How to Get Out of Debt: 5 Steps to Financial Freedom

Debt can feel like a weight you’ll never escape. The constant stress, the guilt when you check your balance, the shame of feeling like you “should know better” by now. If that sounds familiar, you’re not alone—and you’re not broken.

The average American carries over $6,000 in credit card debt. Add student loans, car payments, and medical bills, and the number climbs much higher. But here’s what matters: people escape debt every day. Not through luck or inheritance, but through a plan and consistent action.

This guide will give you that plan. No judgment, no shame—just practical steps to take control of your finances and start your debt-free journey.

Why Traditional Budgeting Fails for Debt Payoff

Before diving into the steps, let’s address why previous attempts might have failed. Understanding this helps you succeed this time.

| Why Budgets Fail | What Actually Works |

|---|---|

| Too complicated—50 categories to track | Simple daily limit you can check in seconds |

| Requires linking bank accounts (feels scary) | Manual tracking that keeps you aware |

| Focuses on restriction and deprivation | Focuses on awareness and choice |

| Monthly view—too abstract | Daily view—actionable right now |

| Red numbers that feel like judgment | Color system that guides without shaming |

The key insight: awareness beats restriction. When you know what you can spend today and still make progress on debt, you make better choices naturally—without feeling deprived.

The True Cost of Different Debts

Not all debt is created equal. Understanding which debts cost you the most helps you prioritize.

The True Cost of Different Debt Types

Interest rate comparison and 5-year cost on $10,000

Key insight: At 22% interest, credit card debt costs more in interest than you originally borrowed. A $10,000 balance becomes $25,000+ over 5 years with minimum payments.

Credit card debt is the silent killer. A $10,000 balance at 22% interest becomes over $25,000 if you only make minimum payments. That’s why high-interest debt should typically be your first target.

| Debt Type | Typical Interest Rate | Priority Level |

|---|---|---|

| Payday loans | 300-500% APR | Highest (emergency) |

| Credit cards | 18-29% APR | Very high |

| Personal loans | 10-20% APR | High |

| Car loans | 5-10% APR | Medium |

| Student loans | 4-8% APR | Lower |

| Mortgage | 6-8% APR | Lowest |

Now let’s walk through the five steps to freedom.

The 5 Steps to Get Out of Debt

Face Your Numbers

List every debt with its balance, interest rate, and minimum payment. This is uncomfortable but essential—you can't fix what you won't look at.

Choose Your Strategy

Pick between the debt snowball (smallest first) or avalanche (highest interest first). Both work—choose what fits your personality.

Find Extra Money

Adjust your budget to free up cash for debt payments. Even $50-100 extra per month accelerates your timeline significantly.

Execute Consistently

Make payments on time, every time. Set up autopay for minimums, then manually add extra to your target debt.

Build Systems to Stay Free

Create an emergency fund and spending awareness habits so you never fall back into the debt trap.

Step 1: Face Your Numbers (Without Shame)

The hardest part of getting out of debt isn’t the math—it’s looking at the numbers in the first place. If opening your credit card statement makes your stomach drop, you’re not alone.

But here’s the truth: the number isn’t as scary once you face it. The anxiety of not knowing is often worse than the reality.

The 10-Minute Debt Inventory

Set a timer for 10 minutes. During this time, gather three pieces of information for each debt:

| Debt Name | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | $4,200 | 24.99% | $84 |

| Credit Card 2 | $1,800 | 19.99% | $36 |

| Personal Loan | $3,500 | 12% | $150 |

| Car Loan | $8,000 | 6% | $280 |

| Total | $17,500 | — | $550 |

That’s it. You now know your starting point. The total might be uncomfortable, but you’ve just done the hardest part.

Why This Matters

Without this inventory, debt feels infinite and hopeless. With it, debt becomes a finite problem with a solution. You’re not “bad with money”—you have $17,500 in debt that you’re going to pay off systematically.

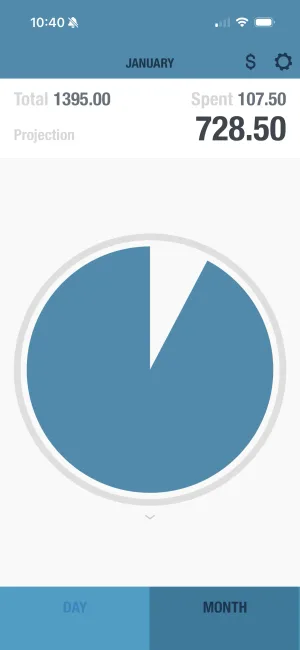

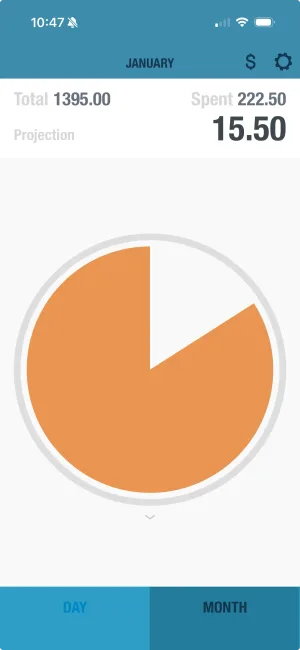

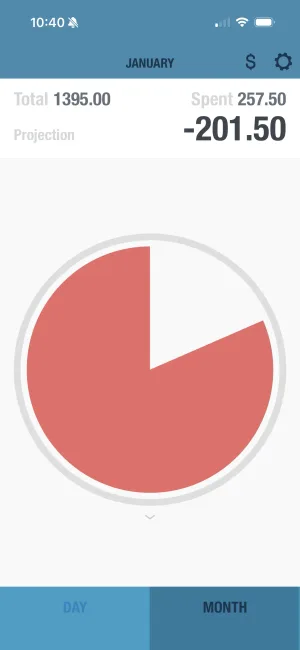

See where you actually stand

BUDGT's month overflow feature shows the reality of overspending clearly. Facing your numbers is the first step—and BUDGT makes it manageable, not overwhelming.

Step 2: Choose Your Debt Payoff Strategy

Two proven methods dominate debt payoff: the snowball and the avalanche. Both work. The best one is whichever you’ll actually stick with.

The Debt Snowball Method

How it works: Pay minimums on all debts, then throw every extra dollar at your smallest balance first. Once it’s paid off, roll that payment to the next smallest.

| Month | Card 1 ($1,800) | Card 2 ($4,200) | Feeling |

|---|---|---|---|

| Start | $1,800 | $4,200 | Overwhelmed |

| Month 6 | $0 (PAID!) | $3,900 | First win! |

| Month 12 | $0 | $2,800 | Momentum building |

| Month 18 | $0 | $0 (PAID!) | Freedom |

Best for: People who need quick wins to stay motivated. If you’ve tried budgeting before and quit, the psychological boost of eliminating a debt quickly can keep you going.

The Debt Avalanche Method

How it works: Pay minimums on all debts, then throw every extra dollar at your highest interest rate debt first. Once it’s paid off, move to the next highest rate.

| Debt | Interest Rate | Priority |

|---|---|---|

| Credit Card 1 | 24.99% | Pay first |

| Credit Card 2 | 19.99% | Pay second |

| Personal Loan | 12% | Pay third |

| Car Loan | 6% | Pay last |

Best for: People motivated by math and efficiency. You’ll pay less total interest, saving potentially thousands of dollars.

Which Should You Choose?

| Choose Snowball If… | Choose Avalanche If… |

|---|---|

| You need quick wins to stay motivated | You’re motivated by saving money |

| You’ve quit budgets before | You can delay gratification |

| You have several small debts | Your highest-interest debt isn’t huge |

| Emotional momentum matters to you | Mathematical efficiency matters to you |

The honest truth: The difference in total interest paid is often smaller than people think. A plan you follow beats a “perfect” plan you abandon.

Step 3: Find Extra Money for Debt Payments

Here’s where your daily budget becomes your debt payoff engine. Every dollar you don’t spend today can go toward debt tomorrow.

Quick Wins: Expenses to Cut First

| Category | Potential Savings | Effort |

|---|---|---|

| Unused subscriptions | $50-200/month | Easy |

| Dining out / takeout | $100-300/month | Medium |

| Impulse purchases | $50-150/month | Medium |

| Downgrade phone plan | $20-50/month | Easy |

| Cancel gym (walk instead) | $30-80/month | Easy |

The subscription audit: Log into every streaming service, app, and membership. Cancel anything you haven’t used in the past month. You can always resubscribe later—but right now, that money goes to debt.

Increase Your Income

| Side Income Idea | Potential Earnings | Time Required |

|---|---|---|

| Sell unused items (eBay, Facebook) | $200-1,000+ one-time | Low |

| Freelance your skills | $200-500/month | Medium |

| Part-time retail/service job | $500-1,000/month | High |

| Gig work (delivery, rideshare) | $300-800/month | Flexible |

Even selling $500 worth of items you don’t use anymore can knock out a small debt entirely.

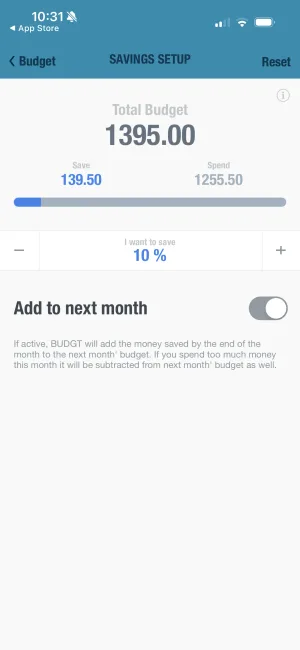

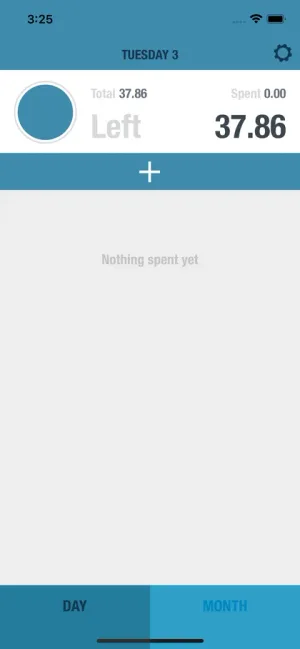

Know exactly what you can spend

BUDGT shows your daily spending limit—the amount you can safely spend while still making progress on debt. Stay in the blue, and you'll have money left for extra debt payments.

The Debt Snowflake Method

Beyond snowball and avalanche, consider snowflaking: every small windfall goes straight to debt.

- Got a $20 rebate? Debt payment.

- Sold something for $50? Debt payment.

- Spent $15 less on groceries? Debt payment.

These small amounts add up faster than you’d expect.

Step 4: Execute Your Plan Consistently

Strategy means nothing without execution. Here’s how to make debt payoff automatic and sustainable.

Automate What You Can

- Set up autopay for all minimum payments — Never miss a payment and damage your credit

- Schedule extra payments for payday — Pay yourself first, then pay debt second

- Track spending daily — Awareness prevents overspending that derails your plan

The Weekly Debt Check-In

Every Sunday, spend 5 minutes:

| Check | Action |

|---|---|

| Did I stay within daily budget? | If not, identify why and adjust |

| Did I make extra debt payment? | If not, transfer what you can now |

| What’s my current balance? | Update your tracking (watch it shrink!) |

| Any windfalls to snowflake? | Apply to target debt |

When You Slip Up

You will slip up. Everyone does. The difference between people who get out of debt and people who don’t isn’t perfection—it’s getting back on track quickly.

If you overspend:

- Don’t spiral into shame

- Identify what triggered it

- Adjust the next few days to compensate

- Keep going

One bad week doesn’t erase months of progress. What matters is the overall trend.

See your progress over time

BUDGT's month-end projection shows where you're headed. Even after a slip-up, you can see the path forward and course-correct before month's end.

Step 5: Build Systems to Stay Debt-Free

Paying off debt is an achievement. Staying debt-free is a lifestyle. Here’s how to make sure you never go back.

Build an Emergency Fund

The #1 reason people fall back into debt: an unexpected expense hits, and the credit card comes out again.

| Emergency Fund Stage | Target | Purpose |

|---|---|---|

| Starter fund | $500-1,000 | Cover small emergencies during debt payoff |

| Full fund | 3-6 months expenses | Never need credit cards again |

Start with the starter fund while paying off debt. Once debt-free, build the full fund before anything else.

Create Spending Awareness Habits

The goal isn’t to budget forever with intense focus—it’s to build awareness that becomes automatic.

| Habit | How It Helps |

|---|---|

| Check your daily budget each morning | Start the day with awareness |

| Log purchases as they happen | No “where did my money go?” moments |

| Review weekly (5 minutes) | Catch patterns before they become problems |

| Monthly reflection (15 minutes) | Celebrate progress, adjust as needed |

Build lasting money awareness

BUDGT's daily reminders help you build consistent tracking habits. A few seconds each day creates awareness that lasts a lifetime—long after debt is gone.

Avoid the Debt Traps

Once you’re debt-free, certain patterns can pull you back in:

| Debt Trap | How to Avoid |

|---|---|

| ”Buy Now, Pay Later” schemes | If you can’t pay cash, you can’t afford it |

| Lifestyle inflation | When income rises, savings should too |

| ”I deserve this” spending | You deserve financial peace more |

| Keeping up with others | Their finances aren’t your business |

| Credit card rewards | Only if you pay in full every month |

Your Debt-Free Timeline

How long will it take? That depends on your numbers, but here’s a realistic framework:

| Total Debt | Extra Monthly Payment | Approximate Timeline |

|---|---|---|

| $5,000 | $200 | 2-3 years |

| $10,000 | $300 | 3-4 years |

| $20,000 | $500 | 4-5 years |

| $50,000+ | $800+ | 5-7 years |

These timelines assume average interest rates and consistent payments. You can accelerate by increasing income, cutting expenses, or both.

The key insight: Even if your timeline is 5+ years, that’s 5 years that lead somewhere better. Without a plan, you’ll be in the same place—or worse—5 years from now.

Start Today, Not Monday

The best time to start paying off debt was years ago. The second best time is today. Not next month, not after the holidays, not when things “calm down.” Today.

Your first action: Create your debt inventory. Set a 10-minute timer, list your debts, and face the numbers. That single step puts you ahead of most people who let debt anxiety paralyze them.

Debt doesn’t define you. It’s just a problem to solve—and now you have the tools to solve it.

Need help staying on track? BUDGT shows you exactly what you can spend each day while still making progress on debt. No bank linking, no judgment—just clarity when you need it most.

Frequently Asked Questions

What's the difference between the debt snowball and avalanche methods?

The snowball method focuses on paying off your smallest debts first to build momentum and motivation through quick wins. The avalanche method prioritizes debts with the highest interest rates to minimize the total interest paid over time. Both are effective—snowball is better if you need psychological wins, avalanche saves more money mathematically.

How long does it take to pay off $10,000 in credit card debt?

At minimum payments (~2% of balance), it takes 20+ years and costs over $15,000 in interest. Paying $400/month instead, you'd be debt-free in about 31 months, paying around $2,800 in interest. The more you can pay above minimum, the faster you escape.

Should I use savings to pay off debt?

Keep a small emergency fund ($500-1,000) first, then throw everything else at high-interest debt. Without any buffer, an unexpected expense puts you right back on credit cards. Once high-interest debt is gone, rebuild savings fully.

How can I pay off debt with a low income?

Focus on small wins—even $25 extra per month makes a difference. Use the snowball method to eliminate small debts quickly and free up those minimum payments. Look for ways to earn extra: selling unused items, side gigs, or asking for a raise. Every dollar counts.

Is debt consolidation a good idea?

Consolidation can help if you qualify for a lower interest rate and won't accumulate new debt. Balance transfers (0% APR cards) or personal loans can work. But consolidation doesn't solve the spending habits that created the debt—combine it with budgeting changes.

How do I stay motivated while paying off debt?

Track progress visually—whether in an app or on paper. Celebrate milestones (each debt paid off, each $1,000 gone). Join debt-free communities for support. Remember your 'why'—what will life look like without debt payments? Keep that vision front and center.

Should I stop using credit cards while paying off debt?

For most people, yes. Switch to debit or cash while you're in payoff mode. The psychological break from credit helps reset spending habits. Once debt-free, you can reintroduce credit cards if you pay the balance in full each month.

How does BUDGT help with debt payoff?

BUDGT shows your daily spending limit—the amount you can spend while still having money left for debt payments. By staying within your daily budget, you automatically free up cash for extra debt payments without complex calculations. The color system (blue/yellow/orange) gives instant feedback.

What debts should I pay off first?

Always pay minimums on everything first. Then choose: high-interest debts first (avalanche) to save money, or smallest balances first (snowball) to build momentum. Payday loans and credit cards typically have the highest rates and should be priorities.

Can I negotiate with creditors to reduce my debt?

Sometimes. Call your credit card company and ask for a lower interest rate—many will reduce it if you have good payment history. For accounts in collections, you can sometimes negotiate a lower payoff amount. Get any agreement in writing before paying.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS