Diwali Shopping on a Budget: How to Celebrate Big Without Breaking the Bank

This post is crafted for our wonderful users in India—though the wisdom here applies no matter where you call home.

Diwali is more than just a festival—it’s an emotion. The twinkling diyas, the burst of crackers, the aroma of fresh mithai, and the joy of family gatherings make it India’s most beloved celebration. But let’s be honest: Diwali can also be India’s most expensive celebration.

The average Indian family spends anywhere from ₹15,000 to ₹50,000 during the Diwali season. From new clothes and home decorations to gifts and sweets, the expenses add up faster than you can say “Shubh Deepavali.” But here’s the good news: you can celebrate Diwali in all its glory without dimming your financial future.

This guide will show you exactly how to plan your Diwali budget, where to save without sacrificing joy, and how to emerge from the festival season with your finances intact.

Understanding Your Diwali Spending Categories

Before you can control your Diwali spending, you need to understand where the money typically goes. Here’s a breakdown of how most Indian families allocate their festival budget:

| Category | % of Budget | Example (₹25,000 budget) | What It Covers |

|---|---|---|---|

| Clothes & Accessories | 30-40% | ₹7,500-10,000 | Sarees, kurtas, kids’ outfits, jewelry |

| Gifts & Mithai | 20-30% | ₹5,000-7,500 | Dry fruits, sweets, gift hampers |

| Home Decoration | 15-20% | ₹3,750-5,000 | Diyas, lights, rangoli, torans |

| Puja Items | 5-10% | ₹1,250-2,500 | Idols, incense, flowers, offerings |

| Electronics | 0-20% | ₹0-5,000 | Optional: phones, appliances |

| Buffer | 5-10% | ₹1,250-2,500 | Unexpected expenses |

Understanding this breakdown helps you identify where you tend to overspend. For many families, clothes and gifts eat up 60-70% of the budget—often more than planned.

Sample Diwali Budgets by Income Level

Not sure what’s reasonable for your situation? Here’s a guide based on monthly household income:

| Monthly Income | Suggested Diwali Budget | % of Monthly Income |

|---|---|---|

| ₹30,000-50,000 | ₹8,000-15,000 | 5-8% |

| ₹50,000-80,000 | ₹15,000-25,000 | 5-8% |

| ₹80,000-1,50,000 | ₹25,000-40,000 | 5-7% |

| ₹1,50,000+ | ₹40,000-75,000 | 5-6% |

These are guidelines, not rules. Your actual budget should reflect your savings goals, existing debts, and other financial priorities. If you’re paying off a loan or building an emergency fund, lean toward the lower end.

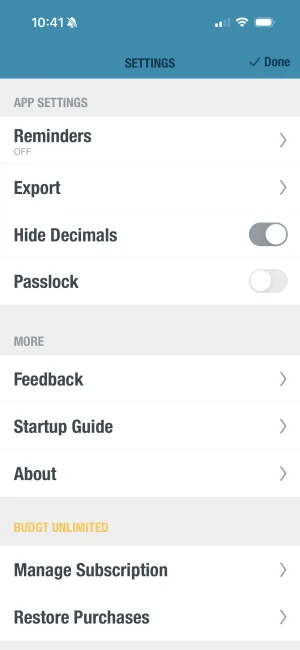

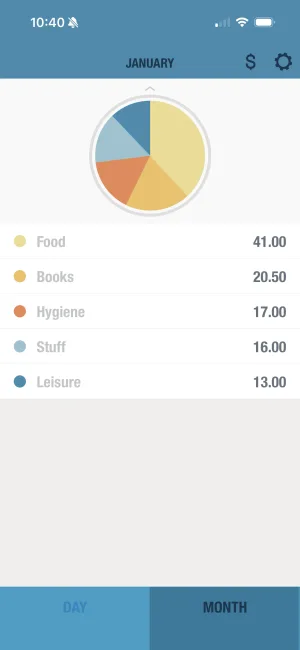

Clean budgeting with large Rupee amounts

BUDGT's hide decimals feature makes managing ₹25,000 festival budgets cleaner and easier to read at a glance.

Creating Your Diwali Budget: Step by Step

The most important step that most people skip: decide your total Diwali budget before the shopping begins. Here’s how to do it right:

Calculate What You Can Afford

Look at your monthly income and existing expenses. Your Diwali budget should come from savings or discretionary spending—not from skipping bills or taking loans.

Set Your Total Number

Write down a specific amount. ₹25,000—not 'around 25-30k' or 'let's see.' A vague budget is no budget at all.

Allocate by Category

Divide your total into clothes, gifts, decorations, puja items, and buffer. Use the percentages above as a starting point.

List Everyone Who Needs Gifts

Write down every person you'll buy gifts for: family, colleagues, neighbors, household help. Assign a budget per person.

Track Every Purchase

Log each Diwali expense as it happens. Waiting until after the festival means losing track—and overspending.

Open BUDGT and allocate a specific amount for festival expenses. Work backwards from what you can actually afford, not from what you wish you could spend. If you have ₹25,000 to spare, that’s your number. Not ₹30,000, not “let’s see how it goes.”

Smart Shopping Strategies

Start Early: September, Not October

The best Diwali shopping happens before Diwali fever hits. September sales often have better deals than the crowded October rush.

| Shopping Time | Advantages | Best For |

|---|---|---|

| September | Less crowds, better selection, time to compare | Clothes, decorations, gifts |

| Early October | Pre-Diwali sales begin, good electronics deals | Appliances, phones |

| Week Before Diwali | Last-minute discounts on perishables | Fresh flowers, sweets |

| Diwali Week | Huge crowds, picked-over stock, panic buying | Avoid if possible |

Starting early also gives you time to comparison shop. That saree you found for ₹3,500 at the first store? You might find it for ₹2,800 at another. But you’ll never know if you’re rushing through stores on Dhanteras.

Online vs. Local Markets: Know When to Use Each

The debate between online shopping and local markets isn’t about which is better—it’s about knowing which works best for what you’re buying.

| Item | Best Place to Buy | Why |

|---|---|---|

| Traditional clothes | Local market | Better quality check, bargaining possible |

| Electronics | Online (during sales) | Genuine discounts, easy returns |

| Diyas & decorations | Local market | Much cheaper, support local artisans |

| Branded gifts | Online | Better prices, no bargaining hassle |

| Dry fruits | Local wholesale market | 40-50% cheaper than packaged boxes |

| Fresh flowers | Local vendor | Fresher, negotiate for bulk |

For clothes and decorations, your local market often beats online prices—especially for traditional items. But for electronics and branded goods, online sales during Diwali (Amazon Great Indian Festival, Flipkart Big Billion Days) genuinely offer savings of 20-40%.

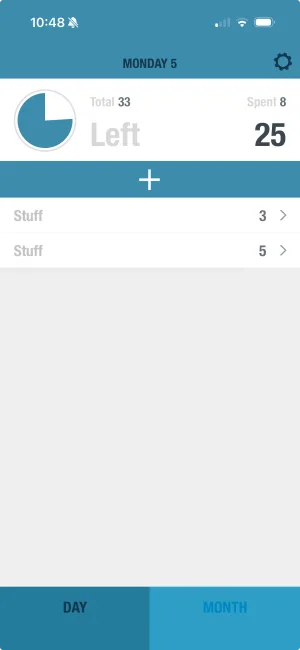

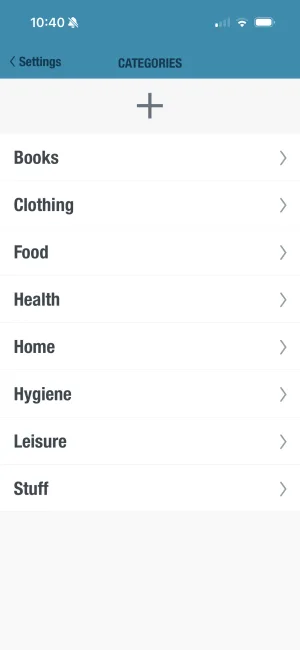

Track your Diwali spending by category

BUDGT's category feature shows exactly where your festival money is going—clothes, gifts, decorations, or that 'small' electronics purchase.

DIY Decorations: Beautiful and Budget-Friendly

Some of the most beautiful Diwali decorations cost almost nothing. Before buying everything from a store, consider what you can create at home:

| DIY Decoration | Materials Needed | Approximate Cost |

|---|---|---|

| Paper diyas | Color paper, glue, tea lights | ₹50-100 |

| Flower rangoli | Marigolds, rose petals, rice flour | ₹100-200 |

| Upcycled jar lanterns | Old glass jars, paint, candles | ₹50 |

| Paper lanterns (kandil) | Chart paper, wire, light | ₹30-50 |

| Toran from fabric scraps | Old dupattas, beads | ₹0-50 |

YouTube has thousands of tutorials for Diwali decorations. Spend an evening with your family making decorations together—it becomes a memory more valuable than anything you could buy.

Pro tip: Save your fairy lights and reusable decorations from previous years. That ₹500 light string from last Diwali still works perfectly fine.

Homemade Sweets vs. Store-Bought Mithai

A box of sweets from a fancy mithai shop can cost ₹500-2,000. The same quantity made at home? Under ₹200—and it tastes better.

| Sweet | Store Price (500g) | Homemade Cost | Difficulty |

|---|---|---|---|

| Besan ladoo | ₹400-600 | ₹80-100 | Easy |

| Coconut barfi | ₹350-500 | ₹70-90 | Easy |

| Kaju katli | ₹800-1,200 | ₹400-500 | Medium |

| Gulab jamun | ₹300-400 | ₹60-80 | Medium |

| Chocolate barfi | ₹400-600 | ₹100-150 | Easy |

Even if you’re not a cooking enthusiast, simple sweets like coconut ladoos and besan ladoos can be made in under an hour. Bonus: homemade sweets come with love that store-bought can’t match.

For gifts, consider making a mixed box with 2-3 types of homemade sweets. Presented nicely, these are more appreciated than generic store boxes.

Gift-Giving Without Going Broke

The Diwali gift spiral is real. You give a ₹500 box to your colleague, they give you a ₹1,000 hamper, and suddenly you’re both trapped in an escalating gift war that benefits no one.

Setting Gift Budgets by Relationship

| Relationship | Suggested Budget | Gift Ideas |

|---|---|---|

| Immediate family | ₹1,000-2,000 | Clothes, jewelry, electronics |

| Extended family | ₹500-1,000 | Sweets, dry fruits, home items |

| Close friends | ₹500-800 | Personalized gifts, plants, books |

| Colleagues | ₹300-500 | Sweets box, dry fruits, candles |

| Neighbors | ₹200-300 | Homemade sweets, small diyas |

| Household help | ₹500-1,000 | Cash bonus, clothes, sweets |

Set these amounts before you start shopping and stick to them. When you see that beautiful ₹1,500 gift set for your colleague, remember: your budget is ₹500, and a thoughtful ₹500 gift is better than an impressive ₹1,500 one that strains your finances.

Breaking the Gift Escalation Cycle

Consider group gifting at work. Instead of 10 colleagues each spending ₹500 on random gifts, pool ₹5,000 for meaningful gifts selected by each person’s close team members.

Experience over things. A handwritten card with genuine wishes is more memorable than yet another dry fruit box that will sit unopened until it expires.

Talk about it. Many people feel the same pressure you do. Suggesting a “no gifts” or “₹300 limit” policy among friends often brings relief to everyone.

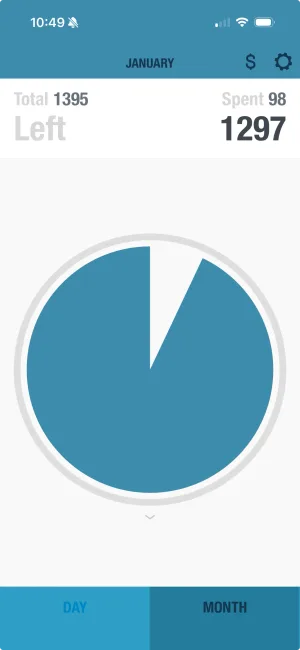

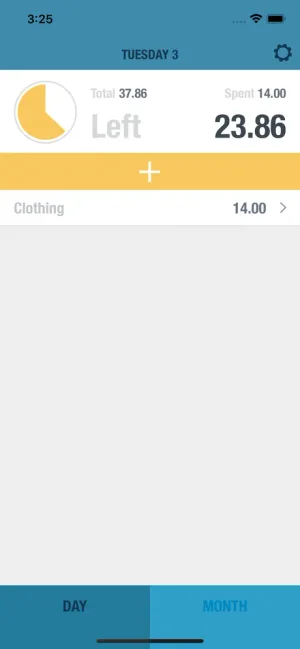

See your daily spending limit during Diwali

Even during festival season, BUDGT shows what's safe to spend each day. The color system keeps you aware without killing the festive mood.

Electronics & Appliances: The Diwali Sale Trap

Yes, Diwali sales offer real discounts on electronics. But they also create artificial urgency that leads to unnecessary purchases. The “auspicious time to buy” becomes an excuse for impulse buying.

Before Buying Any Electronics, Ask:

| Question | If Yes | If No |

|---|---|---|

| Did I need this before seeing the sale? | Consider buying | Skip it |

| Have I compared prices from 2-3 months ago? | Good—proceed if genuine discount | Research first |

| Is this replacing something broken? | Legitimate need | Probably a want |

| Can I afford this without affecting other goals? | Budget allows | Wait for next year |

| Will I still want this in January? | Probably useful | Probably impulse |

Set price alerts using apps like Keepa (for Amazon) before the sale begins. You’ll know if the “60% off” is calculated from an inflated MRP or represents genuine savings.

Sleep on big purchases. If that TV or smartphone is still a good idea tomorrow, buy it then. The sale lasts several days—there’s no need to decide in 10 minutes.

The Post-Diwali Reality Check

Diwali ends. The diyas go out. The guests leave. And then comes the moment of truth: checking what you actually spent.

Open BUDGT and review every expense from the festival season. Compare it against your original budget:

| Category | Budgeted | Actual | Difference |

|---|---|---|---|

| Clothes | ₹10,000 | ₹12,500 | +₹2,500 over |

| Gifts & Sweets | ₹7,000 | ₹6,200 | -₹800 under |

| Decorations | ₹4,000 | ₹3,500 | -₹500 under |

| Puja items | ₹2,000 | ₹1,800 | -₹200 under |

| Buffer | ₹2,000 | ₹3,000 | +₹1,000 over |

| Total | ₹25,000 | ₹27,000 | +₹2,000 over |

This isn’t about guilt—it’s about learning. If you overspent on clothes but saved on decorations, you now know where your budget needs adjustment next year. If you consistently go over in certain categories, build that reality into future budgets.

If you did overspend, adjust your spending for the rest of the month to compensate. If you stayed under budget, congratulate yourself—and consider putting that extra money into savings or your emergency fund.

A Brighter Diwali, A Brighter Future

Celebrating Diwali on a budget isn’t about being a miser or skipping the festivities. It’s about being intentional with your money so that the joy of Diwali doesn’t come with a January hangover of debt and regret.

The real light of Diwali comes from family, tradition, and gratitude—none of which require a shopping cart. The warmth of diyas you lit together, the rangoli your children helped create, the sweets you made as a family—these are the memories that last.

This year, let your budget shine as bright as your diyas. Plan ahead, spend intentionally, and enter the new year with your finances as bright as your home.

Shubh Deepavali! May your lights—and your savings—burn bright.

Frequently Asked Questions

How much should I budget for Diwali?

A reasonable Diwali budget depends on your income, but a general guideline is 5-10% of your monthly income. For a family earning ₹50,000-80,000 per month, a Diwali budget of ₹15,000-25,000 covers clothes, gifts, decorations, and puja items comfortably. The key is setting this amount before shopping begins—not after.

How can I save on Diwali clothes?

Start shopping in September when stores aren't crowded and offer pre-Diwali discounts. Consider mixing new pieces with existing wardrobe items, buying from local markets instead of malls, and choosing versatile outfits that work beyond Diwali.

Is it better to buy during Diwali sales or before?

It depends on what you're buying. Electronics and branded items genuinely see their best prices during Diwali sales (October). However, traditional items like clothes, decorations, and sweets are often cheaper in September before demand peaks.

How do I avoid overspending on Diwali gifts?

Set a per-person gift budget before you start shopping and stick to it strictly. Consider group gifting with colleagues or friends to share costs. Focus on thoughtful, personalized gifts rather than expensive generic hampers.

Can I celebrate Diwali meaningfully on a tight budget?

Absolutely. Diwali's essence lies in light, family, and gratitude—none of which require spending. Make rangolis with rice flour and flower petals, create paper diyas with your children, cook traditional sweets together as a family activity. The most memorable Diwalis are often the simplest ones.

When is the best time to start Diwali shopping?

Start in September, about 4-6 weeks before Diwali. This gives you time to compare prices, avoid crowds, and take advantage of early-bird discounts. Electronics can wait for the October sales, but traditional items are best purchased early.

How do I handle social pressure to overspend during Diwali?

Remember that financial peace matters more than appearances. Set boundaries politely but firmly. If someone gives you an expensive gift, a heartfelt thank-you note is sufficient—you're not obligated to match their spending. True relationships don't require expensive gifts to thrive.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS