The Envelope Budgeting Method: Cash-Based Spending Control

Swipe. Tap. Click. Modern spending is frictionless—which is exactly the problem. When money is invisible, so is overspending.

The envelope budgeting method brings friction back. By allocating physical cash to specific categories, you create hard limits that your brain actually respects. When the envelope is empty, it’s empty. No willpower required.

This old-school method might seem outdated in our digital world. But for people who struggle with overspending, it works when nothing else does.

How the Envelope Method Works

The concept is simple:

- Decide your spending categories (groceries, dining out, entertainment, clothing, etc.)

- Assign a monthly budget to each category

- Withdraw that amount in cash at the start of each month

- Put the cash in labeled envelopes

- Spend only from the appropriate envelope

- When an envelope is empty, stop spending in that category

That’s it. No complicated tracking. No apps (unless you want them). Just physical limits on physical money.

Why Physical Cash Works

The envelope method works because cash spending hurts.

Research consistently shows that paying with cash triggers pain centers in the brain more than cards do. When you hand over a $50 bill, you feel it leaving. When you tap a card, you feel almost nothing.

This “pain of paying” is a feature, not a bug. It makes you pause. Consider. Ask if you really need it. That pause prevents impulse spending.

Plus, physical limits are absolute. You can’t swipe an envelope when it’s empty. You can’t “just this once” exceed a pile of cash that doesn’t exist. The boundary is real and tangible.

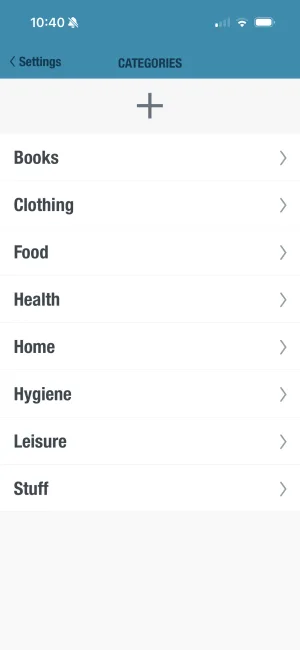

See your spending categories clearly

BUDGT shows how your spending breaks down by category—the digital version of knowing exactly what's in each envelope.

Setting Up Your Envelope System

Identify Your Variable Spending Categories

Focus on areas where amounts change and you tend to overspend: groceries, dining out, entertainment, clothing, personal care. Skip fixed costs like rent, utilities, and subscriptions.

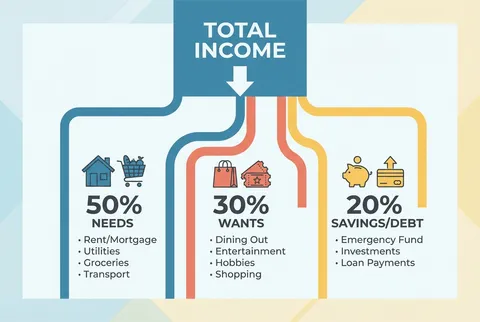

Determine Category Amounts

Look at past spending for baseline reality. Adjust based on goals—if spending $400 on dining out, maybe start with $300. Aggressive cuts rarely stick; gradual reductions work better.

Create Your Envelopes

Physical options: paper envelopes, accordion file organizers, or purpose-made cash wallets. Label each clearly with the category and budgeted amount.

Withdraw and Fill

At month start, withdraw your total envelope budget in cash. Divide into envelopes: groceries $400, dining out $150, entertainment $100, etc.

Spend From Envelopes

Going shopping? Take that envelope. Grab cash, leave the envelope. Come home, put change back. Never mix envelopes—the whole point is category-specific limits.

When an Envelope Is Empty

Three options: stop spending in that category, borrow from another envelope, or accept and adjust next month's budget. The pain of an empty envelope teaches better estimation.

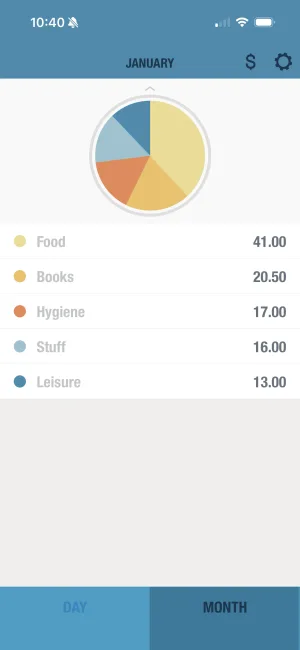

Watch your spending change day to day

BUDGT's color system shows your budget status throughout the month—blue to yellow to orange as you spend more.

Going Digital: Modern Envelope Alternatives

Physical cash isn’t for everyone. Here are digital equivalents:

Separate Bank Accounts

Open multiple free checking accounts (many online banks offer this). Treat each as a digital envelope. Transfer category amounts at month start.

Pros: Still creates real limits. Works with modern payments. Cons: Managing multiple accounts. Transfer fees at some banks.

Budgeting Apps

Apps like YNAB (You Need A Budget) or Goodbudget use the envelope concept digitally. You assign money to categories and track spending against those limits.

Pros: Works with cards. Automatic tracking. Cons: Requires discipline to respect virtual limits. Less friction than cash.

Prepaid Cards

Load prepaid debit cards with category amounts. One card for groceries, one for entertainment, etc.

Pros: Hybrid of cash limits and card convenience. Cons: Fees on some cards. Managing multiple cards.

BUDGT Approach

Daily budgeting achieves similar awareness. Knowing your daily allowance creates the same intentionality as envelopes—you see what you have, you spend within it.

Envelope Budgeting for Couples

The envelope method can transform couple finances.

The visibility helps. Both partners see exactly how much is left for groceries. No more “I didn’t know we were low” arguments.

Divided envelopes work. Each person can have half the dining-out budget. Spend it how you want, but when it’s gone, it’s gone.

Communication improves. Moving money between envelopes requires agreement. “Can we shift $50 from entertainment to dining out?” is a conversation, not a unilateral decision.

Personal envelopes preserve autonomy. Each partner gets a personal spending envelope to use however they want—no questions asked. This prevents resentment over small purchases.

Handling Irregular Expenses

The envelope method handles irregular expenses beautifully.

Create “savings envelopes” for predictable-but-irregular costs:

- Car maintenance: $100/month → money ready when oil changes or repairs hit

- Gifts: $50/month → birthday and holiday presents covered

- Clothing: $75/month → seasonal shopping funded

- Medical: $100/month → copays and unexpected health costs

These envelopes accumulate until needed. It’s sinking funds by another name.

Common Envelope Method Mistakes

Mistake 1: Too Many Envelopes

Start with 5-7 categories. More than that becomes complicated and discouraging. You can always add categories later.

Mistake 2: Unrealistic Amounts

Budgeting $200/month for groceries when you’ve always spent $400 sets you up for failure. Start near reality, reduce gradually.

Mistake 3: Not Accounting for All Spending

If you use envelopes for some things and cards for others, make sure you’re tracking both. The envelope method doesn’t work if card spending goes unchecked.

Mistake 4: Robbing Envelopes Constantly

Occasionally moving money between envelopes is fine. Doing it every week means your budget doesn’t match reality. Adjust the budget instead of constantly reshuffling.

Mistake 5: Giving Up After One Hard Month

The first month will feel restrictive. Empty envelopes will frustrate you. This is the system working. Stick with it for three months before evaluating.

Who the Envelope Method Works Best For

Overspenders: If you consistently spend more than intended, the physical limits of cash help.

Visual/tangible learners: Some people need to see and touch their budget for it to feel real.

People who’ve failed with apps: If digital tracking hasn’t worked, analog might.

Couples with communication issues around money: Shared visibility and agreed-upon limits reduce conflict.

Those who want simplicity: No apps to learn, no accounts to sync—just cash in envelopes.

Who Might Prefer Other Methods

Frequent travelers or online shoppers: Cash is impractical for your lifestyle.

People comfortable with digital tools: If apps provide enough awareness, physical cash adds hassle without benefit.

Those building credit card rewards: You miss points/cashback using cash (though overspending usually costs more than rewards gain).

Anyone uncomfortable carrying cash: Security and loss concerns are valid.

Your Action Steps This Week

-

Identify your top overspending categories. Where does money disappear? Those are your first envelopes.

-

Review past spending. Check bank statements for realistic amounts per category. Don’t guess—look at actual numbers.

-

Create 3-5 envelopes to start. Physical or digital. Label them clearly.

-

Withdraw or allocate your budget. Fill each envelope with its monthly amount.

-

Spend from envelopes for one month. See how it feels. Note where amounts need adjustment.

-

Evaluate and adjust. After one month, refine your categories and amounts based on experience.

The Bottom Line

The envelope budgeting method assigns specific cash amounts to spending categories. When an envelope is empty, spending in that category stops.

It works because physical cash triggers spending awareness that cards don’t. Hard limits prevent the slow drift of “just this once” overspending.

Whether you use physical envelopes or digital equivalents, the principle is the same: give every dollar a job, make limits real, and stop when you hit them.

Simple doesn’t mean outdated. Sometimes old-school methods work because they address timeless problems.

When money is tangible, spending is intentional.

Frequently Asked Questions

What is the envelope budgeting method?

The envelope method assigns cash to labeled envelopes for each spending category (groceries, dining out, entertainment, etc.). When you spend from a category, you take cash from that envelope. When the envelope is empty, you're done spending in that category until next month.

Does envelope budgeting have to use physical cash?

No. While traditional envelope budgeting uses physical cash, digital envelope systems work too. Apps and separate checking accounts can create virtual envelopes. The principle—hard limits per category—works regardless of whether the money is physical.

What categories should I create envelopes for?

Create envelopes for variable spending where you tend to overspend: groceries, dining out, entertainment, clothing, personal care, household items. Fixed bills (rent, utilities) don't need envelopes since they're predictable. Focus envelopes where you need control.

What if I run out of money in an envelope before the month ends?

You have three options: stop spending in that category, move money from another envelope (like entertainment to groceries), or accept you overspent and adjust next month's budget. The pain of an empty envelope teaches better estimation over time.

Is the envelope method good for couples?

It can be excellent for couples who struggle with coordinated spending. Each person knows exactly how much remains for shared categories. No more 'I thought we still had grocery money.' The visibility creates accountability and communication.

How do I handle big purchases with envelope budgeting?

Create savings envelopes for large purchases. Contribute monthly toward clothing, car repairs, gifts, etc. When the purchase comes up, the money is ready. This treats irregular expenses as predictable categories rather than emergencies.

Isn't carrying cash unsafe and inconvenient?

Cash has risks—theft, loss, no purchase protection. Modern envelope users often go digital or use a hybrid: cash for temptation categories (dining, shopping), cards for everything else. The goal is spending awareness, not cash worship.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS