Saving Money Tips for Single Parents: 8 Budget Strategies That Work

Single parenting is one of the most demanding jobs there is—and doing it on one income makes it even harder. You’re managing everything: childcare, household responsibilities, work, and finances. There’s no partner to split costs with, no backup income, and every financial decision falls on your shoulders.

But here’s what single parents who’ve built financial stability know: it’s not about how much you earn—it’s about how you manage what you have. With the right strategies, you can stretch your income further, build savings, and create security for your family.

This guide covers eight proven strategies that work for single-parent households, with real numbers and practical steps you can start using today.

The Single Parent Financial Reality

Let’s be honest about the challenges:

| Challenge | Impact |

|---|---|

| One income | Less margin for error |

| Childcare costs | Often 20-30% of income |

| Time poverty | Less time to comparison shop, cook, plan |

| No backup | When you’re sick, income stops |

| Higher per-person costs | Can’t split fixed costs with partner |

But single parents also have advantages:

| Advantage | Benefit |

|---|---|

| Full financial control | No spending disagreements |

| Simple decision-making | You choose priorities |

| Modeling resilience | Teaching kids valuable lessons |

| Tax benefits | Head of household status, child credits |

Understanding your situation clearly is the first step to improving it.

Strategy 1: Create a Single-Income Budget That Actually Works

A realistic budget is the foundation of financial stability:

Calculate True Monthly Income

Include salary, child support, benefits, and any side income. Use the lower number if income varies month to month.

List All Fixed Expenses

Rent/mortgage, utilities, insurance, childcare, car payment, minimum debt payments. These rarely change.

Estimate Variable Expenses

Groceries, gas, clothing, activities, household items. Track for one month if you're unsure.

Subtract from Income

Fixed + variable expenses from income = what's left for savings and extras.

Calculate Daily Spending Limit

Divide remaining money by days in month. This one number tells you if you can afford purchases.

Build in Savings

Even $25-50/month. Take this off the top before calculating daily spending limit.

Sample Single Parent Budget ($3,500/month income)

| Category | Amount | % of Income |

|---|---|---|

| Housing (rent + utilities) | $1,200 | 34% |

| Childcare | $600 | 17% |

| Transportation | $350 | 10% |

| Groceries | $400 | 11% |

| Insurance (health, car, life) | $200 | 6% |

| Debt payments | $150 | 4% |

| Phone/internet | $100 | 3% |

| Kids’ activities/needs | $150 | 4% |

| Personal/household | $150 | 4% |

| Savings | $100 | 3% |

| Emergency buffer | $100 | 3% |

| Total | $3,500 | 100% |

Adjust percentages based on your local cost of living and priorities.

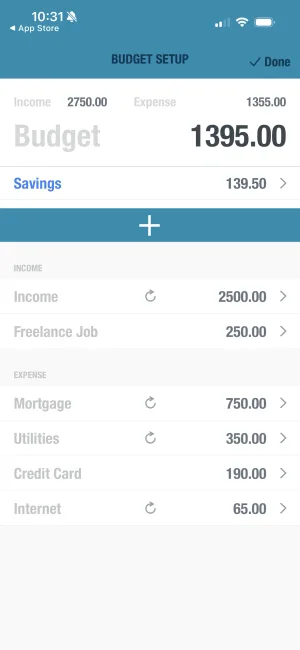

Set up your family budget in minutes

BUDGT makes it simple to plan your family's budget. Enter your income and recurring expenses, then see exactly how much you can safely spend each day.

Strategy 2: Track Every Dollar (Without It Taking Over Your Life)

Tracking is what makes budgets work. But as a single parent, you don’t have hours to spend on spreadsheets.

The 10-Second Tracking Method

| When | Action | Time |

|---|---|---|

| After each purchase | Log amount and category | 10 seconds |

| Morning | Check daily spending limit | 30 seconds |

| Evening | Quick review of day’s spending | 1 minute |

| Weekly | Review patterns, adjust as needed | 5 minutes |

Total time: Less than 10 minutes per week

What Tracking Reveals

| Discovery | Typical Savings |

|---|---|

| Subscription services you forgot about | $20-50/month |

| Small purchases that add up | $50-100/month |

| Dining out/takeout true cost | $100-200/month |

| Impulse purchases | $50-75/month |

Most single parents find $100-300/month in “invisible” spending when they start tracking.

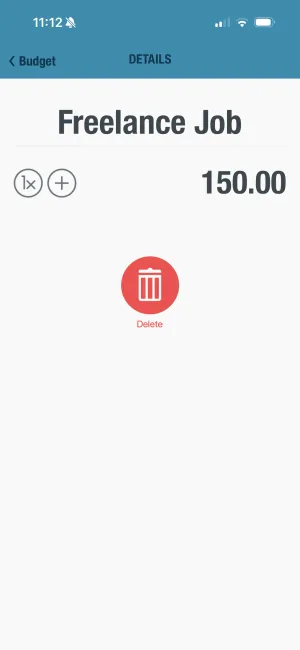

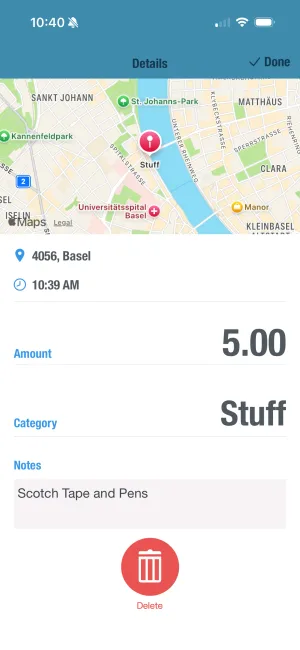

Track spending in seconds

BUDGT's quick entry makes logging effortless—even while juggling kids. Tap, enter amount, done. Your daily limit updates instantly so you always know where you stand.

Strategy 3: Build an Emergency Fund (Even on a Tight Budget)

An emergency fund prevents small problems from becoming financial disasters:

Emergency Fund Goals

| Stage | Target | Purpose |

|---|---|---|

| Mini fund | $500-1,000 | Covers minor emergencies without credit cards |

| Basic fund | 1 month expenses | Handles job loss for short period |

| Full fund | 3-6 months expenses | Real financial security |

How to Build It When Money Is Tight

| Method | Monthly Savings | Annual Total |

|---|---|---|

| Cancel 1 streaming service | $15 | $180 |

| Pack lunch 2x per week | $40 | $480 |

| Skip coffee shop 1x/week | $20 | $240 |

| Sell unused items | $25 | $300 |

| Round up purchases | $30 | $360 |

| Total | $130 | $1,560 |

That’s a full mini emergency fund in under 8 months—from small changes.

Where to Keep Emergency Fund

| Option | Pros | Cons |

|---|---|---|

| High-yield savings account | Earns interest, separate from checking | May take 1-2 days to access |

| Money market account | Higher interest, check-writing | May have minimum balance |

| Separate bank entirely | Out of sight, harder to spend | Less convenient |

The best place is somewhere you won’t touch it for non-emergencies.

Build savings automatically

BUDGT's Savings Mode reserves money for your goals before calculating your daily budget. Build an emergency fund, save for school supplies, or plan for a family vacation—one day at a time.

Strategy 4: Cut Grocery Costs Without Sacrificing Nutrition

Food is one of the most flexible budget categories:

Grocery Savings Strategies

| Strategy | Savings | Effort |

|---|---|---|

| Meal planning | 20-30% | Medium |

| Shopping with list | 15-20% | Low |

| Store brands | 20-25% | Low |

| Buying in bulk (staples) | 10-15% | Low |

| Using coupons/apps | 5-15% | Medium |

| Shopping sales cycles | 10-20% | Medium |

Sample Meal Plan Savings

| Without Planning | With Planning |

|---|---|

| Daily “what’s for dinner?” stress | Week planned in 30 minutes |

| Multiple grocery trips | One main trip + one quick stop |

| Food waste from forgotten items | Use what you buy |

| Expensive last-minute takeout | Backup easy meals for busy nights |

| $600-800/month | $400-500/month |

Budget-Friendly Kid Meals

| Meal Type | Examples | Cost per Serving |

|---|---|---|

| Batch cooking | Soup, chili, pasta bakes | $1-2 |

| Simple proteins | Eggs, beans, chicken thighs | $1-2 |

| Breakfast for dinner | Pancakes, eggs, toast | $1-1.50 |

| Sheet pan meals | Roasted chicken + vegetables | $2-3 |

| Slow cooker | Pulled pork, stews | $2-3 |

Strategy 5: Reduce Childcare and Kids’ Expenses Smartly

Kids are expensive, but there are ways to save without sacrificing their well-being:

Childcare Cost Reduction

| Strategy | Potential Savings |

|---|---|

| Flexible work schedule (if available) | $100-500/month |

| Family/friend childcare arrangement | $200-600/month |

| Childcare co-op with other parents | $100-300/month |

| Before/after school programs vs. daycare | $200-400/month |

| Dependent care FSA (tax savings) | $1,000-2,000/year |

Kids’ Clothing Strategy

| Approach | Cost per Item | Annual Savings vs. New |

|---|---|---|

| Thrift stores | $2-5 | $300-500 |

| Consignment shops | $5-10 | $200-400 |

| Hand-me-down networks | Free | $400-600 |

| End-of-season sales | 50-70% off | $150-300 |

| Buy ahead in larger sizes | Sale prices | $100-200 |

Free and Low-Cost Activities

| Activity | Cost | Kids Love It? |

|---|---|---|

| Library story time | Free | High |

| Park days | Free | High |

| Community center programs | Free-$20 | High |

| Home movie nights | $2-5 (popcorn) | High |

| Backyard camping | Free | Very high |

| Nature hikes | Free | Medium-high |

| Free museum days | Free | High |

| Baking/cooking together | Ingredient cost | High |

Kids remember experiences and time together, not expensive outings.

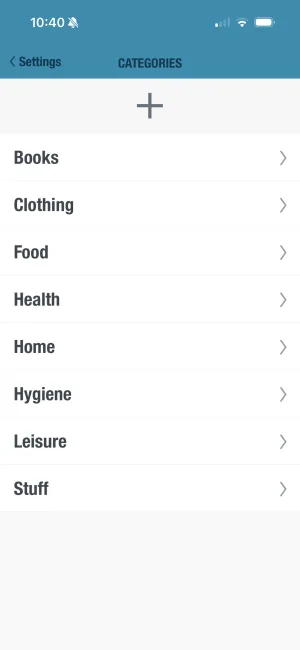

Track kids' expenses separately

BUDGT's categories let you see exactly what you're spending on kids' needs. Understand where money goes and make informed decisions about activities and purchases.

Strategy 6: Tap Into Community Resources

Many programs exist specifically to help single parents—and using them frees up money for savings:

Financial Assistance Programs

| Program | What It Provides | How to Access |

|---|---|---|

| SNAP | Food assistance | Local DSS office |

| WIC | Nutrition for moms and young kids | Health department |

| LIHEAP | Utility bill assistance | Local utility or 211 |

| Medicaid/CHIP | Healthcare for kids | Healthcare.gov or state |

| School lunch program | Free/reduced meals | School registration |

| Head Start | Free preschool | HeadStart.gov |

Community Resources

| Resource | Benefit |

|---|---|

| Libraries | Free books, programs, internet, activities |

| Food banks | Supplemental groceries |

| Community centers | Free or low-cost activities |

| Churches/nonprofits | Emergency assistance, food pantries |

| YMCA | Reduced-cost memberships and childcare |

| 211.org | Directory of all local resources |

Using these programs isn’t failure—it’s smart resource management that frees up money for your family’s future.

Strategy 7: Find Ways to Increase Income

Sometimes the best budget strategy is bringing in more money:

Side Income Options for Single Parents

| Option | Earning Potential | Schedule Flexibility |

|---|---|---|

| Freelance work (writing, design, admin) | $15-50/hour | High |

| Tutoring | $20-50/hour | Medium-high |

| Selling items online | Variable | High |

| Evening/weekend retail | $12-18/hour | Medium |

| Childcare for others | $15-25/hour | Medium |

| Survey sites/apps | $50-200/month | High |

| Delivery driving | $15-25/hour | High |

Making Side Income Work

| Consideration | Strategy |

|---|---|

| Childcare during work | Trade babysitting with other single parents |

| Limited time | Focus on highest hourly rate options |

| Burnout risk | Set firm boundaries, don’t overcommit |

| Tax implications | Set aside 25-30% for taxes |

Even $200-400/month extra can fund your emergency fund in a year.

See your daily spending limit

BUDGT's color-coded daily view tells you instantly if you're on track. Blue means safe to spend, yellow means be careful, orange means slow down. One glance is all you need.

Strategy 8: Teach Kids About Money (It Saves Money Too)

Financially literate kids make fewer “I want” demands and grow into financially responsible adults:

Age-Appropriate Money Lessons

| Age | Concepts | Activities |

|---|---|---|

| 3-5 | Coins have value, waiting | Piggy bank, “saving for” talks |

| 6-8 | Earning, spending choices | Small allowance, saving jars |

| 9-12 | Budgeting, comparison shopping | Own budget for activities |

| 13+ | Banking, compound interest | Savings account, part-time work |

How Money Education Saves Money

| Behavior Change | Savings |

|---|---|

| Kids understand “we’re saving for” | Fewer impulse requests |

| Kids help find deals | Engaged in frugal habits |

| Kids appreciate what they have | Less keeping-up-with-friends pressure |

| Kids contribute (age-appropriate) | Shared responsibility |

Involving Kids in Budget Discussions

| Do | Don’t |

|---|---|

| Explain choices in simple terms | Share adult financial stress |

| Let them make small decisions | Give them financial anxiety |

| Celebrate savings milestones together | Make them feel deprived |

| Answer questions honestly | Overshare debt or struggle details |

Making It All Work Together

Start Tracking Today

Download BUDGT and log expenses for one week. Don't change anything yet—just observe where money goes.

Create Your Budget

Use what you learned to build a realistic monthly budget. Include savings, even if it's small.

Set Up Savings

Open a separate savings account. Set up automatic transfers, even $25/week. Use BUDGT's Savings Mode.

Find One Area to Cut

Pick one category where you can realistically reduce spending. Start there.

Explore Resources

Look into community programs that could help. There's no shame in using available support.

Review and Adjust Monthly

Spend 15 minutes monthly reviewing what worked and what didn't. Adjust as life changes.

Your Single Parent Financial Action Plan

| This Week | This Month | This Year |

|---|---|---|

| Start tracking all expenses | Create complete budget | Build $1,000 emergency fund |

| Identify one subscription to cancel | Set up automatic savings | Reduce debt by 10-20% |

| Check library/community programs | Meal plan for 2 weeks | Increase income (raise/side work) |

| Download BUDGT | Apply for any relevant assistance | Start teaching kids about money |

You’ve Got This

Single parenting is hard. Managing money on one income is hard. But thousands of single parents have built financial security, and you can too.

The key isn’t dramatic changes or perfect budgeting. It’s small, consistent actions that add up over time:

- Tracking expenses daily (10 seconds)

- Checking your daily limit each morning (30 seconds)

- Putting a little into savings each month (any amount)

- Using community resources without guilt

- Teaching your kids about money

One year from now, you could have:

- A $1,000+ emergency fund

- Clear understanding of your spending patterns

- Reduced financial stress

- Kids who understand money basics

- Momentum toward bigger financial goals

Download BUDGT today and take the first step toward financial stability for your family. You’re already doing the hardest job there is—managing money doesn’t have to make it harder.

Your data stays private

BUDGT works 100% offline with no cloud sync or bank linking required. Your family's financial data stays on your device—complete privacy while you build your financial future.

Frequently Asked Questions

How do I start budgeting when I've never tracked expenses before?

Begin by tracking every expense for one week without judgment. Write down or log each purchase to understand your spending patterns. Then categorize expenses into fixed (rent, utilities) and variable (groceries, entertainment). This baseline helps you create a realistic budget and identify areas to cut back. Apps like BUDGT make this simple with quick daily logging.

How much should a single parent save each month?

Start with whatever you can afford, even $20-50 per month. The habit matters more than the amount. Aim to build a $500-1000 mini emergency fund first, then work toward 3 months of expenses. Many single parents save 5-10% of income once they have an emergency fund. Use BUDGT's Savings Mode to automatically reserve money before calculating your daily budget.

What's the best way to save money with kids without feeling deprived?

Focus on free or low-cost family activities like park visits, library programs, and home movie nights. Meal plan to reduce food waste and grocery costs. Shop thrift stores for kids' clothing they'll quickly outgrow. Create a small "fun money" category so you can enjoy treats guilt-free while staying within budget. Kids remember experiences, not expenses.

How can I build an emergency fund when money is already tight?

Start incredibly small - even $5-10 per week builds the habit and adds up to $260-520 per year. Look for areas to trim like unused subscriptions, takeout reduction, or selling unused items. Use automatic savings that come off before you can spend it. BUDGT's Savings Mode reserves your savings goal before calculating your daily limit.

What are the biggest budget mistakes single parents make?

The top mistakes are not tracking at all (surprises kill budgets), trying to maintain pre-single lifestyle, feeling guilty and overspending on kids, not having any emergency fund, and ignoring small purchases that add up. The fix for all of these is simple daily tracking that builds awareness without judgment.

Should I involve my children in family budgeting discussions?

Age-appropriate money conversations teach financial literacy early. With young kids, use simple concepts like "we're saving for..." With older kids, include them in budget discussions and goal-setting. This reduces "I want" demands while teaching valuable life skills. Kids who understand money make better financial decisions as adults.

How do I handle child-related expenses that vary month to month?

Track child expenses for 3 months to find your true average, including school fees, activities, clothing, and medical. Add 10-15% buffer for surprises. Some parents create a dedicated "kids" category in their budget. Plan ahead for predictable seasonal expenses like back-to-school and holidays.

What community resources can help single parents save money?

Many communities offer free or reduced-cost resources including food banks, utility assistance programs (LIHEAP), free school lunch programs, library programs, community center activities, clothing banks, and healthcare clinics. 211.org is a great starting point to find local resources. Using these programs frees up money for savings.

How do I budget when my income varies month to month?

Budget based on your lowest expected income so you're never caught short. Treat any extra as bonus money split between debt payoff and savings. Build a buffer of at least one month's expenses to smooth out income variations. Track income patterns over 3-6 months to understand your real baseline.

Can I save for retirement as a single parent on a tight budget?

Start small - even $25/month in a Roth IRA grows significantly over time. Prioritize employer 401(k) match if available (it's free money). Focus first on emergency fund, then add retirement savings. Many single parents start with just 2-3% of income and increase annually. Future you will thank present you.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS