What is Inflation? Why Your Money Buys Less Each Year

You’ve probably noticed: things cost more than they used to. That coffee that was $3 five years ago is now $4.50. Your rent keeps climbing. Groceries feel more expensive every time you shop.

You’re not imagining it. This is inflation at work—the silent force that erodes your money’s purchasing power year after year. Understanding inflation isn’t just academic; it directly affects every financial decision you make.

What Inflation Actually Means

Inflation is the rate at which prices increase over time. When inflation is 3%, something that costs $100 today will cost $103 next year.

But here’s the crucial point: your dollars don’t change. You still have the same $100. It just buys less than it did before.

Think of money as a ticket to buy things. Inflation gradually reduces what each ticket gets you. A dollar in 2000 bought what it takes about $1.80 to buy today. Your grandparents’ stories about $0.25 movies and $0.05 candy aren’t exaggerated—money really went that much further.

The Three Causes of Inflation

1. Demand-Pull Inflation (Too Much Money Chasing Too Few Goods)

When everyone wants something and there’s not enough of it, prices rise. During the pandemic, everyone wanted home gym equipment simultaneously. Peloton bikes sold for way above retail. That’s demand-pull inflation in action.

At a national level, when the economy is booming and people have money to spend, demand for everything increases. If production can’t keep up, prices rise across the board.

2. Cost-Push Inflation (Production Gets More Expensive)

When it costs more to make things, those costs get passed to consumers. Rising oil prices make transportation more expensive, which makes everything transported more expensive. Higher wages for workers can increase prices (though this also means more spending power).

Supply chain disruptions, natural disasters, or material shortages all push costs up and prices along with them.

3. Monetary Inflation (Too Much Money Printed)

When governments create too much money, each dollar becomes worth less. If the money supply doubles but the amount of goods stays the same, prices roughly double because there are more dollars chasing the same stuff.

This is why massive money printing often precedes high inflation. More currency in circulation = each unit worth less.

How Inflation Is Measured

The Consumer Price Index (CPI) tracks price changes for a “basket” of goods and services typical households buy: food, housing, transportation, healthcare, education, entertainment.

Each month, the Bureau of Labor Statistics checks prices on about 80,000 items. The average change becomes the official inflation rate.

But here’s the catch: your personal inflation rate may differ significantly from the official number.

If you’re a renter in a hot housing market, your costs might be rising 8% annually while official inflation is 3%. If you’re a homeowner with a fixed mortgage and minimal healthcare needs, your costs might be below average.

The official rate is useful for policy decisions but doesn’t necessarily reflect your reality.

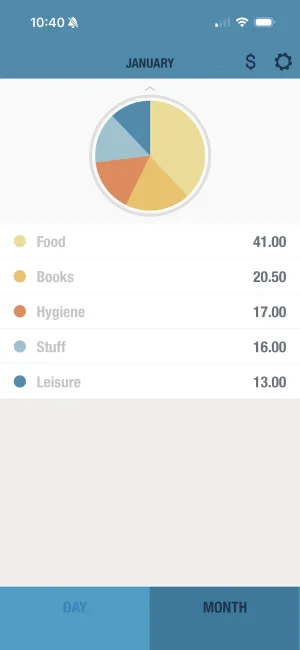

Track your actual monthly spending

BUDGT shows your real spending patterns over time—your personal inflation rate, not just the official number.

How Inflation Affects Your Daily Life

Your Savings Lose Value

Money sitting in a checking account earning 0.01% interest while inflation is 3% means you’re effectively losing 3% of your purchasing power every year. After 10 years, that $10,000 can only buy what $7,400 could buy when you started.

See Inflation’s Impact

Adjust the sliders below to visualize how inflation erodes your money’s purchasing power over time:

This is why financial advice emphasizes investing rather than hoarding cash. Cash feels safe but slowly bleeds value.

Your Salary Might Not Keep Up

If you get a 2% raise but inflation is 4%, you actually took a pay cut. You’re earning more dollars, but those dollars buy less than they did before.

This is why negotiating salary increases (or switching jobs for higher pay) matters. You’re not being greedy by asking for inflation-matching raises—you’re trying to maintain your standard of living.

Debts Get “Cheaper”

Here’s the silver lining: if you have fixed-rate debt (like a mortgage), inflation works in your favor. You pay back loans with future dollars worth less than the dollars you borrowed. A $300,000 mortgage feels very different after 20 years of inflation.

This is one reason homeownership builds wealth—you lock in housing costs while rents inflate around you.

Retirement Planning Gets Complicated

Planning for retirement isn’t just about accumulating a number—it’s about accumulating purchasing power. $1 million sounds like a lot, but if inflation averages 3%, that million in 30 years will buy what $400,000 buys today.

This is why retirement calculators account for inflation and why financial planners talk about “real” returns (after inflation) versus “nominal” returns.

Why a Little Inflation is Actually Normal

Central banks like the Federal Reserve target around 2% annual inflation. This seems strange—why would they want any inflation?

Reason 1: Room for wages to adjust In a zero-inflation world, employers can only cut costs by cutting nominal wages, which workers resist fiercely. With mild inflation, real wages can adjust without actual pay cuts.

Reason 2: Encourages spending and investment If your cash loses value sitting around, you’re motivated to spend or invest it. This keeps the economy moving. Deflation (falling prices) sounds nice but actually causes people to delay purchases, which crashes economies.

Reason 3: Makes debt manageable National debts, like personal debts, become more manageable with mild inflation. The debt stays the same, but the economy grows nominally to pay it.

Project your month-end finances

See where you're headed before the month ends. BUDGT helps you plan for rising costs and adjust your spending.

How to Protect Your Money From Inflation

1. Don’t Hold Excessive Cash

Keep an emergency fund (3-6 months expenses) in an accessible account, but don’t hoard beyond that. Cash sitting idle is guaranteed to lose purchasing power.

2. Invest for the Long Term

Historically, stocks return about 7-10% annually before inflation, 4-7% after. Real estate typically keeps pace with or exceeds inflation. These assets grow your purchasing power over time rather than losing it.

3. Use High-Yield Savings for Cash

If you must hold cash, use high-yield savings accounts. While they may not fully beat inflation, earning 4-5% is much better than 0.01%.

4. Consider I-Bonds

Series I Savings Bonds are designed specifically to beat inflation. They pay a rate tied to CPI plus a fixed rate. There are limits on how much you can buy, but they’re worth considering for medium-term savings.

5. Grow Your Income

The best inflation hedge is earning more. Develop skills that command higher wages. Ask for raises. Switch companies for better pay. Your earning power, not your savings alone, determines your financial future.

6. Lock In Fixed Costs

Fixed-rate mortgages, long-term leases at current rates, prepaying for services when possible—locking in today’s prices protects you from tomorrow’s inflation.

The Inflation Mindset Shift

Most people think about money in nominal terms: “I have $50,000 in savings.”

Financially savvy people think in real terms: “I have $50,000, which will be worth about $37,000 in purchasing power in 10 years if I don’t invest it.”

This mindset shift changes behavior. You stop feeling proud of a savings account growing by 1% when inflation is 3%. You stop accepting 2% raises as “doing okay.” You start thinking about growing purchasing power, not just accumulating dollars.

Inflation and Your Budget

How does inflation affect your daily budgeting?

Your budget categories creep up. What you spent on groceries last year may not cover this year’s prices. Review and adjust budget categories annually.

Fixed costs stay flat; variable costs rise. A fixed mortgage payment becomes easier to handle over time. But groceries, utilities, and gas don’t stay fixed.

Your “enough” number changes. The amount you need for retirement, a house down payment, or financial independence needs inflation adjustment. Recalculate periodically.

Your Action Steps This Week

-

Calculate your personal inflation. Compare what you spent on specific categories this year versus last year. How much did YOUR costs rise?

-

Check your savings account rate. If it’s below the inflation rate, you’re losing purchasing power. Consider moving excess cash to higher-yield options.

-

Review your salary history. Have your raises kept pace with inflation? If not, you’ve been taking effective pay cuts.

-

Reassess your budget categories. Are the amounts you allocated last year still realistic? Adjust for inflation where needed.

-

Think long-term. When setting financial goals, account for inflation. A goal for $500,000 in 20 years should consider that it’ll buy less than $500,000 buys today.

The Bottom Line

Inflation is the silent erosion of your money’s purchasing power. At 3% annually, prices roughly double every 24 years. The same money buys less and less over time.

Understanding inflation means understanding that holding cash has a cost. It means recognizing that your salary needs to grow just to stay even. It means investing for growth rather than hoarding money that slowly loses value.

You can’t stop inflation, but you can make decisions that protect and grow your purchasing power. That starts with understanding what inflation actually is and how it affects your daily financial life.

Your dollars are worth less every year. Make sure they’re working hard enough to overcome that.

Frequently Asked Questions

What is inflation in simple terms?

Inflation is when prices go up over time, making your money buy less. If a gallon of milk costs $4 today and $4.12 next year (3% inflation), you need more dollars to buy the same thing. Your money loses purchasing power.

What causes inflation?

Three main causes: 1) Demand-pull inflation—when people want more goods than are available, prices rise. 2) Cost-push inflation—when production costs increase, companies raise prices. 3) Monetary inflation—when too much money is printed, each dollar becomes worth less.

Is some inflation normal and even good?

Yes. Central banks like the Federal Reserve target around 2% annual inflation. Mild inflation encourages spending and investment (why hold cash if it loses value?) and gives wages room to adjust. Zero or negative inflation (deflation) can actually harm economies.

How does inflation affect my savings?

Money sitting in a regular savings account earning 0.5% while inflation is 3% actually loses purchasing power—you're effectively losing 2.5% yearly. This is why keeping large amounts in low-interest accounts over long periods is risky.

What's the difference between inflation and cost of living?

Inflation measures price increases across the whole economy. Cost of living is what you personally pay—which might differ from official inflation rates. If you spend heavily on categories with above-average price increases (like healthcare or education), your personal cost of living rises faster than official inflation.

How do I protect my money from inflation?

Three strategies: 1) Invest in assets that grow faster than inflation (stocks, real estate historically outpace it). 2) Use high-yield savings accounts or I-bonds for cash reserves. 3) Increase your income over time—wages should at least keep up with inflation.

Why do people complain about inflation when the rate is only 3%?

Because 3% compounds. Over 20 years, 3% annual inflation means prices roughly double. Something costing $100 today will cost about $180 in 20 years. Also, official inflation averages many prices—your specific costs (rent, childcare, healthcare) may rise much faster.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS