The Anti-Budget: Budgeting for People Who Hate Budgets

The Anti-Budget: Budgeting for People Who Hate Budgets

You’ve tried budgeting. Multiple times. Spreadsheets, apps, envelope systems, zero-based budgets—none of them stuck.

Maybe the problem isn’t you. Maybe the problem is budgeting itself.

The anti-budget offers an alternative: a system so simple that calling it “budgeting” feels like a stretch. No categories. No tracking. No weekly reviews. Just one number to manage.

What Is the Anti-Budget?

The anti-budget reverses traditional budgeting logic:

Traditional budget: Track all spending, allocate to categories, compare to plan Anti-budget: Automate savings and bills, spend the rest without tracking

Here’s how it works:

- Income arrives

- Savings transfer automatically (pay yourself first)

- Fixed expenses auto-pay (rent, utilities, subscriptions)

- Spend whatever’s left freely (no tracking required)

You manage one number: your checking account balance. When it’s gone, stop spending. That’s the entire system.

Why the Anti-Budget Works

Simplicity You’ll Actually Maintain

Traditional budgets require ongoing effort: categorizing transactions, reviewing spending, adjusting allocations. Most people do this enthusiastically for two weeks, then stop.

The anti-budget requires almost zero ongoing effort. Set it up once, then live your life.

Savings Guaranteed

By automating savings first, you guarantee financial progress regardless of spending choices. The money is gone before you can spend it.

Natural Spending Limits

Your checking account balance creates an automatic boundary. Unlike credit cards, you can’t spend beyond what’s there.

No Guilt, No Tracking

Once savings and bills are handled, the remaining money is truly yours to spend. No categories means no “should I put this in dining out or entertainment?” decisions.

Setting Up Your Anti-Budget

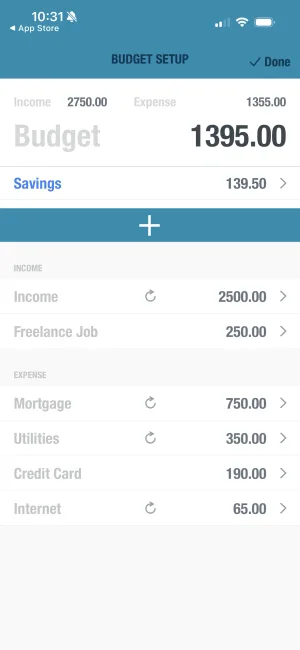

Calculate Monthly Income

List all reliable income sources. Use take-home pay (after taxes).

List Fixed Expenses

Predictable, recurring costs: rent/mortgage, utilities, insurance, subscriptions, loan payments, phone/internet. Total these up.

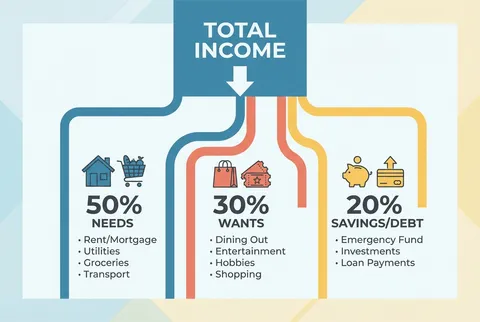

Set Your Savings Target

Recommended: 20% of gross income. Minimum: 10%. Starter: whatever you can maintain. Be honest—an aggressive target you'll reduce later defeats the purpose.

Calculate What's Left

Monthly income - Fixed expenses - Savings = Spending money. Example: $4,500 income - $2,000 fixed - $900 savings = $1,600 spending money.

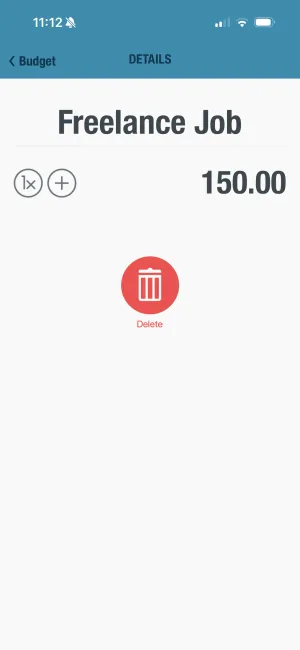

Automate Everything

Set up automatic savings transfer on payday. Set up autopay for all fixed expenses. Whatever lands in checking after automation is yours to spend.

Your Daily Spending Number

The anti-budget gives you total monthly freedom. BUDGT goes further—showing you a daily spending limit so you never run out before month's end.

Living the Anti-Budget Life

The Weekly Glance

Your only monitoring task: occasionally check your checking account balance. Are you roughly on track for the month?

Early month + high balance = Spend freely Late month + low balance = Slow down Any time + zero balance = Stop until next paycheck

That’s your entire budgeting system.

No Category Guilt

Want coffee? Buy it. Dinner out? Sure. New shoes? If the money’s there, it’s yours.

The anti-budget trusts you to make reasonable spending decisions without constant monitoring.

The End-of-Month Test

If you consistently run out of money before month’s end, either:

- Reduce savings temporarily (but keep something)

- Cut fixed expenses (subscriptions, services)

- Acknowledge that spending patterns need adjustment

If you consistently have money left over, increase savings.

Anti-Budget Enhancements

The basic system works, but these additions make it better:

Separate Accounts

Keep savings in a separate bank (not just separate account). The friction of transferring money adds a pause before you “borrow” from savings.

Emergency Fund Buffer

Maintain a $1,000+ buffer in checking beyond monthly spending. This handles unexpected expenses without touching savings.

The “Sinking Fund” Addition

For periodic expenses (car maintenance, annual subscriptions, gifts), add a small automatic transfer to a “stuff that comes up” fund. Prevents these from crashing your monthly spending.

Weekly Spending Target

If monthly feels too loose, divide spending money by 4.3 for a weekly target. Glance once weekly instead of once monthly.

When the Anti-Budget Doesn’t Work

The anti-budget isn’t for everyone:

Debt crisis: If you’re in serious debt, you may need detailed tracking to find every possible dollar for repayment.

Irregular income: Without predictable income, the automation model breaks down.

Spending problems: If you genuinely can’t control spending, the lack of structure may enable poor choices.

Optimization goals: If you want to squeeze every dollar toward specific goals, detailed tracking helps.

Couples with different styles: If partners have incompatible money approaches, the loose structure can create conflict.

Anti-Budget vs. Traditional Budget: Comparison

| Aspect | Anti-Budget | Traditional Budget |

|---|---|---|

| Setup time | 1-2 hours | 2-5 hours |

| Ongoing effort | Minimal | Weekly reviews |

| Savings reliability | High (automated) | Variable |

| Spending insight | Low | High |

| Category tracking | None | Required |

| Flexibility | High | Lower |

| Risk of abandonment | Low | High |

Neither is “better”—they serve different personalities and situations.

The Philosophy Behind Anti-Budgeting

Traditional budgeting assumes you need to control every dollar. Anti-budgeting assumes you need to control the important dollars—savings and fixed costs—and can handle the rest.

This isn’t about being irresponsible. It’s about:

- Prioritizing sustainability over optimization

- Automating what matters instead of tracking everything

- Accepting “good enough” rather than demanding perfect

If you save 20% and pay your bills, the specifics of your remaining spending don’t actually matter.

Simple Setup, Daily Clarity

Set your monthly budget once, and BUDGT divides it into daily amounts. See what you can spend today without tracking categories.

Getting Started Today

Right Now (5 minutes)

List your monthly income and fixed expenses. Calculate what’s left.

This Week (1 hour)

Set up automatic savings transfer on payday. Set up autopay for all bills.

This Month

Live on what remains. Check your balance occasionally. Notice how it feels.

Ongoing

Adjust savings rate as needed. Increase if you have consistent surplus. That’s the entire maintenance plan.

The Liberation of Less

Most financial advice adds complexity. More tracking, more categories, more analysis.

The anti-budget subtracts. Less monitoring, less decision-making, less cognitive load.

If traditional budgets make you feel controlled and suffocated, try the opposite. Automate what matters, trust yourself with the rest, and enjoy the freedom of one number to manage.

Want the simplicity of anti-budgeting with daily guidance? BUDGT shows you one number—what you can spend today. All the freedom, none of the month-end surprises.

Frequently Asked Questions

What is the anti-budget method?

The anti-budget automates savings and fixed expenses, then lets you spend the remainder freely without tracking categories. You only manage one number—what's left in your checking account after savings and bills are handled.

How is the anti-budget different from regular budgeting?

Traditional budgeting tracks spending across multiple categories and compares to planned amounts. The anti-budget skips all that—you save automatically, pay fixed bills automatically, and spend what remains without tracking where it goes.

Does the anti-budget actually work?

Yes, for people who struggle with detailed tracking. By automating savings first, you guarantee financial progress regardless of spending choices. The simplicity means people actually stick with it long-term, unlike complex budgets that get abandoned.

What if I overspend with the anti-budget?

The system has a built-in limit: once your checking account hits zero, spending stops. Unlike credit cards, you can't overspend beyond what's there. If you consistently run out before month's end, either reduce savings temporarily or cut fixed expenses.

Who should use the anti-budget method?

The anti-budget works well for people who hate tracking, have stable income, have already handled high-interest debt, and want simplicity over optimization. It's less suitable for those in debt crisis, with irregular income, or who enjoy detailed financial analysis.

How do I set up an anti-budget?

Calculate your monthly income, list all fixed expenses (rent, utilities, subscriptions), decide your savings target (aim for 20%), then set up automatic transfers for savings and autopay for bills. What remains after all automatic transfers is your spending money.

What counts as 'fixed expenses' in the anti-budget?

Fixed expenses are predictable, recurring costs: rent/mortgage, utilities, insurance, subscriptions, loan payments, and any other bills that stay roughly the same each month. Variable expenses like groceries, dining, and shopping come from your remaining spending money.

Related Articles

Ready to take control of your budget?

Download BUDGT and start tracking your daily spending today.

Download for iOS