Daily Budget Tips: Master Your Money One Day at a Time

Daily Budget Tips: Master Your Money One Day at a Time

Monthly budgets are overwhelming. You set a number at the beginning of the month, then watch helplessly as it disappears faster than expected. By day 20, you’re either overspent or stressed about every purchase.

Daily budgeting flips this approach. Instead of managing a large monthly sum, you focus on one question: “What can I spend today?”

This simple shift transforms budgeting from anxiety-inducing to manageable—and actually works.

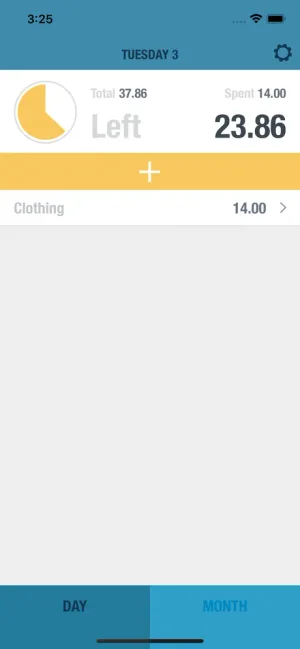

Your daily spending at a glance

One number tells you everything you need to know about today's budget.

Why Daily Budgeting Works

Psychology: Small Numbers Are Manageable

$50 per day is easier to grasp than $1,500 per month. Your brain can evaluate whether a $15 purchase fits within $50, but struggles to calculate whether $15 affects a monthly budget meaningfully.

Immediate Feedback Loop

Monthly budgets provide feedback once a month—too late to course correct. Daily budgets show impact immediately. Spend $70 on day one? You know right away. You can adjust day two.

No “Month-End Panic”

When you budget daily, you can’t overspend for three weeks and hope to recover in the last seven days. Each day is its own unit, preventing problems from compounding.

Decision Simplification

“Can I afford this?” becomes simple. Check your daily balance. If it’s there, you can spend it. If not, wait until tomorrow. No complex calculations needed.

How to Calculate Your Daily Budget

Basic Calculation

Monthly discretionary spending ÷ Days in month = Daily budget

Example:

- Monthly income: $4,000

- Fixed expenses (rent, utilities, subscriptions, debt payments): $2,500

- Discretionary spending available: $1,500

- Daily budget: $1,500 ÷ 30 = $50/day

What Counts as “Discretionary”

Include in daily budget:

- Groceries

- Dining out

- Coffee/drinks

- Entertainment

- Shopping

- Gas (if variable)

- Personal care

- Impulse purchases

Exclude (handle separately):

- Rent/mortgage (fixed, not daily)

- Utilities (fixed monthly)

- Subscriptions (automate and track separately)

- Debt payments (automate)

- Insurance (monthly/annual)

Adjusting for Reality

Variable income? Calculate based on guaranteed income. Treat extras as bonuses.

Large expected expenses? Deduct from monthly total before dividing. Planning a $200 event this month? Your daily budget becomes ($1,500 - $200) ÷ 30 = $43/day.

Seasonal changes? December might need more daily allowance for gifts. Adjust monthly, then divide.

Daily Budget Strategies

Strategy 1: Strict Daily Limit

Each day, you have $X. If you don’t spend it all, great—but it doesn’t roll over. Tomorrow is a fresh $X.

Best for: People who need clear boundaries

Challenge: Doesn’t allow saving for larger purchases

Strategy 2: Rolling Balance

Unspent money rolls to the next day. Spend only $30 of your $50? Tomorrow you have $70.

Best for: People saving for occasional larger purchases

Challenge: Can create “permission” to overspend after good days

Strategy 3: Weekly Buckets

Same concept, weekly instead of daily. $350/week (if monthly is $1,500). Spend it whenever, but don’t exceed weekly limit.

Best for: People who prefer weekly rather than daily tracking

Challenge: Less immediate feedback

Strategy 4: Buffer Building

Spend under your daily limit intentionally, building a monthly buffer. Aim for $40 daily when your limit is $50—the remaining $300/month becomes savings or covers unexpected expenses.

Best for: People building savings or emergency funds

Challenge: Requires consistent discipline

Daily Budget Tips That Work

Morning Review

Start each day knowing your number. Check your balance, know what you can spend, mentally plan your day.

Why it works: Starting the day aware prevents “accidental” overspending.

The “Before Buying” Pause

Before any purchase, check your daily balance. Is this purchase within what’s available? If yes, proceed. If no, wait.

Why it works: Creates a conscious moment between urge and action.

Evening Log

End each day by logging what you spent. Takes 60 seconds. Reinforces awareness and prepares you for tomorrow.

Why it works: Evening reflection cements the habit and catches anything you forgot.

Weekly Review

Once per week, look at the pattern. Which days were high? What triggered overspending? Any patterns emerging?

Why it works: Daily focus can miss weekly patterns.

The “Green/Red” Mindset

Throughout the day, know your status:

- Green: Under budget, spending is fine

- Yellow: Approaching limit, be careful

- Red: Over budget, stop spending on non-essentials

Why it works: Status awareness guides decisions without constant checking.

Color-coded feedback

Blue means on track. Orange means approaching your limit. Know where you stand instantly.

Handling Common Daily Budget Challenges

”I Went Over Today”

It happens. Options:

- Spend less tomorrow to balance

- Accept it and start fresh tomorrow

- Identify the trigger and plan differently

Don’t: Shame spiral, give up, “write off” the rest of the week.

”I Have a Large Purchase Coming”

Either:

- Save up over multiple days (rolling balance strategy)

- Deduct from monthly budget before calculating daily amount

- Create a separate “planned purchases” fund

”Some Days I Need More”

Build flexibility in:

- Use weekly instead of daily

- Keep a small buffer for variable days

- Accept some days will be over, others under

”I Forgot to Track”

Don’t try to recreate every purchase. Best estimate is fine. Resume tracking from now. Imperfect tracking beats no tracking.

”It’s Not Working”

Evaluate:

- Is your daily amount realistic?

- Are you actually checking before purchases?

- Do you need a different strategy (weekly, rolling, etc.)?

- Is there an emotional spending issue to address?

Daily Budgeting With Partners/Family

Shared Daily Budget

Both partners operate from the same daily limit. Requires communication (“I spent $30 today, we have $20 left”).

Works when: You’re highly coordinated and communicate frequently.

Split Daily Budgets

Each person gets their own daily amount. Personal spending is personal. Shared expenses come from a separate pool.

Works when: You need autonomy but still track spending.

Categorical Split

Some categories are shared (groceries, household), others are individual. Track shared items daily, personal items however each person prefers.

Works when: You want to maintain individual money habits while managing shared costs.

The Daily Budget Lifestyle

Beyond mechanics, daily budgeting changes how you relate to money.

From Scarcity to Clarity

Instead of vague worry about whether you can afford something, you have clear information. Clarity feels better than anxiety.

From Restriction to Permission

Knowing your number means you can spend within it freely. $50 today is yours to use without guilt.

From Impulsive to Intentional

The daily check creates a pause that transforms impulse purchases into conscious choices.

From Overwhelmed to In Control

Managing one day at a time is sustainable. Managing a whole month at once isn’t for most people.

Getting Started With Daily Budgeting

Day 1: Calculate

Figure out your monthly discretionary spending. Divide by 30 (or 31, depending on month). That’s your daily number.

Day 2-7: Track Without Judgment

Spend as you normally would, but track daily spending. See where you actually land versus your calculated daily limit.

Day 8-14: Adjust and Practice

Now try to stay within your daily limit. Notice when it’s easy, when it’s hard, and what triggers overspending.

Day 15-30: Refine

Adjust the daily limit if it’s unrealistic. Build habits. Handle challenges as they come.

Ongoing

Daily budgeting becomes automatic. The morning check, the purchase pause, the evening log—all become natural parts of your routine.

Why Simple Beats Complex

You could create elaborate budgets with 20 categories, monthly reviews, and spreadsheet formulas. Some people thrive with that complexity.

But for most people, simplicity wins:

- One number to remember

- One question to answer (“Is this within my daily budget?”)

- One habit to build (daily check-in)

Complex systems get abandoned. Simple systems become habits.

Daily budgeting isn’t sophisticated. It doesn’t optimize every dollar. But it works—which makes it more valuable than any elaborate system you’ll quit using.

BUDGT is built around daily budgeting. Set your monthly budget once, and the app shows you what you can spend today. That number updates in real-time as you log purchases. Blue means on track. Red means slow down. Simple clarity, daily.

Frequently Asked Questions

What's a good daily budget amount?

It depends entirely on your income and fixed expenses. Take your monthly income, subtract fixed costs (rent, utilities, debt payments, subscriptions), then divide what's left by 30. For example, $1,500 monthly discretionary spending becomes a $50/day budget. The right amount is what leaves you able to save while covering necessities.

Should I use the same daily budget amount every day?

Most people find a consistent daily amount simplest to manage. However, you can intentionally vary by day (higher on weekends, lower on weekdays) as long as the weekly total stays on target. The key is having a clear number you're working with each day.

What happens if I go over my daily budget?

Options include: spending less the next day to balance, accepting it and starting fresh, or identifying what triggered the overspending. Don't spiral into shame or "write off" the rest of the week. One over-budget day doesn't ruin your finances—how you respond matters more.

Does unspent daily budget roll over to the next day?

That depends on your strategy. Strict daily limits don't roll over—each day is independent. Rolling balance approaches do carry over unspent amounts. Choose based on your personality: strict limits provide clearer boundaries; rolling balances allow saving for larger purchases.

How do I budget for large monthly expenses on a daily budget?

Either deduct the known expense from your monthly total before dividing into daily amounts, or save up over multiple days using a rolling balance. Example: $200 planned expense + $1,500 regular budget = adjust daily amount to $43 instead of $50, or save $7/day for 28 days.

Is daily budgeting better than monthly budgeting?

For most people, yes. Daily budgets provide immediate feedback, manageable numbers, and prevent month-end panic. Monthly budgets give feedback too late to course-correct. However, some people prefer weekly or monthly approaches—the best system is the one you'll actually use consistently.

How do I handle daily budgets with a partner?

Options include: shared daily budget with frequent communication, individual daily budgets with separate tracking, or splitting categories (shared expenses from joint pool, personal from individual limits). Choose the approach that matches how you already manage finances together.

Should I track all spending against my daily budget?

Track discretionary spending (groceries, dining, entertainment, shopping) against your daily budget. Fixed expenses (rent, utilities, automated bills) should be handled separately—they don't change daily. This keeps the daily tracking simple and focused on spending you can actually control.

What if my daily budget feels too restrictive?

Either your calculation needs adjustment (income vs. expenses may need reassessing) or your expectations need calibrating. Try tracking without limits for one week to see actual spending, then set a realistic daily budget based on that data. Sustainable budgets stretch but don't break you.

How long does it take to get comfortable with daily budgeting?

Most people feel comfortable within 2-3 weeks of consistent practice. The first week involves building the tracking habit. By week two, checking your daily balance becomes more natural. By week three, you'll likely catch yourself automatically thinking in daily terms.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS