What is a Stock? Owning a Piece of a Company

What is a Stock? Owning a Piece of a Company

When you buy a stock, you’re buying ownership in a real business. Not a lottery ticket. Not a gambling chip. Actual ownership in a company that makes products, employs people, and generates revenue.

Understanding this simple truth transforms how you think about investing.

The Simple Explanation

A stock represents a tiny ownership share in a company.

If a company is divided into 1 million shares and you own 100 of them, you own 0.01% of that business. You’re a partial owner—a shareholder.

As the company grows and becomes more valuable, your shares become more valuable. If the company struggles, your shares lose value.

That’s the entire concept.

Why Companies Sell Stock

Companies sell ownership shares to raise money. Instead of borrowing from banks (debt), they sell pieces of themselves (equity).

Example: A growing company needs $10 million to build a new factory. They can:

- Borrow $10 million (and pay it back with interest)

- Sell $10 million worth of new shares (and give up some ownership)

When a company first sells shares to the public, it’s called an Initial Public Offering (IPO). After that, shares trade between investors on stock exchanges.

When you buy Apple stock today, Apple doesn’t get that money—you’re buying shares from another investor who’s selling.

How Stock Prices Move

Stock prices reflect what investors collectively believe a company is worth.

Prices rise when:

- Company reports strong profits

- Future growth looks promising

- More buyers than sellers

Prices fall when:

- Earnings disappoint

- Business outlook weakens

- More sellers than buyers

Over short periods, prices can be irrational—driven by fear, greed, and news cycles. Over long periods, prices tend to follow actual business performance.

Two Ways Stocks Make Money

1. Price Appreciation

Buy shares at one price, sell later at a higher price. The difference is your profit.

Example:

- Buy 10 shares at $100 each = $1,000 invested

- Sell later at $150 each = $1,500 received

- Profit: $500 (50% return)

Most wealth from stocks comes from long-term appreciation—holding quality companies as they grow over years and decades.

2. Dividends

Some companies share profits with shareholders through regular cash payments called dividends.

Example:

- Own 100 shares of a company

- Company pays $1 per share quarterly dividend

- You receive $100 every three months ($400/year)

Dividend stocks provide income while you hold them, regardless of price movements.

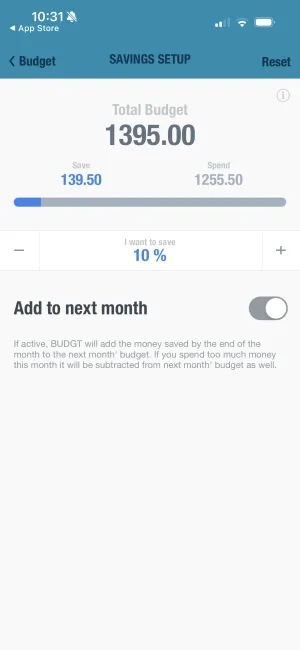

Track Your Investment Contributions

Building wealth through stocks requires consistent saving. BUDGT helps you track what you can set aside for investing each month.

Stock Market Basics

Stock Exchanges

Stocks trade on exchanges—organized marketplaces where buyers and sellers connect.

Major U.S. exchanges:

- NYSE (New York Stock Exchange): Oldest, largest

- NASDAQ: Tech-heavy, electronic

When you place an order through a brokerage, it routes to the appropriate exchange.

Trading Hours

U.S. markets operate Monday-Friday, 9:30 AM - 4:00 PM Eastern Time.

Some brokers offer extended hours trading, but liquidity (the ability to buy/sell easily) is lower outside regular hours.

Stock Tickers

Each publicly traded company has a ticker symbol—a short code used to identify it.

Examples:

- AAPL = Apple

- GOOGL = Alphabet (Google)

- MSFT = Microsoft

- AMZN = Amazon

Types of Stocks

By Company Size (Market Capitalization)

Market cap = share price × total shares outstanding

- Large-cap: $10+ billion (Apple, Microsoft)

- Mid-cap: $2-10 billion

- Small-cap: Under $2 billion

Large-caps are generally more stable; small-caps have more growth potential but higher risk.

By Characteristics

Growth stocks: Companies reinvesting profits to expand rapidly. Little/no dividends. Higher potential returns, higher volatility.

Value stocks: Established companies trading below perceived worth. Often pay dividends. More stable, potentially undervalued.

Dividend stocks: Companies returning profits to shareholders regularly. Popular for income-focused investors.

The Power of Long-Term Holding

Stock investing rewards patience. Consider historical returns:

S&P 500 Index (500 largest U.S. companies):

- Average annual return since 1957: ~10%

- Any single year: Returns range from -37% to +54%

- Any 20-year period: No negative returns historically

The lesson: short-term volatility is normal; long-term growth is consistent.

$10,000 invested in S&P 500 Index:

- After 10 years (at 10%): ~$25,900

- After 20 years: ~$67,300

- After 30 years: ~$174,500

S&P 500 Historical Growth

$10,000 invested at average 10% annual return

Key insight: The last 10 years contribute more than the first 20 combined. This is compound interest at work—time is your greatest advantage.

Time transforms modest investments into significant wealth.

Risks of Stock Investing

Company Risk

Individual companies can fail completely. Enron, Lehman Brothers, and countless others went to zero. Diversification protects against single-company disasters.

Market Risk

The entire market can decline. During crashes (2008, 2020), broad indexes dropped 30-50%. However, markets have recovered from every historical crash—eventually.

Volatility Risk

Prices fluctuate daily. If you need money during a downturn, you may be forced to sell at a loss. Only invest money you won’t need for 5+ years.

Inflation Risk

Cash loses purchasing power over time. Stocks historically outpace inflation, making them important for long-term wealth preservation.

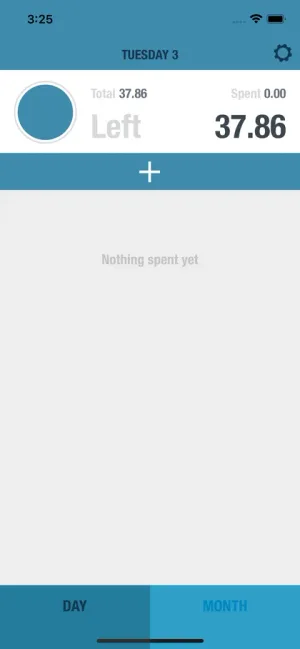

Build Your Investment Fund

Before investing, ensure your daily spending is under control. BUDGT shows you exactly what's safe to spend—leaving room for consistent investing.

Getting Started: Practical Steps

Build Financial Foundation First

Before buying stocks: emergency fund (3-6 months expenses), high-interest debt paid off, stable income. Don't invest money you might need soon.

Open a Brokerage Account

Popular options: Fidelity (no minimums, excellent research), Schwab (full-service), Vanguard (low-cost index funds), Robinhood (simple interface). Most have no account minimums or trading fees.

Start with Index Funds

Instead of picking individual stocks, buy index funds: S&P 500 Index Fund (500 largest U.S. companies), Total Stock Market Fund, or Total World Fund. One fund provides instant diversification.

Invest Consistently

Set up automatic monthly investments. This 'dollar-cost averaging' removes emotion from timing, buys more shares when prices are low, and builds wealth systematically.

Common Beginner Mistakes

Trying to Time the Market

“I’ll wait for prices to drop.” Markets are unpredictable. Time in market beats timing the market.

Checking Prices Constantly

Daily price watching creates anxiety and encourages poor decisions. Check quarterly at most.

Panic Selling During Drops

Markets decline regularly—it’s normal. Selling during crashes locks in losses. Stay invested.

Overconcentration

Putting too much into one stock is gambling. Diversify across many companies.

Ignoring Fees

High-fee funds drag on returns. Choose low-cost index funds (expense ratios under 0.2%).

Stocks vs. Other Investments

| Investment | Risk | Potential Return | Liquidity |

|---|---|---|---|

| Savings Account | Very Low | 4-5% | Instant |

| Bonds | Low-Medium | 4-6% | High |

| Stocks | Medium-High | 7-10% | High |

| Real Estate | Medium | 6-8% | Low |

| Crypto | Very High | Unknown | High |

Stocks offer the best balance of growth potential and accessibility for most investors.

Your Action Plan

This week:

- Check if you have an emergency fund (prerequisite to investing)

- Research one low-cost brokerage

- Learn what S&P 500 index funds are available

This month:

- Open a brokerage account (if foundation is solid)

- Set up automatic transfer from checking

- Make first index fund purchase

Ongoing:

- Increase contributions when possible

- Ignore short-term market noise

- Stay invested through volatility

Before investing, master your daily spending. BUDGT shows you what’s safe to spend each day—ensuring you have money left over to invest consistently.

Frequently Asked Questions

What is a stock in simple terms?

A stock is a small ownership share in a company. When you buy a stock, you become a partial owner (shareholder) of that business. If the company does well, your share becomes more valuable. If it does poorly, your share loses value.

How do you make money from stocks?

Two ways: price appreciation (selling shares for more than you paid) and dividends (some companies pay shareholders a portion of profits regularly). Most long-term wealth comes from appreciation—buying and holding as companies grow over decades.

How much money do you need to start buying stocks?

You can start with as little as $1 thanks to fractional shares. Many brokerages now allow you to buy portions of expensive stocks. However, $100-500 is a more practical starting point to build meaningful positions while keeping fees proportionally low.

Are stocks risky?

Individual stocks can be volatile—a single company can lose most of its value. However, diversified stock portfolios (owning many companies through index funds) historically return 7-10% annually over long periods. Risk decreases significantly with diversification and time horizon.

What's the difference between stocks and shares?

The terms are often used interchangeably. Technically, 'stock' refers to ownership in a company generally, while 'shares' refers to the specific units of that ownership. 'I own stock in Apple' and 'I own 100 shares of Apple' both describe the same thing.

When should I start investing in stocks?

After you have: (1) an emergency fund covering 3-6 months expenses, (2) high-interest debt paid off, and (3) stable income. The earlier you start, the more time compound growth has to work. Even small amounts invested in your 20s can grow substantially by retirement.

Should I buy individual stocks or index funds?

For most people, index funds are better. They provide instant diversification across hundreds of companies, require no research, and historically outperform most professional stock pickers. Individual stocks are riskier and require significant time to research properly.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS