Budgeting in the United States

Master your daily spending with smart budgeting strategies tailored for American households.

Calculate Your Daily Budget in USD

Enter your income and expenses to find out exactly what you can spend each day. The calculator uses US Dollar ($) as the default currency.

Income

$0Fixed Expenses

-$0Savings Goal

$0/monthHow much of your remaining income do you want to save?

10% of remaining income

Monthly Budget

Your Daily Budget

That's $0 ÷ 31 days = $0.00/day

Budgeting Tips for United States

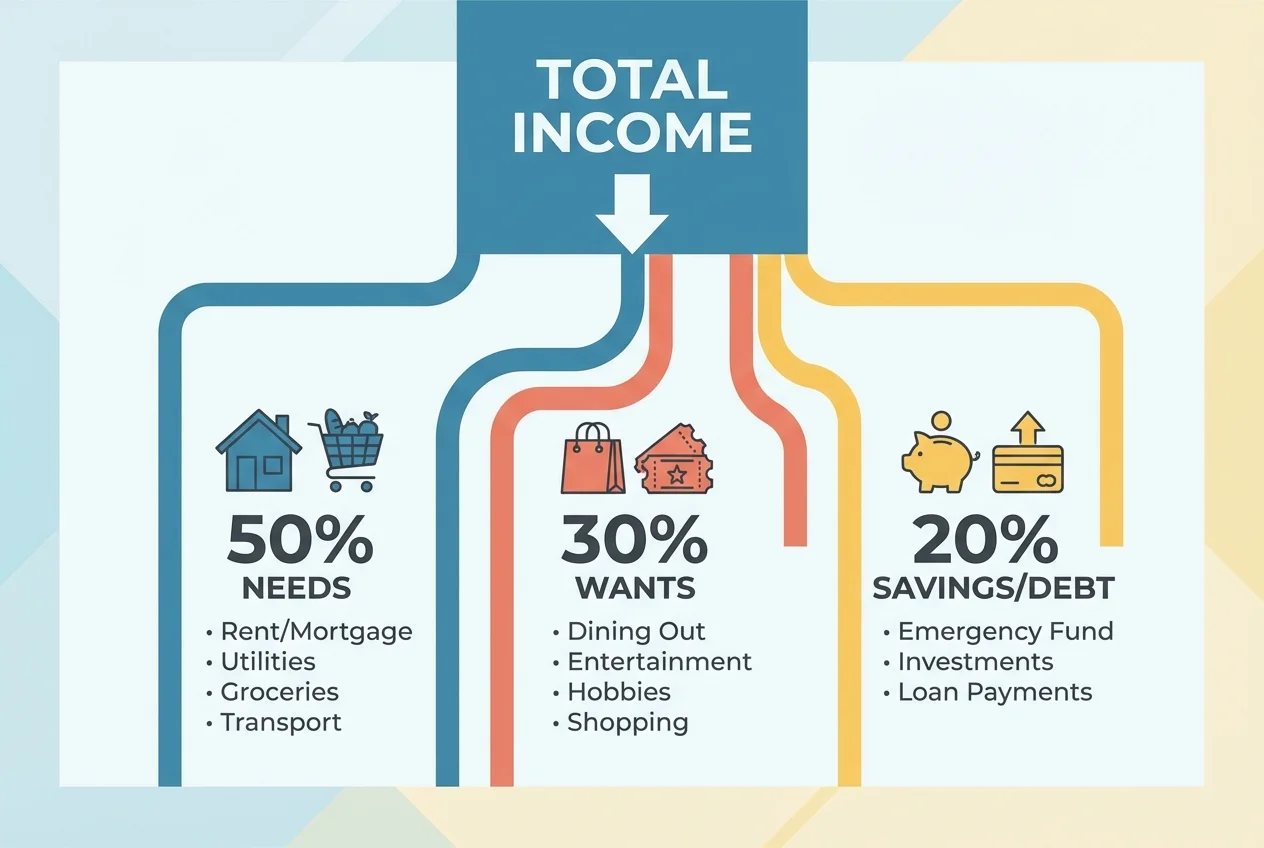

Use the 50/30/20 rule: 50% needs, 30% wants, 20% savings

Take advantage of high-yield savings accounts (many offer 4-5% APY)

Max out employer 401(k) matching before other investments

Track spending in USD using apps that work offline for privacy

Build an emergency fund covering 3-6 months of expenses

Common Budgeting Challenges in United States

- High healthcare costs can disrupt monthly budgets

- Credit card culture makes overspending easy

- Regional cost differences (NYC vs rural areas) vary dramatically

- Student loan payments can consume significant income

Frequently Asked Questions

How do I budget in United States?

Start by calculating your monthly income in USD, subtract fixed expenses like rent and utilities, set a savings goal, then divide the remaining amount by the days in the month to get your daily budget. Use the calculator above to do this automatically.

What's the average daily budget in United States?

Based on a median income of $5,000/month, after typical expenses for rent and utilities, and saving 15% of remaining income, a typical daily budget is around $94 per day. Your actual budget will depend on your specific income and expenses.

Does this calculator need to connect to my bank?

No. This calculator is 100% private. There's no bank connection, no account creation, and no data collection. Everything stays in your browser and is never sent anywhere. Your financial privacy is completely protected.

Helpful Resources

- Consumer Financial Protection Bureau (CFPB) - free budgeting tools

- Annual Credit Report - free credit reports

- FDIC - bank deposit insurance information

Budgeting Tips & Guides

Simple Budget Tracking Without Spreadsheets or Stress

Discover budget tracking methods that don't require spreadsheets, complex apps, or hours of your time

Single Mom Budget Guide: How to Make Every Dollar Count in 2026

The complete single mom budget guide for 2026. Realistic budgeting strategies, money-saving tips, and financial advice that works with your actual life—not some idealized version.

The 50/30/20 Rule: The Simplest Budget That Works

The 50/30/20 budget rule divides your after-tax income into three simple categories: needs, wants, and savings. Learn how this flexible framework can work for any income level.

Track Your Daily Budget on the Go

Download BUDGT to track expenses in US Dollar anywhere — even offline.

Download for iOS