What is Dollar Cost Averaging? Investing Without Timing the Market

What is Dollar Cost Averaging? Investing Without Timing the Market

Should you invest now or wait for prices to drop? What if the market crashes right after you buy?

Dollar cost averaging answers these questions simply: invest the same amount regularly, regardless of what markets do. No timing required.

The Simple Explanation

Dollar cost averaging (DCA) means investing a fixed dollar amount on a regular schedule.

Example: Invest $500 on the 15th of every month, no matter what.

When prices are high, your $500 buys fewer shares. When prices are low, your $500 buys more shares. Over time, your average cost per share falls somewhere in the middle.

That’s the entire strategy.

How It Works in Practice

Let’s say you invest $500 monthly in a stock index fund:

| Month | Share Price | Shares Bought | Total Shares |

|---|---|---|---|

| January | $50 | 10.0 | 10.0 |

| February | $40 | 12.5 | 22.5 |

| March | $45 | 11.1 | 33.6 |

| April | $55 | 9.1 | 42.7 |

| May | $50 | 10.0 | 52.7 |

Total invested: $2,500 Total shares: 52.7 Average cost per share: $47.44

Your average cost ($47.44) is lower than the average of the prices ($48), because you automatically bought more shares when prices were lower.

See DCA in Action

Here’s a visual example showing how your $500 monthly investment plays out over a year with fluctuating prices:

Dollar Cost Averaging in Action

Investing $500/month over 12 months

Key insight: Your average cost ($0) is lower than the simple average price ($0) because you automatically bought more shares when prices were low.

Why DCA Works

Removes Timing Decisions

Nobody can consistently predict market movements—not professional investors, not algorithms, not financial news. DCA eliminates the question “is now a good time to buy?”

The answer is always yes, because you’re following a system, not chasing predictions.

Reduces Emotional Mistakes

Fear and greed destroy investment returns. DCA enforces discipline:

- Market crashing? You still invest.

- Market soaring? You still invest.

- Feeling nervous? System says invest.

The schedule removes emotion from the equation.

Builds Investing Habit

Regular contributions become automatic—like paying rent or a phone bill. Investing transforms from “something to think about” to “something that happens.”

Smooths Volatility

Instead of one entry point that might be unlucky, you get many entry points. Some will be better than others. They average out.

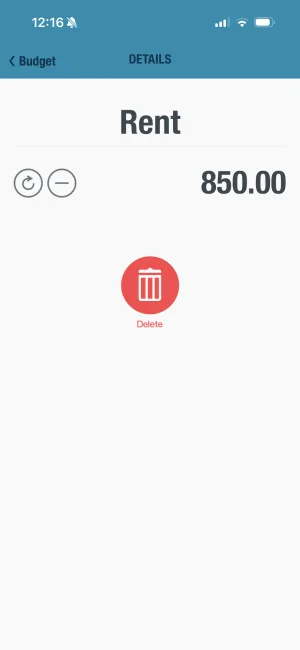

Budget for Regular Investments

Dollar cost averaging requires knowing how much you can invest monthly. BUDGT shows what's safe to spend—leaving room for consistent investing.

DCA vs. Lump Sum Investing

What if you have a large sum (inheritance, bonus, tax refund) to invest? Should you invest it all at once or spread it out?

The Data

Studies show lump sum investing beats DCA about two-thirds of the time. Why? Markets trend upward over time. Delaying investment means missing potential gains.

Example: Investing $12,000 in January vs. $1,000/month throughout the year.

If markets rise (most years), January investment grows more. If markets fall, spreading it out wins.

The Psychology

Despite the data, many people prefer DCA for large sums because:

- Less regret if market drops immediately after investing

- Feels less risky (even if statistically less optimal)

- Easier to commit to psychologically

The Real Answer

For most people, this debate is academic. You receive income regularly and invest from each paycheck—that’s DCA by necessity, not choice. The lump sum question only applies when you suddenly have a large windfall.

Setting Up DCA

Determine Your Amount

How much can you invest consistently? Look at your budget for available savings, consider starting small and increasing over time. Consistency matters more than size.

Choose Your Frequency

Monthly is most common and aligns with paychecks. Bi-weekly matches bi-weekly pay schedules. Weekly offers more frequent averaging. Monthly works well for most people.

Select Your Investment

DCA works best with total stock market index funds, S&P 500 index funds, target-date retirement funds, or diversified ETFs. Avoid individual stocks—company-specific risk negates averaging benefits.

Automate Everything

Set up automatic transfers: money moves from checking to investment account on payday, investment account automatically buys your chosen fund. Once set up, the system runs itself.

Know What You Can Invest

Consistent investing starts with knowing your daily spending limit. BUDGT helps you see exactly what's left after essentials.

When DCA Shines

Bear Markets

During market declines, DCA is powerful:

Scenario: Market drops 40% over 12 months, then recovers

- Lump sum investor: Bought at the top, waits for recovery

- DCA investor: Bought throughout the decline, owns many shares purchased at lower prices

When markets recover, the DCA investor’s portfolio rebounds faster because they own more shares bought cheaply.

Volatile Markets

Markets that bounce up and down create DCA opportunities:

If prices swing between $40 and $60 repeatedly:

- Your $500 buys 12.5 shares at $40

- Your $500 buys 8.3 shares at $60

- Average cost: less than $50 per share

Long Time Horizons

The longer you DCA, the more price variations you capture. A 30-year DCA investor experiences multiple market cycles, buying through crashes and booms.

Common DCA Mistakes

Stopping During Downturns

The worst time to stop DCA is when markets fall—that’s when you buy more shares cheaply. Yet many people pause contributions during scary markets, missing the best buying opportunities.

Trying to Time Within DCA

“I’ll skip this month because the market seems high.” That’s timing the market, defeating DCA’s purpose. Stick to the schedule regardless of what markets do.

Using DCA with Individual Stocks

Individual companies can go to zero. Averaging into a declining stock might just mean buying more of a loser. Use DCA with diversified funds, not single stocks.

Waiting to Start

“I’ll start when I have more money” or “I’ll wait for a better time.” These delay tactics cost years of growth. Start now, even with small amounts.

DCA and Your 401(k)

If you contribute to a 401(k), you’re already doing DCA:

- Fixed percentage from each paycheck

- Same contribution regardless of market conditions

- Automatic investment in your chosen funds

401(k) participants are natural dollar cost averagers. The structure forces good behavior.

Real-World Example

Sarah’s DCA Journey (starting 2016, investing $400/month in S&P 500 index):

| Year | Market Condition | Average Cost | Annual Contribution |

|---|---|---|---|

| 2016 | Up 12% | Moderate | $4,800 |

| 2017 | Up 22% | Higher | $4,800 |

| 2018 | Down 4% | Lower | $4,800 |

| 2019 | Up 31% | Higher | $4,800 |

| 2020 | Up 18% (volatile) | Mixed | $4,800 |

By continuing through ups and downs:

- Never worried about “the right time”

- Bought more shares during 2018 decline

- Built position before 2019’s strong returns

- Total investment: $24,000 over 5 years

- Value after 5 years: ~$35,000

The automatic approach beat most investors who tried to time the market.

DCA with Different Account Types

401(k) / 403(b)

DCA is built-in:

- Payroll deductions are automatic

- Same percentage every paycheck

- Just choose your funds and contribution rate

Roth/Traditional IRA

Set up automatic monthly transfers:

- Bank → IRA on payday

- IRA automatically invests in chosen fund

Annual limit ($7,000 in 2026) ÷ 12 = ~$583/month max

Taxable Brokerage

Same approach:

- Link checking account

- Schedule recurring transfers

- Set up automatic investment

Most brokerages support automatic investing in mutual funds; some now support ETFs.

The Psychological Power

DCA’s greatest value may be psychological:

Eliminates Analysis Paralysis

“Should I invest now?” becomes irrelevant. The schedule answers every timing question.

Removes Regret

If markets drop after investing, you know you’ll buy more at lower prices next month. If markets rise, you’re glad you invested. Either way, you feel okay.

Builds Confidence

Watching your portfolio grow through systematic investing builds belief in the process. You experience market drops and recoveries firsthand, learning that staying invested works.

Your Action Plan

This week:

- Calculate how much you can invest monthly

- Choose one diversified index fund

- Look up automatic investment options at your brokerage

This month:

- Set up automatic transfer from checking to investment account

- Schedule automatic purchase of your chosen fund

- Delete any price alert notifications (you don’t need them)

Ongoing:

- Ignore market news and predictions

- Let the automatic system run

- Increase contribution when income rises

- Never stop during market drops

Building wealth through DCA requires knowing what you can spare each month. BUDGT shows you exactly what’s safe to spend daily—ensuring you have money left for consistent investing.

Frequently Asked Questions

What is dollar cost averaging in simple terms?

Dollar cost averaging (DCA) means investing a fixed dollar amount on a regular schedule, regardless of whether the market is up or down. If prices are high, you buy fewer shares. If prices are low, you buy more shares. Over time, this averages out your purchase price.

Is dollar cost averaging better than lump sum investing?

Statistically, lump sum investing (investing everything immediately) beats DCA about two-thirds of the time because markets tend to rise. However, DCA reduces regret risk and is psychologically easier. For most people receiving regular paychecks, DCA happens naturally through ongoing contributions.

How often should I invest when dollar cost averaging?

Monthly is most common and works well for most people—it aligns with paychecks and is easy to automate. Weekly or bi-weekly can work too. The frequency matters less than consistency. Pick a schedule you'll actually maintain.

Does dollar cost averaging work in a bear market?

DCA shines in bear markets. When prices fall, your fixed contribution buys more shares. You're automatically 'buying the dip' without trying to time it. When markets recover, you own more shares purchased at lower prices—accelerating your gains.

What's the main benefit of dollar cost averaging?

The biggest benefit is removing emotion from investing decisions. You never have to decide if 'now is a good time to invest.' The schedule decides for you. This prevents both panic-selling during drops and fear of buying at peaks.

Can I dollar cost average with any investment?

DCA works best with diversified investments like index funds or ETFs. It's less effective with individual stocks (which may never recover from declines) or very short-term investments. The strategy assumes your investment will grow over the long term.

Should I stop dollar cost averaging when the market is high?

No. That's attempting to time the market—exactly what DCA helps you avoid. 'Market highs' are normal; markets frequently set new highs during long-term uptrends. Continue your regular contributions regardless of current prices.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS