Smart Money Management for Students: The Ultimate Guide to Saving While Studying (2025)

College is expensive—but it doesn’t have to drain every dollar you have. With tuition at an all-time high and living costs rising, mastering money management has become as essential as any class you’ll take.

The financial habits you build during college follow you for decades. Students who learn to budget graduate with less debt, more savings, and a foundation for financial success. Those who don’t often spend years recovering from money mistakes made between ages 18-22.

This guide covers everything you need to manage money effectively as a student: realistic budgets, expense-cutting strategies, income ideas, and the simple daily tracking system that makes it all work.

The Reality of Student Finances

Let’s start with honest numbers about what college actually costs:

Average annual college costs (2024-2025):

| Expense | Public (In-State) | Public (Out-of-State) | Private |

|---|---|---|---|

| Tuition & fees | $11,260 | $29,150 | $43,350 |

| Room & board | $12,770 | $12,770 | $15,640 |

| Books & supplies | $1,240 | $1,240 | $1,240 |

| Transportation | $1,840 | $1,840 | $1,150 |

| Personal expenses | $2,170 | $2,170 | $1,810 |

| Total | $29,280 | $47,170 | $63,190 |

Where Student Money Goes

The good news: While tuition is largely fixed, you have significant control over living expenses. Smart choices in housing, food, and personal spending can save thousands annually.

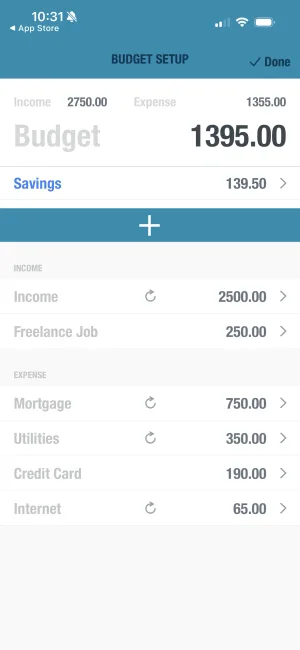

Creating Your Student Budget

Calculate Your Income

Add up all money coming in: financial aid refunds, parent contributions, work income, savings. Be realistic—use amounts you're sure of, not hopeful estimates.

List Fixed Expenses

Identify costs that stay the same: rent, phone bill, subscriptions, insurance. These come off the top before your spending budget.

Estimate Variable Expenses

Budget for costs that change: food, transportation, entertainment, supplies. Use last month's spending or estimates based on your situation.

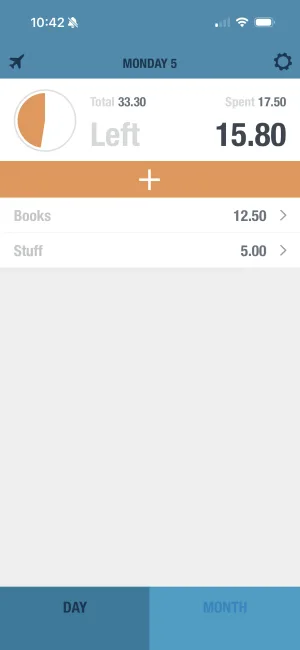

Calculate Your Daily Budget

Subtract fixed and estimated expenses from income, divide by days in the month. This is what you can spend daily on discretionary purchases.

Track Everything

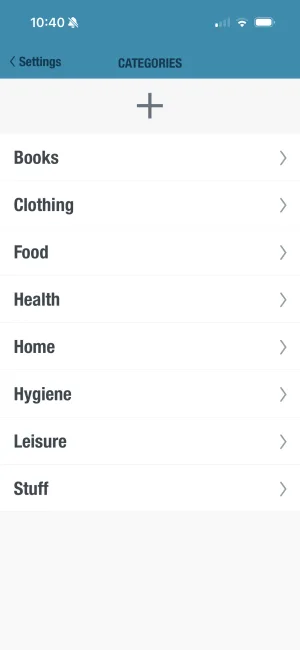

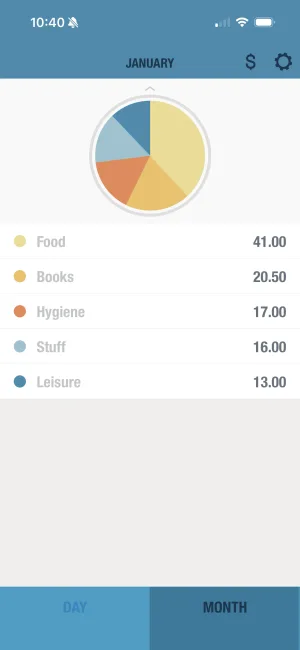

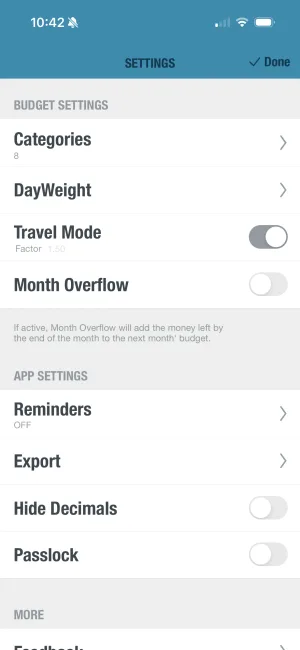

Use BUDGT to log every expense as it happens. The app shows if you're in the safe zone (blue), on track (yellow), or need to slow down (orange).

Review and Adjust Weekly

Spend 5 minutes each week reviewing your spending. Adjust your daily budget or habits based on what you learn.

Sample Student Budgets

Here are realistic monthly budgets for different student situations:

Budget A: Living on campus with meal plan

| Category | Monthly Amount | Daily Equivalent |

|---|---|---|

| Income | ||

| Financial aid (after tuition) | $800 | |

| Part-time job | $600 | |

| Total income | $1,400 | |

| Fixed expenses | ||

| Phone | $50 | |

| Subscriptions (Spotify, etc.) | $15 | |

| Variable expenses | ||

| Off-campus food | $100 | $3.33 |

| Transportation | $50 | $1.67 |

| Personal care | $40 | $1.33 |

| Entertainment | $75 | $2.50 |

| Supplies | $30 | $1.00 |

| Savings | $200 | |

| Remaining daily budget | $28/day |

Budget B: Living off-campus, cooking at home

| Category | Monthly Amount | Daily Equivalent |

|---|---|---|

| Income | ||

| Financial aid (after tuition) | $400 | |

| Part-time job | $800 | |

| Parent contribution | $300 | |

| Total income | $1,500 | |

| Fixed expenses | ||

| Rent (with roommates) | $500 | |

| Utilities | $75 | |

| Phone | $50 | |

| Renter’s insurance | $15 | |

| Variable expenses | ||

| Groceries | $250 | $8.33 |

| Transportation/gas | $100 | $3.33 |

| Personal care | $40 | $1.33 |

| Entertainment | $60 | $2.00 |

| Savings | $100 | |

| Remaining daily budget | $10/day |

Know your daily spending limit

BUDGT calculates exactly what you can spend each day. Blue means you're safe, yellow means slow down, orange means stop. Simple visual feedback keeps you on track.

Where Students Waste Money (And How to Stop)

Common student money leaks:

| Money Leak | Average Monthly Waste | Simple Fix |

|---|---|---|

| Coffee shop drinks | $60-120 | Make coffee at home, treat yourself 1-2x/week |

| Dining out/delivery | $150-300 | Cook 5+ meals at home weekly |

| Impulse Amazon purchases | $50-150 | Add to cart, wait 24 hours before buying |

| Unused subscriptions | $20-50 | Audit and cancel what you don’t use weekly |

| Full-price textbooks | $200-400/semester | Buy used, rent, or use library reserves |

| Late fees/overdrafts | $20-50 | Set up account alerts, track spending daily |

| Brand-name everything | $50-100 | Try store brands for basics |

Potential Monthly Savings

Total potential monthly savings: $300-500+

That’s $3,600-6,000 per year—money that could go toward tuition, emergency savings, or graduating with less debt.

Mastering Food Costs

Food is the biggest controllable expense for most students. Here’s how to eat well without breaking your budget:

Cost comparison: Different eating strategies

| Approach | Weekly Cost | Monthly Cost | Annual Cost |

|---|---|---|---|

| All dining out/delivery | $150+ | $600+ | $7,200+ |

| Campus meal plan only | $100-125 | $400-500 | $4,800-6,000 |

| Mix of meal plan + cooking | $75-100 | $300-400 | $3,600-4,800 |

| Primarily cooking at home | $50-75 | $200-300 | $2,400-3,600 |

Budget grocery list (weekly, $40-50):

| Category | Items | Estimated Cost |

|---|---|---|

| Proteins | Eggs, chicken, beans, peanut butter | $12-15 |

| Grains | Rice, pasta, bread, oats | $6-8 |

| Produce | Bananas, apples, carrots, onions, frozen veggies | $10-12 |

| Dairy | Milk, cheese | $5-7 |

| Basics | Cooking oil, salt, basic spices | $3-5 (lasts weeks) |

| Snacks | Popcorn kernels, crackers | $4-6 |

5 easy cheap meals for students:

| Meal | Cost per Serving | Prep Time | Skill Level |

|---|---|---|---|

| Rice and beans | $0.75-1.00 | 20 min | Beginner |

| Pasta with jarred sauce | $1.00-1.50 | 15 min | Beginner |

| Scrambled eggs with toast | $0.75-1.00 | 5 min | Beginner |

| Chicken stir-fry | $2.00-3.00 | 20 min | Beginner |

| Bean burritos | $1.50-2.00 | 15 min | Beginner |

Track food spending by category

Use BUDGT's categories to see exactly how much you spend on groceries vs. dining out. This awareness naturally helps you make better choices.

Textbooks: Stop Overpaying

Never pay full price for textbooks. Here’s the cost comparison:

Textbook options:

| Source | Typical Cost | Savings vs. New |

|---|---|---|

| Campus bookstore (new) | $150-300 | Baseline |

| Campus bookstore (used) | $100-200 | 25-35% |

| Amazon (new) | $100-250 | 15-25% |

| Amazon (used/rental) | $30-100 | 50-75% |

| Chegg rental | $20-75 | 60-80% |

| Library reserves | $0 | 100% |

| PDF (where legal) | $0 | 100% |

| Older editions | $10-50 | 80-95% |

| Classmate sharing | $0-50 (split) | 50-100% |

Textbook strategy:

- Wait until first week of class—some “required” books aren’t actually used

- Check library reserves first (often 2-hour loans available)

- Ask professor if older editions work (usually yes for intro courses)

- Compare prices: Amazon, Chegg, campus bookstore used section

- Rent if you won’t need the book long-term

- Sell back or resell at semester’s end

Potential savings: $200-600/semester

Student Discounts You’re Probably Missing

Your student ID is a discount card. Here’s what you might be missing:

Technology:

| Brand/Service | Student Discount |

|---|---|

| Apple | Education pricing (save $100-200 on Mac) |

| Spotify | $5.99/mo (includes Hulu) vs. $11.99 |

| Amazon Prime | $7.49/mo vs. $14.99 |

| Adobe Creative Cloud | 60%+ off |

| Microsoft 365 | Often free through school |

| YouTube Premium | $7.99/mo vs. $13.99 |

Everyday savings:

| Category | Where to Look |

|---|---|

| Food | Chipotle, Chick-fil-A, local restaurants |

| Clothing | ASOS, Topshop, J.Crew, Madewell (15-20% off) |

| Entertainment | Movie theaters, museums, theme parks |

| Transportation | Amtrak, Greyhound, local transit |

| Fitness | Planet Fitness, local gyms, campus rec |

| Insurance | Auto insurance (good student discount) |

Annual potential savings: $500-1,500+

Always ask “Do you have a student discount?” before paying full price for anything.

Making Money as a Student

Income helps, but not at the expense of grades. Here are realistic student income options:

On-campus jobs (best for most students):

| Position | Typical Pay | Hours/Week | Pros |

|---|---|---|---|

| Library assistant | $10-14/hr | 10-15 | Quiet, can study slow times |

| Research assistant | $12-18/hr | 10-20 | Resume builder, professor connections |

| Tutoring center | $12-18/hr | 5-15 | Reinforces your learning |

| Campus rec | $10-14/hr | 10-20 | Free gym access often |

| IT help desk | $12-16/hr | 10-15 | Tech skills, can study |

| Resident advisor | Room + stipend | 15-20 | Free housing worth $5,000+ |

Flexible off-campus options:

| Gig | Typical Earnings | Flexibility | Best For |

|---|---|---|---|

| Tutoring (private) | $20-50/hr | High | Students with strong GPA |

| DoorDash/Uber Eats | $15-25/hr | High | Car owners |

| Freelance writing | $15-50/hr | High | English/communications majors |

| Babysitting | $15-25/hr | Medium | Reliable students |

| Dog walking (Rover) | $15-25/walk | High | Animal lovers |

| Social media management | $15-30/hr | High | Marketing students |

Income reality check:

| Hours Worked | Monthly Income (at $14/hr) | Impact on Grades |

|---|---|---|

| 10 hrs/week | $560 | Minimal |

| 15 hrs/week | $840 | Manageable |

| 20 hrs/week | $1,120 | Noticeable |

| 25+ hrs/week | $1,400+ | Significant risk |

Research shows working more than 20 hours per week negatively impacts GPA. Earn what you need, but prioritize graduation.

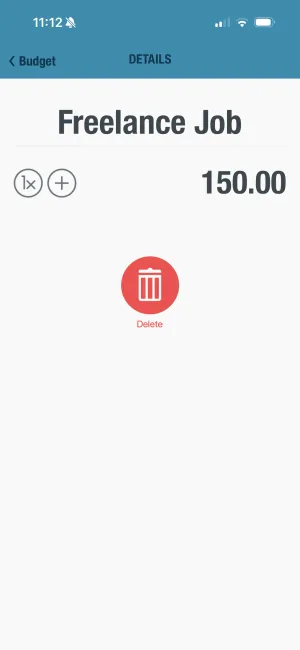

Track income and spending together

BUDGT helps you see how part-time income contributes to your daily budget. Watch your financial situation improve as you earn and save.

Building an Emergency Fund

Even as a student, an emergency fund prevents small problems from becoming big ones.

Why students need emergency funds:

| Emergency | Typical Cost | Without Fund | With Fund |

|---|---|---|---|

| Laptop repair/replacement | $200-1,000 | Credit card debt, panic | Handled |

| Car repair | $200-800 | Can’t get to work/class | Covered |

| Medical expense | $100-500 | Ignore or go into debt | Paid |

| Unexpected travel | $200-500 | Miss important events | Affordable |

| Lost/stolen items | $50-300 | Replace or go without | Replaced |

Building your fund:

| Stage | Target | How Long |

|---|---|---|

| Starter | $250 | 2-3 months at $25/week |

| Basic | $500 | 2-3 more months |

| Solid | $1,000 | One semester |

| Strong | $2,000 | One year |

Where to find $25/week for savings:

- Skip 2 coffee shop drinks

- Cook one more meal at home

- Cancel one unused subscription

- Work 2 extra hours

- Sell unused items

Build savings with every paycheck

BUDGT's Savings Mode helps you set aside money for emergencies. Even $25/month adds up to real security over a semester.

Handling Student Loans Wisely

If you have student loans, manage them strategically from day one.

Loan basics every student should know:

| Factor | Federal Loans | Private Loans |

|---|---|---|

| Interest rates | Fixed, 5-8% | Variable, 3-15% |

| Repayment flexibility | High (income-driven, deferment) | Low |

| Forgiveness options | Yes (PSLF, etc.) | Rarely |

| Should borrow first | Yes | Only if federal maxed |

Smart loan strategies while in school:

| Strategy | Benefit |

|---|---|

| Only borrow what you need | Less debt at graduation |

| Pay interest while in school | Prevents capitalization |

| Understand your total debt | No surprise at graduation |

| Consider working to borrow less | Every dollar earned = less borrowed |

The true cost of borrowing:

| Amount Borrowed | Interest Rate | Monthly Payment | Total Paid | Interest Paid |

|---|---|---|---|---|

| $10,000 | 6% | $111 | $13,320 | $3,320 |

| $25,000 | 6% | $278 | $33,300 | $8,300 |

| $50,000 | 6% | $555 | $66,600 | $16,600 |

| $100,000 | 6% | $1,110 | $133,200 | $33,200 |

Every dollar you don’t borrow saves you $1.30-1.50 over the life of the loan.

Credit Cards: Handle with Care

Credit cards can build credit or destroy finances. Here’s how to use them wisely:

Credit card rules for students:

| Rule | Why It Matters |

|---|---|

| Never carry a balance | 20%+ interest destroys budgets |

| Track spending in BUDGT | Treat credit like real money |

| Pay in full every month | No exceptions |

| Keep utilization under 30% | Protects credit score |

| Don’t upgrade lifestyle | Credit isn’t extra money |

Good vs. bad credit card use:

| Situation | Good Use | Bad Use |

|---|---|---|

| Buying groceries | Pay off same week | Carry balance for months |

| Emergency expense | Use and immediately plan payoff | Use as excuse to not save |

| Building credit | Small purchase, immediate payoff | Max out card |

| Rewards | Use for budgeted expenses only | Buy things to earn points |

If you can’t pay in full monthly, don’t get a credit card yet. Build budgeting habits first.

Study Abroad and Travel on a Budget

Studying abroad doesn’t have to be financially devastating.

Budgeting for study abroad:

| Expense Category | Budget Strategy |

|---|---|

| Program fees | Compare programs, choose affordable destination |

| Flights | Book 2-3 months early, use student discounts |

| Daily expenses | Research cost of living before choosing location |

| Travel during program | Budget separately, prioritize experiences |

| Emergency fund | Save extra $500-1,000 before departure |

Budget-friendly study abroad destinations:

| Region | Daily Budget | Notes |

|---|---|---|

| Southeast Asia | $30-50 | Thailand, Vietnam very affordable |

| Eastern Europe | $40-60 | Prague, Budapest, Krakow |

| Latin America | $40-60 | Mexico, Costa Rica, Argentina |

| Spain/Portugal | $50-70 | More affordable than N. Europe |

| Western Europe | $70-100+ | UK, France, Germany, Netherlands |

Budget abroad with Travel Mode

BUDGT's Travel Mode handles foreign currencies automatically. Set your daily budget in the local currency and track spending no matter where your studies take you.

Building Financial Habits for Life

The habits you build now matter more than the specific numbers. Here’s what successful financial adults do—start practicing now:

Habits to build:

| Habit | How to Practice | Long-Term Benefit |

|---|---|---|

| Track every expense | Use BUDGT daily | Awareness prevents overspending |

| Live below your means | Spend less than you earn | Always have margin |

| Pay yourself first | Save before spending | Build wealth automatically |

| Avoid consumer debt | Use credit responsibly | Financial freedom |

| Question purchases | Wait 24 hours on wants | Intentional spending |

| Keep learning | Read personal finance content | Continuous improvement |

What $100/month in savings becomes:

| Start Saving At | By Age 65 (7% return) |

|---|---|

| Age 18 | $378,000 |

| Age 22 | $298,000 |

| Age 25 | $249,000 |

| Age 30 | $177,000 |

Starting in college gives you an enormous advantage. Even small amounts matter.

Your Student Money Action Plan

You don’t need to be perfect. Start with these steps:

| Week | Action | Time |

|---|---|---|

| Week 1 | Download BUDGT, calculate monthly income | 20 min |

| Week 1 | List all fixed expenses | 15 min |

| Week 1-4 | Track every expense daily | 2 min/day |

| End of Month 1 | Review spending patterns | 30 min |

| Month 2 | Set spending limits based on Month 1 data | 20 min |

| Month 2+ | Continue tracking, adjust as needed | 2 min/day |

| Each semester | Reassess budget for new expenses | 30 min |

Start tracking today

BUDGT works offline, requires no bank linking, and takes seconds to log expenses. The perfect first step for students learning to manage money.

From Student to Financial Success

The money skills you build in college determine your financial trajectory for decades. Students who graduate understanding budgeting, saving, and intentional spending build wealth faster than those who don’t.

Start simple: know what comes in, track what goes out, spend less than you earn. That’s 90% of successful money management.

The daily tracking habit is key. Two minutes a day for four years of college creates a foundation that serves you for life.

Your future self will thank your college self for learning this now.

Frequently Asked Questions

How can students start budgeting when they've never done it before?

Start by tracking all your expenses for one month to understand your spending patterns. Then create a simple budget using the 50/30/20 rule: 50% for needs like rent and food, 30% for wants, and 20% for savings. Apps like BUDGT make this easy with daily budget tracking that works 100% offline—no bank linking required.

Is BUDGT available for Android or does it require internet connection?

BUDGT is currently available for iOS only and works completely offline. You don't need internet connectivity, cloud sync, or bank linking. All your financial data stays private on your device, which is perfect for students who want simple, secure budgeting without sharing bank information.

How much does BUDGT cost for students on a tight budget?

BUDGT offers a free trial with full functionality so you can test all features before committing. After the trial, you can choose from flexible subscription options including weekly, monthly, 3-month, 6-month, or yearly plans to fit your student budget. Even the paid options cost less than one coffee per week.

What budgeting features does BUDGT offer that are helpful for students?

BUDGT includes categories for organizing expenses, CSV export for tracking semester spending, geotagging to see where you spend money on campus, and notes to track what purchases were for. The daily budget philosophy helps you stick to a daily limit so you'll have money left at the end of each month.

How can I manage irregular student expenses like textbooks and supplies?

Set aside money each month in your budget for irregular expenses. If textbooks cost $400/semester, budget $45/month. BUDGT's Savings Mode feature is great for building up funds for larger purchases, and you can use categories to separate textbook funds from daily spending.

Can BUDGT help me track spending across different locations on campus?

Yes, BUDGT includes geotagging functionality that shows where you make purchases. This helps you identify spending patterns like how much you spend at the campus cafeteria versus off-campus restaurants, making it easier to find areas to cut back.

What's the best way to build an emergency fund as a student?

Start small with just $20-25 per month. Use BUDGT's daily budget approach to find extra money by sticking to your daily limit. Even small amounts add up over a semester—$25/month becomes $100 by finals. The Savings Mode feature can help you set aside funds specifically for emergencies.

How much should a college student budget for food each month?

Most students spend $200-400 monthly on food depending on location and meal plan status. If you have a meal plan, budget $50-100 extra for off-campus food. Without a meal plan, budget $250-350 and prioritize groceries over dining out. Cooking at home can cut food costs by 50% or more.

What are the biggest money mistakes college students make?

The top mistakes are: not tracking spending at all, relying on credit cards without a payoff plan, eating out instead of cooking, paying full price for textbooks, ignoring student discounts, and treating financial aid refunds as 'free money.' Awareness through daily tracking prevents most of these mistakes.

How do I budget when my income varies from month to month?

Base your budget on your minimum expected monthly income. When you earn more, put the extra toward savings or debt. BUDGT's daily budget adjusts automatically based on what you've already spent, so even with variable income, you always know what's safe to spend each day.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS