BUDGT: A Minimalist Powerhouse for Your Budgeting Needs

While many budgeting apps are overloaded with features, dashboards, and complexity, BUDGT takes a different approach. It focuses on what really matters: helping you track expenses, stay within budget, and save more—without the clutter.

This guide explores how BUDGT’s minimalist design philosophy makes budgeting easier, more sustainable, and more effective than feature-heavy alternatives.

The Problem with Complex Budgeting Apps

Most budgeting apps fail for a simple reason: they’re too complicated.

| Complex App Problem | Real-World Impact |

|---|---|

| 50+ features to learn | Users give up within a week |

| Requires bank linking | Privacy concerns, sync errors |

| Detailed category systems | Analysis paralysis |

| Investment tracking built in | Overwhelms basic budgeters |

| Social features, gamification | Distracts from core purpose |

| Subscription tiers with limits | Frustration with paywalls |

Research shows that 80% of people who download budgeting apps stop using them within 30 days. The #1 reason? Too complicated.

What Minimalists Actually Need

| Essential | Nice to Have | Unnecessary |

|---|---|---|

| How much can I spend today? | Category breakdown | Investment tracking |

| Am I on track this month? | Spending trends | Bill negotiation |

| How much have I saved? | Data export | Social sharing |

| Where is my money going? | Multiple budgets | Net worth calculation |

BUDGT delivers the essentials—and nothing more.

The BUDGT Philosophy: Intentional Simplicity

BUDGT is built on three principles:

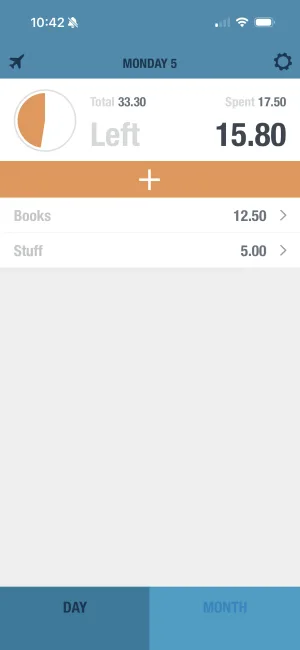

1. One Number Tells You Everything

Instead of dashboards with charts, graphs, and statistics, BUDGT shows you one number: what you can spend today.

| Other Apps | BUDGT |

|---|---|

| ”You’ve spent $347.23 this month across 12 categories…" | "You can spend $45 today” |

| Requires analysis and interpretation | Instantly actionable |

| Easy to rationalize overspending | Clear yes/no for purchases |

This single number—your daily budget—updates in real-time as you spend. Blue means on track. Yellow means careful. Orange means stop. No analysis required.

One number tells you everything

BUDGT's color-coded display shows you instantly if you're on track. Blue means safe to spend—the simplest way to stay in control.

2. Manual Entry Creates Awareness

While automatic bank imports seem convenient, they actually reduce financial awareness. You see transactions days later, often not recognizing what they were.

| Auto-Import | Manual Entry |

|---|---|

| See spending days later | Log at point of purchase |

| ”What was that $47.23?” | Remember exactly what it was |

| Passive review | Active engagement |

| No pause before spending | Natural pause creates awareness |

| Weaker habit formation | Builds financial mindfulness |

BUDGT’s manual entry takes 10 seconds per expense. That brief pause before and after spending creates the awareness that drives lasting change.

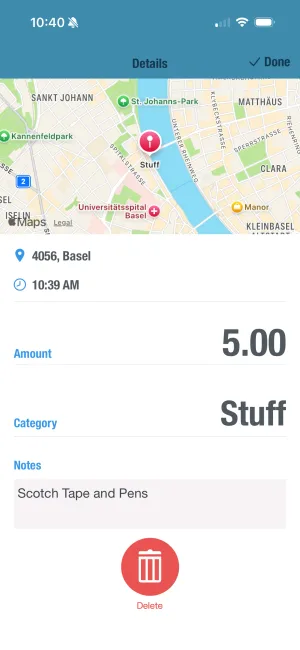

Add context to every expense

BUDGT's notes feature lets you add quick context to any purchase. When you review later, you'll know exactly what each expense was and why.

3. Privacy as a Feature

BUDGT is 100% offline—your financial data never leaves your device.

| Other Apps | BUDGT |

|---|---|

| Cloud servers store your data | Device-only storage |

| Bank credentials shared | No bank access ever |

| Subject to data breaches | Nothing to breach |

| Sell anonymized data | No data to sell |

| Require account creation | No account needed |

For privacy-conscious minimalists, this isn’t just a feature—it’s a requirement.

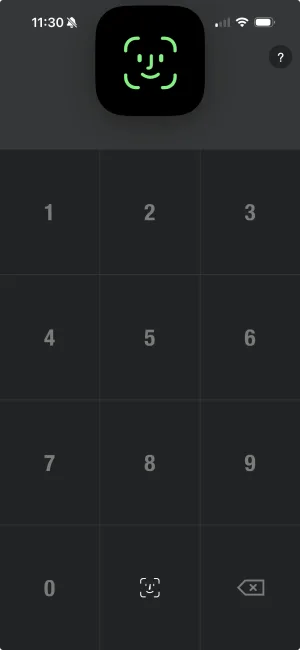

Your finances stay private

BUDGT works 100% offline with Face ID protection. Your data never leaves your device—guaranteed privacy with no cloud sync, no servers, no risk.

Core Features: Everything You Need, Nothing You Don’t

Daily Spending Limit

BUDGT’s core innovation is the daily budget. Your monthly budget minus fixed expenses, divided by remaining days, equals what you can spend today.

| How It Works | Why It Matters |

|---|---|

| Starts fresh each month | Clean slate mentality |

| Updates in real-time | Instant feedback |

| Unspent money rolls forward | Reward for frugal days |

| Overspending reduces tomorrow | Natural consequences |

Monthly Overview

When you want the bigger picture:

| View | What You See |

|---|---|

| Income summary | What came in this month |

| Expense total | What went out |

| Category breakdown | Where money went |

| Month projection | Where you’ll end up |

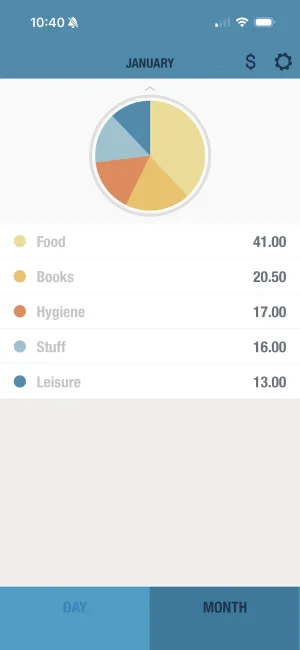

Your complete monthly picture

BUDGT's monthly view shows income, expenses, and remaining budget at a glance. No clutter—just the clarity you need.

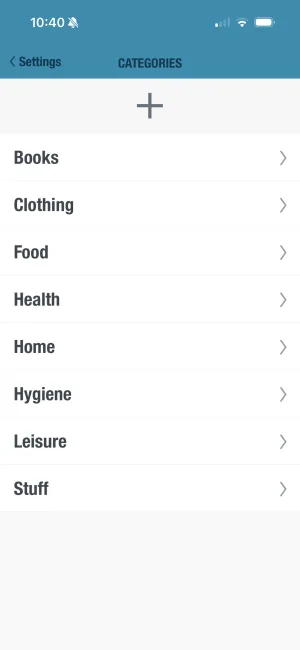

Flexible Categories

Create categories that match your life:

| Default Categories | Custom Examples |

|---|---|

| Food & Dining | Coffee habit |

| Transportation | Car maintenance |

| Shopping | Kids’ activities |

| Entertainment | Self-care |

| Bills & Utilities | Side hustle expenses |

See where your money goes

BUDGT's category breakdown shows spending patterns clearly. Create categories that match your life and track what matters to you.

Savings Goals

Set aside money before calculating your daily budget:

| Feature | How It Works |

|---|---|

| Percentage-based | Save 10-20% automatically |

| Goal tracking | See progress visually |

| Comes off the top | Savings happens first |

| Adjustable anytime | Change as needs change |

Build savings automatically

BUDGT's Savings Mode sets aside money before calculating your daily budget. Save without thinking about it—your daily limit already accounts for your goals.

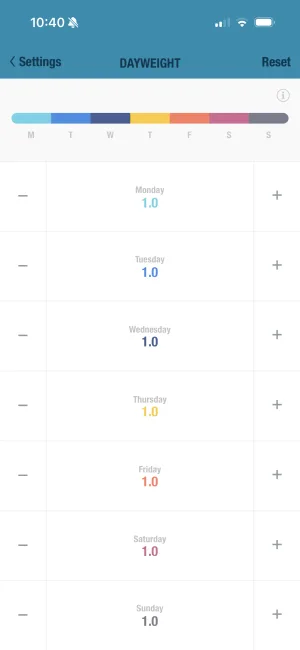

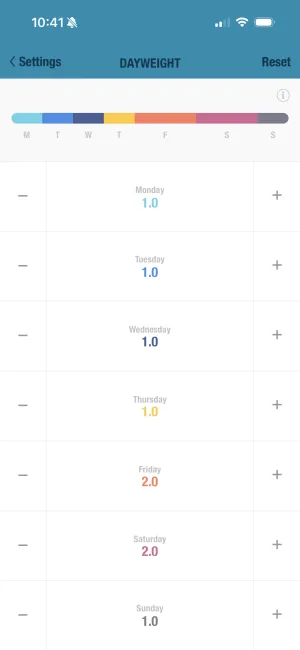

Day Weighting

Real life isn’t flat—some days you need more spending flexibility:

| Scenario | Solution |

|---|---|

| Busy weekdays, social weekends | Low weight Mon-Fri, high Sat-Sun |

| Meal prep Sundays | Higher weight Sunday for groceries |

| Payday flexibility | Higher weight around paydays |

| Minimalist weekdays | Very low weight Mon-Thu |

Flexible budgets for real life

BUDGT's day weighting lets you allocate more budget to weekends and less to weekdays—or whatever pattern fits your life.

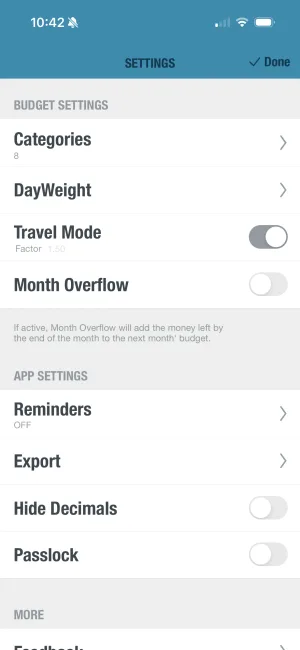

Travel Mode

Budget abroad without confusion:

| Feature | Benefit |

|---|---|

| Enter in local currency | No mental math required |

| Auto-conversion | Accurate home currency impact |

| Works offline | No international data needed |

| Clear tracking | Know exactly what trips cost |

Budget while traveling

BUDGT's Travel Mode lets you enter expenses in any currency. Track your spending abroad while always knowing the impact on your home budget.

Getting Started: The Minimalist Way

Download and Open

BUDGT works immediately—no account creation, no signup, no bank linking. Just open and start.

Set Your Monthly Budget

Enter your total monthly income and any fixed expenses (rent, bills, subscriptions). BUDGT calculates what's left for daily spending.

Set a Savings Goal (Optional)

If you want to save, set a percentage. This comes off the top before calculating your daily budget.

Start Tracking

Each purchase takes 10 seconds to log. Watch your daily limit update in real-time with color feedback.

Review Weekly

Spend 5 minutes weekly reviewing categories and trends. Adjust your approach as you learn your patterns.

How BUDGT Supports Frugal Living

Frugality isn’t about never spending—it’s about spending intentionally. BUDGT supports this mindset by:

Daily Mindfulness

| Action | Impact |

|---|---|

| Check daily limit each morning | Start day with financial awareness |

| Log each purchase | Creates pause before spending |

| See color change after spending | Immediate visual feedback |

| Review categories weekly | Understand patterns |

Intentional Spending

| Without BUDGT | With BUDGT |

|---|---|

| ”I think I can afford this" | "I have $42 left today" |

| "Where did my money go?” | Clear category breakdown |

| ”I’ll figure it out later” | Real-time tracking |

| Guilt after overspending | Confidence in decisions |

Sustainable Habits

| Complex App Approach | BUDGT Approach |

|---|---|

| Detailed budgets that need constant adjustment | Simple daily number that self-adjusts |

| Weekly hours reviewing reports | 2 minutes daily, 5 minutes weekly |

| Guilt-driven restriction | Awareness-driven choices |

| Burns out after months | Sustainable for years |

5 Tips to Maximize BUDGT

1. Check Your Daily Budget Every Morning

Make it part of your routine—like checking the weather. Knowing your number before you leave the house sets the tone for intentional spending.

2. Log Immediately (Not Later)

The moment you make a purchase, log it. Waiting until “later” leads to forgotten expenses and lost awareness. BUDGT’s quick entry makes this easy.

3. Use Notes for Context

Add quick notes like “birthday gift for mom” or “stress purchase.” When reviewing later, these notes reveal patterns you might otherwise miss.

4. Adjust Day Weights to Match Your Life

If you consistently overspend on weekends and underspend on weekdays, adjust your day weights. BUDGT should fit your life, not force you into a rigid pattern.

5. Review Categories Weekly

Spend 5 minutes each week looking at your category breakdown. Which categories surprise you? Where can you cut back? This awareness drives long-term change.

Who BUDGT Is Perfect For

| User Type | Why BUDGT Works |

|---|---|

| Minimalists | No unnecessary features or complexity |

| Privacy-conscious | 100% offline, no data sharing |

| Frugal lifestylers | Built for intentional spending |

| Busy professionals | 10-second logging, no maintenance |

| Feature-overwhelmed | Simple by design |

| Previous app quitters | Sustainable, not overwhelming |

The Minimalist Advantage

In a world of feature bloat and complexity, BUDGT proves that less is more.

| More Features | Better Design |

|---|---|

| More to learn | Less to learn, more to use |

| More distraction | More focus |

| More maintenance | Less maintenance |

| More abandonment | More consistency |

The best budgeting app isn’t the one with the most features—it’s the one you’ll actually use. And simplicity is what makes consistent use possible.

Take Control with BUDGT

If you’re serious about living a frugal lifestyle, saving more money, and mastering your budget, BUDGT is the tool you’ve been waiting for.

It’s minimal by design but powerful in impact—perfect for anyone looking to bring clarity, control, and calm to their personal finances.

Download BUDGT today and start budgeting better—one day, one dollar, one intentional choice at a time.

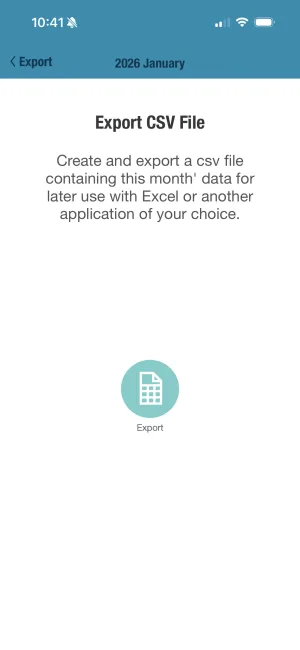

Export your data—it's yours

Need to analyze your spending in a spreadsheet? Export your full history to CSV anytime. Your data always belongs to you.

Frequently Asked Questions

What is the best way to start budgeting if I want to live frugally?

Start by tracking all your expenses manually for at least one month. Use a budgeting app like BUDGT to set a realistic monthly budget, categorize spending, and aim to spend less than you earn. Prioritize needs over wants and look for areas to cut back. The key is awareness—you can't optimize what you don't measure.

How can BUDGT help with frugal living?

BUDGT encourages intentional daily spending by showing how much you can afford to spend each day while staying within your monthly budget. It helps you avoid overspending, track your habits, and save consistently—perfect for anyone embracing a frugal lifestyle. The minimalist design means you spend time living, not managing complex software.

What's the easiest way to manage my expenses every day?

Manually recording your expenses with an app like BUDGT keeps you mindful and in control. BUDGT breaks your monthly budget into daily allowances and updates it in real time as you log your spending. The 10-second logging process fits into even the busiest day.

Can I save money consistently using BUDGT?

Yes. BUDGT includes a savings goal feature that lets you automatically reserve a percentage of your income each month. It subtracts that amount from your spending budget so you prioritize saving before spending. This "pay yourself first" approach is proven to build wealth over time.

What's the best budgeting method for personal finance beginners?

A simple monthly budget with daily limits is one of the most effective methods. BUDGT uses this approach, making it ideal for beginners who want to keep budgeting easy and actionable without being overwhelmed. Start simple, build consistency, then add complexity only if needed.

Is frugal living the same as being cheap?

No. Frugal living is about being mindful and strategic with your money—spending intentionally and avoiding waste. It's not about depriving yourself, but about making choices that align with your financial goals and values. Frugal people often spend more on things they truly value and less on things that don't matter.

How does BUDGT support travel and budgeting abroad?

BUDGT includes a travel mode that allows you to enter expenses in foreign currencies. It automatically converts them so you can stay on budget while traveling and still maintain a clear overview of your finances. Since BUDGT works 100% offline, you can track expenses anywhere—no international data required.

How can I stick to my monthly budget without feeling restricted?

With BUDGT's daily allowance and customizable day weighting, you can give yourself more flexibility on weekends or special occasions while staying within your monthly limits. This balance helps you stick to your budget long-term. The key is sustainable habits, not strict deprivation.

What are the benefits of tracking expenses manually?

Manual tracking makes you more aware of your spending habits and helps build stronger financial discipline. Research shows manual entry creates a "pause point" before spending that automatic imports can't replicate. Apps like BUDGT make manual tracking fast and simple while keeping you accountable every day.

Why is BUDGT's minimalist design better than feature-rich alternatives?

Complex apps with dozens of features often get abandoned because they're overwhelming. BUDGT focuses on what actually matters—knowing what you can spend today, where your money goes, and progress toward savings. This intentional simplicity means you'll actually use it consistently, which is the only thing that matters for financial success.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS