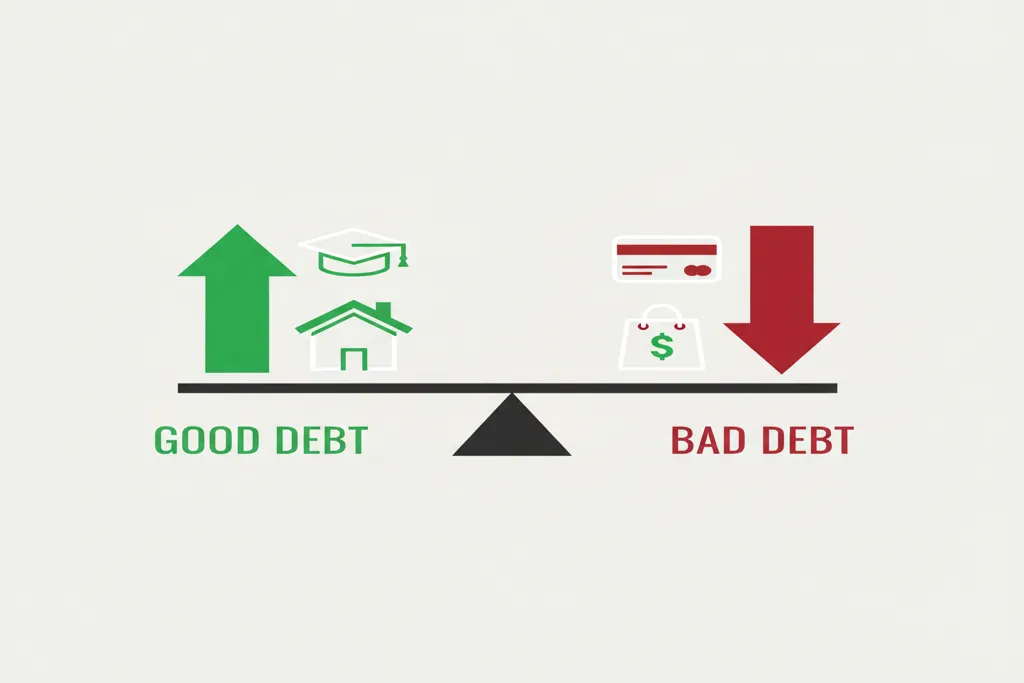

Good Debt vs Bad Debt: Not All Borrowing is Equal

“Debt is bad. Pay off all debt immediately. Live debt-free.”

You’ve heard this advice. It’s well-intentioned but incomplete. Not all debt is created equal.

Some debt traps you in cycles of paying interest on things that lose value. Other debt strategically puts money to work, building wealth faster than paying cash would.

Understanding the difference between good and bad debt is essential for making smart financial decisions—not just “no debt” decisions.

The Simple Framework

Good debt generally:

- Finances something that increases in value or generates income

- Carries relatively low interest rates

- May offer tax advantages

- Improves your financial position over time

Bad debt generally:

- Finances consumption or depreciating assets

- Carries high interest rates

- Offers no tax benefits

- Weakens your financial position over time

Quick Reference: Debt Types at a Glance

| Debt Type | Interest Rate | Appreciates? | Tax Benefits? | Verdict |

|---|---|---|---|---|

| Mortgage | 4-7% | ✓ Yes | ✓ Yes | Good |

| Student Loans | 5-8% | Earning potential | Some | Depends |

| Business Loan | 6-10% | Possible | ✓ Yes | Depends |

| Auto Loan | 5-10% | ✗ Depreciates | ✗ No | Usually Bad |

| Credit Card | 15-25% | ✗ No | ✗ No | Bad |

| Payday Loan | 400%+ | ✗ No | ✗ No | Terrible |

The True Cost of Different Debt Types

Interest rate comparison and 5-year cost on $10,000

Key insight: At 22% interest, credit card debt costs more in interest than you originally borrowed. A $10,000 balance becomes $25,000+ over 5 years with minimum payments.

Let’s apply this to real debt types.

Good Debt Examples

Mortgage

A mortgage is the classic good debt. Here’s why:

It finances an appreciating asset. Real estate historically increases in value over time. You’re building equity—ownership—instead of paying rent that builds nothing.

Interest rates are low. Mortgage rates (4-7% typically) are much lower than other debt types.

Tax advantages exist. In the US, mortgage interest is often tax-deductible. Other countries have similar benefits.

It leverages your money. Put down $50,000 on a $250,000 home. If the home appreciates 3% ($7,500), that’s a 15% return on your $50,000 down payment. Leverage amplifies gains.

But there are limits. A mortgage becomes bad debt when:

- You buy more house than you can afford

- The loan has predatory terms

- You bought at a market peak in a declining area

- Monthly payments strain your budget dangerously

Rule of thumb: Keep housing costs under 30% of gross income.

Student Loans (Strategic Ones)

Education debt can dramatically increase lifetime earnings—or not. The difference is strategy.

Good student debt:

- Finances high-return degrees (engineering, healthcare, accounting, skilled trades)

- Kept to reasonable amounts ($30-50K for degrees leading to $60K+ starting salaries)

- From accredited institutions with strong job placement

- Used at community college + state university to minimize cost

Bad student debt:

- $100,000+ for degrees with median salaries of $40,000

- For-profit schools with poor outcomes

- No clear career path or plan

- Luxury school experience when affordable alternatives exist

The math: Don’t borrow more than your expected first-year salary after graduation.

Business Loans

Borrowing to start or grow a business that generates income can be excellent debt—if the business succeeds.

Good business debt:

- Finances equipment that increases production

- Funds inventory with clear demand

- Enables expansion with realistic projections

- Has manageable payments from business income

Risky business debt:

- Funds speculative ventures with no validation

- Bets everything on an unproven idea

- Requires personal guarantees you can’t afford to lose

- Finances “nice to haves” rather than necessities

Business debt is higher risk than mortgages or education—businesses fail. But successful business debt builds wealth faster than almost any other method.

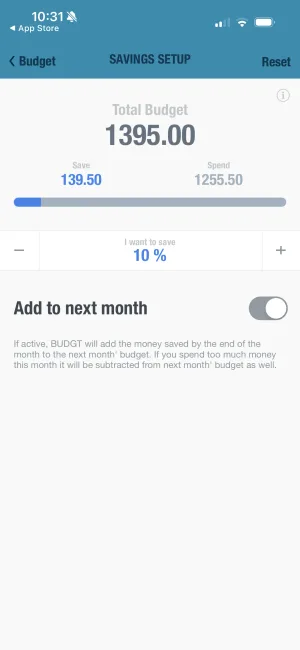

Track debt's impact on your budget

BUDGT shows when spending exceeds your budget, helping you avoid debt that spirals. Orange means slow down.

Bad Debt Examples

Credit Card Debt (For Purchases)

Credit cards charging 15-25% interest are almost never good debt. At 20% interest, debt doubles in 3.5 years.

Why it’s bad:

- Interest rates are extremely high

- Usually finances consumption (doesn’t appreciate)

- Compounds against you aggressively

- Minimum payments extend payoff for years/decades

The only exception: 0% promotional APR offers paid off completely before the promotion ends. Even then, you’re playing with fire.

If you can’t pay your credit card in full monthly, you can’t afford what you’re buying.

Car Loans (Especially New Cars)

Cars depreciate. A new car loses 20-30% of value in year one, roughly 60% over five years.

Why it’s bad:

- You’re financing a depreciating asset

- Interest rates are higher than mortgages

- By the time it’s paid off, it’s worth much less than you paid

- Encourages buying more car than needed

Mitigating factors:

- A reliable car needed for work is justified

- Used car loans on 2-3 year old vehicles avoid the steepest depreciation

- Shorter loan terms (3 years vs. 7) limit interest paid

- Some professions need reliable transportation

The best car debt is no car debt—buy used with cash if possible. But some car debt is reality for most people.

Payday Loans and Title Loans

These are predatory debt that should be avoided at almost all costs.

Why they’re terrible:

- APRs often exceed 400%

- Designed to trap borrowers in cycles

- Target financially vulnerable people

- Short terms create cash-flow crises

If you’re considering payday loans, explore every alternative: family help, negotiating bills, selling possessions, cash advances from employers, local assistance programs.

Vacation and Lifestyle Debt

Financing vacations, weddings, electronics, or lifestyle on credit cards is pure consumption debt.

Why it’s bad:

- Finances experiences/items that have no financial return

- Often at high interest rates

- The thing is gone or outdated while you’re still paying

- Indicates living beyond means

If you can’t save for it, you can’t afford it. This applies to vacations, weddings, the latest phone, and most consumer purchases.

See where your spending leads

BUDGT's projection shows if current spending will leave you in the red. Change course before it's too late.

The Gray Areas

Some debt falls between clearly good and clearly bad.

Medical Debt

Often unavoidable and finances health—hard to call “bad.” But it doesn’t appreciate. Negotiate aggressively, use payment plans, apply for assistance programs.

Home Improvement Loans

If improvements increase home value (kitchen, bathroom) by more than the loan cost, it’s closer to good debt. If it’s a pool that doesn’t return value, it’s closer to bad debt.

Personal Loans

Depends entirely on use. Consolidating high-interest debt into a lower-rate personal loan is smart. Funding a vacation on a personal loan is bad debt.

How to Evaluate Any Debt

Ask these questions:

-

What does it finance? Appreciating asset = better. Consumption = worse.

-

What’s the interest rate? Lower is better. Above 10% should be scrutinized heavily.

-

Does it increase earning potential? Education and business loans might. Credit cards don’t.

-

Are there tax advantages? Mortgage interest and student loan interest may be deductible.

-

Can I comfortably afford payments? Payments straining your budget make even “good” debt bad.

-

What’s the alternative? Sometimes debt is the best available option. Other times, saving and patience wins.

The Real Goal: Strategic Debt

The goal isn’t zero debt forever. The goal is strategic debt management:

- Use low-interest debt to acquire appreciating assets

- Avoid high-interest debt for consumption

- Pay off bad debt aggressively

- Pay good debt according to terms (prepaying isn’t always optimal)

- Never let any debt strain your monthly budget

Wealthy people use debt strategically—mortgages, business loans, leveraged investments. They don’t carry credit card balances.

Your Action Steps This Week

-

List all your debts with balances, interest rates, and what they financed.

-

Categorize each as good, bad, or gray. Be honest about what really counts as “good.”

-

Create a payoff priority list. Bad debt first (highest interest), then gray, then good.

-

Before taking new debt, apply the questions. Will it appreciate? Is the rate low? Can I afford it?

-

Track one spending category. Use BUDGT to watch an area where you’re tempted to overspend. That awareness prevents future bad debt.

The Bottom Line

Not all debt is equal. Mortgages and strategic student loans can build wealth. Credit card balances and car loans typically destroy it.

The difference comes down to: Does this debt finance something that grows in value or generates income? Is the interest rate reasonable? Can I comfortably afford payments?

Smart financial decisions aren’t “never borrow.” They’re “borrow strategically for the right purposes at the right rates.”

Use debt as a tool, not a crutch. Let it work for you, not against you.

Frequently Asked Questions

What makes debt 'good' or 'bad'?

Good debt typically finances assets that appreciate or increase earning potential (education, real estate, business), has low interest rates, and offers tax advantages. Bad debt finances depreciating assets or consumption (credit cards, cars, vacations), carries high interest, and provides no return on investment.

Is a mortgage good debt?

Generally yes. Mortgages have low interest rates, offer tax advantages (in many countries), and finance an asset that typically appreciates. You're building equity instead of paying rent that builds nothing. However, buying too much house or at bad terms can make even a mortgage problematic.

Are student loans good debt?

It depends. Student loans for degrees that significantly increase earning potential (engineering, nursing, accounting) in reasonable amounts are good debt. Six-figure loans for degrees with limited job prospects are bad debt—the investment doesn't pay off. The debt-to-starting-salary ratio matters.

Is all credit card debt bad?

Almost always, yes. Credit card interest rates (15-25%+) are too high to justify for almost any purpose. Even if you're buying something valuable, the interest cost destroys the value. The exception: 0% promotional rates paid off before the promotion ends.

Is a car loan good or bad debt?

Usually bad. Cars depreciate rapidly—a new car loses 20-30% of value in year one. You're borrowing money to buy something worth less every day. However, a reasonable auto loan for reliable transportation needed for work beats not being able to get to your job.

Should I pay off good debt early?

Not necessarily. If your mortgage is at 4% and you could invest at 7%, mathematically you're better off investing. But debt freedom has psychological value. A middle path: pay off high-interest debt aggressively, make regular payments on low-interest 'good' debt, invest the difference.

Can good debt become bad debt?

Yes. A mortgage becomes bad debt if you can't afford the payments and face foreclosure. Student loans become bad debt if they exceed what your career can support. Business loans become bad debt if the business fails. Context and management matter as much as the type of debt.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS