The Complete Beginner's Guide to Personal Budgeting: How to Create, Manage, and Stick to a Budget

Money stress affects nearly everyone at some point. According to financial surveys, 78% of Americans live paycheck to paycheck, and the top source of stress isn’t work or relationships—it’s money.

The solution isn’t earning more (though that helps). The solution is knowing where your money goes. That’s what budgeting does.

This guide will take you from complete beginner to confident budgeter. No spreadsheet wizardry required. No financial degree needed. Just simple, practical steps you can start today.

What Is a Personal Budget (Really)?

A budget is simply a plan for your money. It answers one question: Where should each dollar go?

| Without a Budget | With a Budget |

|---|---|

| ”Where did my paycheck go?” | Know exactly where every dollar went |

| Surprised by overdrafts | Anticipate upcoming expenses |

| Guilt when spending | Permission to spend (within limits) |

| Reactive to financial emergencies | Prepared with emergency fund |

| Money controls you | You control your money |

What a Budget Is NOT

Let’s clear up some misconceptions:

| Myth | Reality |

|---|---|

| ”Budgeting means I can’t spend money” | Budgeting means you decide how to spend money |

| ”I don’t earn enough to budget” | Low income makes budgeting MORE important, not less |

| ”Budgets are too restrictive” | Good budgets include fun money and flexibility |

| ”I need spreadsheets and math” | Apps like BUDGT do all calculations automatically |

| ”Budgeting takes hours” | 2-3 minutes per day once established |

Why Most People Fail at Budgeting (And How to Avoid It)

Before we start, understand why budgets fail so you can avoid these traps:

| Failure Pattern | Why It Happens | How to Avoid It |

|---|---|---|

| Too complicated | 30 categories, detailed projections | Start with basics: income, fixed costs, daily spending |

| Too restrictive | Zero fun money, unrealistic limits | Include guilt-free spending in your budget |

| Set and forget | Make budget once, never check it | Daily 30-second check, weekly 5-minute review |

| Perfection obsession | One overspend = “I failed” | Expect slip-ups; success is getting back on track |

| Wrong tools | Spreadsheets that require effort | Use apps that make tracking effortless |

The key insight: A simple budget you use beats a perfect budget you abandon.

How to Create Your First Budget: Step-by-Step

Calculate Your Monthly Income

Add up all money coming in each month: salary (after taxes), side gig income, child support, etc. Use the lower number if income varies.

List Fixed Monthly Expenses

Write down every predictable monthly cost: rent/mortgage, utilities, insurance, subscriptions, loan payments. These don't change much month to month.

Calculate Your Flexible Budget

Subtract fixed expenses from income. What's left is your 'flexible' money for food, gas, entertainment, and savings.

Divide by Days in the Month

Take your flexible budget and divide by 30 (or days remaining). This is your daily spending limit—the most useful number in your budget.

Set a Savings Goal

Decide what percentage to save (start with 10% if 20% feels impossible). Subtract this from flexible budget BEFORE calculating daily limit.

Start Tracking

Log every expense as it happens. Watch your daily limit update in real-time. Adjust based on what you learn in month one.

Example: Building Your First Budget

Try the calculator below with your own numbers. We’ve pre-filled a typical example—replace the values with your actual income and expenses:

Calculate Your Daily Budget

Salary + side gigs + any other income

Your biggest fixed cost

Or transit pass if no car

All recurring monthly charges

Minimum payments on all debt

Pay yourself first

Enter your numbers above - results update automatically

Note: This uses 30 days as an average month. Actual months vary from 28-31 days—BUDGT adjusts automatically based on the current month.

Your daily limit covers groceries, gas, dining out, entertainment, clothing—everything that isn’t a fixed monthly expense. This single number tells you if you can afford a purchase without math or guilt.

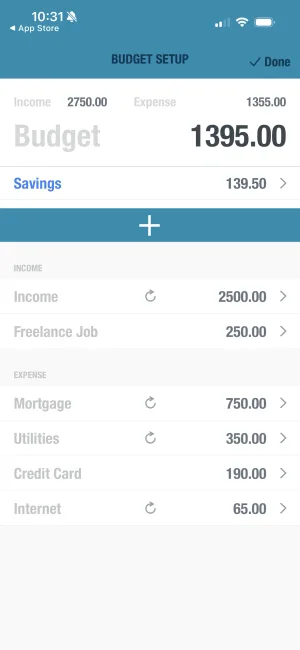

Set up your budget in minutes

BUDGT calculates your daily spending limit automatically. Enter your income and fixed expenses once, and you'll know exactly what you can spend each day.

Understanding Budgeting Methods: Which Is Right for You?

There’s no single “best” method. Here’s how popular approaches compare:

| Method | How It Works | Best For | Complexity |

|---|---|---|---|

| Daily Budget | Income minus expenses divided by days = daily limit | Beginners, busy people | Very simple |

| 50/30/20 | 50% needs, 30% wants, 20% savings | People who like guidelines | Simple |

| Zero-Based | Every dollar assigned to a category until $0 left | Detail-oriented planners | Moderate |

| Envelope System | Cash in physical envelopes per category | Chronic overspenders | Moderate |

| Pay Yourself First | Save first, spend what’s left | Savings-focused | Simple |

Why We Recommend the Daily Budget Method

For beginners, the daily budget method has key advantages:

| Feature | Daily Budget | Traditional Categories |

|---|---|---|

| Numbers to track | 1 (daily limit) | 10-30 categories |

| Decision making | ”Can I afford this today?" | "Which category? How much left?” |

| Overspending recovery | Tomorrow’s limit adjusts | Manual reallocation needed |

| Time required | 2-3 min/day | 15-30 min/week |

| Mental load | Minimal | Significant |

The daily budget approach answers the only question that matters: “Can I buy this?”

One number tells you everything

Instead of tracking dozens of categories, BUDGT shows you one number: what you can spend today. Blue means safe, yellow means careful, orange means stop.

How to Track Expenses Effectively

Tracking is where budgets succeed or fail. Here’s how to make it work:

The Golden Rule: Track Immediately

| Timing | Success Rate | Why |

|---|---|---|

| At point of purchase | 95%+ | Can’t forget what just happened |

| End of day | 70% | Miss small purchases, estimation errors |

| End of week | 30% | Major gaps, pure guessing |

| ”When I remember” | Under 10% | Guaranteed failure |

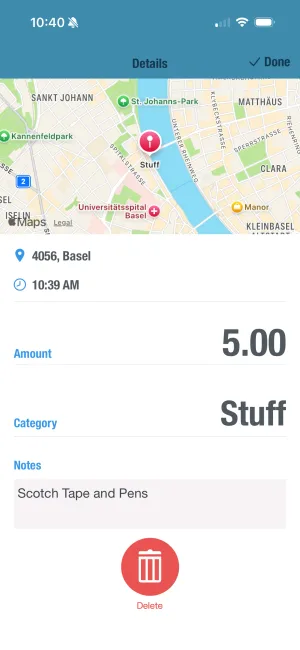

The 10-second habit: Log every expense the moment you make it.

What to Track

| Track | Examples |

|---|---|

| Every purchase | Coffee, groceries, gas, online orders |

| Cash spending | Often forgotten—especially dangerous |

| Small amounts | $3 here, $5 there adds up to hundreds |

| Subscriptions | Monthly charges you might forget |

What NOT to Track (It’s Already in Fixed Costs)

| Don’t Track Daily | Why |

|---|---|

| Rent/mortgage | Already deducted from your budget |

| Utility bills | Already accounted for |

| Loan payments | Already subtracted from income |

| Insurance | Part of fixed expenses |

Track expenses in 10 seconds

BUDGT's quick entry makes logging effortless. Tap, enter amount, add optional category—done. Your daily limit updates instantly so you always know where you stand.

Building the Daily Budget Habit

Habits make or break budgets. Here’s how to build consistency:

The Daily Budget Routine

| Time | Action | Duration |

|---|---|---|

| Morning | Check your daily limit | 30 seconds |

| After each purchase | Log the expense | 10 seconds |

| Evening | Quick review of day’s spending | 1 minute |

Weekly Check-In (5 Minutes)

| Review | Questions to Ask |

|---|---|

| Spending patterns | What categories surprised me? |

| Daily limit trend | Am I consistently over or under? |

| Upcoming expenses | Anything unusual next week? |

| Adjustments needed | Should I change my approach? |

Monthly Review (15 Minutes)

| Assess | Action |

|---|---|

| Total spent vs. planned | Were you within budget overall? |

| Category breakdown | Where did most money go? |

| Savings progress | Did you hit your savings goal? |

| Next month prep | Any unusual expenses coming up? |

See your complete monthly picture

BUDGT's monthly view shows income, expenses, and remaining budget at a glance. Review your progress in seconds, not hours.

Handling Common Budget Challenges

Every budgeter faces obstacles. Here’s how to handle them:

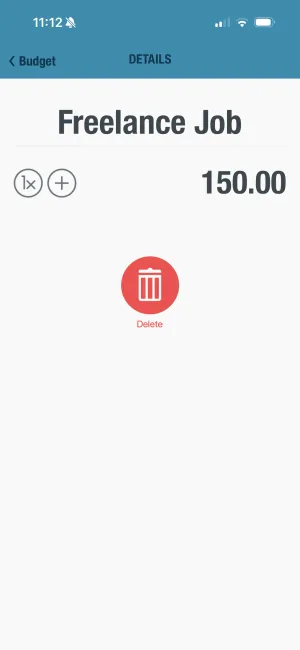

Challenge 1: Irregular Income

| Situation | Solution |

|---|---|

| Freelance/gig income | Budget based on lowest expected month |

| Commission-based | Use base salary for budget, treat commission as bonus |

| Seasonal work | Save extra during high months for low months |

Challenge 2: Unexpected Expenses

| Expense Type | Strategy |

|---|---|

| Car repairs | Build repair fund ($50-100/month) |

| Medical bills | Build health fund + payment plans |

| Home maintenance | 1% of home value annually |

| Emergency | Emergency fund covers the rest |

Challenge 3: Overspending

| Pattern | Fix |

|---|---|

| End-of-month binge | Use daily limits that adjust down if you overspend |

| Emotional spending | Wait 24 hours before non-essential purchases |

| Social pressure | Budget for social activities specifically |

| Online shopping | Remove saved cards, add friction |

Challenge 4: Partner Disagreements

| Issue | Solution |

|---|---|

| Different spending priorities | Agree on shared goals, allow individual “fun money” |

| One person tracks, one doesn’t | Use separate accounts for daily spending |

| Big purchase disagreements | Set threshold for discussing purchases ($50-100+) |

Visual feedback prevents overspending

BUDGT's color system gives instant awareness. Watch your daily limit change from blue to yellow to orange as you spend. You'll naturally slow down when you see orange.

Budgeting at Different Life Stages

Your budget needs evolve. Here’s what to prioritize:

Students & Young Adults (18-25)

| Priority | Why |

|---|---|

| Avoid/minimize debt | Student loans compound fast |

| Build small emergency fund | $500-1000 prevents card debt |

| Start tracking habit | Easier to build now than later |

| Live below your means | Lifestyle inflation is hard to reverse |

Early Career (25-35)

| Priority | Why |

|---|---|

| Pay off high-interest debt | Returns 15-25% risk-free |

| Build 3-6 month emergency fund | Job security isn’t guaranteed |

| Start retirement savings | Time is your biggest asset |

| Avoid lifestyle inflation | Save raises, don’t spend them |

Family Years (30-50)

| Priority | Why |

|---|---|

| Childcare/education costs | Plan ahead—these are massive |

| Insurance coverage | Protect your family |

| Maintain emergency fund | More people depending on you |

| Balance present/future | Kids don’t need everything |

Pre-Retirement (50-65)

| Priority | Why |

|---|---|

| Maximize retirement savings | Catch-up contributions available |

| Pay off mortgage | Reduce fixed costs before retirement |

| Plan healthcare costs | Biggest expense in retirement |

| Downsize if needed | Less house = less expense |

Category Breakdown: Where Does Money Actually Go?

Understanding typical spending helps you evaluate your own:

| Category | US Average | Recommended Range |

|---|---|---|

| Housing | 33% | 25-30% |

| Transportation | 17% | 10-15% |

| Food (home + dining) | 13% | 10-15% |

| Insurance/Healthcare | 8% | 5-10% |

| Entertainment | 5% | 5-10% |

| Savings | 5% | 15-20% |

| Other | 19% | Varies |

If you’re significantly above average in any category, that’s worth examining.

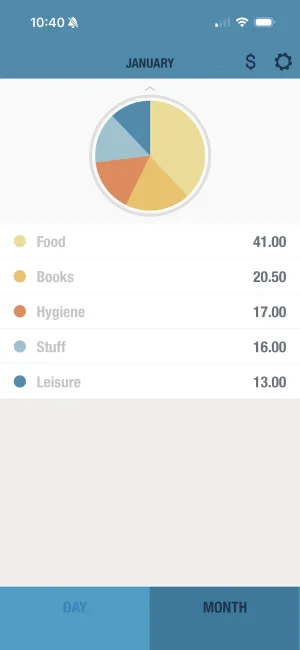

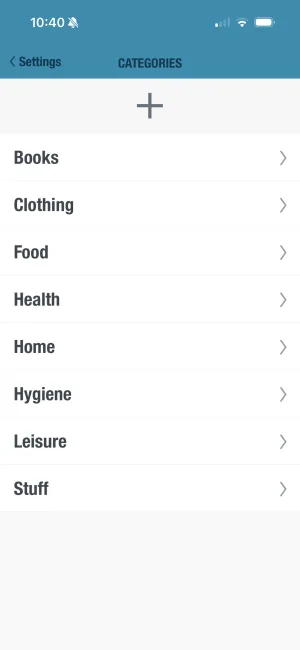

See where your money goes

BUDGT's category breakdown shows your spending patterns clearly. Identify where money leaks out and make informed decisions about where to cut.

The Power of Saving First

The most important budget habit: Pay yourself first.

| Approach | Result |

|---|---|

| ”I’ll save what’s left” | Usually $0 left at month end |

| ”Save first, spend what’s left” | Guaranteed savings every month |

How to Implement Pay Yourself First

- Decide your savings percentage (start with 10% if 20% feels impossible)

- Subtract savings from your flexible budget before calculating daily limit

- Automate transfers on payday if possible

- Treat savings as non-negotiable like rent

With BUDGT, you set your savings goal once. The app automatically reserves that amount before showing you your daily spending limit.

Build savings automatically

BUDGT's Savings Mode reserves your savings goal before calculating your daily budget. You'll save consistently because the money is 'gone' before you can spend it.

10 Tips for Budget Success

1. Start Today, Not Monday

The best time to start budgeting was years ago. The second best time is today. Don’t wait for the “perfect” moment.

2. Keep It Simple

Start with income minus fixed costs divided by days. Add complexity only after mastering basics.

3. Log Immediately

Every expense, as it happens. Waiting guarantees forgotten purchases.

4. Check Your Number Daily

Know your daily limit before leaving the house. It takes 30 seconds and changes behavior.

5. Allow Fun Money

Budgets without enjoyment get abandoned. Include guilt-free spending.

6. Expect Imperfection

You’ll overspend sometimes. Success is getting back on track, not never slipping.

7. Review Weekly

Five minutes prevents month-end surprises. Notice patterns early.

8. Automate Savings

Remove the decision. Automatic transfers mean consistent saving.

9. Celebrate Wins

Hit your savings goal? Stayed on budget all week? Acknowledge progress.

10. Use the Right Tools

Life is easier with the right tools. BUDGT makes tracking effortless.

Getting Started: Your First Week

Day 1: Download BUDGT

Set up takes 2 minutes. Enter your income and main fixed expenses. See your daily limit immediately.

Day 2-3: Track Everything

Log every expense, no matter how small. Don't change behavior yet—just observe.

Day 4-5: Review Patterns

What surprised you? Where did money go that you didn't expect?

Day 6-7: Adjust

Now that you see reality, adjust your daily limit or identify cuts. Set a savings goal.

Week 2+: Build the Habit

Morning check, immediate logging, evening glance. It becomes automatic within 30 days.

Your Budget, Your Life

Personal budgeting isn’t about restriction—it’s about intention. When you know where your money goes, you can direct it toward what matters most to you.

| Without a Budget | With a Budget |

|---|---|

| Money disappears mysteriously | Every dollar has a purpose |

| Stress about finances | Confidence in your situation |

| Goals remain dreams | Goals become achievable |

| React to emergencies | Prepared for surprises |

| Feel out of control | Feel empowered |

You don’t need to be perfect. You don’t need complex spreadsheets. You just need to start—and keep going.

Download BUDGT today and take the first step toward financial clarity. In 30 days, you’ll wonder how you ever lived without knowing your daily spending limit.

Export your data anytime

Your budget data belongs to you. Export to CSV anytime for deeper analysis or records. BUDGT works 100% offline—your finances stay private.

Frequently Asked Questions

How do I start a personal budget with no experience?

Start by tracking every expense for one week to understand where your money goes. Then list your monthly income, subtract fixed costs (rent, utilities, subscriptions), and divide what's left by the days in the month. This gives you a daily spending limit. Apps like BUDGT automate this calculation and show you exactly what you can spend each day.

What's the easiest budgeting method for beginners?

The daily budget method is simplest for beginners. Instead of managing dozens of categories, you know one number - what you can spend today. BUDGT uses this approach, taking your monthly income minus fixed expenses and showing you a real-time daily limit. If you underspend, the extra rolls forward to tomorrow.

How much should I save each month as a beginner?

Start with 10% of your income if 20% feels impossible. Even $50/month builds habits that matter more than the amount. The key is consistency. As your income grows or expenses decrease, gradually increase your savings rate. Many people start at 5-10% and work up to 20% over a year.

What if I don't earn enough to budget?

Budgeting is most valuable when money is tight because it prevents waste. Even on a low income, tracking shows where small amounts leak out - $5 here, $10 there. Many people discover $100-200/month in unnecessary spending they didn't realize they were making. That money can build an emergency fund instead.

How do I stick to a budget without feeling deprived?

Build small rewards into your budget. Allow yourself "fun money" - even $20-50/month for guilt-free spending. Focus on what you're gaining (security, goals, freedom) rather than what you're giving up. The daily budget approach helps because you're not saying "no forever" - just "not today if it means going into the red."

Do I need an emergency fund before budgeting?

You can build both simultaneously. Start budgeting immediately and allocate a small amount toward emergency savings each month. Aim for $500-1000 initially to cover minor emergencies, then work toward 3-6 months of expenses over time. Having even a small emergency fund prevents budget derailment when surprises happen.

How often should I check my budget?

Check your daily spending limit each morning (30 seconds). Log expenses immediately after purchases (10 seconds each). Do a weekly review (5 minutes) to see patterns. Monthly, do a full review (15 minutes) to assess progress and adjust for the next month. This totals about 30 minutes per month.

What's the biggest mistake budgeting beginners make?

Starting too complicated. People create 20+ categories, try to predict every expense, and burn out within weeks. Start with just income, fixed costs, and daily spending. Add complexity only after you've maintained the basics for 2-3 months. Simple systems you actually use beat complex systems you abandon.

Should I use cash, cards, or apps for budgeting?

Use whatever you'll actually track. Cash envelopes work for some people but are inconvenient for online purchases. Cards are convenient but easy to overspend. Apps like BUDGT work with any payment method - you log the expense regardless of how you paid. The best method is the one you'll consistently use.

How long until budgeting becomes a habit?

Most people need 30-60 days of consistent tracking before it feels automatic. The first two weeks are hardest. After a month, you'll naturally check your daily limit. After three months, you'll feel uncomfortable NOT knowing where you stand. The key is logging expenses immediately, not waiting until "later."

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS