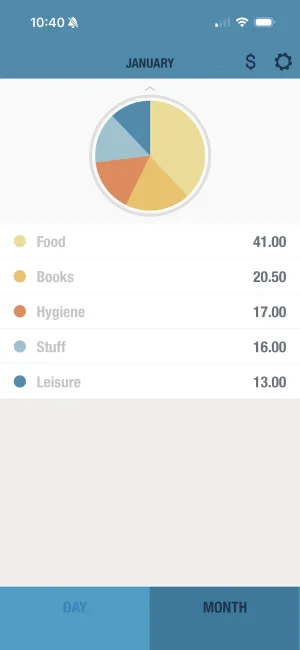

Know your daily limit

See exactly what you can spend today—the foundation of frugal living.

The Frugal Mindset Shift

Before the specific tips, let’s reframe what frugal means:

Old frugal: Don’t spend money. Deprive yourself. Feel guilty about purchases.

New frugal: Spend on what matters. Eliminate waste. Feel good about intentional choices.

The goal isn’t minimizing spending—it’s maximizing value. Sometimes that means spending more on quality; sometimes it means finding free alternatives. Always it means thinking before paying.

High-Impact Frugal Moves

Start here for the biggest savings with reasonable effort.

Housing Hacks

Housing typically consumes 25-35% of income. Even small percentages here mean real money.

Negotiate rent at renewal: Most landlords prefer existing tenants to turnover costs. Ask for lower rent or improvements before signing a new lease.

Reduce square footage: Can you downsize? Every hundred square feet saved is lower rent, utilities, and maintenance.

House hack if possible: Rent a spare room, use a portion for home office (tax deduction potential), or consider duplex ownership.

Refinance strategically: If rates have dropped since your mortgage, refinancing could save hundreds monthly.

DIY basic maintenance: Learn to fix minor plumbing, paint, and handle basic repairs. YouTube has tutorials for everything.

Transportation Transformation

The second-biggest expense for most households.

One-car household: If possible, going from two cars to one saves insurance, registration, maintenance, and depreciation—potentially $5,000-10,000 annually.

Buy used: Let someone else take the depreciation hit. Cars 2-3 years old offer the best value-to-quality ratio.

Drive less: Batch errands, work from home when possible, use alternative transportation for short trips.

DIY maintenance: Oil changes, air filters, and basic services are simple and save $100+ per service compared to dealerships.

Proper tire inflation: Underinflated tires waste fuel. Check monthly.

Food Fundamentals

Food costs have increased dramatically, but smart strategies still work.

Meal planning: Know what you’re eating before you shop. This alone can cut food spending 20-30%.

Cook in batches: Make large portions on weekends, eat throughout the week. Saves time and money.

Strategic meat reduction: You don’t need to go vegetarian—just use less meat. Beans, eggs, and legumes stretch meals affordably.

Shop the perimeter first: Fresh foods around the store’s edge often offer better nutrition per dollar than processed items in the center aisles.

Use what you have: Before shopping, inventory what’s already in your fridge and pantry. Reduce waste by building meals around existing ingredients.

Buy store brands: Same manufacturers, different labels, 20-40% savings.

Moderate-Effort Frugal Strategies

These require some setup or habit change but deliver consistent returns.

Subscription Surgery

The average household pays for 8+ subscriptions, often forgetting half of them.

Quarterly audits: Set a calendar reminder to review all recurring charges every 3 months.

Share when allowed: Family plans for streaming, music, and software split costs legally.

Rotate don’t stack: Instead of 4 streaming services simultaneously, subscribe to one at a time and rotate quarterly.

Negotiate or cancel: Call to cancel and accept the retention offer—or actually cancel and rejoin at new-customer rates later.

Utility Optimization

Programmable thermostats: Set temperatures lower when away or sleeping. 10% savings for every degree you adjust.

LED everything: Replace bulbs as they burn out. LEDs use 75% less energy and last years longer.

Unplug vampires: Devices on standby still draw power. Use smart power strips or unplug what’s not in use.

Water consciousness: Low-flow fixtures, shorter showers, fixing leaks promptly—water costs add up.

Compare providers: Some areas have electricity competition. Shop annually for better rates.

Shopping Smarter

Wait 48 hours: For any non-essential purchase over $30, wait two days. Most urges pass.

Use cashback strategically: If you’re buying anyway, get something back—but don’t let rewards justify unnecessary purchases.

Buy secondhand first: Check thrift stores, Facebook Marketplace, and eBay before buying new. Clothing, furniture, and tools especially.

Quality over quantity: One $100 item that lasts 5 years beats five $30 items that each last one year.

End-of-season shopping: Buy winter items in spring, summer items in fall. Patience saves 50-70%.

Low-Effort Frugal Wins

Quick wins that require minimal change.

Daily Habits

Coffee at home: A home coffee setup pays for itself in weeks. Make it just as good as coffee shops with practice.

Pack lunch 3x weekly: Even a few homemade lunches save $40-60/week compared to buying out daily.

Use the library: Free books, movies, music, and often museum passes. Your taxes already paid for it.

Free exercise: Walk, run, YouTube workouts, outdoor activities. Gym membership is optional.

Drink water: It’s free at restaurants, healthy, and eliminates beverage spending.

Money-Saving Swaps

| Instead of | Try |

|---|---|

| Cable TV | Antenna + one streaming service |

| Salon highlights | At-home hair care (or less frequent salon) |

| New books | Library, used bookstores, or e-library |

| Lunch out daily | Pack lunch 3-4 days, eat out 1-2 |

| Premium gas | Regular (unless car specifically requires premium) |

| Name brand OTC meds | Store brand (same active ingredients) |

| Yearly phone upgrades | Keep phones 3-4 years |

Automatic Savings

Round-up programs: Many banks offer automatic savings from rounding purchases.

Automatic transfers: Move money to savings on payday before you can spend it.

Cash-back to savings: Direct credit card rewards to savings account instead of statements.

Frugal Without Feeling Deprived

The key to sustainable frugality is strategic indulgence.

The “Spend More, Spend Less” Strategy

Pick 2-3 categories where spending brings genuine joy. Spend freely there (within budget). Cut aggressively everywhere else.

Example:

- Spend more: Quality food, books, coffee equipment

- Spend less: Clothing, electronics, home decor

This approach feels abundant because you’re prioritizing, not depriving.

The 10% Indulgence Rule

Build a small “no guilt” fund into your budget—maybe 10% of discretionary spending. Use it for whatever brings joy, no justification needed.

This prevents the restriction → binge cycle that derails strict budgets.

Quality of Life Investments

Some spending saves money long-term or improves life enough to justify the cost:

- Good shoes that last years

- Comfortable mattress (you spend 1/3 of life sleeping)

- Tools that enable DIY

- Kitchen equipment for home cooking

- Health investments (preventive care, exercise equipment that gets used)

Being frugal doesn’t mean buying the cheapest option—it means buying the best value.

Seasonal Frugal Strategies

Winter

- Lower thermostat, add layers

- Use programmable scheduling (cooler when away/sleeping)

- Seal drafts around doors and windows

- Use slow cooker for efficient hot meals

Spring

- Deep clean instead of buying organizing products

- Start a basic garden (herbs are easiest)

- Sell winter items you didn’t use

- Service AC before summer peak prices

Summer

- Air dry clothes when possible

- Use fans before AC

- Embrace free outdoor activities

- Stock up on back-to-school deals for future needs

Fall

- Stock up on summer clearance items for next year

- Prepare garden for next season

- Service heating system before winter

- Plan holiday spending before the pressure starts

The Annual Frugal Calendar

Build these reviews into your year:

January: New year spending reset, subscription audit February: Insurance policy review (shop for better rates) March: Tax filing (maximize deductions) April: Spring cleaning and selling unused items May: Summer planning (book travel early for savings) June: Mid-year budget review July: Back-to-school shopping strategy August: End-of-summer clearance shopping September: Insurance renewal shopping October: Heating system service November: Holiday budget planning December: Year-end financial review, charitable giving

Tracking Your Frugal Progress

Watch your savings grow

Track daily spending and watch your frugal choices add up over the month.

Frugal living works better when you see results:

Monthly savings rate: What percentage of income are you keeping?

Cost per category: Track major categories quarterly—are they trending down?

Net worth progress: Are your assets growing over time?

Frugal wins log: Keep a list of money you didn’t spend due to frugal choices. Seeing “$30 saved: brought lunch instead of buying” accumulate is motivating.

Common Frugal Mistakes

Going too extreme too fast: Drastic cuts lead to burnout and binge spending. Gradual changes stick.

Spending to save: Buying something you don’t need because it’s on sale isn’t saving—it’s spending.

Ignoring time value: Driving 30 minutes to save $5 isn’t frugal if your time is worth more.

Deprivation mindset: Frugality from scarcity and fear isn’t sustainable. Frugality from intentionality is.

Forgetting why: Without connecting savings to goals (freedom, security, experiences), cutting spending feels pointless.

Start Today

Pick three ideas from this guide:

- One high-impact change

- One moderate-effort habit

- One quick win

Implement them this week. Once they’re established (2-3 weeks), add three more.

Frugal living isn’t about overnight transformation. It’s about steady progress toward spending that reflects your actual priorities—and keeping the rest.

Want to see your daily spending at a glance? BUDGT shows you exactly what’s safe to spend today, helping you make frugal choices in the moment without complicated tracking.

Frequently Asked Questions

What's the difference between frugal and cheap?

Frugal means spending intentionally to maximize value—sometimes that means spending more for quality that lasts. Cheap means spending the least possible regardless of value, often leading to replacing items frequently or sacrificing quality of life. Frugal considers long-term costs; cheap only looks at the sticker price.

How much money can frugal living actually save?

Depending on your starting point, frugal living can save $200-1,000+ monthly. High-impact areas like housing, transportation, and food offer the biggest opportunities. Someone spending freely across all categories might reduce expenses by 20-30% through intentional frugal choices without feeling deprived.

Can you live frugally and still enjoy life?

Absolutely—that's the entire point of modern frugal living. By cutting spending on things that don't bring joy, you free up money for things that do. Many frugal people spend more than average on their priorities (travel, hobbies, quality food) while spending far less on everything else.

What are the easiest frugal changes to start with?

Start with low-effort wins: audit and cancel unused subscriptions, switch to store brand groceries, use the library, pack lunch a few days per week, and make coffee at home. These changes require minimal lifestyle adjustment but can save $100-300 monthly immediately.

Is frugal living worth the time and effort?

It depends on your financial situation and goals. If you're struggling to save or pay off debt, frugal living is highly valuable. If you're financially comfortable, the time spent might exceed the savings value. Focus on high-impact, low-effort strategies first—these offer the best return on your time.

How do I stay motivated to live frugally?

Connect frugal choices to specific goals: "I'm bringing lunch because I'm saving for a house down payment." Track your savings visually to see progress. Celebrate milestones. Join communities of like-minded people for support and ideas. Remember that frugality creates options and reduces financial stress.

What frugal tips actually don't work or aren't worth it?

Tips that often backfire: extreme couponing (time cost exceeds savings for most), buying bulk items you won't use before they expire, driving far out of your way to save small amounts, and making your own products when the time/quality ratio doesn't make sense. Focus on high-impact strategies instead.

How do I be frugal without affecting my family?

Involve family in goal-setting so everyone understands why. Make frugal activities fun (cooking together, thrift shopping, free outings). Don't cut things that matter to them without discussion. Find savings in areas they won't notice (switching brands, negotiating bills) before touching visible categories.

Can frugal living help with debt payoff?

Yes—frugal living is one of the most powerful debt payoff accelerators. Every dollar not spent can go toward debt, potentially cutting payoff time by years. Many people use aggressive frugal living during debt payoff specifically, then relax once debt-free.

How do I deal with social pressure to spend more?

Be honest without over-explaining: "We're focused on saving for [goal]." Suggest free or low-cost alternatives for social activities. Surround yourself with people who share or respect your values. Remember that much "social pressure" is internal—others often notice your choices less than you think.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS