How to Track Your Spending (5 Simple Methods That Actually Work)

How to Track Your Spending in 2026: A Complete Guide

The best way to track your spending is to log every purchase as you make it using a simple app or notebook. Choose one method (daily check-in, weekly review, or envelope system), record amount and category for each expense, and review your totals weekly. Start with just 2 minutes per day—that’s enough to build awareness and reduce unnecessary spending by 10-15%.

If you’ve ever reached the end of the month wondering where all your money went, you’re not alone. Studies show that most people underestimate their spending by 20-40%—and that gap between perception and reality is exactly why so many budgets fail.

The good news? Tracking your spending is one of the simplest, most effective ways to take control of your finances. And in 2026, with the right approach and tools, it’s easier than ever to build this habit without drowning in spreadsheets or complicated apps.

This guide will show you exactly how to track your spending in a way that fits your life—whether you have five minutes a day or prefer a weekly check-in. Let’s turn your financial awareness from a vague intention into a concrete habit.

Why Tracking Your Spending Actually Matters

Before diving into the how, let’s talk about the why. Understanding the benefits will help you stay motivated when the initial enthusiasm fades.

The Awareness Effect

Simply tracking your spending—without changing anything else—typically reduces unnecessary purchases by 10-15%. This isn’t magic; it’s psychology. When you know you’ll have to record a purchase, you naturally pause before buying. That moment of reflection is often all it takes to skip the impulse buy.

Finding Your Money Leaks

Most people have spending “leaks”—small, recurring expenses that add up to surprisingly large amounts. That daily coffee shop habit? Streaming services you forgot you had? Subscription boxes gathering dust? Tracking reveals these leaks so you can decide if they’re worth keeping.

Building Financial Confidence

There’s a particular kind of stress that comes from not knowing where you stand financially. Tracking eliminates that uncertainty. When you know exactly what you’ve spent and what you have left, you can make purchases confidently instead of with a vague sense of guilt.

Making Better Decisions

With spending data, you can make informed choices about your money. Maybe you discover you’re spending more on food delivery than you realized—and you’d rather put that money toward a vacation fund. Without tracking, you’d never have the information to make that trade-off consciously.

The 5 Best Methods to Track Your Spending in 2026

Not everyone tracks the same way, and that’s perfectly fine. Here are five proven methods, from simplest to most detailed. Pick the one that matches your personality and lifestyle.

| Method | Time Required | Best For | Complexity |

|---|---|---|---|

| Daily Check-In | 2 min/day | Beginners, habit builders | Low |

| Envelope System | 15 min setup + daily | Visual thinkers, overspenders | Medium |

| Weekly Review | 15 min/week | Busy schedules | Low |

| Zero-Based Budget | 30+ min/month | Detail-oriented planners | High |

| 50/30/20 Framework | 10 min setup + weekly | Structure without micromanaging | Low |

Method 1: The Daily Check-In (2 Minutes/Day)

Best for: People who want minimal friction and maximum awareness

This is the simplest approach: at the end of each day, spend two minutes recording what you spent. No categories, no analysis—just a quick log.

How to do it:

- Set a daily reminder (after dinner works well)

- Open your tracking app or notebook

- Record each purchase with amount and a brief description

- Done

Why it works: The daily habit keeps spending top-of-mind without overwhelming you. Most people find that this minimal tracking is enough to significantly improve their financial awareness.

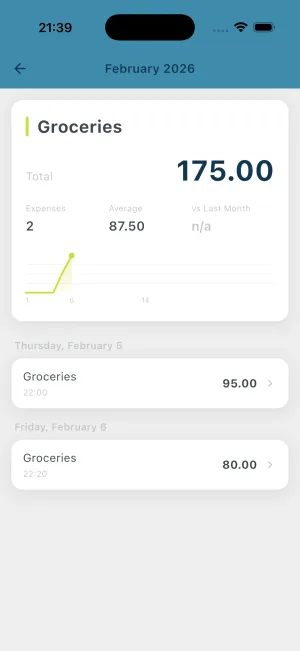

Pro tip: Use an app like BUDGT that shows your remaining daily budget at a glance. When you can see “I have $47 left today” in blue (on track) or red (over budget), the feedback is immediate and motivating.

Watch your spending status change through the day

BUDGT's color-coded feedback shows your progress as you spend. Blue means on track, yellow means mindful, orange means slow down. Real-time awareness builds better habits.

Method 2: The Envelope System (Digital or Physical)

Best for: Visual thinkers who struggle with abstract numbers

The envelope method divides your monthly budget into categories, each with a set amount. When an envelope is empty, you stop spending in that category until next month.

How to do it:

- Determine your monthly income after bills

- Create envelopes for variable expenses (groceries, entertainment, dining out, etc.)

- Allocate specific amounts to each envelope

- Track spending within each category

- When an envelope runs out, you’re done spending there

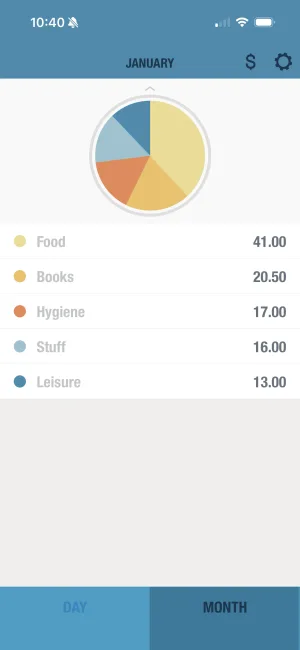

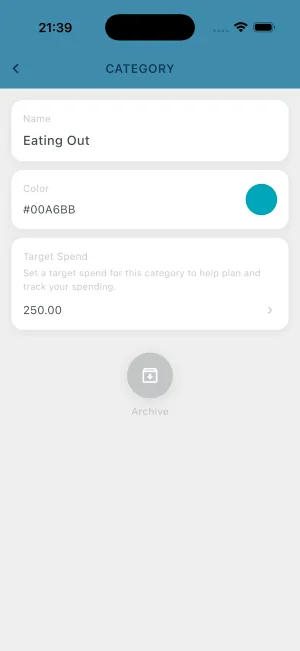

Digital version: Many apps simulate this system digitally. BUDGT’s category feature with color-coded feedback (blue for on track, orange for close, red for over) gives you the same visual clarity without physical cash.

Why it works: Categories create natural boundaries. It’s easier to say “my entertainment budget is empty” than “I should probably stop spending.”

Method 3: The Weekly Review (15 Minutes/Week)

Best for: Busy people who can’t track daily but want meaningful insight

Instead of daily tracking, batch your expense logging into a weekly session. Review your bank and credit card statements, categorize purchases, and assess your progress.

How to do it:

- Choose a consistent day/time (Sunday evening works well)

- Open your bank app and tracking tool side by side

- Log each transaction from the past week

- Review totals by category

- Adjust next week’s behavior if needed

Why it works: Weekly tracking is sustainable for people with unpredictable schedules. The key is consistency—same time, same process, every week.

Caution: If you tend to forget details, daily tracking may work better. A week’s worth of “what was that $23 charge?” can be frustrating.

Method 4: The Zero-Based Budget

Best for: Detail-oriented people who want complete control

Zero-based budgeting means assigning every dollar a job before you spend it. Your income minus your planned spending should equal zero.

How to do it:

- List your monthly income

- Assign amounts to every category (bills, savings, groceries, etc.)

- Track each expense against its category

- Adjust categories as real spending reveals your actual needs

- “Zero out” at month end—all money accounted for

Why it works: This method eliminates the vague “leftover money” that often gets frittered away. Every dollar has a purpose.

Challenge: Requires more setup and ongoing attention. Best for people who enjoy financial planning as an activity.

Method 5: The 50/30/20 Framework

Best for: People who want structure without micromanaging

This popular framework divides after-tax income into three buckets:

- 50% for needs (rent, utilities, groceries, insurance)

- 30% for wants (entertainment, dining out, hobbies)

- 20% for savings and debt payoff

How to do it:

- Calculate your after-tax monthly income

- Determine the 50/30/20 amounts

- Track spending by bucket (not detailed categories)

- Adjust if you’re consistently over in one area

Why it works: Simple enough to maintain, structured enough to ensure you’re saving. The broad categories reduce tracking fatigue.

Choosing Your Tracking Tool

The best tracking tool is the one you’ll actually use. Here’s what to consider:

Paper and Pen

Pros: No app to learn, tactile satisfaction, works offline Cons: Easy to lose, hard to analyze trends, no automatic calculations Best for: People who retain information better when writing by hand

Spreadsheets

Pros: Infinitely customizable, free, good for analysis Cons: Requires setup, manual entry, easy to abandon Best for: People comfortable with Excel/Sheets who enjoy building systems

Banking App Categorization

Pros: Automatic tracking, no manual entry Cons: Categorization often inaccurate, only shows what’s already spent (no budget view) Best for: People who want zero effort (but accept less insight)

Dedicated Budget Apps

Pros: Purpose-built for tracking, often include budgeting features, mobile-friendly Cons: Learning curve, some require bank linking Best for: Most people who want meaningful tracking with minimal friction

When choosing an app, consider whether you want something simple or comprehensive. Apps that require bank linking and sync every transaction can feel invasive and overwhelming. Simpler apps like BUDGT focus on daily awareness—you log what matters, see your remaining budget, and move on. The data stays on your device, and the friction of manual entry actually helps build awareness.

Building a Tracking Habit That Sticks

Knowing how to track is only half the battle. Here’s how to make it a lasting habit:

Start Smaller Than You Think

Don’t commit to detailed categorization from day one. Start with just logging amounts. Add categories later once the basic habit is solid.

Attach It to an Existing Habit

“After I brush my teeth at night, I log my expenses.” Connecting new habits to established ones dramatically improves consistency.

Embrace Imperfection

Missed a day? Don’t try to reconstruct every purchase. Estimate, log what you remember, and move on. Perfectionism kills more tracking habits than laziness ever will.

Make It Visible

Keep your tracking app on your phone’s home screen. Use a dedicated notebook that stays on your nightstand. The easier it is to access, the more likely you’ll use it.

Celebrate Small Wins

Tracked for a week straight? Noticed a spending leak? Stayed under budget? Acknowledge these victories. Positive reinforcement builds lasting habits.

Common Tracking Mistakes (And How to Avoid Them)

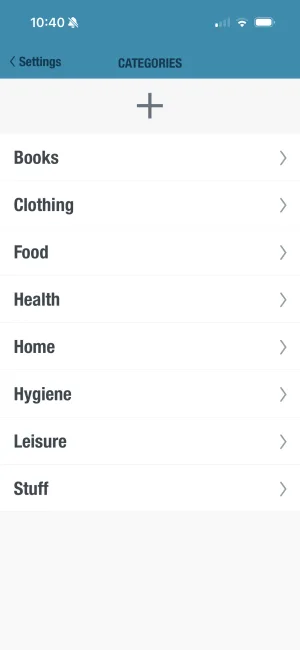

See spending patterns by category

BUDGT's monthly category view reveals where your money really goes. Simple categories, powerful insights—without overwhelming complexity.

Mistake 1: Over-Categorizing

Twenty spending categories might seem thorough, but it’s usually overkill. More categories mean more decisions, which means more friction, which means you’ll eventually stop tracking.

Fix: Start with 5-7 broad categories. Add more only if you genuinely need the detail.

Mistake 2: Forgetting Cash Spending

Digital transactions are easy to track, but cash can disappear without a trace.

Fix: Either avoid cash, or make it a rule to immediately log any cash purchase.

Mistake 3: Not Reviewing the Data

Tracking without reviewing is just data collection. The value comes from using the information.

Fix: Schedule a monthly review. Look at totals by category. Identify one thing to adjust.

Mistake 4: Giving Up After a Slip

One bad week doesn’t erase your progress. Financial tracking is a skill that improves over time.

Fix: Treat slip-ups as data, not failure. Why did you stop? What would make it easier next time?

Mistake 5: Tracking Without a Budget

Tracking shows where money went. Budgeting decides where it should go. You need both.

Fix: Set a simple monthly budget, even if it’s just “spend less than I earn.” Tracking becomes more meaningful when you have a target.

Your 2026 Spending Tracker Action Plan

Ready to start? Here’s your week-by-week plan for building a solid tracking habit:

Week 1: Setup

- Choose your tracking method

- Download your app or prepare your notebook

- Set a daily reminder

- Track everything without judgment

Week 2: Observe

- Continue tracking

- Notice patterns without trying to change them

- Identify your biggest spending categories

Week 3: Analyze

- Review your data

- Calculate category totals

- Identify one “leak” you’d like to address

Week 4: Adjust

- Set a simple goal based on your findings

- Continue tracking with this target in mind

- Celebrate completing your first month

From here, monthly reviews and ongoing daily tracking will keep you on course. The habit gets easier, the insights get richer, and your financial confidence grows.

The Bottom Line

Tracking your spending isn’t about restriction or guilt—it’s about awareness and choice. When you know where your money goes, you can decide if that’s where you want it to go. That shift from unconscious spending to intentional spending is the foundation of every successful budget.

Start simple. Stay consistent. And remember: the goal isn’t perfect tracking, it’s better financial awareness. Every expense you log is a step toward taking control of your money in 2026.

Looking for a simple way to track your daily spending? BUDGT shows you exactly what you can spend today—and updates in real-time as you log purchases. No bank linking, no complicated setup. Just clarity.

Frequently Asked Questions

What is the best way to start tracking my spending in 2026?

Start with the simplest method possible—a daily 2-minute check-in where you record what you spent. Use an app like BUDGT that shows your remaining daily budget at a glance. Don't worry about detailed categories at first; just build the habit of logging expenses consistently.

How long does it take to build a spending tracking habit?

Most people need about 3-4 weeks to establish a solid tracking habit. Start by simply logging amounts without judgment for the first two weeks, then begin analyzing patterns in weeks 3-4. The key is consistency over perfection—even imperfect tracking beats none at all.

Should I track every single purchase?

Ideally yes, but don't let perfectionism stop you. Track what you can, when you can. If you miss a day, estimate and move on. The goal is awareness, not accounting precision. Over time, tracking becomes automatic and takes just seconds per transaction.

What's the difference between tracking spending and budgeting?

Tracking shows where your money went (past tense). Budgeting decides where it should go (future tense). You need both for financial success. Start with tracking to understand your patterns, then create a budget based on that data.

Why does manual expense tracking work better than automatic bank syncing?

Manual entry creates a "pause moment" before or after each purchase, making you more conscious of spending. Studies show this awareness alone reduces unnecessary purchases by 10-15%. Automatic syncing is convenient but doesn't build the same mindfulness.

How many spending categories should I use?

Start with 5-7 broad categories like Food, Transport, Entertainment, Shopping, and Bills. More categories create more friction and decision fatigue. You can always add detail later once tracking feels effortless.

What is the 50/30/20 rule for budgeting?

The 50/30/20 rule divides after-tax income into three buckets—50% for needs (rent, utilities, groceries), 30% for wants (entertainment, dining out), and 20% for savings and debt repayment. It provides structure without requiring detailed category tracking.

How does BUDGT help track daily spending?

BUDGT calculates your safe daily spending limit based on your income and fixed expenses. Each time you log a purchase, it updates your remaining budget in real-time with color-coded feedback—blue means on track, orange means close to limit, red means over. Everything stays private on your device.

What should I do if I forget to track for several days?

Don't try to reconstruct every purchase perfectly. Check your bank statement, estimate the main expenses, log what you remember, and move forward. Treat slip-ups as learning opportunities, not failures. Consistency over time matters more than perfection.

Does tracking spending really help save money?

Yes. Simply tracking—without changing anything else—typically reduces unnecessary purchases by 10-15%. The awareness effect makes you naturally pause before impulse buys. Combined with a budget, tracking helps identify "money leaks" and redirect spending toward your actual priorities.

What is the easiest way to keep track of spending?

The easiest method is a simple budgeting app on your phone. Log each purchase right after you make it—takes 10 seconds. Apps like BUDGT calculate your remaining daily budget automatically. If apps aren't your thing, a small notebook works too. The key is picking one method and sticking with it.

How do I track my daily expenses?

Set a reminder on your phone for the same time each day (after dinner works well). Spend 2-3 minutes logging everything you spent. Write the amount and a brief note for each purchase. Use categories if you want, but even just totals work. Review weekly to spot patterns and adjust.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS