Mortgage Calculator for Australia

Calculate your Australian home loan repayments including LMI for deposits under 20%.

Typical Rate

5.5%

Common Term

30 years

Min Down Payment

5%

Max Term

30 years

Calculate Your Mortgage Payment in AUD

Enter the home price and loan details to estimate your monthly payment. Default values are based on typical Australia market conditions.

Home Price

Down Payment

$020% of home price

LMI (Lenders Mortgage Insurance) will be required because down payment is less than 20%.

Loan Details

Additional Monthly Costs

Optional: Include property tax and insurance in your monthly estimate

Monthly Payment

Loan Summary

Mortgage Tips for Australia

Consider an offset account to reduce interest on your home loan

First Home Owner Grant (FHOG) available for eligible buyers

Compare variable and fixed rate options from multiple lenders

Factor in stamp duty - it varies significantly by state

Get pre-approval before attending auctions

Important Considerations in Australia

- LMI (Lenders Mortgage Insurance) required for deposits under 20%

- Stamp duty varies by state (some offer exemptions for first-home buyers)

- Variable rates are more common than fixed rates in Australia

- Council rates and strata fees are separate ongoing costs

Frequently Asked Questions

What is the typical mortgage term in Australia?

In Australia, common mortgage terms are 25, 30 years. The most popular option is 30 years, balancing monthly affordability with total interest paid. The maximum term typically available is 30 years.

What is the minimum down payment required?

The minimum down payment in Australia is typically 5% of the home price. However, if your down payment is less than 20%, you'll typically need to pay LMI (Lenders Mortgage Insurance), which adds to your monthly costs. A 20% down payment is often recommended to get the best terms.

How much would a typical monthly payment be?

For a A$980,000 home with 20% down (A$196,000) at 5.5% for 30 years, the principal and interest payment would be approximately A$4,451 per month. Add property taxes and insurance for your total housing payment.

Does this calculator need my bank information?

No. This calculator is 100% private. There's no bank connection, no account creation, and no data collection. Everything is calculated in your browser and never sent anywhere. Your financial privacy is completely protected.

Other Country Calculators

Budgeting Tips & Guides

Simple Budget Tracking Without Spreadsheets or Stress

Discover budget tracking methods that don't require spreadsheets, complex apps, or hours of your time

Single Mom Budget Guide: How to Make Every Dollar Count in 2026

The complete single mom budget guide for 2026. Realistic budgeting strategies, money-saving tips, and financial advice that works with your actual life—not some idealized version.

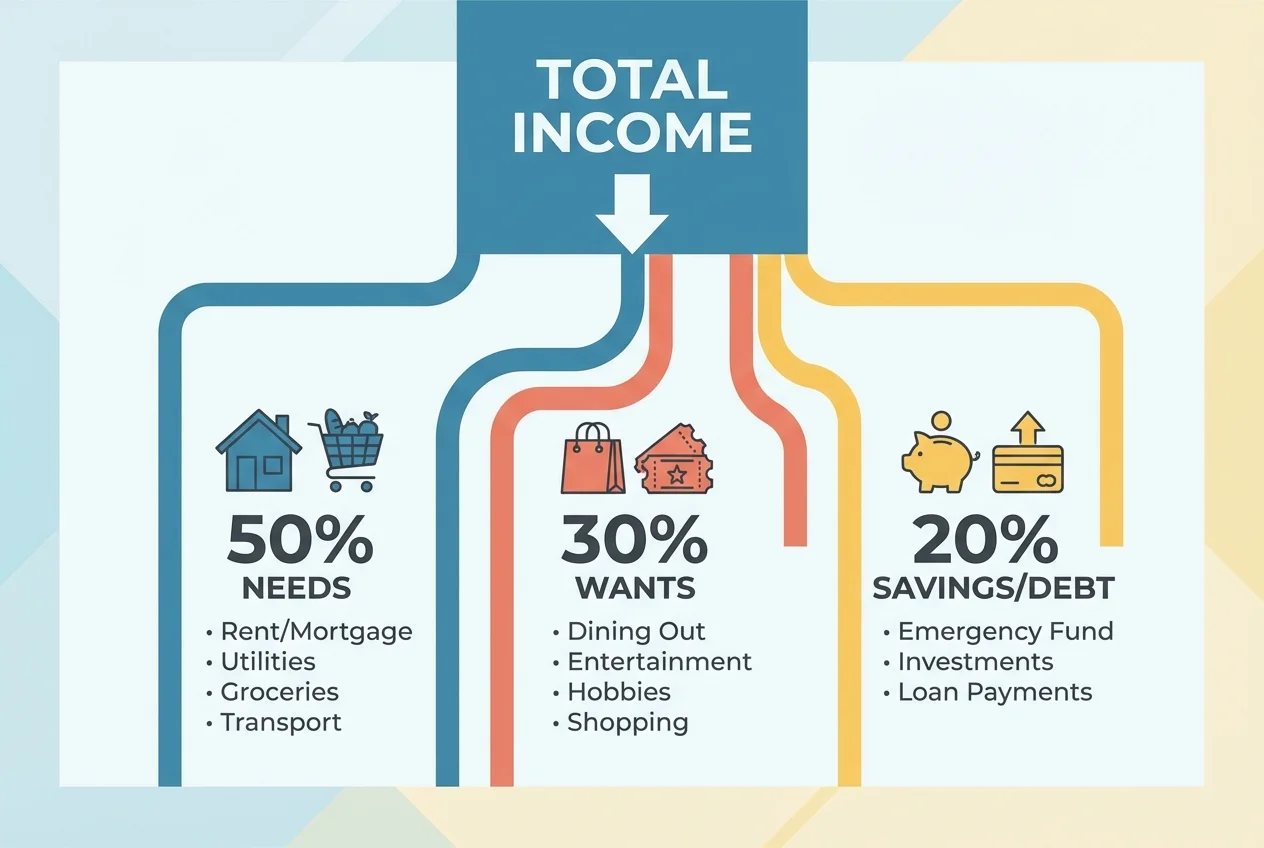

The 50/30/20 Rule: The Simplest Budget That Works

The 50/30/20 budget rule divides your after-tax income into three simple categories: needs, wants, and savings. Learn how this flexible framework can work for any income level.

Track Your Budget While Saving for a Home

Download BUDGT to track your daily spending and build your down payment faster.

Download for iOS