Financial Anxiety and Money Stress: How Finances Impact Your Well-Being

Your bank account and your peace of mind are more connected than you might realize. For many people—especially those managing households, raising children, or living on a tight budget—financial stress isn’t just a money issue. It’s a mental health challenge.

When every dollar counts, anxiety can take root, affecting sleep, emotional well-being, and daily decision-making. But by understanding the connection between your finances and your mental health, you can begin to take control of both.

This guide explores the link between money and mental wellness, provides strategies to manage financial anxiety, and shows how simple tools can help restore your peace of mind.

The Hidden Cost of Financial Stress

Money worries go beyond missed payments—they impact your body and mind in ways you might not expect.

Physical Symptoms of Financial Anxiety

| Symptom | How It Manifests | Why It Happens |

|---|---|---|

| Insomnia | Can’t fall or stay asleep | Racing thoughts about bills and money |

| Headaches | Tension headaches, migraines | Chronic stress causes muscle tension |

| Fatigue | Always tired despite rest | Mental exhaustion from constant worry |

| Digestive issues | Stomach pain, nausea | Stress hormones affect gut function |

| Muscle tension | Neck, shoulder, back pain | Body holds stress physically |

| Weakened immunity | Frequent colds/illness | Cortisol suppresses immune system |

Emotional and Mental Symptoms

| Symptom | Signs | Impact on Daily Life |

|---|---|---|

| Constant worry | Can’t stop thinking about money | Difficulty concentrating on work/family |

| Shame and guilt | Feeling like a failure | Avoiding friends, social withdrawal |

| Irritability | Short temper, mood swings | Relationship strain |

| Hopelessness | ”It will never get better” | Giving up on financial goals |

| Avoidance | Not opening bills/statements | Problems compound without attention |

| Decision paralysis | Unable to make choices | Missed opportunities, inaction |

The Cortisol Connection

Prolonged financial stress raises cortisol levels, your body’s stress hormone. Chronic elevated cortisol:

- Increases risk of heart disease

- Disrupts sleep patterns

- Impairs memory and concentration

- Weakens immune function

- Contributes to weight gain

- Accelerates aging

Financial Stress Impact on Health

Percentage of people with financial stress reporting these impacts

Financial Anxiety Self-Assessment

Understanding your level of financial anxiety is the first step toward managing it.

Quick Assessment Quiz

| Statement | Never (0) | Sometimes (1) | Often (2) | Always (3) |

|---|---|---|---|---|

| I worry about money even when things are okay | ||||

| I avoid checking my bank account | ||||

| I have trouble sleeping due to money concerns | ||||

| I feel ashamed talking about money | ||||

| I snap at loved ones over money issues | ||||

| I feel hopeless about my financial situation | ||||

| I make impulsive purchases to feel better | ||||

| I experience physical symptoms from money stress |

Scoring:

- 0-6 points: Low financial anxiety—you have healthy money stress management

- 7-12 points: Moderate anxiety—some coping strategies would help

- 13-18 points: High anxiety—active stress management is important

- 19-24 points: Severe anxiety—consider professional support alongside self-help

How Financial Awareness Reduces Anxiety

The good news? Gaining clarity over your finances can significantly boost your well-being. Here’s how:

Replace Uncertainty with Information

Vague fears are worse than known problems. When you know exactly where your money goes, anxiety decreases because you're dealing with facts, not fears.

Create a Sense of Control

Budgeting gives you a plan—and a plan gives you power. Even on limited income, the ability to allocate funds creates confidence and reduces helplessness.

Build Predictability

When you track spending consistently, surprises decrease. Fewer surprises means less anxiety-triggering uncertainty about your financial future.

Enable Progress Measurement

Watching small improvements adds up to hope. Seeing your emergency fund grow or debt decrease provides tangible evidence that things can get better.

Normalize Money Management

Regular engagement with finances removes the scariness. Daily tracking makes money just another thing you handle, not a source of dread.

Coping Strategies for Financial Anxiety

Immediate Relief Techniques

When financial anxiety hits hard, these strategies can help in the moment:

| Technique | How to Do It | Why It Works |

|---|---|---|

| Box breathing | Inhale 4 sec, hold 4 sec, exhale 4 sec, hold 4 sec | Activates parasympathetic nervous system |

| Grounding (5-4-3-2-1) | Name 5 things you see, 4 hear, 3 feel, 2 smell, 1 taste | Interrupts anxious thought spiral |

| Physical movement | Walk, stretch, exercise for 10+ minutes | Burns off stress hormones |

| Cold water | Splash face or hold ice cube | Triggers dive reflex, slows heart rate |

| Journaling | Write out worries for 10 minutes | Externalizes thoughts, reduces rumination |

Long-Term Anxiety Management

| Strategy | Implementation | Benefit |

|---|---|---|

| Regular tracking | 2-3 minutes daily expense logging | Reduces fear of the unknown |

| Weekly money time | 15-minute scheduled financial review | Normalizes money management |

| Emergency fund | Small, consistent savings | Creates safety net, reduces catastrophizing |

| Information diet | Limit financial news consumption | Reduces external anxiety triggers |

| Support network | Talk to trusted friend or group | Reduces isolation and shame |

| Professional help | Therapist or financial counselor | Expert guidance for complex situations |

Visual feedback calms financial anxiety

BUDGT's color system tells you instantly if you're on track. Blue means safe, yellow means mindful, orange means slow down. This visual clarity replaces money worries with confidence.

The Daily Budget Approach for Mental Wellness

Traditional monthly budgeting can feel overwhelming when you’re already stressed. The daily approach offers a gentler alternative.

Monthly vs. Daily: Anxiety Impact

| Factor | Monthly Budgeting | Daily Budgeting |

|---|---|---|

| Time horizon | 30 days to worry about | Just today to manage |

| Recovery from mistakes | One slip can ruin the month | Tomorrow is a fresh start |

| Decision complexity | Many categories to track | One number to watch |

| Feedback speed | Learn at month end | Instant feedback |

| Overwhelm potential | High—big numbers, long timeline | Low—small, manageable chunks |

Why Daily Works for Anxious Minds

The daily budget philosophy breaks finances into manageable pieces:

- Reduced cognitive load — One simple question: “Can I afford this today?”

- Immediate feedback — No waiting 30 days to know if you’re on track

- Quick recovery — A bad day doesn’t ruin the month

- Consistent engagement — Daily attention prevents avoidance buildup

- Visible progress — Watch your remaining budget replenish each day

Focus on just today

BUDGT shows one simple number: what's safe to spend today. Instead of worrying about making it through the month, you only manage today. This approach reduces overwhelm and makes budgeting feel achievable.

Building Healthy Money Habits

Mental and financial health both thrive on consistent habits. Here’s a sustainable routine:

The Weekly Money Wellness Routine

| Day | Activity | Time | Purpose |

|---|---|---|---|

| Daily | Log expenses | 2-3 min | Maintain awareness |

| Sunday | Week review | 15 min | Assess progress, plan ahead |

| 1st of month | Monthly review | 30 min | Bigger picture assessment |

| Quarterly | Goal check-in | 1 hour | Adjust goals and strategies |

Mindful Money Practices

| Practice | How | Benefit |

|---|---|---|

| 24-hour rule | Wait a day before non-essential purchases | Reduces impulse spending and regret |

| Spending intention | Ask “Does this align with my values?” | Creates purposeful spending |

| Gratitude noting | List 3 things money helped with this week | Shifts focus from scarcity to abundance |

| Progress celebration | Acknowledge small wins | Builds positive money associations |

| Fear facing | Check account balance daily | Reduces avoidance-based anxiety |

Time Investment for Financial Wellness

Small time investments lead to significant stress reduction

Financial Anxiety in Relationships

Money stress affects more than just the individual—it impacts relationships too.

Common Relationship Money Conflicts

| Conflict | Root Cause | Solution |

|---|---|---|

| Spending disagreements | Different money values | Agree on shared goals while respecting differences |

| Secret purchases | Fear of judgment | Create individual spending allowances |

| Blame games | Stress seeking outlet | Focus on “us vs. the problem” not “me vs. you” |

| Avoidance | Anxiety about discussions | Schedule regular, calm money meetings |

| Different risk tolerance | Personality differences | Find compromises that respect both styles |

Healthy Financial Communication

| Do | Don’t |

|---|---|

| Use “I feel” statements | Blame or accuse |

| Focus on shared goals | Bring up past mistakes |

| Schedule money talks | Ambush during stress |

| Acknowledge progress | Only discuss problems |

| Listen to understand | Listen to respond |

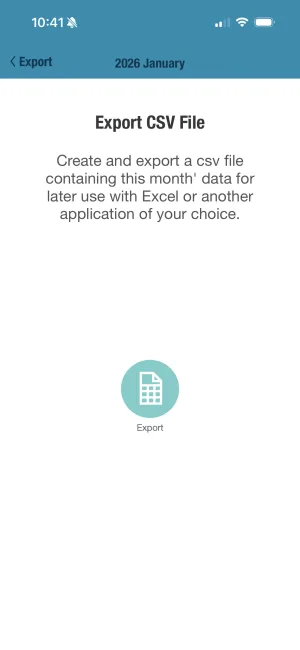

Share your financial picture

BUDGT's CSV export lets you share spending data with a partner or advisor. Review numbers together without emotional charge, making money conversations productive rather than painful.

When to Seek Professional Help

Self-help strategies work for many people, but sometimes professional support is needed.

Signs You Need Professional Help

| Sign | What It Looks Like |

|---|---|

| Persistent sleep disruption | More than 2 weeks of money-related insomnia |

| Panic attacks | Physical symptoms like racing heart, sweating when thinking about finances |

| Complete avoidance | Months without opening bills or checking accounts |

| Relationship damage | Money conflicts seriously harming important relationships |

| Harmful coping | Turning to alcohol, drugs, or destructive behaviors |

| Suicidal thoughts | Feeling hopeless about ever being okay financially |

Types of Professional Support

| Professional | Best For | What They Do |

|---|---|---|

| Therapist/Counselor | Anxiety, depression, coping skills | Address emotional relationship with money |

| Financial Counselor | Debt, budgeting, planning | Practical money management strategies |

| Financial Coach | Goal setting, behavior change | Accountability and guidance |

| Credit Counselor | Debt management | Negotiate with creditors, create payment plans |

Important: If you’re having thoughts of self-harm, please reach out to a crisis helpline immediately. Financial problems are temporary and solvable—your life is precious.

Building Your Financial Anxiety Recovery Plan

30-Day Anxiety Reduction Plan

| Week | Focus | Actions |

|---|---|---|

| Week 1 | Awareness | Track spending, notice anxiety triggers |

| Week 2 | Information | Calculate total debt, income, monthly expenses |

| Week 3 | Small wins | Cut one expense, start $5/week emergency fund |

| Week 4 | Routine | Establish daily tracking, weekly review habit |

Key Milestones

| Milestone | Why It Matters |

|---|---|

| Open all bills/statements | Breaks avoidance cycle |

| Know exact debt total | Fear of unknown eliminated |

| One week of daily tracking | Habit foundation built |

| $100 in emergency fund | Tangible safety net created |

| One successful budget week | Proof that it’s possible |

See your financial future clearly

BUDGT's month-end projection shows exactly where you'll be if you stick to your plan. Seeing a positive outcome ahead replaces worry with motivation and peace of mind.

From Financial Stress to Financial Peace

Financial anxiety is real, it’s common, and it’s treatable. You’re not broken—you’re human, dealing with very real pressures in a world that often makes money management harder than it needs to be.

The path from stress to peace isn’t about becoming rich or eliminating all financial challenges. It’s about:

- Replacing fear with information

- Building systems that reduce uncertainty

- Creating small wins that compound into confidence

- Treating yourself with compassion through setbacks

- Seeking help when you need it

Start small. Track one day of spending. Check your account balance once. Open one bill. Each small action reduces the anxiety just a little, and those reductions add up.

Your mental health matters. Your financial wellness matters. And taking control of both is possible—one day at a time.

Frequently Asked Questions

How can tracking expenses actually reduce financial anxiety?

Understanding where your money goes eliminates the fear of the unknown. When you track expenses with BUDGT, you replace vague worries with concrete information. This awareness helps you feel more in control, which directly reduces stress and anxiety about money.

Is my financial data private in BUDGT or could data breaches add to my stress?

BUDGT is 100% offline with no cloud sync or bank linking, meaning your financial data never leaves your device. You never have to worry about data breaches, server hacks, or privacy violations. This security model is designed to reduce stress, not add to it.

Can BUDGT help me build healthy money habits that improve mental health?

Yes! BUDGT's daily budget philosophy creates a simple, sustainable routine. By checking your daily limit and tracking expenses in real-time, you build awareness and consistency. Features like Categories and Notes help you understand your spending patterns and make intentional choices that support both financial and mental well-being.

What if I feel overwhelmed by budgeting apps with too many features?

BUDGT is intentionally simple, focusing on essential features without overwhelming complexity. There's no complicated setup, no bank account linking, and no confusing dashboards. The clean, intuitive design means you can start tracking expenses immediately without a learning curve.

How does BUDGT work if I'm traveling or away from home during stressful times?

BUDGT's Travel Mode feature is designed specifically for managing expenses while traveling. Since the app works 100% offline, you can track spending anywhere in the world without worrying about internet access or international data charges. This consistency reduces travel-related financial stress.

Can I try BUDGT risk-free before committing?

Absolutely! BUDGT offers a free trial with full functionality. You can experience all features and see if the app reduces your financial stress before subscribing. After the trial, choose from flexible subscription options including weekly, monthly, 3-month, 6-month, or yearly plans.

How does the daily budget approach help with financial stress compared to monthly budgeting?

Monthly budgets can feel overwhelming when you're stressed. BUDGT's daily budget philosophy breaks your finances into manageable, bite-sized pieces. Instead of worrying about making it through the entire month, you focus on just today's spending. This approach is less intimidating and more sustainable for mental health.

What are physical symptoms of financial anxiety?

Financial anxiety often manifests physically including insomnia, headaches, muscle tension, fatigue, digestive issues, and weakened immune function. Chronic money stress raises cortisol levels, affecting your entire body. Addressing the financial stress often helps alleviate these physical symptoms.

How do I talk to my partner about financial stress without fighting?

Choose a calm moment, not during a crisis. Use "I" statements ("I feel worried") instead of blame. Focus on shared goals rather than individual failures. Consider weekly money meetings to normalize financial discussions. A shared budget app can make conversations about specific numbers rather than vague accusations.

When should I seek professional help for financial anxiety?

Seek help if money worries interfere with sleep for more than two weeks, cause panic attacks, prevent you from opening bills or checking accounts, affect your relationships significantly, or lead to harmful coping behaviors. Both financial counselors and mental health professionals can help address money-related anxiety.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS