Compound Interest Explained: How $100/Month Becomes $260,000

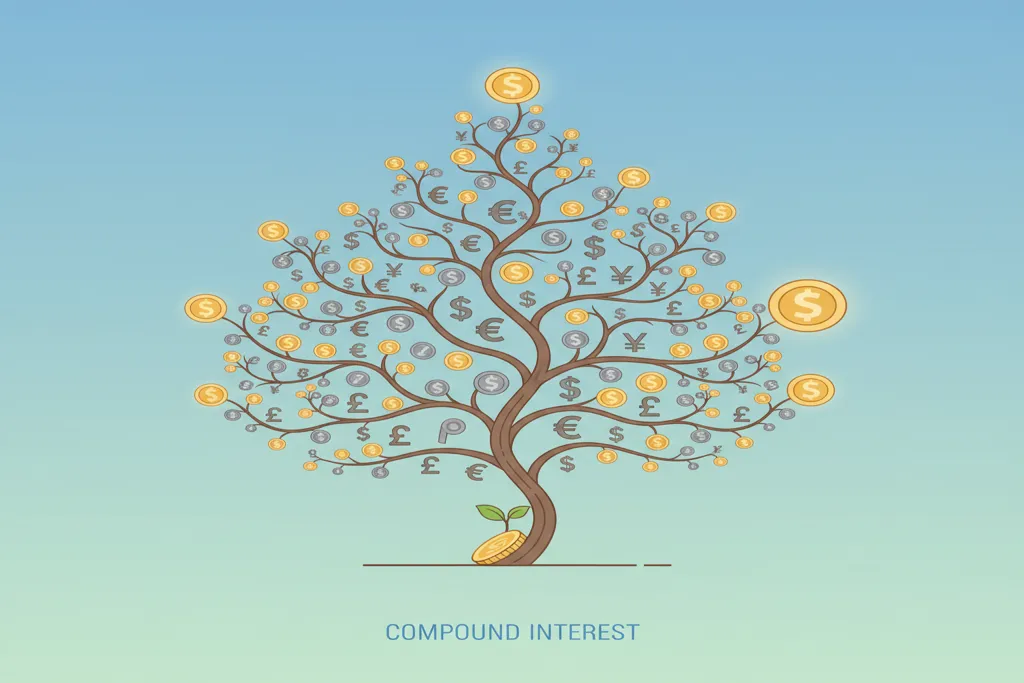

Compound interest is when you earn interest on both your original money AND on the interest you’ve already earned. Unlike simple interest (which only grows your principal), compound interest creates exponential growth over time. Example: $1,000 at 10% becomes $17,449 after 30 years with compound interest, versus just $4,000 with simple interest.

Is Compound Interest Really the 8th Wonder of the World?

Yes—compound interest is often called the “eighth wonder of the world” because small amounts grow exponentially over time. While Einstein may or may not have said it, the math proves why: $100/month invested at 7% for 40 years becomes over $260,000. That’s $48,000 in contributions turning into $260,000—the “wonder” is how time transforms modest savings into extraordinary wealth.

Compound interest is the single most powerful force in personal finance, and understanding it changes everything about how you think about saving and investing.

Here’s the uncomfortable truth: most people don’t understand compound interest. They know the words, maybe even the formula, but they don’t feel its power in their gut. That’s why they put off saving, thinking “I’ll start next year when I earn more.”

This post will change that. By the end, you’ll understand why starting today with $50 beats starting in five years with $500.

What is Compound Interest? The Simple Explanation

Compound interest is interest that earns interest.

That’s it. That’s the magic.

When you save or invest money, you earn interest on your original amount. With compound interest, that earned interest stays in your account and starts earning interest too. Then that interest earns interest. And so on, forever.

Think of it like a snowball rolling down a hill. At first, it’s small and slow. But as it rolls, it picks up more snow, which helps it pick up even more snow, which helps it roll faster, which helps it pick up even MORE snow. Given enough hill, a tiny snowball becomes an avalanche.

Your money works the same way. Given enough time, small savings become life-changing wealth.

Simple Interest vs. Compound Interest: A Real Example

Let’s make this concrete with $1,000 earning 10% interest over 30 years.

With Simple Interest: You earn 10% of $1,000 ($100) every year. After 30 years, you have:

- Original: $1,000

- Interest earned: $100 × 30 = $3,000

- Total: $4,000

With Compound Interest: You earn 10% of your total balance every year. After 30 years:

- Year 1: $1,000 → $1,100

- Year 2: $1,100 → $1,210

- Year 10: $2,594

- Year 20: $6,727

- Year 30: $17,449

Same starting amount. Same interest rate. Same time period. But compound interest gives you $17,449 instead of $4,000. That’s the “eighth wonder” at work.

Try It Yourself

Adjust the sliders below to see how principal, interest rate, and time affect your money’s growth. Notice how the compound interest line curves upward while simple interest stays straight:

The Three Ingredients of Compound Growth

Compound interest needs three things to work its magic:

1. Principal (Your Starting Amount)

This is the money you put in. More is better, but here’s the surprise: it matters less than you think. $100/month beats $10,000 once if you have enough time.

2. Interest Rate (Your Growth Rate)

This is how fast your money grows each period. Higher rates mean faster compounding. A savings account at 0.5% compounds slowly. An index fund averaging 7% compounds much faster.

3. Time (The Secret Ingredient)

This is the multiplier that makes everything work. Time is so powerful that it beats both principal AND interest rate.

Consider two investors:

| Investor | Start Age | Monthly | Years Investing | Total Invested | Value at 65 |

|---|---|---|---|---|---|

| Early Emma | 25 | $200 | 10 (then stops) | $24,000 | $472,000 |

| Late Larry | 35 | $200 | 30 (until 65) | $72,000 | $243,000 |

Assuming 7% average returns

Emma invested one-third the money but ended up with nearly double the wealth. That’s the power of starting early.

Track your savings growth over time

Watch your savings compound by tracking every contribution. BUDGT's savings mode helps you stay motivated as your money grows.

The Rule of 72: Quick Mental Math

Want to know how long it takes to double your money? Use the Rule of 72.

72 ÷ interest rate = years to double

Examples:

- At 4% interest: 72 ÷ 4 = 18 years to double

- At 7% interest: 72 ÷ 7 = ~10 years to double

- At 10% interest: 72 ÷ 10 = ~7 years to double

This is why interest rate matters. At 4%, your money doubles roughly 2 times over 36 years ($1,000 → $4,000). At 10%, it doubles 5 times ($1,000 → $32,000).

But here’s what’s wild: time matters even more. At 7%, your money doubles every 10 years. Over 40 years, that’s 4 doublings: $1,000 → $2,000 → $4,000 → $8,000 → $16,000.

Start 10 years later? You lose an entire doubling. $16,000 becomes $8,000.

Where Compound Interest Happens in Real Life

Compound interest isn’t just a textbook concept. It’s working right now in several places:

Savings Accounts

Banks pay you interest on your deposits, typically compounding daily or monthly. Rates are low (0.5-5% depending on the type and economy), but it’s guaranteed growth.

Retirement Accounts (401k, IRA)

When you invest in stocks and bonds through retirement accounts, your returns compound tax-free or tax-deferred. Average stock market returns of 7-10% annually, compounding for decades, creates serious wealth.

Index Funds and ETFs

Low-cost funds that track the market let compound interest work without you picking individual stocks. Set up automatic investments, forget about them, let time do the work.

Dividend Reinvestment

When companies pay dividends, reinvesting them instead of cashing out creates additional compounding. You buy more shares, which pay more dividends, which buy more shares.

The Dark Side: Compound Interest on Debt

The same math that grows your savings can devastate you in debt.

Credit cards typically charge 15-25% APR, compounding daily. A $5,000 balance at 20% APR, making only minimum payments, takes over 20 years to pay off and costs more than $8,000 in interest—you pay back nearly triple what you borrowed.

Car loans, mortgages, student loans—they all use compound interest against you.

This is why the first rule of personal finance is: pay off high-interest debt before investing. Paying off a 20% APR credit card gives you a guaranteed 20% return—better than any investment.

Common Mistakes That Kill Compound Growth

1. Waiting for “More Money”

“I’ll start investing when I earn more.” This is the most expensive mistake in personal finance. Every year you wait costs you a doubling. Someone investing $50/month starting today will likely beat someone starting with $500/month in five years.

2. Withdrawing Early

Taking money out of investments resets the compounding clock. That $1,000 you withdrew wasn’t just $1,000—it was potentially $16,000 in 40 years. Early withdrawals don’t just cost you the amount; they cost you all the future growth.

3. Ignoring Small Amounts

“$50 a month won’t make a difference.” Actually, $50/month at 7% for 30 years becomes $58,000. That’s retirement money from amounts many people spend on streaming subscriptions.

4. Chasing High Returns Instead of Consistent Returns

Compound interest works best with steady, reliable growth. Chasing risky investments for higher returns often leads to losses that destroy years of compounding. A boring index fund beats exciting speculation almost every time.

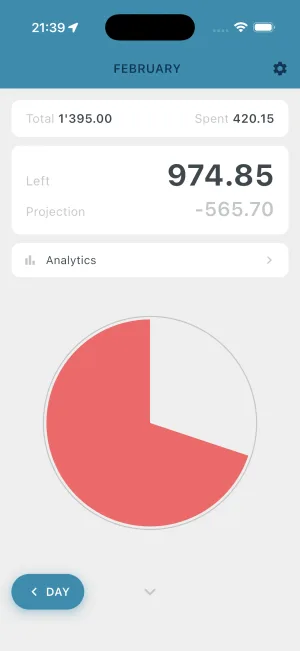

See your month-end projection

BUDGT shows where you're headed financially so you can adjust today for a better tomorrow.

How BUDGT Helps You Harness Compound Interest

You might be thinking: “This is great, but BUDGT is a daily budgeting app, not an investment calculator.”

True. But compound interest doesn’t help you if you have no money to invest. That’s where daily budgeting comes in.

Every dollar you don’t overspend is a dollar that can compound. BUDGT helps you:

- Find money to save by showing your daily budget clearly

- Build the saving habit by tracking expenses consistently

- Hit savings goals through savings mode

- Stay motivated by watching your progress compound

The path to wealth isn’t complicated: spend less than you earn, invest the difference, give it time. BUDGT handles the first part so compound interest can handle the rest.

Your Action Steps This Week

-

Calculate your potential: Use an online compound interest calculator. Enter $100/month, 7% returns, and your years until retirement. See what you could build.

-

Find $50: Look at your BUDGT spending. Where can you cut $50/month without pain? Subscriptions? Eating out? That $50 could become $58,000 in 30 years.

-

Automate something: Set up automatic transfers to savings or investments. Even $25/week adds up. Automation beats willpower.

-

Pay off high-interest debt: If you have credit card debt, that’s your first priority. You can’t earn 7% investing while paying 20% on debt.

-

Start today, not Monday: The best day to start was years ago. The second-best day is today. Not next month. Not when you “have more money.” Today.

The Bottom Line

Compound interest is simple: your money earns money, which earns more money. Time is the magic ingredient that makes it powerful.

Starting early beats starting big. Consistency beats perfection. Small amounts, invested regularly over decades, create wealth that seems impossible until you do the math.

Einstein may or may not have called it the eighth wonder of the world. But after you run the numbers yourself, you’ll understand why the attribution persists.

The question isn’t whether compound interest works—the math proves it does. The question is whether you’ll start early enough to benefit.

Your future wealthy self is counting on what you do today.

Frequently Asked Questions

What is compound interest in simple terms?

Compound interest is when you earn interest on both your original money AND on the interest you've already earned. Think of it like a snowball rolling downhill—it keeps growing faster as it picks up more snow. Your money earns money, and then that money earns money too.

How is compound interest different from simple interest?

Simple interest is calculated only on your original amount (principal). Compound interest is calculated on your principal PLUS any interest you've already earned. For example, $1,000 at 5% simple interest earns $50 every year. But with compound interest, year one earns $50, year two earns $52.50 (5% of $1,050), and it keeps growing.

Why is compound interest called the 8th wonder of the world?

This quote is often attributed to Einstein, though there's no proof he said it. The point stands: compound interest is remarkable because small amounts grow exponentially over time. $100/month for 40 years at 7% becomes over $260,000. The 'wonder' is how time transforms modest savings into significant wealth.

How often should interest compound for the best results?

More frequent compounding means faster growth. Daily compounding beats monthly, monthly beats yearly. However, the difference is often small. What matters most is the interest rate and time. A savings account compounding daily at 0.5% will never beat an investment compounding annually at 7%.

Can compound interest work against me?

Yes—compound interest on debt is how credit card balances spiral out of control. A $5,000 credit card balance at 20% APR, making only minimum payments, can take 20+ years to pay off and cost over $8,000 in interest. Compound interest is a tool: make sure it works for you, not against you.

What's the best age to start taking advantage of compound interest?

Now. Literally, right now. A 25-year-old investing $200/month until 65 (40 years) ends up with about $525,000 at 7% returns. A 35-year-old investing the same amount has only 30 years, ending with about $243,000—less than half. The ten-year head start is worth more than $280,000.

How can I calculate compound interest myself?

The formula is A = P(1 + r/n)^(nt), where P is principal, r is annual interest rate, n is compounding frequency, and t is time in years. But honestly? Use an online calculator. Search 'compound interest calculator' and plug in your numbers. Seeing the growth visually is much more motivating than doing math.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS