Break Free from the Paycheck-to-Paycheck Cycle: 5 Steps to Financial Freedom

Living paycheck to paycheck means one unexpected expense away from crisis. No savings cushion. No breathing room. The constant stress of wondering if you’ll make it to the next payday.

If this sounds familiar, you’re not alone. Over 60% of Americans live paycheck to paycheck—and it’s not just low earners. People making $100,000+ struggle too when spending rises to match income.

The good news? You can break this cycle. Not with a magic solution or extreme deprivation, but with a clear system and daily discipline. This guide gives you everything you need to build real financial security.

Are You Stuck in the Paycheck-to-Paycheck Cycle?

Before building a plan, let’s assess where you stand:

Self-Assessment: Signs You’re Living Paycheck to Paycheck

| Sign | Check If True |

|---|---|

| You have less than $500 in savings | __ |

| You worry about bills before payday | __ |

| An unexpected $500 expense would require credit | __ |

| You’ve overdrafted in the past year | __ |

| You pay only minimum on credit cards | __ |

| You borrow from next month to cover this month | __ |

| You can’t remember your last savings deposit | __ |

| You’ve skipped bills to cover other expenses | __ |

If you checked 3 or more, you’re in the paycheck-to-paycheck cycle. But every checked box is a problem with a solution.

The True Cost of Living Paycheck to Paycheck

| Hidden Cost | Impact |

|---|---|

| Overdraft fees | $35 per incident, hundreds per year |

| Late payment fees | $25-50 per bill |

| Credit card interest | 20%+ APR on carried balances |

| Stress on health | Medical costs from chronic financial anxiety |

| Missed opportunities | Can’t invest, save, or take advantage of deals |

| Emergency debt spiral | One crisis leads to months of recovery |

Living paycheck to paycheck costs more than just money—it costs peace of mind.

The 5-Step Plan to Financial Freedom

Track Every Dollar

You can't fix what you can't see. Track all spending for 30 days to understand where money actually goes. Most people find hundreds in 'invisible' spending.

Create a Realistic Budget

Build a budget based on your actual income and essential expenses. The goal isn't perfection—it's a daily limit you can actually follow.

Build a Starter Emergency Fund

Save $500-1000 as your first safety net. This small buffer prevents most emergencies from becoming debt. Start small, stay consistent.

Cut Expenses and Boost Income

Find $100-300 in monthly cuts from subscriptions, dining out, and impulse purchases. Explore side income. Every dollar has a job.

Attack Debt Strategically

Once you have a small emergency fund, throw everything extra at high-interest debt. Use snowball or avalanche method based on what keeps you motivated.

Step 1: Track Every Dollar

The biggest lie we tell ourselves: “I know where my money goes.”

Most people are shocked when they actually track spending. Small purchases add up. Subscriptions multiply. The $5 coffee becomes $150/month.

The 30-Day Tracking Challenge

| Week | Focus | What You’ll Learn |

|---|---|---|

| Week 1 | Log everything (no changes) | Where money actually goes |

| Week 2 | Categorize expenses | Which categories drain your budget |

| Week 3 | Identify patterns | Emotional spending triggers |

| Week 4 | Find the leaks | ”Invisible” spending to cut |

Common Spending Surprises

| Category | What People Expect | What Tracking Reveals |

|---|---|---|

| Dining out | $100/month | $250-400/month |

| Subscriptions | $30/month | $80-150/month |

| Groceries | Reasonable | Includes impulse buys at checkout |

| ”Miscellaneous” | $50/month | $200-400/month |

| Coffee/treats | A few dollars | $75-150/month |

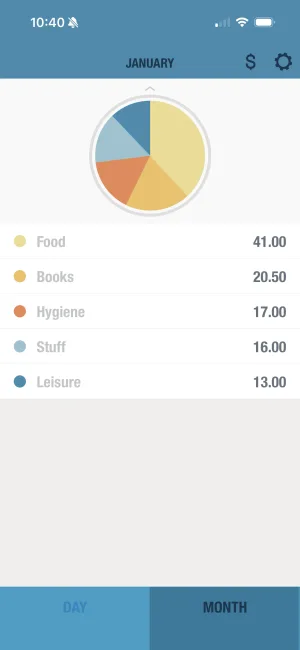

See where every dollar goes

BUDGT makes tracking simple. Log each expense in seconds and watch your daily total update in real-time. After 30 days, you'll know exactly where your money goes.

Step 2: Create a Realistic Budget

A budget isn’t punishment—it’s permission. It tells you what you CAN spend without guilt, and protects what matters.

The 50/30/20 Framework

| Category | Percentage | Example ($4,000 income) |

|---|---|---|

| Needs | 50% | $2,000 |

| Wants | 30% | $1,200 |

| Savings/Debt | 20% | $800 |

Breaking Down “Needs” vs “Wants”

| Needs (50%) | Wants (30%) |

|---|---|

| Rent/mortgage | Dining out |

| Utilities | Entertainment |

| Groceries (basics) | Streaming services |

| Transportation (essential) | Coffee shops |

| Insurance | Shopping (non-essential) |

| Minimum debt payments | Travel |

| Childcare | Hobbies |

When 50/30/20 Doesn’t Work

If your needs exceed 50% (common in high-cost areas), adjust the framework:

| Situation | Adjusted Split |

|---|---|

| High housing costs | 60/20/20 |

| High debt payments | 60/15/25 |

| Very tight budget | 70/20/10 |

| Breaking the cycle | 55/25/20 (more to savings) |

The framework matters less than having a framework. Pick one and stick with it.

Budget Allocation: 50/30/20 Rule

Calculate Your Daily Budget

Your Daily Budget Calculator

Your take-home pay

Bills you must pay every month

Pay yourself first

Minimum payments on credit cards, loans

Enter your numbers above - results update automatically

Note: This uses 30 days as an average month. Actual months vary from 28-31 days—BUDGT adjusts automatically based on the current month.

This daily number is your guide. Stay within it, and you’ll automatically break the paycheck-to-paycheck cycle.

Know your daily limit

BUDGT shows exactly what's safe to spend today. Blue means go ahead, yellow means slow down, orange means stop. Simple colors replace complex calculations.

Step 3: Build a Starter Emergency Fund

The emergency fund is what breaks the cycle. Without it, every unexpected expense becomes debt. With it, you handle problems with cash instead of credit cards.

Emergency Fund Targets

| Stage | Target | Purpose |

|---|---|---|

| Starter | $500-1,000 | Cover most minor emergencies |

| Basic | 1 month expenses | Short-term job loss protection |

| Secure | 3 months expenses | Standard recommendation |

| Comfortable | 6 months expenses | Maximum security |

How Long to Build Each Stage

Assuming $200/month savings:

| Target | Time to Reach |

|---|---|

| $500 | 2.5 months |

| $1,000 | 5 months |

| 1 month expenses ($3,000) | 15 months |

| 3 months expenses ($9,000) | 3.75 years |

Don’t let the bigger numbers discourage you. The first $500 is the most important—it handles most car repairs, medical copays, and household emergencies.

Quick Ways to Build Your Starter Fund

| Method | Potential |

|---|---|

| Sell unused items | $100-500 one-time |

| Cut one subscription | $10-50/month |

| Reduce dining out by half | $100-200/month |

| Use cashback apps | $20-50/month |

| Freelance/side gig | $100-500/month |

| Tax refund (if applicable) | $500-2,000 one-time |

Watch your emergency fund grow

BUDGT's Savings Mode shows your progress toward your goal. Set a target, and the app automatically adjusts your daily budget to help you save.

Step 4: Cut Expenses and Boost Income

Breaking the paycheck cycle requires either spending less, earning more, or both. Here’s where to find extra money:

The Expense Cutting Audit

| Category | Average Savings | How |

|---|---|---|

| Subscriptions | $50-100/month | Cancel unused streaming, apps, memberships |

| Dining out | $100-200/month | Cook at home 2-3 extra meals per week |

| Groceries | $50-100/month | Meal plan, use store brands, avoid impulse buys |

| Utilities | $30-50/month | Adjust thermostat, unplug devices, LED bulbs |

| Insurance | $50-200/month | Shop for better rates annually |

| Phone plan | $20-50/month | Switch to a budget carrier |

Potential Monthly Savings by Category

The Subscription Audit Checklist

| Subscription | Monthly Cost | Used Weekly? | Action |

|---|---|---|---|

| Netflix | $____ | Y / N | Keep / Cancel |

| Spotify | $____ | Y / N | Keep / Cancel |

| Gym | $____ | Y / N | Keep / Cancel |

| Amazon Prime | $____ | Y / N | Keep / Cancel |

| Other streaming | $____ | Y / N | Keep / Cancel |

| Apps (premium) | $____ | Y / N | Keep / Cancel |

| Total | $____ | — | — |

If you don’t use it weekly, cancel it during your break-the-cycle phase. You can always re-subscribe later.

Income Boosting Ideas

| Side Income | Potential | Time Investment |

|---|---|---|

| Sell unused items (eBay, FB Marketplace) | $100-1,000 one-time | Low |

| Freelance skills (writing, design, coding) | $200-2,000/month | Medium-High |

| Gig apps (delivery, rideshare) | $100-500/week | Flexible |

| Tutoring | $20-50/hour | Medium |

| Pet sitting/dog walking | $15-30/walk | Flexible |

| Overtime at current job | Varies | Available for some |

Even an extra $200/month accelerates your emergency fund by 12x compared to $0 extra.

Step 5: Attack Debt Strategically

Debt is the anchor keeping you in the paycheck-to-paycheck cycle. Once your starter emergency fund is in place, it’s time to eliminate it.

Two Proven Debt Payoff Methods

Avalanche Method (Mathematically Best)

Pay minimums on everything, put extra toward highest interest rate first.

| Debt | Balance | Rate | Order |

|---|---|---|---|

| Credit Card A | $3,000 | 24% | 1st |

| Credit Card B | $1,500 | 18% | 2nd |

| Car Loan | $8,000 | 6% | 3rd |

Snowball Method (Psychologically Best)

Pay minimums on everything, put extra toward smallest balance first.

| Debt | Balance | Rate | Order |

|---|---|---|---|

| Credit Card B | $1,500 | 18% | 1st |

| Credit Card A | $3,000 | 24% | 2nd |

| Car Loan | $8,000 | 6% | 3rd |

Which Method to Choose?

| Choose Avalanche if… | Choose Snowball if… |

|---|---|

| You’re motivated by math | You need quick wins |

| Interest rates vary significantly | Balances are similar |

| You have patience | You’ve quit debt payoff before |

| You want to pay least overall | You need momentum |

Either method works if you stick with it. The worst approach is switching between methods or giving up.

Visualize your progress

BUDGT's month-end projection shows where you'll be if you stick to your daily budget. Watch the projection improve as you pay down debt and build savings.

Your 90-Day Break-the-Cycle Plan

| Timeframe | Focus | Milestone |

|---|---|---|

| Days 1-7 | Set up BUDGT, start tracking | Know your starting point |

| Days 8-14 | Analyze spending patterns | Identify $100+ in potential cuts |

| Days 15-30 | Implement budget, cut expenses | First month within budget |

| Days 31-60 | Build tracking habit, start emergency fund | $200-400 saved |

| Days 61-90 | Maintain system, increase savings rate | $500+ emergency fund |

Signs You’re Making Progress

| Green Flag | What It Means |

|---|---|

| Daily budget feels manageable | System is sustainable |

| Emergency fund has money | Breaking the cycle |

| No new credit card charges | Spending within means |

| Less stress about money | Awareness creates control |

| Some money left at month end | Buffer building |

Warning Signs

| Red Flag | Solution |

|---|---|

| Frequently over daily budget | Lower expectations or cut more |

| Dipping into emergency fund for non-emergencies | Redefine “emergency” |

| Adding new debt | Switch to cash only |

| Feeling deprived | Build small treats into budget |

Smart Money Habits for Long-Term Success

Breaking the cycle is step one. Staying free requires building sustainable habits:

| Habit | How to Build It |

|---|---|

| Track daily | Set a reminder to log expenses every evening |

| Pay yourself first | Automate savings transfers on payday |

| Use the 24-hour rule | Wait a day before non-essential purchases |

| Review weekly | Spend 10 minutes each Sunday checking your budget |

| Celebrate wins | Acknowledge progress without spending to celebrate |

| Keep learning | Read one money article or listen to one podcast per week |

From Paycheck to Paycheck to Financial Peace

Living paycheck to paycheck isn’t a life sentence. It’s a pattern—and patterns can be changed.

The solution isn’t a windfall or a dramatic lifestyle change. It’s small, consistent actions:

- Tracking every expense

- Staying within your daily limit

- Building a small emergency fund

- Cutting unnecessary spending

- Paying down debt strategically

These steps won’t transform your finances overnight. But after 90 days of consistency, you’ll look at your bank account and see something you haven’t seen in years: a buffer. Breathing room. Peace of mind.

That’s what breaking the paycheck-to-paycheck cycle looks like. Not wealth—just security. The knowledge that one unexpected expense won’t derail your life.

One day, one dollar, one smart choice at a time.

Frequently Asked Questions

How does the daily budget approach help break the paycheck-to-paycheck cycle?

BUDGT's daily limit shows exactly what's safe to spend today. If you stay within that limit every day, you automatically have money left at month's end. This creates a natural buffer and breaks the cycle without complex calculations or spreadsheets.

How long does it take to break the paycheck-to-paycheck cycle?

Most people see improvement within 2-3 months of consistent daily budgeting. Building a full 3-6 month emergency fund takes 1-2 years depending on income and expenses. The key is starting with small wins—even a $500 buffer changes everything.

What's the first step if I have zero savings?

Start by tracking every expense for 2 weeks without changing anything. This reveals where money actually goes. Then cut one non-essential expense and redirect that money to savings. Even $50/month builds to $600/year—enough to handle many emergencies.

How can I build an emergency fund on a tight budget?

Start small—aim for $500, not 6 months of expenses. Use BUDGT's Savings Mode to automatically reduce your daily budget. Round up purchases and save the difference. Sell unused items. Every small deposit builds the habit and the fund.

What's the 50/30/20 rule and can BUDGT help me implement it?

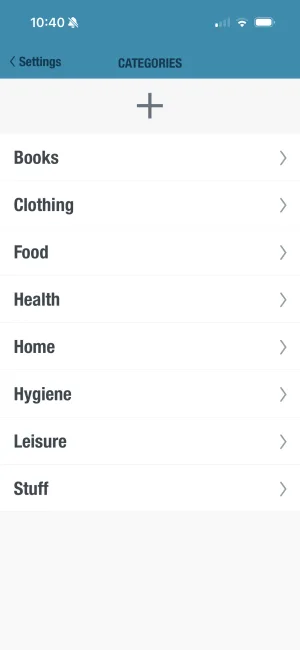

The 50/30/20 rule allocates 50% to needs, 30% to wants, and 20% to savings/debt. BUDGT's Categories feature lets you track spending against these targets. Many people find 60/20/20 or 70/20/10 more realistic when breaking the paycheck cycle.

Can BUDGT help if my income varies from month to month?

Yes! BUDGT's flexible system works well with irregular income. Set your budget based on your lowest expected income, then treat extra as bonus for savings or debt. The daily approach adapts naturally to income fluctuations.

Should I pay off debt or build savings first?

Build a small emergency fund ($500-1000) first, then focus on high-interest debt. Without an emergency fund, you'll add new debt when problems arise. Once high-interest debt is gone, split extra between savings and remaining debt.

How do I stop living paycheck to paycheck if I already have debt?

Focus on stopping the bleeding first. Track spending to find cuts, build a tiny emergency fund ($500), then attack debt with any extra. The daily budget approach prevents adding new debt while you pay off old balances.

What expenses should I cut first when trying to break the cycle?

Start with subscriptions you don't use weekly, dining out, and impulse purchases. Don't cut essentials—that's unsustainable. Most people find $100-300/month in painless cuts. That money goes to emergency fund first, then debt.

Is my financial data safe in BUDGT?

Yes. BUDGT is 100% offline with no cloud sync or bank linking. Your financial data never leaves your device. You maintain complete privacy without worrying about data breaches or third-party access.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS