First-Time Buyer Mortgage UK: Complete Guide + Calculator (2026)

Buying your first home in the UK is one of the biggest financial decisions you’ll ever make. With average house prices around £270,000 and mortgage rates fluctuating, understanding your options as a first-time buyer is essential.

This guide covers everything you need to know about getting a mortgage as a first-time buyer in 2026—from deposit requirements and stamp duty relief to calculating how much you can actually afford.

How Much Can You Borrow as a First-Time Buyer?

UK lenders typically offer 4-4.5 times your annual salary. Here’s what that looks like in practice:

| Annual Salary | Typical Max Mortgage | With Partner (Combined) |

|---|---|---|

| £30,000 | £120,000-£135,000 | £240,000-£270,000 |

| £40,000 | £160,000-£180,000 | £320,000-£360,000 |

| £50,000 | £200,000-£225,000 | £400,000-£450,000 |

| £60,000 | £240,000-£270,000 | £480,000-£540,000 |

Important: These are maximum borrowing figures. What you can borrow and what you should borrow are different things. Lenders also consider your outgoings, debts, and lifestyle expenses.

First-Time Buyer Deposit Requirements

The bigger your deposit, the better your mortgage rate. Here’s what to aim for:

| Deposit | LTV Ratio | Rate Difference | Notes |

|---|---|---|---|

| 5% | 95% LTV | Highest rates | Minimum for most lenders |

| 10% | 90% LTV | Better rates | Good starting point |

| 15% | 85% LTV | Improved rates | Sweet spot for many |

| 20% | 80% LTV | Competitive rates | Access to best deals |

| 25%+ | 75% LTV | Lowest rates | Premium tier products |

What Does This Mean in Real Numbers?

For an average UK home priced at £270,000:

Deposit Amounts by Percentage

A larger deposit doesn’t just get you better rates—it also means borrowing less, so your monthly payments are lower and you pay less interest overall.

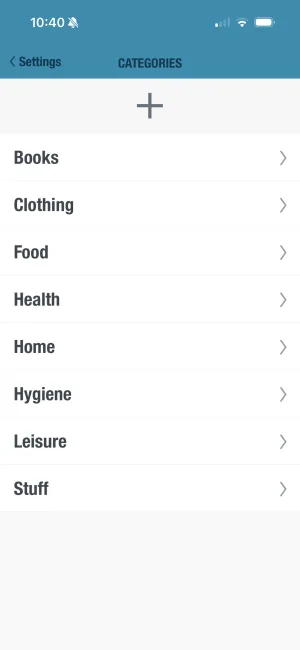

Save for your deposit with BUDGT

Set a savings goal and see your progress daily. BUDGT's Savings Mode reserves money for your house deposit before calculating what you can spend.

Stamp Duty for First-Time Buyers (2026)

First-time buyers get significant stamp duty relief in England and Northern Ireland:

| Property Price | First-Time Buyer Rate | Standard Rate |

|---|---|---|

| Up to £425,000 | £0 | £0-£6,250 |

| £425,001-£625,000 | 5% on amount over £425,000 | 5% on £250,001-£925,000 |

| Over £625,000 | No relief (standard rates apply) | Standard rates |

Stamp Duty Examples for First-Time Buyers

| Property Price | Stamp Duty Owed |

|---|---|

| £250,000 | £0 |

| £350,000 | £0 |

| £425,000 | £0 |

| £500,000 | £3,750 |

| £600,000 | £8,750 |

Note: Properties over £625,000 don’t qualify for first-time buyer relief at all. You’d pay the full standard rates.

Step-by-Step: Getting Your First Mortgage

Check Your Credit Score

Get your free credit report from Experian, Equifax, or TransUnion. Fix any errors. Good credit (700+) gets better rates.

Save Your Deposit

Aim for at least 10% if possible. Use a Lifetime ISA for the 25% government bonus (up to £1,000/year).

Calculate What You Can Afford

Use our UK mortgage calculator to see monthly payments. Remember to budget for bills, council tax, and maintenance.

Get an Agreement in Principle

A lender's AIP shows sellers you're serious. Apply online or through a broker. Usually lasts 30-90 days.

Find Your Property

Start house hunting with your AIP in hand. Stay within your budget, not the maximum the bank will lend.

Make an Offer

When you find the right home, make your offer. Once accepted, your solicitor and lender take over.

Fixed vs Variable Rate Mortgages

Most first-time buyers choose fixed-rate mortgages for payment certainty. Here’s the comparison:

| Type | How It Works | Best For |

|---|---|---|

| 2-Year Fixed | Rate locked for 2 years | Expecting rates to drop, comfortable remortgaging |

| 5-Year Fixed | Rate locked for 5 years | Want certainty, protection against rate rises |

| 10-Year Fixed | Rate locked for 10 years | Maximum stability, premium pricing |

| Tracker | Follows Bank of England base rate | Expecting rates to fall, comfortable with changes |

| Variable | Lender can change rate | Short-term only, post-fix period |

2026 Recommendation for First-Time Buyers

In the current rate environment (2026), many first-time buyers opt for 5-year fixed rates. This provides:

- Protection against potential rate increases

- Time to build equity before remortgaging

- Predictable monthly payments for budgeting

However, your situation may differ. Consult a mortgage broker for personalized advice.

Track your monthly housing costs

Log your mortgage payment, council tax, and bills in BUDGT to see exactly what homeownership costs you each month.

Additional Costs Beyond Your Mortgage

Don’t forget these expenses when budgeting for your first home:

| Cost | Typical Amount | Notes |

|---|---|---|

| Solicitor/Conveyancer | £1,000-£2,000 | Legal fees for the purchase |

| Survey | £250-£700 | Basic to full structural |

| Mortgage Arrangement Fee | £0-£1,000+ | Can be added to mortgage |

| Valuation Fee | £150-£400 | Often free with some lenders |

| Moving Costs | £300-£1,000+ | Van hire or removal company |

| Initial Furnishing | Variable | Basics for a new home |

Total additional costs: Budget £3,000-£5,000 minimum on top of your deposit.

Government Help for First-Time Buyers

Lifetime ISA (LISA)

The main current government support for first-time buyers:

| Feature | Details |

|---|---|

| Annual Limit | £4,000 |

| Government Bonus | 25% (up to £1,000/year) |

| Property Limit | Up to £450,000 |

| Age Requirement | Open between 18-39 |

Example: Save £4,000/year for 5 years = £20,000 + £5,000 bonus = £25,000 toward your deposit.

First Homes Scheme

Some new-build properties are sold at 30-50% discount to first-time buyers and key workers. Availability is limited and location-dependent.

Shared Ownership

Buy a share (25-75%) of a home and pay rent on the rest. Allows you to buy with a smaller deposit. Available on some new-build and resale properties.

How Much Should You Spend on a Mortgage?

Just because you can borrow a certain amount doesn’t mean you should. Financial experts recommend:

| Approach | Recommendation |

|---|---|

| Housing Costs (Mortgage + Bills) | No more than 35% of take-home pay |

| Mortgage Only | No more than 28% of take-home pay |

| Emergency Buffer | Keep 3-6 months expenses saved |

Example: £50,000 Salary (£3,300 take-home)

| Expense | Maximum Recommended |

|---|---|

| Mortgage payment | £924/month |

| Total housing (incl. bills) | £1,155/month |

This ensures you have money left for living, saving, and emergencies.

Know exactly what you can spend each day

After setting your mortgage and bills, BUDGT shows your safe daily spending limit. Keep your housing costs in check while enjoying life.

Common First-Time Buyer Mistakes

| Mistake | Why It Hurts | What to Do Instead |

|---|---|---|

| Borrowing the maximum | Leaves no room for rate rises or life changes | Borrow 80-90% of your max |

| Ignoring additional costs | Short on cash at completion | Budget £5,000+ beyond deposit |

| Skipping the survey | Hidden problems become your problem | Always get at least a basic survey |

| Not shopping around | Missing better deals | Compare 5+ lenders or use a broker |

| Forgetting ongoing costs | Council tax, bills, maintenance add up | Budget housing at 35% of income max |

Your First-Time Buyer Checklist

6-12 Months Before

- Check and improve your credit score

- Open a Lifetime ISA (if under 40)

- Start saving aggressively for deposit

- Track your spending to prove affordability

3-6 Months Before

- Calculate how much you can afford

- Get an Agreement in Principle

- Research areas and property types

- Find a solicitor/conveyancer

When You Find a Property

- Make an offer

- Submit full mortgage application

- Book survey

- Review contract and complete legal process

Calculate Your Mortgage Payment

Use our free UK mortgage calculator to see exactly what your monthly payments would be based on:

- Your property price and deposit

- Current UK interest rates

- Your preferred mortgage term

The calculator shows principal and interest payments, plus estimates for property taxes and insurance.

The Bottom Line

Buying your first home in the UK is achievable with the right preparation. Start by:

- Building your deposit — aim for 10%+ if possible

- Understanding your borrowing power — 4-4.5x salary typically

- Using first-time buyer benefits — stamp duty relief saves thousands

- Staying within your means — don’t max out what the bank offers

The UK property market can be competitive, but first-time buyers have real advantages. Stamp duty relief alone can save you over £10,000 compared to standard buyers.

Use our mortgage calculator to run the numbers, start saving with a Lifetime ISA for the bonus, and get that Agreement in Principle before you start viewing. Your first home is closer than you think.

Planning to buy your first home? BUDGT helps you save for your deposit by showing exactly what you can spend each day. Track your progress, hit your savings goals, and get on the property ladder faster.

Frequently Asked Questions

How much deposit do I need for my first home in the UK?

The minimum deposit for most UK mortgages is 5% of the property price. For a £270,000 home (the UK average), that's £13,500. However, 10-20% deposits get you better interest rates. Lenders see larger deposits as lower risk, so they offer more competitive rates.

Do first-time buyers pay stamp duty in the UK?

First-time buyers in the UK pay no stamp duty on properties up to £425,000. For properties between £425,001 and £625,000, you only pay 5% on the portion above £425,000. Properties over £625,000 don't qualify for first-time buyer relief—you pay standard rates on the full amount.

What is the average mortgage rate for first-time buyers in the UK?

As of early 2026, typical UK mortgage rates are 4-5% for fixed-rate deals. Your actual rate depends on your deposit size, credit score, and the deal length. Two-year fixes are usually slightly cheaper than five-year fixes, but five-year deals offer longer payment certainty.

How much can I borrow for my first mortgage in the UK?

UK lenders typically offer 4-4.5 times your annual salary. With a £50,000 salary, you could borrow £200,000-£225,000. Joint applicants can combine salaries. Some lenders offer up to 5.5x for high earners or with guarantor schemes, but these are less common.

What is a mortgage agreement in principle?

An Agreement in Principle (AIP) is a lender's statement saying they'd likely lend you a specific amount based on initial checks. It's not a guarantee, but it shows sellers you're a serious buyer. Most AIPs last 30-90 days. Getting one before house hunting is strongly recommended.

Should I get a 2-year or 5-year fixed mortgage?

A 2-year fix typically has lower rates but more frequent remortgaging costs and uncertainty. A 5-year fix costs slightly more but gives payment certainty and protection against rate rises. In 2026's uncertain rate environment, many first-time buyers prefer 5-year fixes for peace of mind.

What fees do first-time buyers pay when buying a house?

Beyond your deposit, expect to pay: solicitor/conveyancer fees (£1,000-£2,000), survey costs (£250-£700), mortgage arrangement fees (£0-£1,000+), moving costs (£300-£1,000+). Budget £3,000-£5,000 minimum for these costs on top of your deposit.

Is Help to Buy still available for first-time buyers?

The Help to Buy equity loan scheme closed to new applicants in October 2022. However, the Lifetime ISA remains available—you can save up to £4,000/year and receive a 25% government bonus (up to £1,000/year) toward your first home deposit. This is currently the main government support for first-time buyers.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS